Chubb reportedly makes takeover offer for AIG, stock soars

Trading at around ~$37.7975 two hours after the London open, a confluence of macroeconomic factors continues to secure higher silver pricing.

Having handsomely outperformed its precious metal counterpart, gold, in recent months, XAG/USD currently trades some ~3.43% lower from highs made earlier this week, with market technicals suggesting further upside potential.

Silver (XAG/USD): Key Takeaways From Today’s Session

U.S. inflation remains well-above the current 2% target, as per the CPI/PPI releases from earlier this week. Especially when considering ongoing unknowns surrounding a potential tariff-side inflation, silver prices remain well supported.

Although views are still somewhat mixed, markets generally predict two Fed rate cuts before year-end, helping bolster higher silver pricing.

Following POTUS Donald Trump’s comments yesterday to suggest the firing of Fed Chair Jerome Powell remains ‘highly unlikely’, a stronger dollar and easing market tension may introduce some short-term silver downside.

Silver (XAG/USD): Priced-in Fed Rate Cut Decisions Support Silver Pricing

While it would be fair to say that the Fed’s path for easing later this year remains somewhat murky, markets generally predict at least one, if not two, rate cuts before year-end.

Although this can’t hold a candle to other major central banks in 2025, the notion of lower US interest rates directly benefits non-yielding assets like precious metals, evidenced by the recent rise in silver and gold pricing. This goes double with both silver and gold being priced in U.S. dollars.

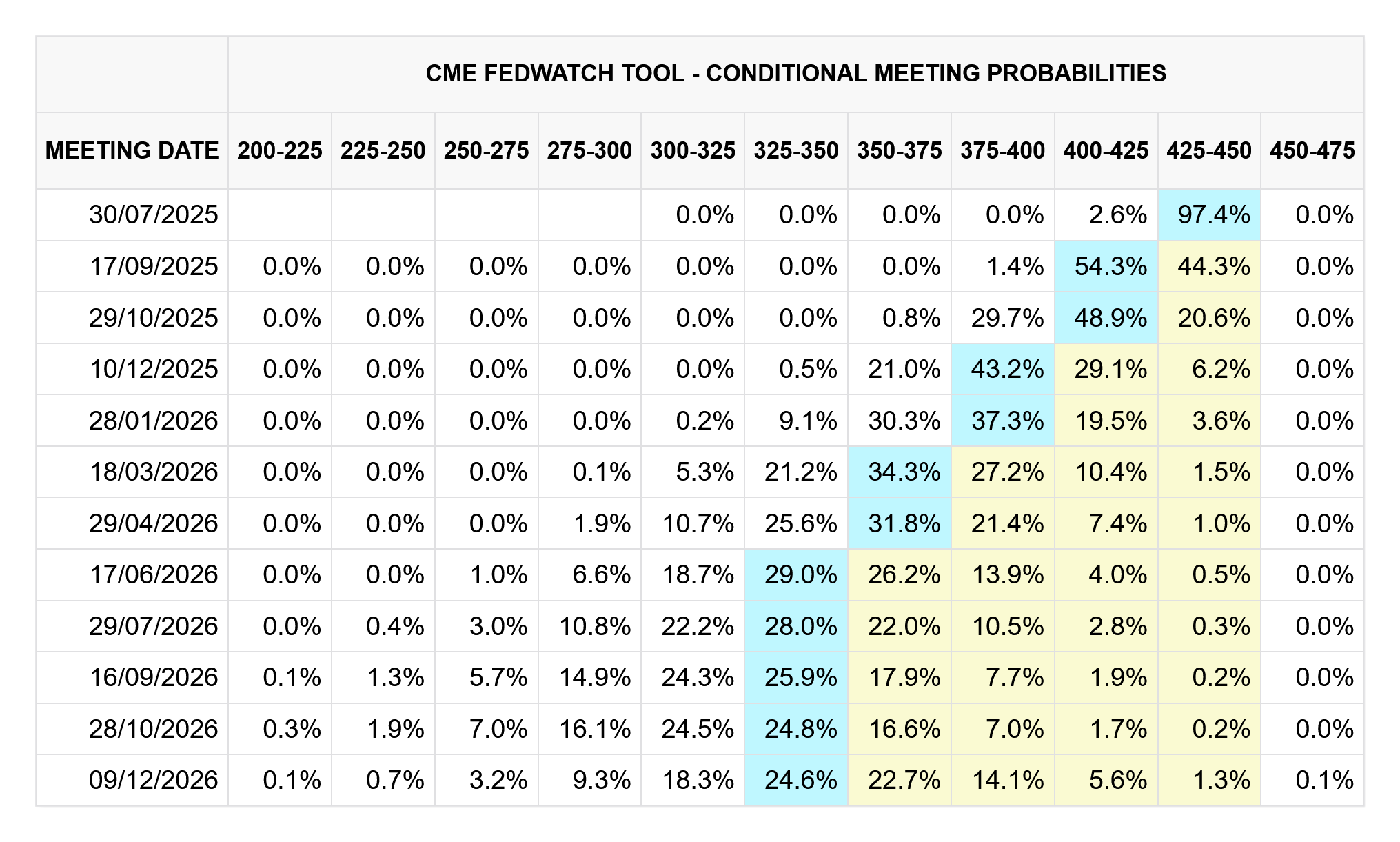

Going forward, markets will closely monitor economic data releases and Fed commentary to better understand the Fed’s likely next move. Most predict the first US rate cut will be made in the upcoming September meeting, currently at a 54.3% likelihood according to CME FedWatch.

Silver (XAG/USD): ‘Highly Unlikely’ Donald Trump is to Fire Fed Chair Powell

While the current Federal Reserve monetary policy predictions generally support precious metal pricing, this comes with one small caveat.

Speaking yesterday, US President Donald Trump went on the record to say the potential replacement of Jerome Powell as Fed Chair is “highly unlikely”, although not taking it off the table entirely.

"Well, he’s too late. He’s always been too late, hence his nickname ‘too late.’ He should have cut interest rates a long time ago. Europe has cut them ten times in a short period of time, and we’ve cut them none"

President Donald Trump on Federal Reserve Chair Jerome Powell, 16/07/2025

Having been a staunch supporter of lower rates for his political career, Trump’s recent demands to lower rates in excess of 100 bps have, somewhat predictably, not been met, with rumours continuing to circulate that Trump would consider firing Powell.

That said, with questions to be asked about the autonomy a central bank should have from its respective government, easing tensions between both parties has added to market stability, introducing some XAG/USD short-term downside.

Silver (XAG/USD): Safe-Haven Demand, Supply-Demand Dynamics, and Inflation

At risk of repeating myself from previous coverage, a trifecta of macroeconomic themes continues to benefit silver:

- Safe-haven demand remains elevated on global conflict, US trade policy, and generalised economic uncertainty

- Silver demand, both for industry and as a store of wealth, is projected to reach new highs this year. 2025 also represents the fifth consecutive year in which demand will outstrip supply, which in and of itself is a relatively new phenomenon

- With questions marks on inflation remaining, precious metals like silver continue to benefit from inflation-hedge demand

Silver (XAG/USD): Technical Analysis (17/07/2025)

Source: TradingView

- On the daily time frame, XAG/USD price action remains in a clear uptrend. Currently halfway between highs and the trendline, markets will need to have more conviction to push price higher, or risks a retracement

- Daily support can be found at ~$36.9457 and ~$37.2983; resistance at ~$38.4220 and ~$38.9729