Oracle releases AI Database 26ai with built-in artificial intelligence

Markets are drifting towards a retest of April swing lows, but not all indices did so following tests of March swing lows. These losses feel a little early, and I still would look for a rally to March lows before they get back to April lows - so it ’feels bullish’, despite what markets look like they are doing. Volume is falling as markets drift lower, which is also bullish, but technicals remain firmly bearish.

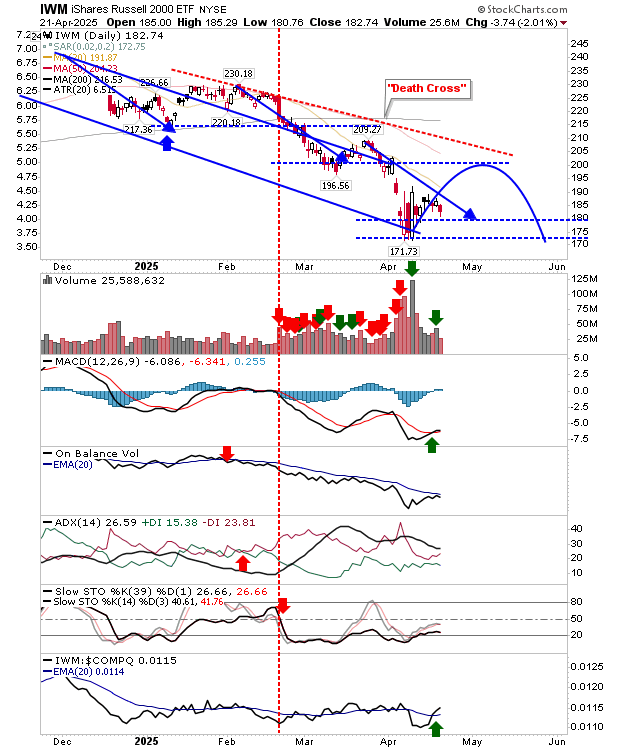

The Russell 2000 (IWM) closed with a ’buy’ signal in the MACD as the index counters with a new period of relative outperformance to peer indices. It’s still a long way from the March swing low, but if it’s able to rally past $190, it will set up a new period of higher lows and higher highs.

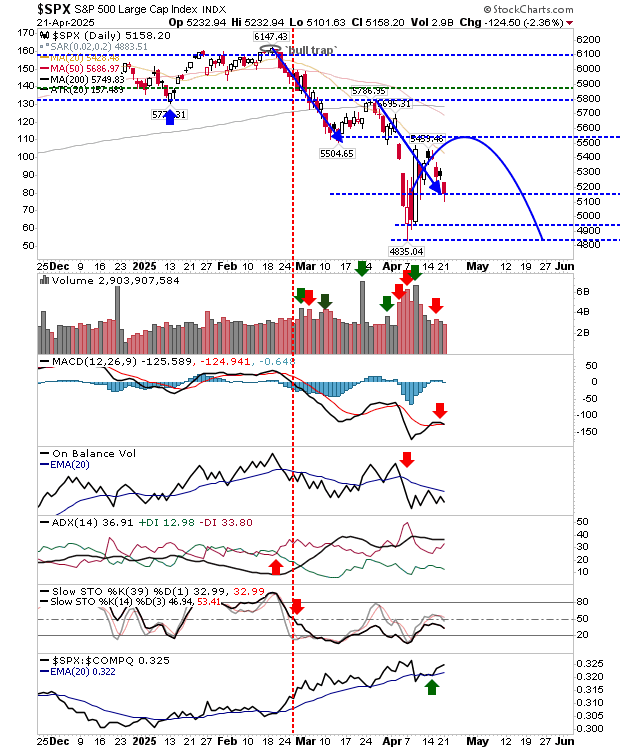

The S&P 500 tagged the March swing low off its one-day rally (large white candlesticks following a sell-off are bearish) and is heading back to the April swing low.

The MACD flashed a new ’sell’ signal, returning to a net bearish technical picture. Watch for a tag of 5,000, this could be a nice ’buy’ trigger with a GTC buy order.

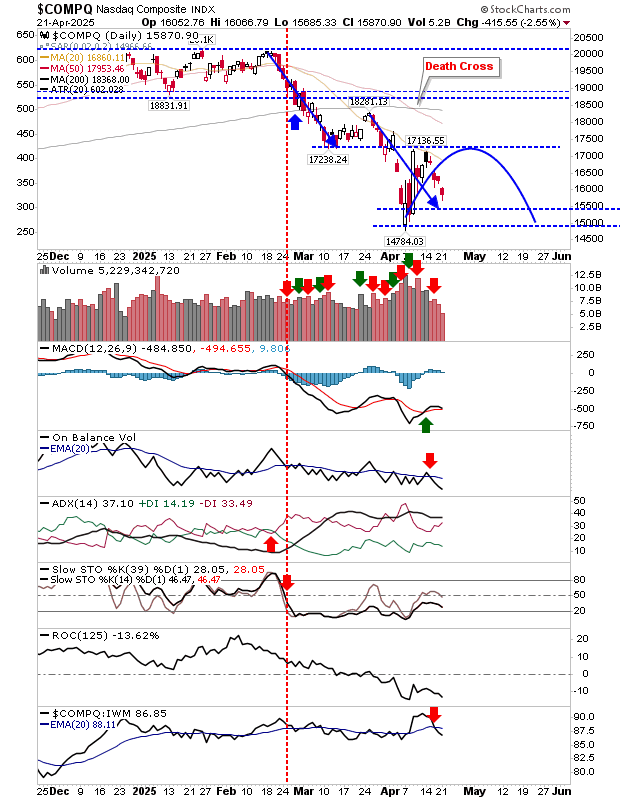

The Nasdaq has lost the most ground relative to its recovery rally. If there is a full April low retest, this will be the first index to do so. Interestingly, it still holds to a weak ’buy’ trigger in the MACD despite such losses. While the S&P 500 may be considered a GTC buy opportunity, the Nasdaq may be a present buying opportunity. The key downside is the sharp shift in relative performance against the Russell 2000, but I wouldn’t hold this too much against it.

For today, look for a bright start from the Nasdaq, and if that doesn’t pan out, wait for the S&P 500 to reach 5,000. It seems a little early for the index to continue accelerating lower, given the reprieve in Trump’s tariffs, but the market will decide.