Can anything shut down the Gold rally?

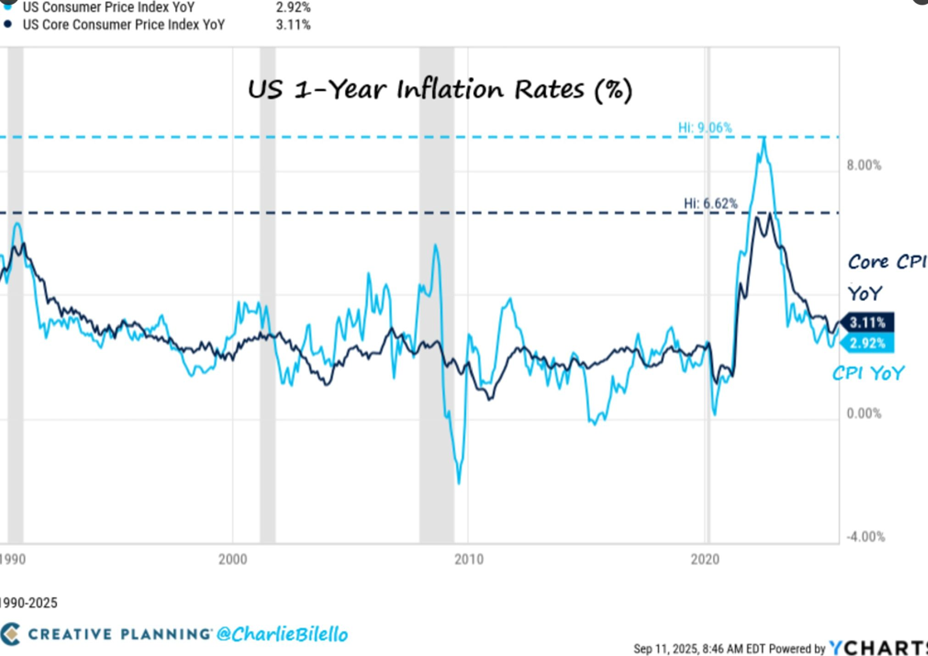

1. US Inflation Numbers Open the Door to a Rate Cut This Month

US inflation ticked higher in August, with headline CPI rising to 2.9%, the highest since January, and Core CPI holding at 3.1%. Together with softer producer prices and a rise in jobless claims, the figures support expectations for a 25bps Fed rate cut in September. Price pressures remain mixed: food costs continue to climb while discretionary goods ease, and service-sector inflation shows subtle signs of abating. With PCE inflation likely to remain around 3%, markets are betting on three cuts this year, though we see room for only two unless the labour market weakens further.

Source: Charlie Bilell

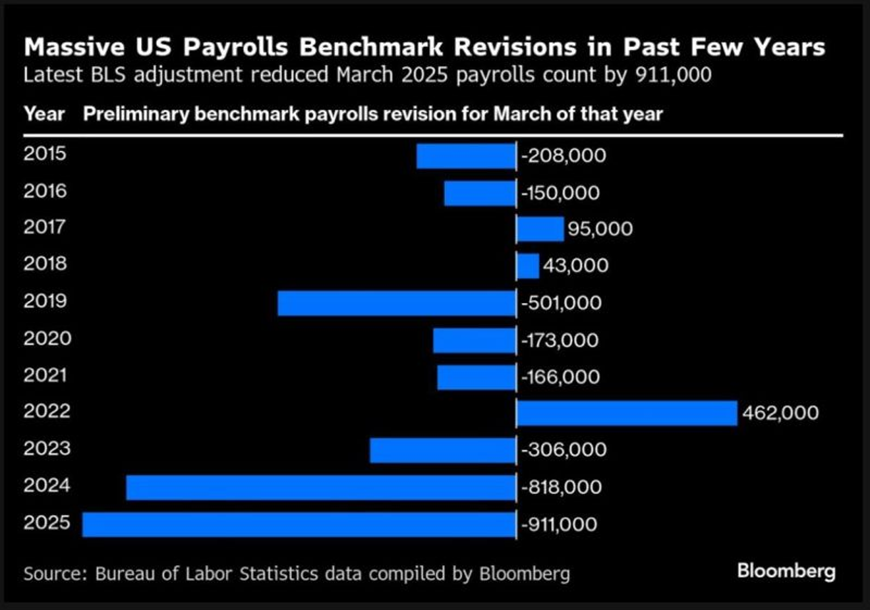

2. 2025 Won’t Be Exempted by US’s Massive Payrolls Revision Trend

The Bureau of Labor Statistics is set to revise down the number of workers on US payrolls by 911,000, or 0.6%, in the year through March. This represents the largest reduction since 2000 and, relative to the workforce, the most significant adjustment since 2009. The preliminary benchmark highlights the volatile changes that have characterised the US labour market data in recent years, with large swings in revisions both upward and downward. The final figures will be released next year, providing a clearer view of underlying employment trends.

Source: Lisa Abramowicz @lisaabramowicz1, Bloomberg

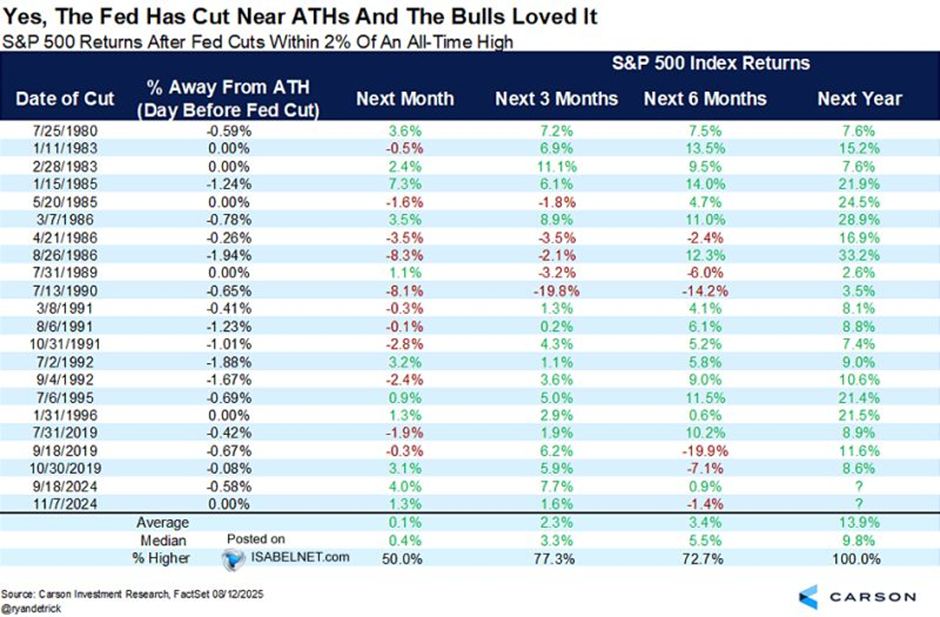

3. Fed Cuts At All-time Highs Often Boost Equities

The chart below underlines the performance of the S&P 500 since the 1980’s Fed rate cuts, very close to the all-time highs. On average, the index rose 3.3% over three months, 5.5% over six months, and 9.8% over the following year, with gains recorded every time one year later. Since 1980, rate cuts near market highs have not derailed bullish markets. Instead, history has shown that they often tend to provide additional momentum for equities rather than signalling to caution.

Source: StockMarket.News, Carson Investment Research

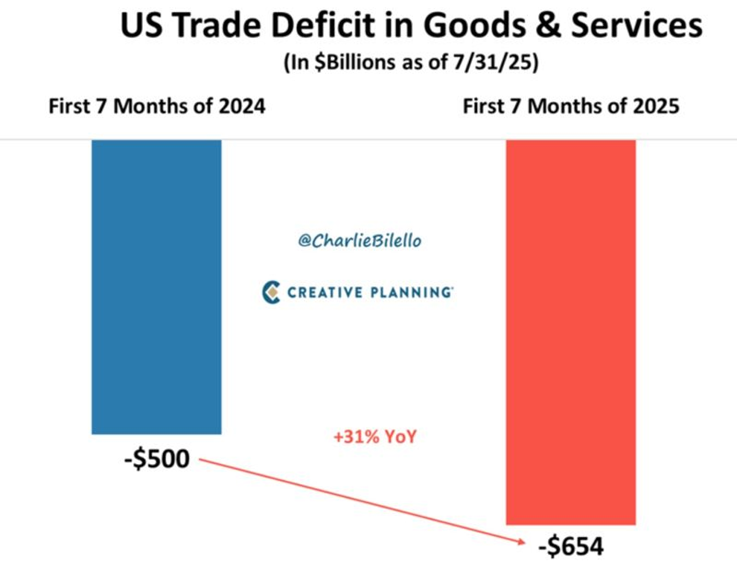

4. Despite Aggressive Tariff Policies, the US Trade Deficit Keeps Widening

Tariffs were pitched as a remedy for America’s growing trade deficit, but data tells a different story. During the first seven months of 2024, the US trade deficit in goods and services amounted to $500 billion. Fast forward one year, and the shortfall has expanded sharply to $654 billion over the same period. This represents a record level with a staggering 31% year-over-year increase. These figures cast doubt on the effectiveness of tariffs as a policy tool, suggesting they have done little to curb the deficit and may have even exacerbated underlying imbalances.

Source: Charlie Bilello

5. The Global Bond Market Re-enters Bullish Market Territories

Bloomberg frames the ongoing bond rally into a bigger picture: after a three-year slump triggered by surging inflation rates that battered global fixed-income markets, bonds have officially returned to bull market territory.

The Bloomberg Global Aggregate Index, which tracks sovereign and corporate debt across both developed and emerging markets, has seen an over 20% climb from its 2022 low, currently reaching a new peak since March 2022. The latest upswings have been fuelled by signs of a cooling down US labour market, which strengthened expectations of the US Federal Reserve accelerating rate cuts. This recovery underscores the bond market’s dynamic reaction to inflationary pressures and the possible easing of monetary policies.

Source: Bloomberg, Mo El Erian on X

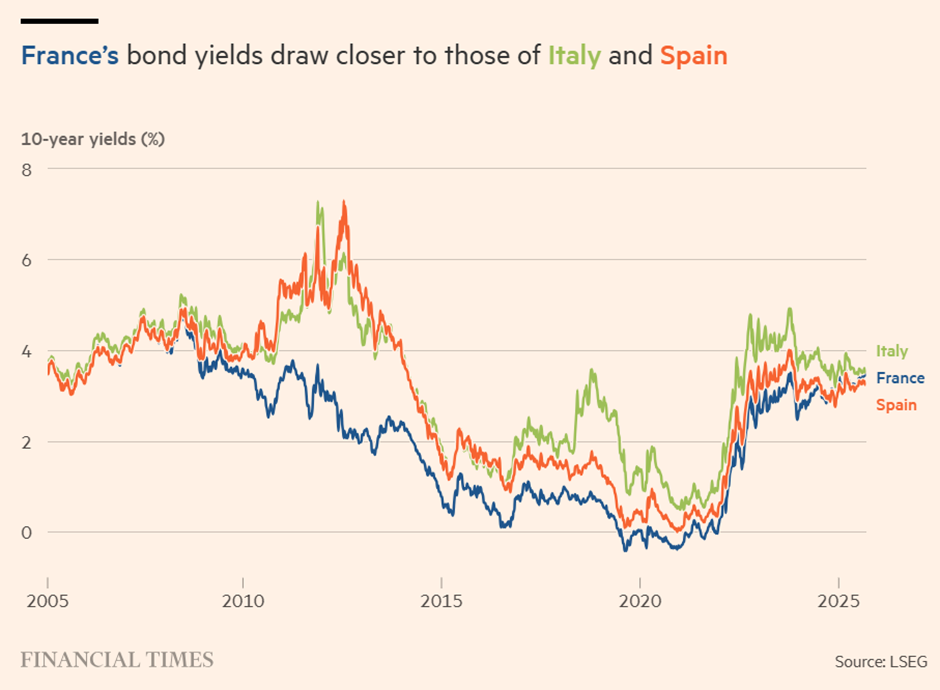

6. France Is the New Periphery of the Eurozone

Large investors now place France in the ranks of the Eurozone’s risky “peripheral” borrowers, as political instability complicates efforts to tackle its mounting debt burden. The fall of Prime Minister François Bayrou’s government, after losing a crucial confidence vote on deficit-reduction measures, has pushed Paris’s borrowing costs soaring to levels last seen during the Eurozone debt crisis. With deepened market unease, the country’s 10-year yield now trades at 3.47% —above Greece’s 3.37% and nearing Italy’s 3.51% —bringing it uncomfortably close to peers long seen as more fragile. This shift highlights a growing reassessment of French sovereign risk and marks the sharp departure from traditional views qualifying its bonds as a core safe asset in the Eurozone.

Source: Financial Times

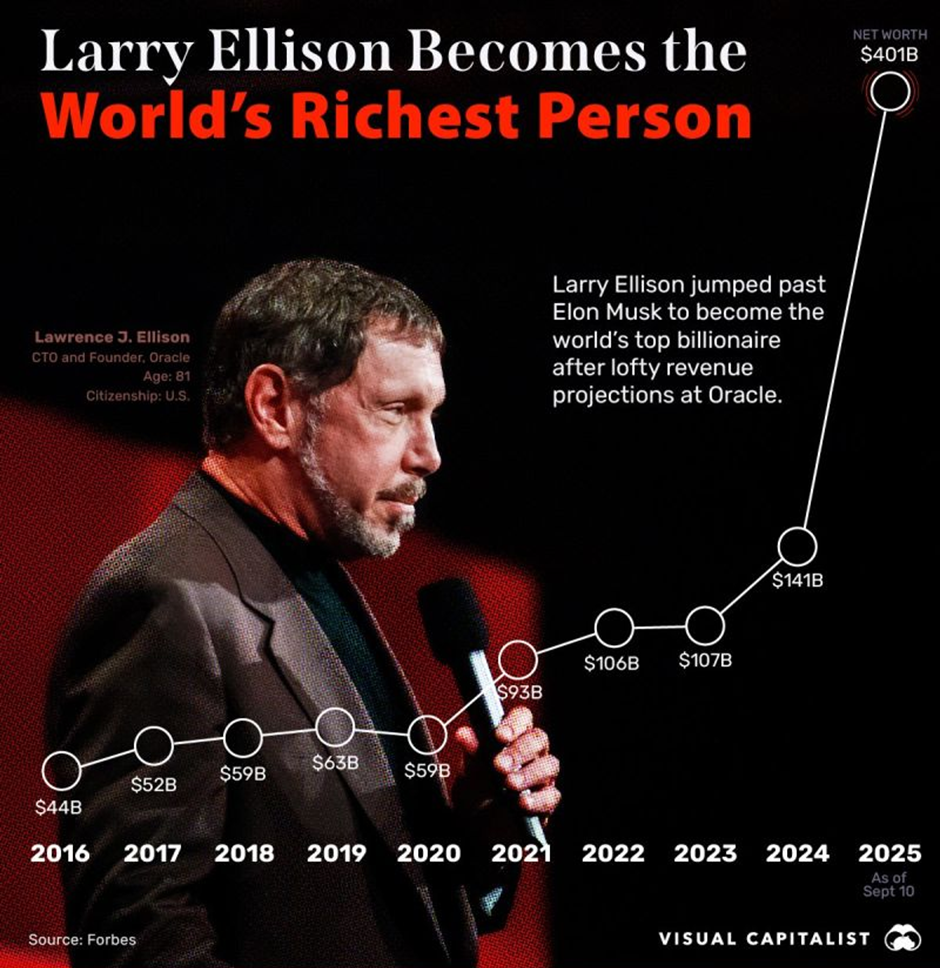

7. Larry Ellison, Currently the Richest Person on Earth

At 81, Larry Ellison has ascended to the position of world’s wealthiest individual, with a net worth reaching $401 billion due to Oracle’s (NYSE:ORCL) recently surging market capitalisation. Nearly 5 decades after founding the company, Ellison still holds an estimated 40% stake—without ever selling a single share.

Meanwhile, the firm’s aggressive buyback program has cut its outstanding stock by about half, further magnifying the value of his ownership. To this day, Ellison continues to serve as Executive Chairman, actively shaping Oracle’s strategic directions and engaging with investors on earnings calls. His steadfast commitment has been instrumental in sustaining shareholder value and reinforcing Oracle’s long-term market position.

Source: Ray Myers @TheRayMyers, Voronoi