BETA Technologies launches IPO of 25 million shares priced $27-$33

After last week's buying it was expected sellers were going to make a return given the prior trend. However, the level of selling has been relatively modest, and with three days of selling banked, the chance bulls will make a reappearance is high.

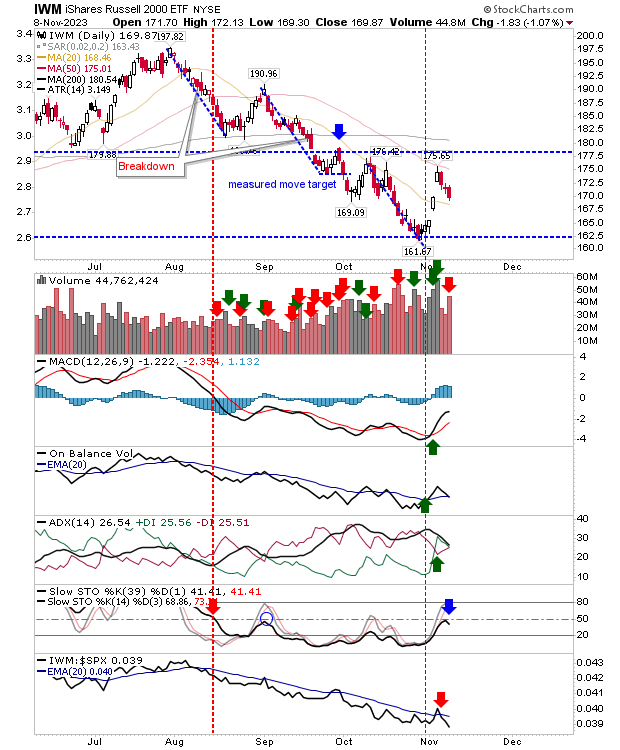

The Russell 2000 (IWM) has been the weakest index to date and has sold off the hardest so far. But the selling of the last three days has only managed to close Friday's gap higher. Yesterday's volume was the first to register as distribution, but Monday and Tuesday's selling volume was light.

The key concern is the rebuff of the intermediate stochastic mid-line; last week's rally wasn't able to push the indicator to the bullish side of this line despite the technical improvement in ADX, On-Balance-Volume, and MACD.

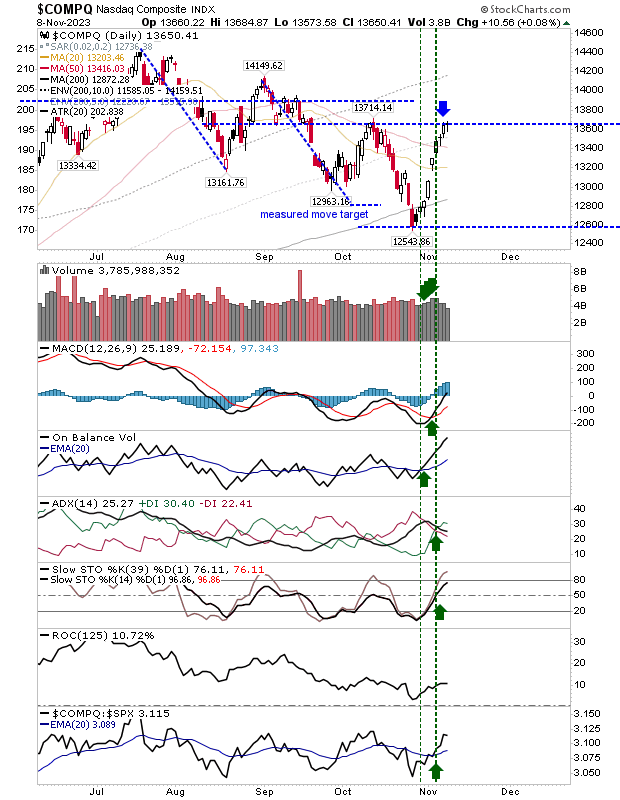

The Nasdaq tagged October swing high resistance on falling volume, but supporting technicals are net bullish with excellent buying momentum. Today's doji at resistance is a bearish marker, but there are 50-day and 20-day MAs nearby for support should sellers follow through on the reversal candlestick.

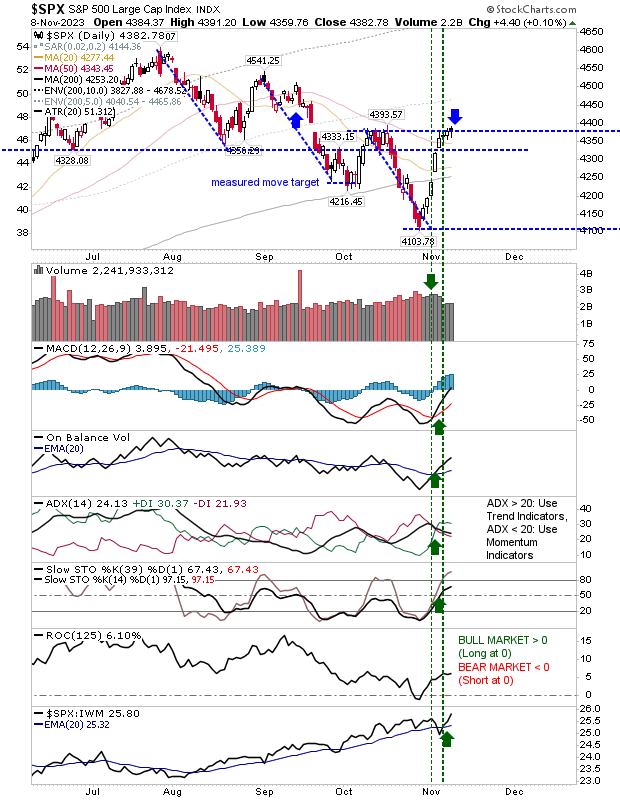

The S&P 500 sits in a similar position to the Nasdaq having tagged the October swing high, but also doing so with a reversal candlestick. Technicals are net positive, although bullish momentum is not as strong as for the Nasdaq. However, it also has 20-day and 50-day MAs to lean on for support.

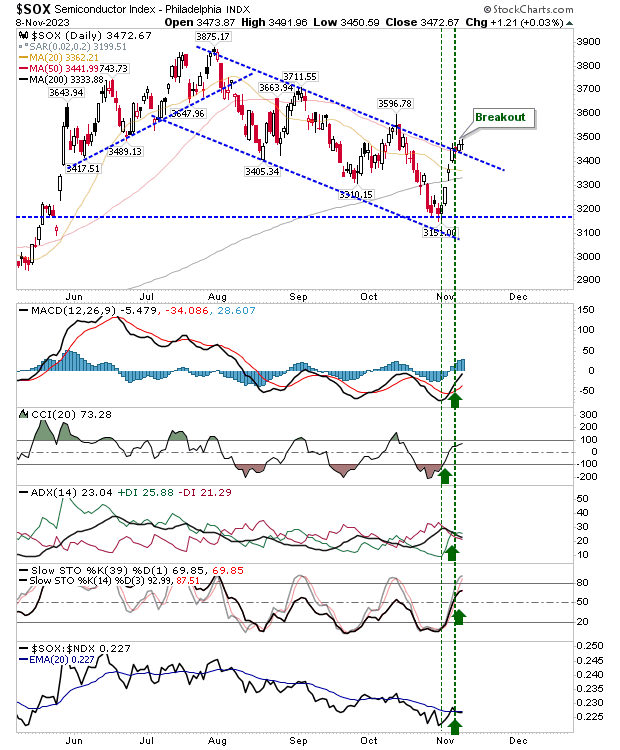

One of the bullish sectors that will help indexes, and the Nasdaq in particular, is the Semiconductor index. This week has seen a channel breakout after recovering from the loss of its 200-day MA.

Up until the recent bounce I had expected the Russell 2000 to fall away in a selling frenzy but this is looking ever less likely. The Nasdaq and S&P 500 are more resilient and have been able to build on the recovery in the Russell 2000. There is still work to do on weekly timeframes, but bulls have opportunities to leverage.