Missed the webinar? Here are Investing.com’s top 10 stock picks for 2026

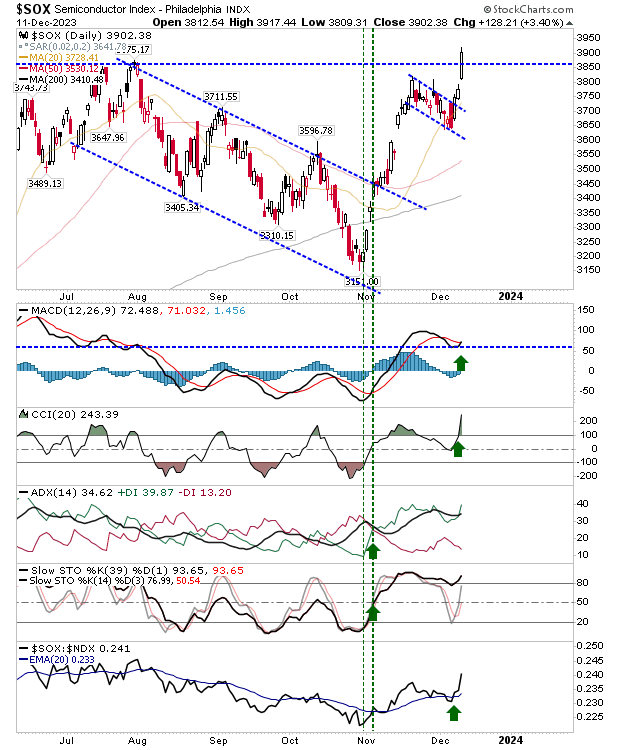

Bulls came into the week with a small edge, but it was left to Semiconductors to push beyond its 'bull flag' and July swing high resistance. Gains in the Semiconductor Index coincided with a new MACD trigger 'buy' and an acceleration in relative performance to the Nasdaq 100.

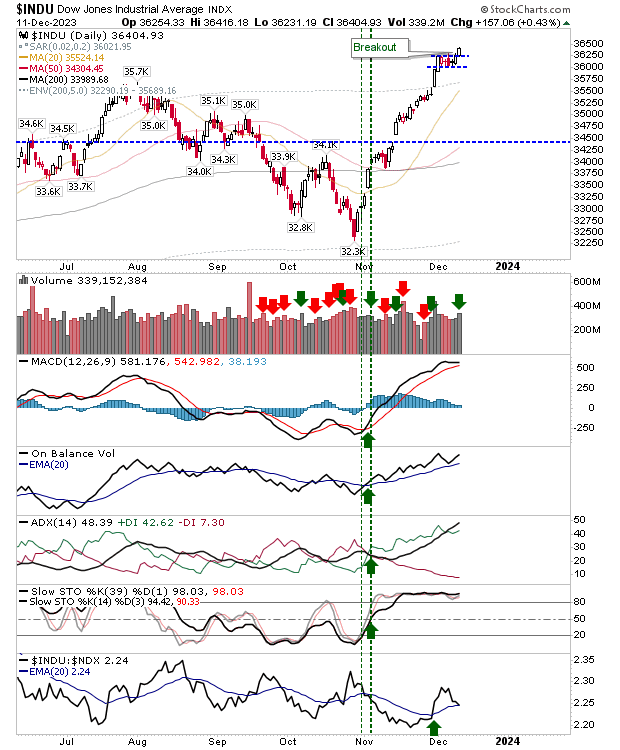

The Dow Industrial ($INDU) pushed above last week's consolidation. Having committed to this break, we need to watch for a potential 'bull trap' as this is a breakout coming off an extend rally of nearly 4,000 points.

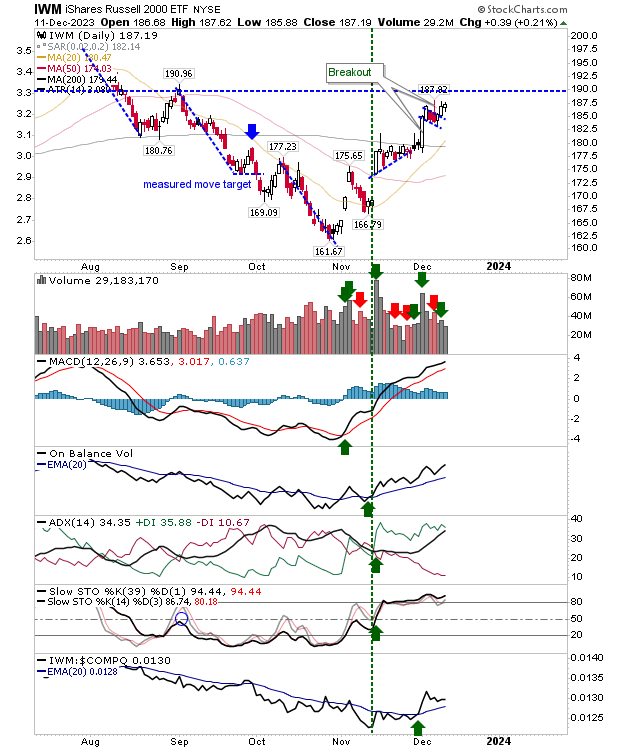

The Russell 2000 (IWM) is on course to test the August swing high around $191. I would be looking for some sideways action should the index make it to this resistance level.

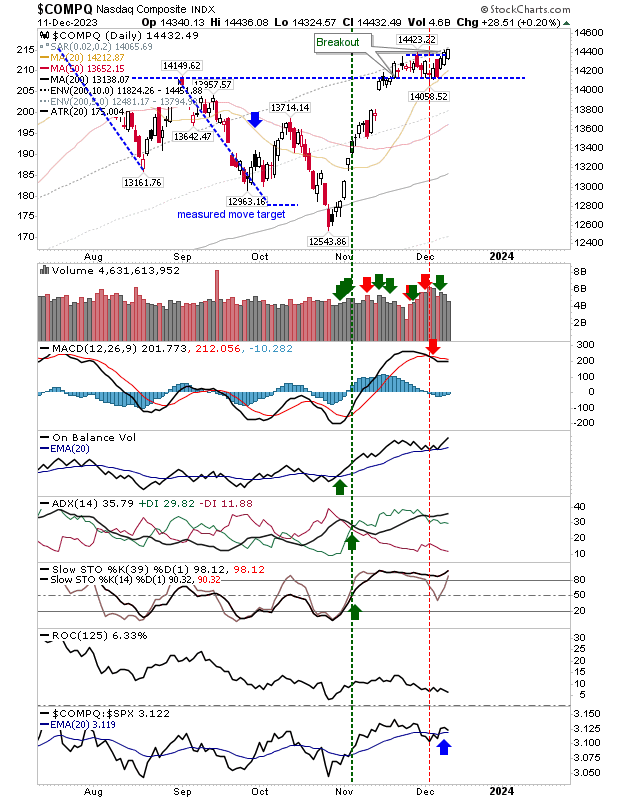

The Nasdaq poked its head above resistance, but it's only an edge breakout. This could very easily drift back into last week's consolidation, setting up a 'bull trap' and a possible move back to fill the November gap.

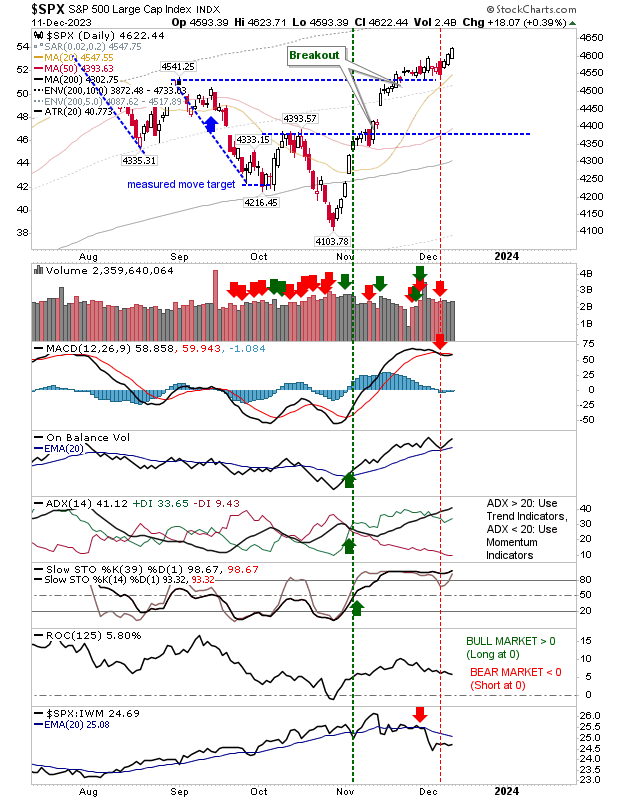

The S&P 500 has done a little more to set itself past the 2-week consolidation and the August swing high.

However, it hasn't reversed the MACD trigger 'sell'; other technicals are positive. While the S&P 500 is pushing beyond its trading range it is losing ground against the Russell 2000.

For today, I would be looking for some weakness, particularly if there are gaps higher for large-cap indexes. I would edge a little more bullish for the Russell 2000 ($IWM), chiefly because it hasn't enjoyed the same level of gains as the other indexes.