Gold rally "fundamentally supported for now," AHG President tells Investing.com

1 Takeaway

-

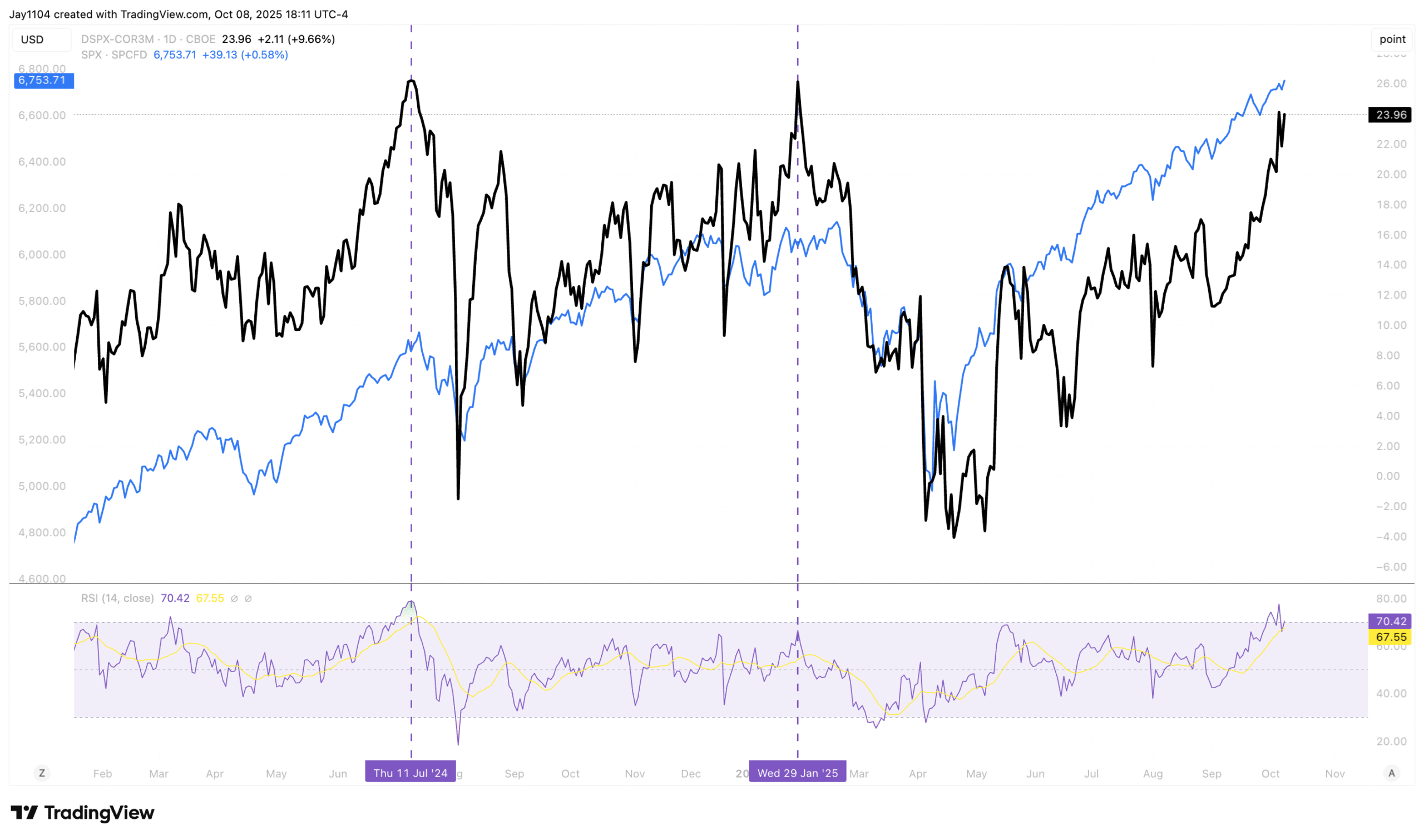

Watch for confirmation of a trend change in the implied correlation versus dispersion spread, which may signal a directional turn for the S&P 500.

The S&P 500 advanced about 60 basis points on the day, but the index has essentially moved sideways since Friday. If it manages to gap higher today, that would be different, but for now, we’ve just been oscillating around the 6,750 gamma level. Technically, there’s not much to note, except for the bearish divergence on the RSI and the potential rising wedge.

I know everyone likes to compare today’s market to 1999, and there are even plenty of analogs circulating. However, I believe today’s market most closely resembles the one from the 1960s. In fact, it’s an analog I identified back in 2021, and it still seems to be tracking fairly well, even if the timing fluctuates a bit.

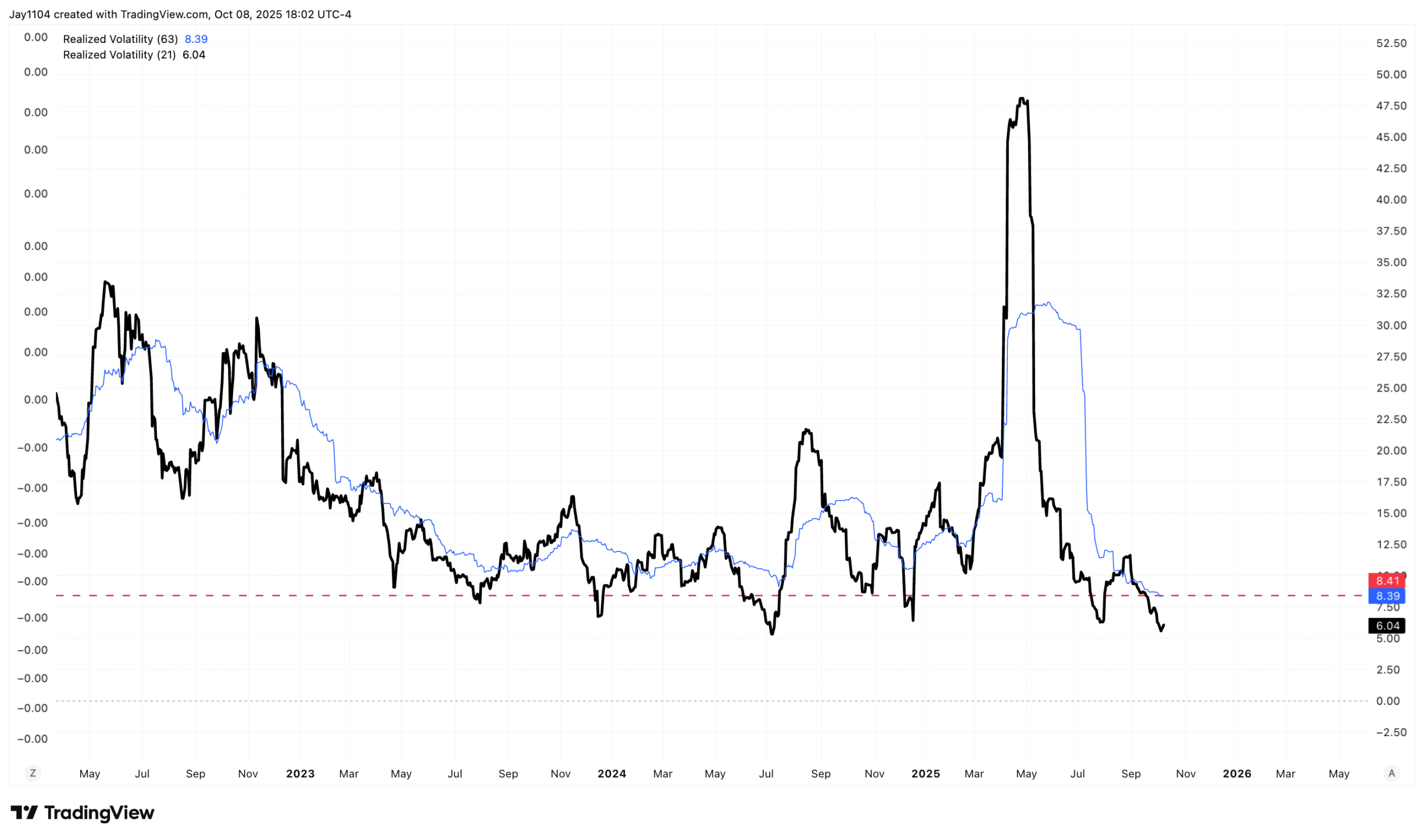

In the meantime, with the index rising by nearly 60 bps today, the 21-day moving average moved up to 6 basis points from 5.55 on Monday’s low. At this point, as long as the S&P 500 continues to rise or fall by more than 38 bps per day, the 21-day realized volatility will keep increasing.

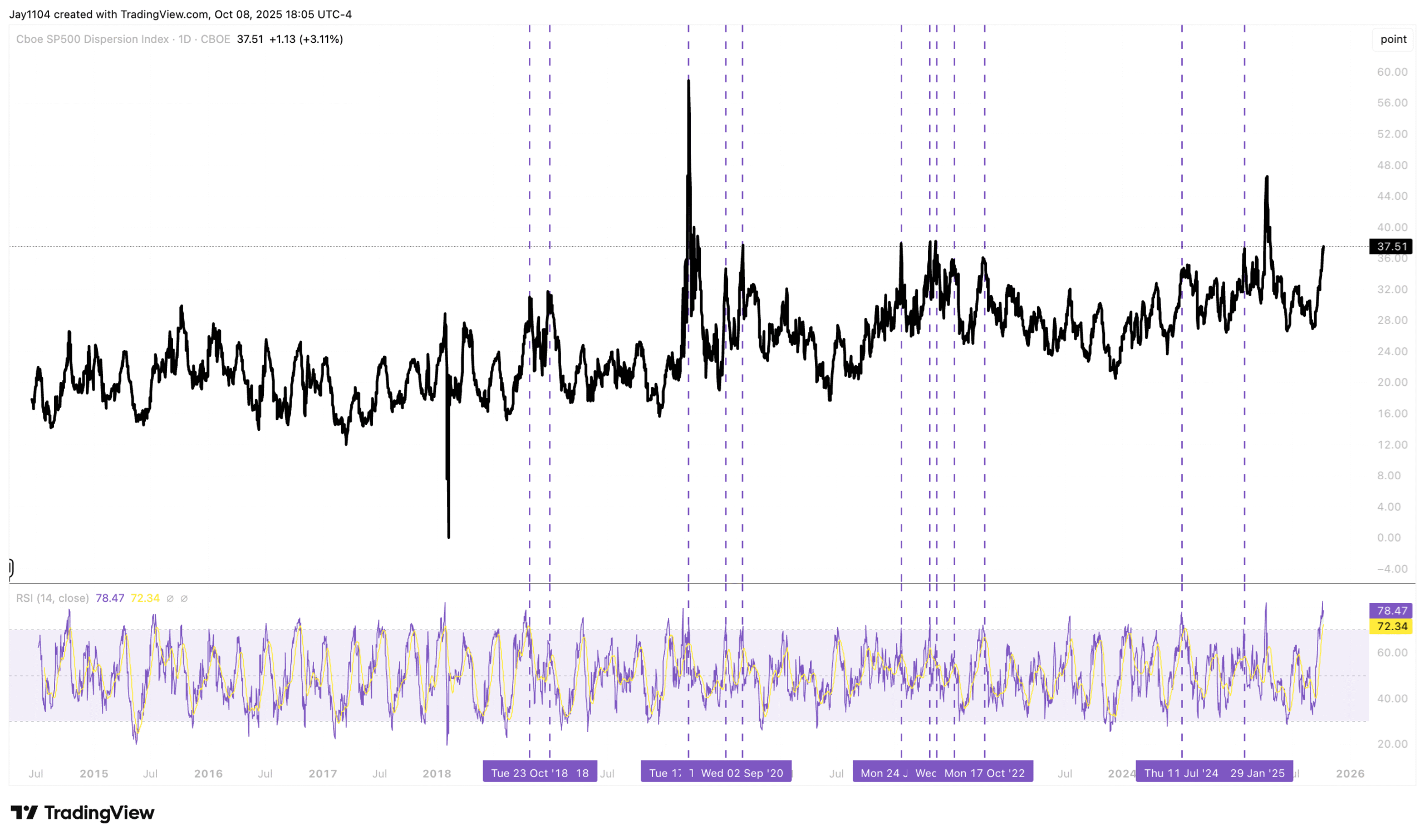

The dispersion index continues to climb to historically high levels.

What was noticeable, however, was that the spread between the 3-month implied correlation index and dispersion index did not make a higher high. While one day doesn’t mean much, a few days of this potential change in trend in the spread could tell us a lot about where the S&P 500 is heading.

In the meantime, we can add Bank of America (NYSE:BAC) to the list of stocks that have turned lower in recent days.

Blackstone (NYSE:BX) broke support on Wednesay at 163.

Home Depot (NYSE:HD) continued to fall as well.

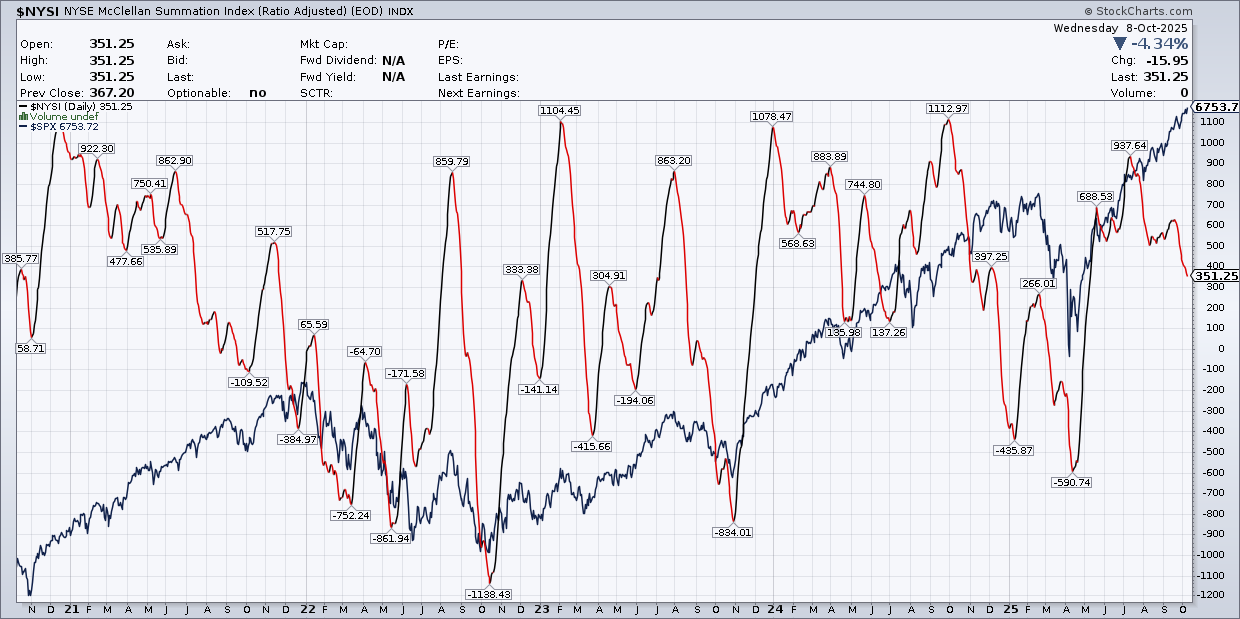

However, overall market breadth continues to deteriorate.

The US dollar continues to show strength, with the index pushing higher and breaking above resistance at 98.50. Momentum is continuing to build positively, with the RSI moving above 61. The 100 level is likely the next stop for the US dollar index.

I’m sure I’m leaving something out, but my brain is hurting.