Trump to impose 100% tariff on China starting November 1

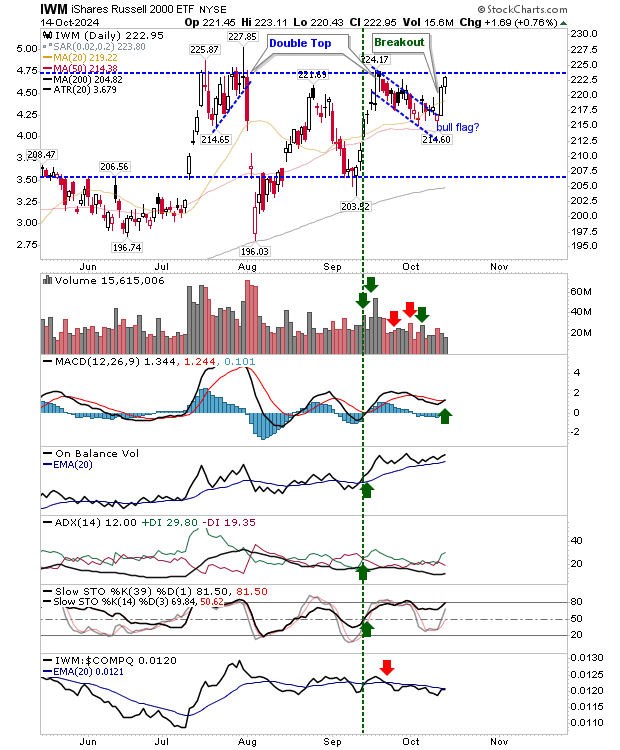

After weeks of inaction the Russell 2000 (IWM) finally made its move.

A surge out of its 'bull flag', which also took out the various upper spikes, has put the index on catchup with the S&P 500 and Nasdaq. Technicals returned net 'bullish'.

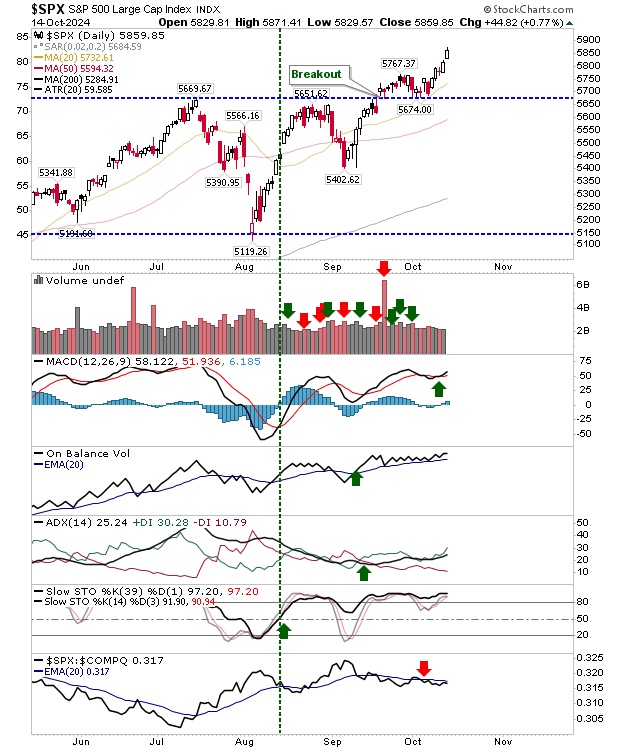

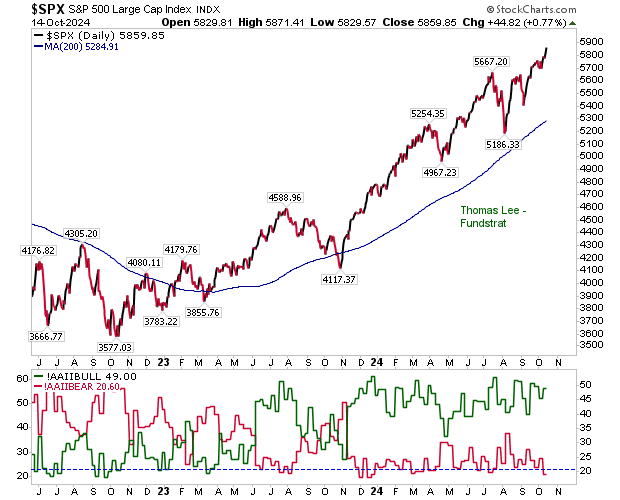

The S&P 500 moved to new highs on a return to net bullish technicals. The index is still underperforming the Nasdaq, which suggests this is orderly buying (of new stocks?) than a short covering escapade. Liking the action here.

S&P investor sentiment has remained consistent and it doesn't suggest a peak has been reached.

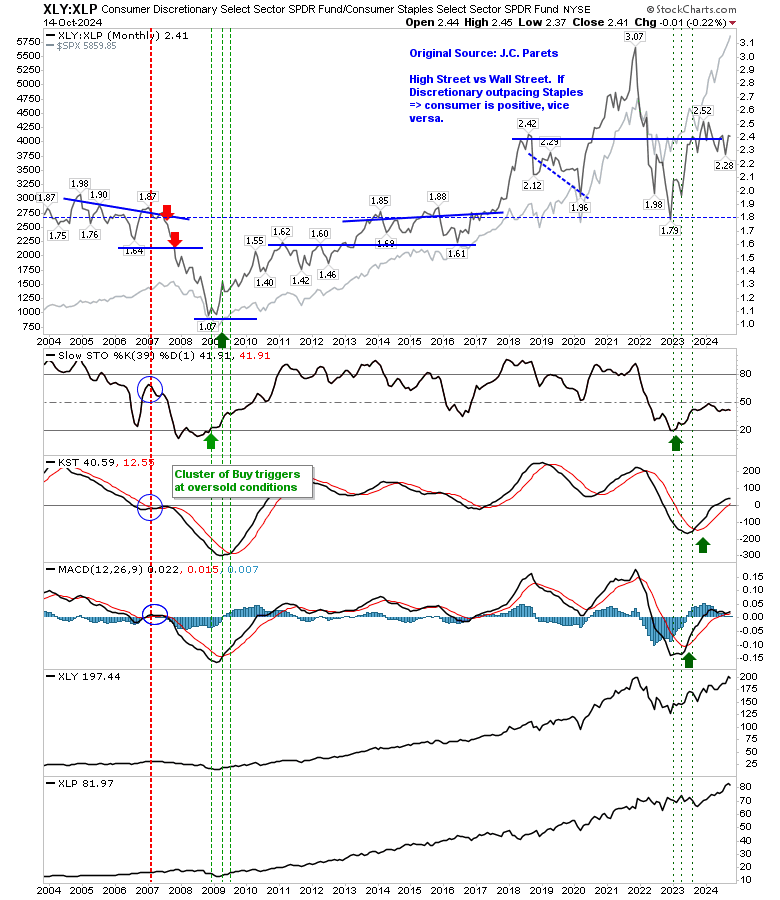

Supporting technicals in the relationship between Consumer Discretionary (NYSE:XLY) and Consumer Staples (NYSE:XLP) have emerged from a pattern similar to that for the bottom in 2009.

The main difference is this lead-out is happening much faster than it did in 2009/10, but this looks to be a secular bullish move.

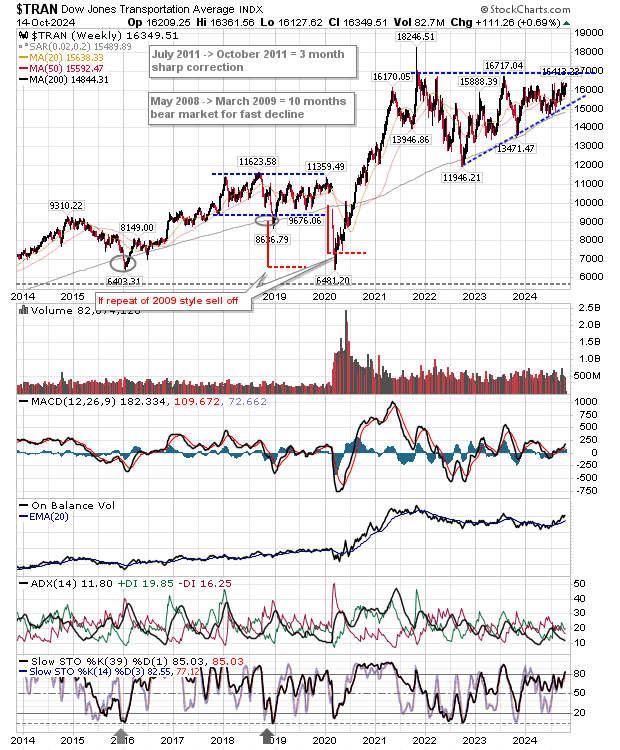

The Dow Transports is also leading towards a major breakout which would confirm the secular move in the Dow Jones Index and S&P.

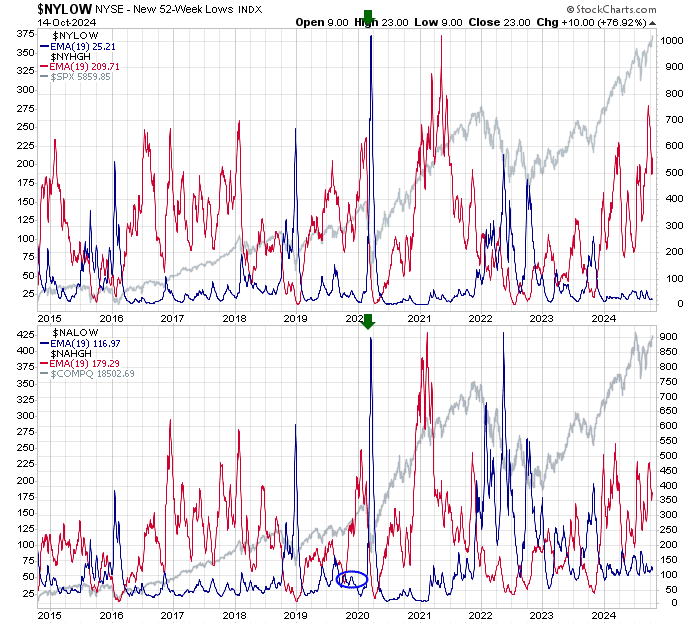

The number of new highs in the NYSE is steadily rising, where market peaks are associated with bearish divergences in such peaks, so no bear market here either.

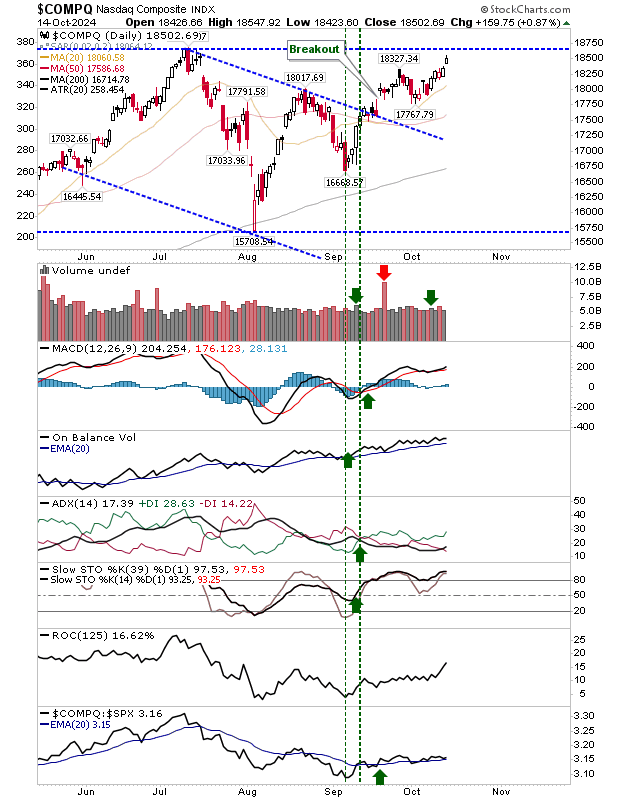

Finally, the Nasdaq is working towards a challenge of July highs. Supporting technicals are bullish and I would be looking for new all-time highs in the coming weeks.

Like a plug being removed from a dam, action over the last couple of days has consumed up supply that had been suppressing challenges of all-time highs for the Nasdaq and Russell 2000 ($IWM).

Things look clearer for markets now and it's now up to the various indices to deliver.