Treasury Secretary Bessent announces tariff relief on coffee, fruits

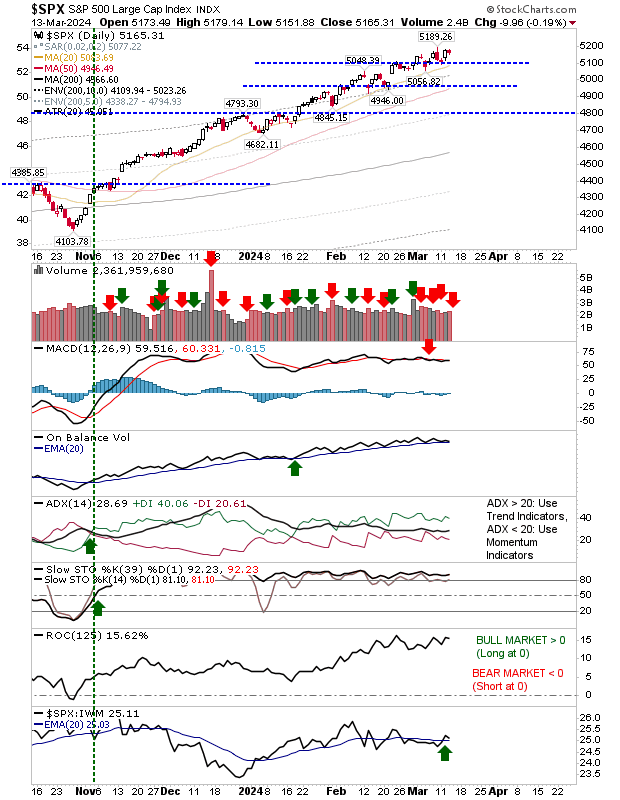

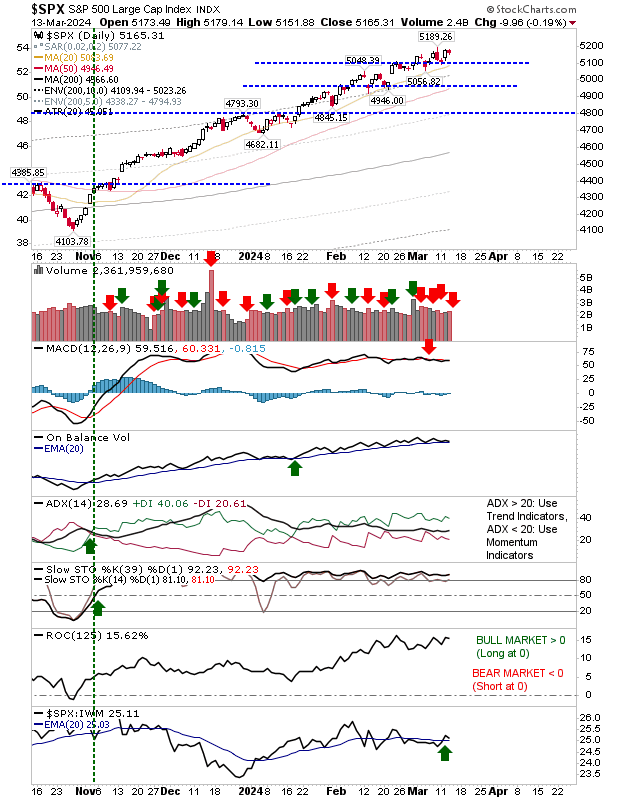

The earlier 'bull trap' risks look safely put to bed as yesterday's losses just dipped into the day before yesterday's gains.

The S&P 500 moved into a period of outperformance relative to the Russell 2000 (IWM), although it came with higher volume (distribution) selling.

The MACD is still on a 'sell' trigger, although it has flat-lined for most of 2024.

The Nasdaq is working through a more substantial 'bearish engulfing pattern', but without the higher volume distribution of the S&P 500.

It has 'sell' triggers in the MACD and On-Balance-Volume to work off, in addition to a relative underperformance to the S&P 500 (but not the Russell 2000).

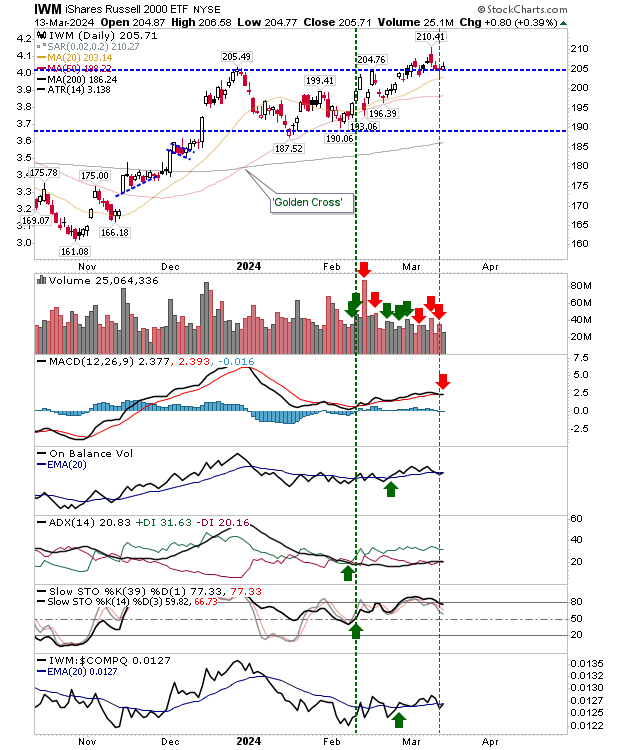

The Russell 2000 ($IWM) is perhaps the index most vulnerable to further selling given it has finished on breakout support.

The breakout remains intact, but further losses and a loss of the 20-day MA would signal something worse; a move back to $190 would seem to be the most likely outcome of a loss of breakout support.

The Russell 2000 ($IWM) is the index that typically leads bull and bear markets. At the moment, it's still on the bull's side, but if there is a loss of breakout support before the end of the week then play it more cautiously for the Nasdaq and S&P 500.