Eos Energy stock falls after Fuzzy Panda issues short report

The year to date has been notable for a broad rally that’s lifted all the major asset classes, but it’s not hard to find a wide array of losers when you look below the surface. As a result, contrarians and deep-value investors can easily find opportunities in the search for battered assets, based on a select review of ETFs through Tuesday’s closing prices (Oct. 7).

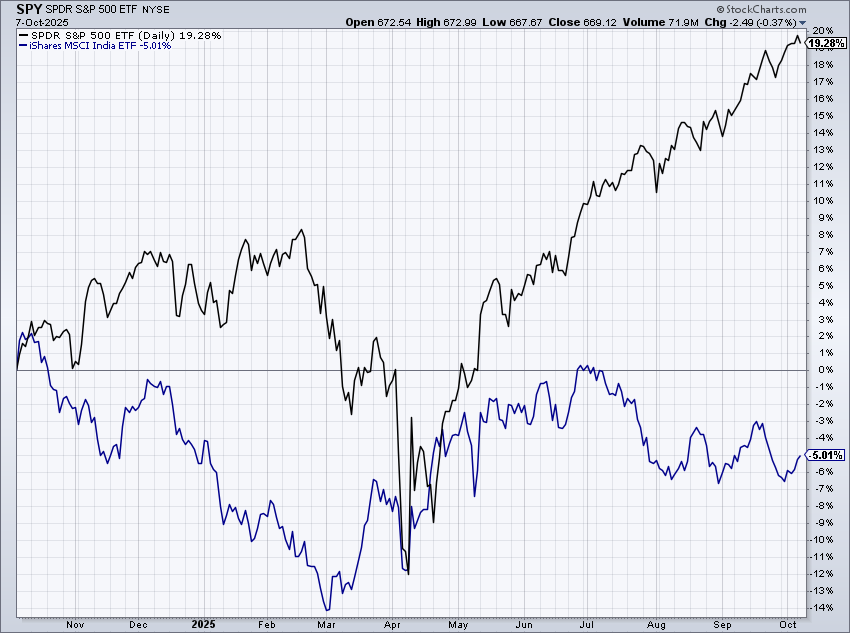

Here are five markets that haven’t participated in 2025’s party. For perspective, each market is compared with the US stock market via SPDR S&P 500 (NYSE:SPY), which has rallied 19.2% so far this year.

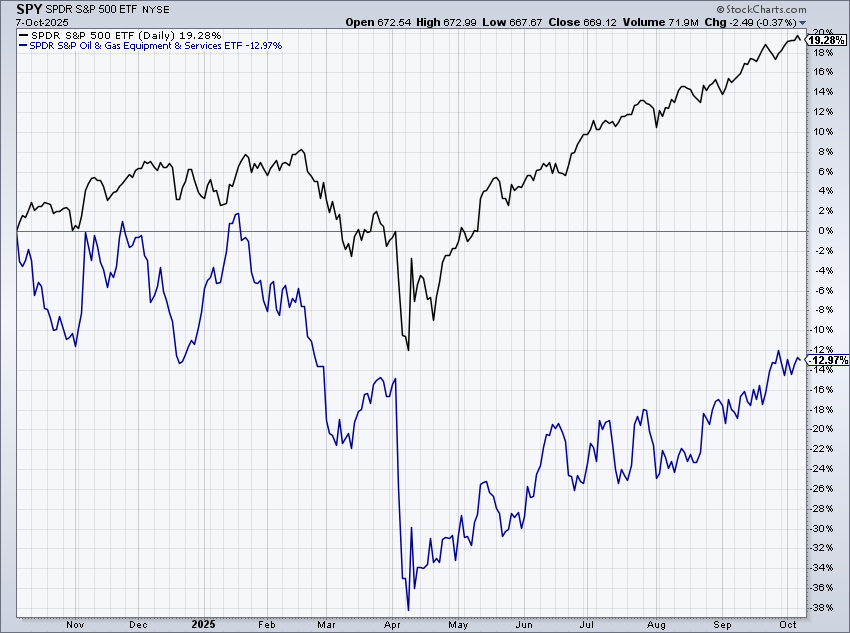

The oil and gas equipment industry, by contrast, has shed 13.0% year to date. Although these stocks have recovered a fair amount of lost ground since the tariff selloff in April, the SPDR S&P Oil & Gas Equipment & Services ETF (NYSE:XES) remains deeply underwater this year.

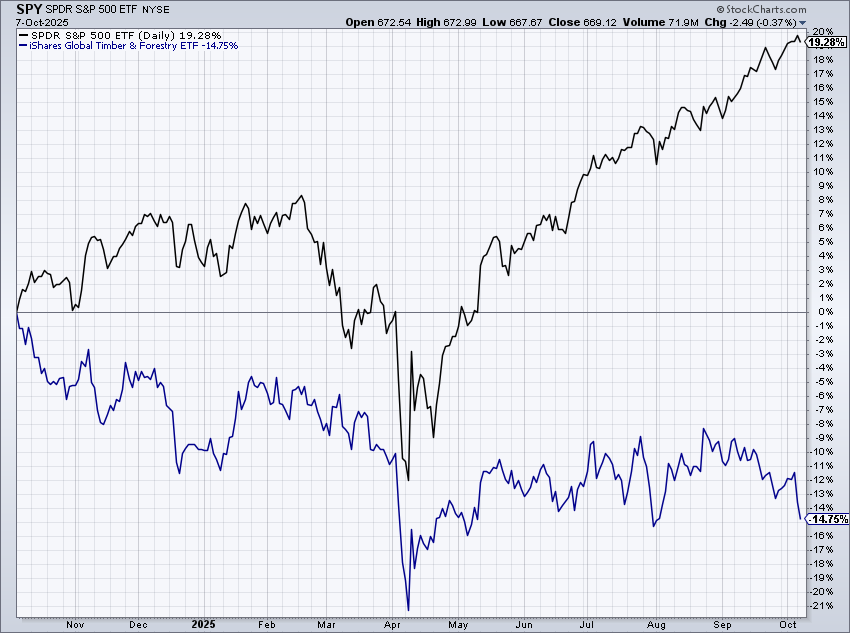

Another industry that’s being carved up by the bears this year: global timber and forestry shares. The iShares Global Timber & Forestry ETF (NASDAQ:WOOD) has slumped 14.8%.

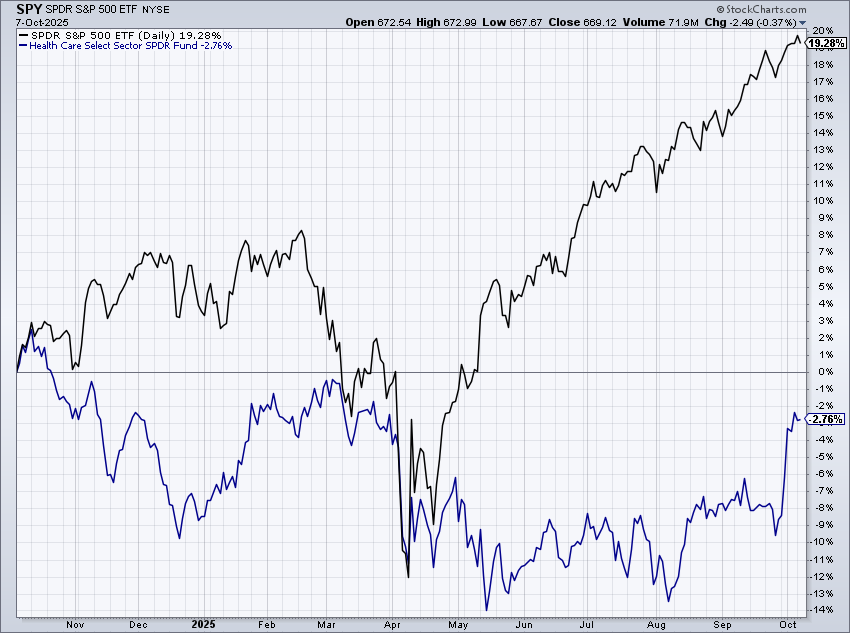

Health care stocks are sickly, too, although a rally in this corner has pared the loss recently. Nonetheless, the SPDR Health Care Sector ETF (NYSE:XLV) is nursing a 2.8% loss year to date.

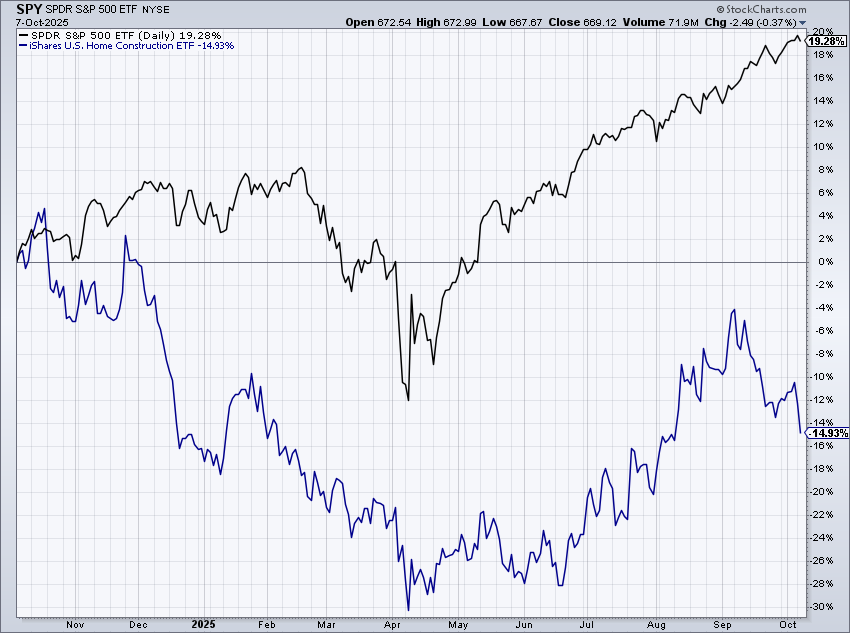

Home construction stocks have also been hammered in 2025. The iShares US Home Construction ETF (NYSE:ITB) has shed 14.9% this year.

Shares in India are also struggling this year. Although the country is expected to be the fastest-growing major economy, according to the World Bank, sentiment has taken a hit this year, in part due to tariffs. As a result, the iShares MSCI India ETF (NYSE:INDA) is off 5.0% so far in 2025.

The list above only scratches the surface for losses this year. Other members of the red-ink brigade include small-cap energy firms (PSCE), residential real estate investment trusts (HAUS), and stocks in Indonesia (EIDO).