China chip stocks fall as US considers allowing Nvidia H200 sales

The pre-market optimism didn’t last long, but when markets are coming off an extended high, it’s hard for buyers to return there, even off the back of ’good news’.

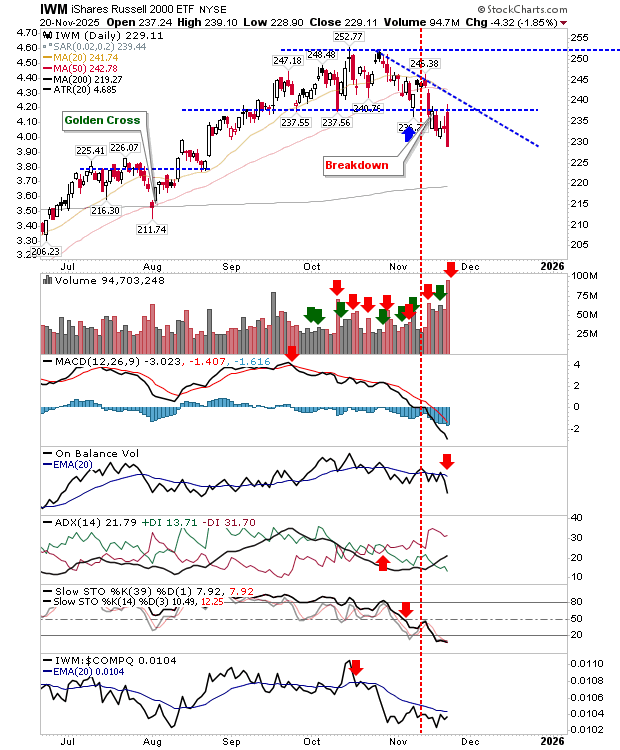

The Russell 2000 (IWM) opened bang on resistance at $237, and then it was all down from there. Volume surged in confirmed distribution, leaving the 200-day MA as the next logical support level.

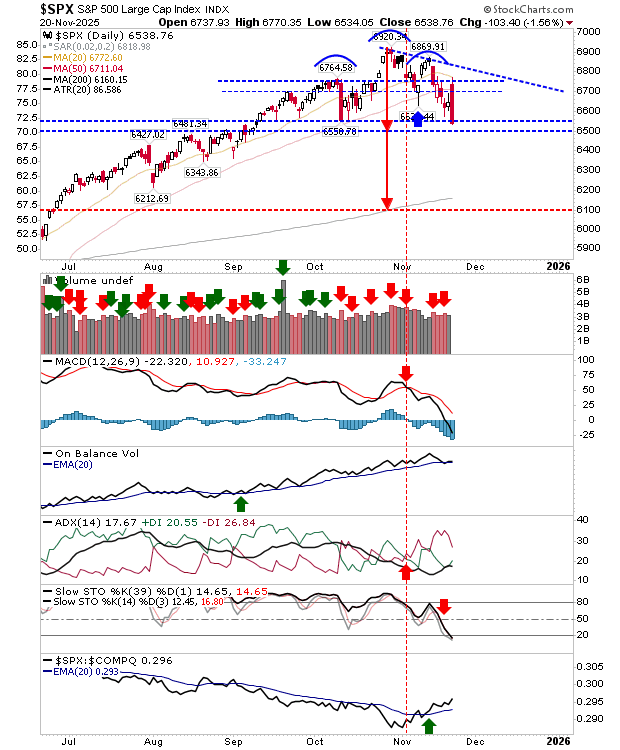

The S&P 500 has created some symmetry with a second red candlestick, practically a carbon copy in price to the one in October. This has the look of a head-and-shoulder reversal pattern with a measured move target that takes it down to its 200-day MA, and maybe more. However, it hasn’t lost neckline support yet; a rally above 6,755 would negate this bearish pattern.

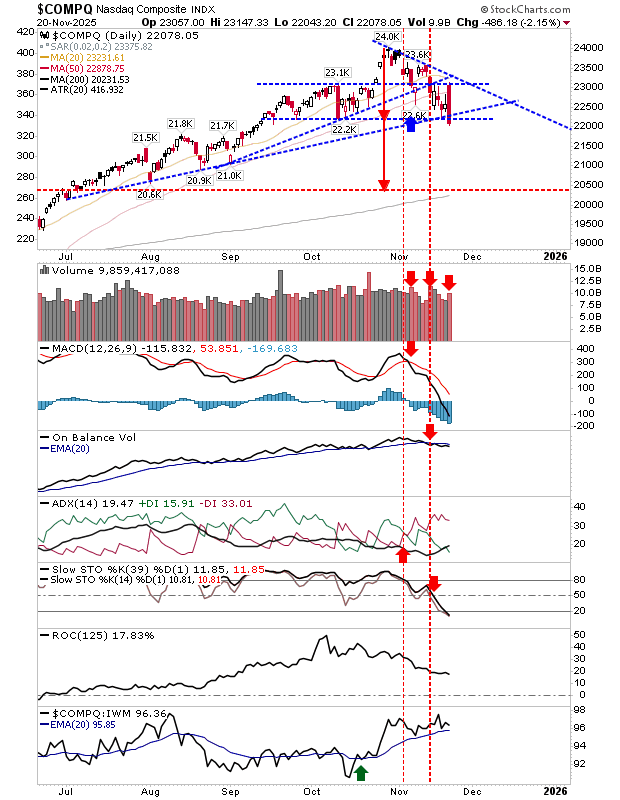

The Nasdaq took it worse than the S&P 500. A sizable bearish engulfing pattern that resulted in an undercut of the rising trendline leaves bulls in a quandry. Any trader holding a long position since September are likely underwater with their position, which will add to the selling pressure for the index. Similar to the S&P 500, a measured move target will bring it back to its 200-day MA.

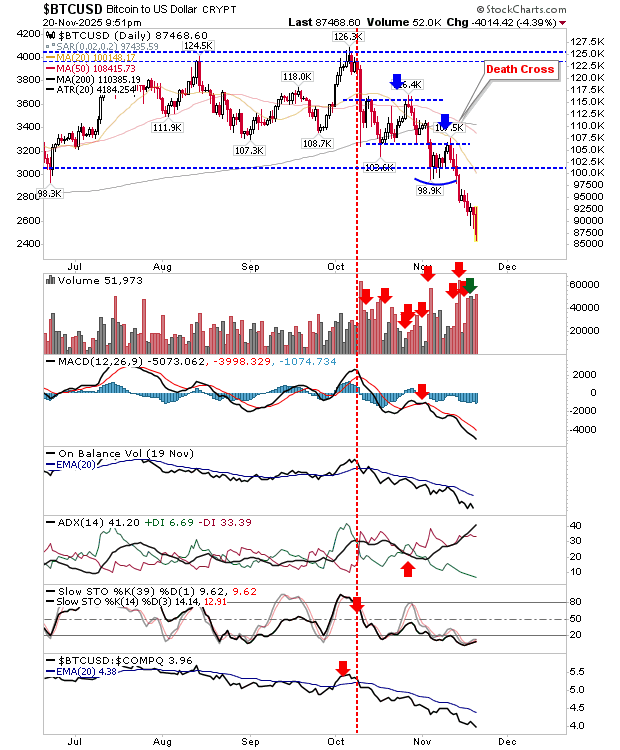

Hardest hit was Bitcoin. It gave up 5% on the day, slicing through the spike lows of the past two days and leaving it in a spot of bother. Watch for a bullish hammer tomorrow. The cryptocurrency is heavily oversold on capitulation volume, but catching a knife is always a dangerous thing.

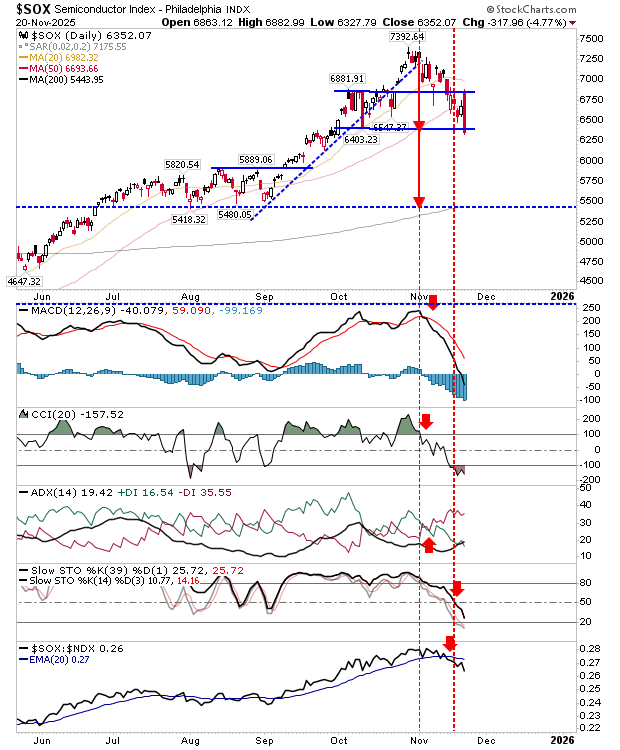

The Semiconductor Index is another index aiming for its 200-day MA if Thursday’s selling follows through tomorrow. It would take a substantial level of selling to get there, but it would take much more to turn it into a major swing low.

Nvidia’s (NASDAQ:NVDA) results were meant to be the catalyst to bring markets back toward their highs, but instead, it had the reverse effect. Markets were extended, and they are still extended - relatively - despite Thuesday’s losses. Watch for a follow-through lower, likely early next week, that will accelerate things downward. This is not a buyer’s market.