Navitas stock soars as company advances 800V tech for NVIDIA AI platforms

- Stellantis is best-in-class by profitability and produces solid FCF due to a strong management team

- Often unnoticed, Stellantis is a top-3 player in the electric vehicle market with a great growth outlook

- Its healthy balance sheet and remaining cost-saving synergies will help Stellantis weather the storm

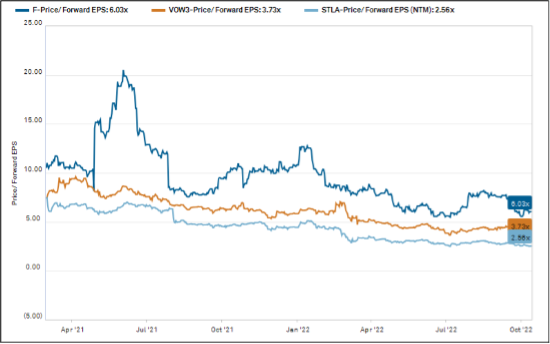

Stellantis (NYSE:STLA) has been reporting excellent results and is getting harder to ignore. Though the market still has its doubts, the numbers show health, stability and a solid long-term growth outlook that will help Stellantis navigate the upcoming recession. The automaker is best-in-class in terms of profitability, inching closer to the likes of Tesla (NASDAQ:TSLA) while leaving Ford (NYSE:F) and Volkswagen (ETR:VOWG_p) behind. Stellantis’ electric strategy is also strong. The company is quietly becoming one of the leaders in electric vehicle sales. In terms of growth, Stellantis is already doing quite well, yet some investors forget that there is much more to come – the iconic Maserati, Lancia and DS brands are all far from reaching their full potential. These cars are popular and are being sold at high prices, I think it’s worth more than a meager 2.56x earnings.

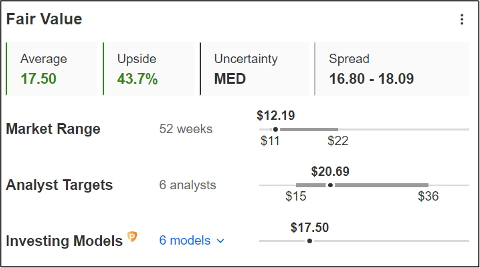

Source: InvestingPro

Macro Environment

Market conditions in the auto industry are gloomy to say the least. Rising inflation and the nearing threat of recession (for some already a reality) mean that consumers aren’t exactly lining up to buy cars. Aside from the weakening demand, supply-chain issues continue to drag down production.

Up to now, the shortage in chips and raw materials has allowed auto manufacturers to raise prices and increase their profit margins. Stellantis has been a big beneficiary of this. Of course, there is also bad news. For example, there is no end in sight for the semiconductor shortage.

The result of all this is that many automakers have revised down their guidance for FY22. Stellantis lowered its outlook for Europe from -2% to -12%, while for the U.S. market it adjusted from low-single-digits to -8%. Despite taking into account a worsening of the scenario in the global auto market, conservative estimates confirm a double-digit operating margin and positive industrial cash flow by the end of the year. Also, as outlined by the firm’s CEO Carlos Tavares, “the break-even point of Stellantis is 40%, which […] gives us a significant sustainability to face any crisis that we could be facing in the near future.”

Essentially, Stellantis only needs to sell 40% of its full production capacity to break even. As I hope to prove below, with a healthy balance sheet and a strong management team, Stellantis is much better positioned than its peers to face an economic downturn.

Best-In-Class 1H 22 Results

Stellantis reported outstanding 1H 22 results, which shed some light on the value and potential held within the auto producer.

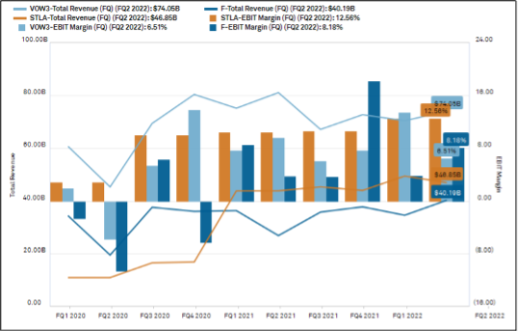

Net revenues for the first two quarters came in at €88.0 billion, up 17% YoY. More importantly, Stellantis recorded an operating margin of 11.7%, with all five regions on double-digit margins and the U.S. reaching a record 18.1%. The result was a net profit of €8.0 billion, up 34% YoY. In terms of cash flow, the company is more than comfortable with industrial free cash flows of €5.3 billion, up €6.5 billion YoY. These results came in spite of shipments declining 7%, for a total of 3 million units.

Stellantis remains the global leader in the commercial vehicle market, with a 33% market share in the EU and 31% in LATAM. The automaker also built up its market share in the fully electric (BEV) and low-emission (LEV) vehicle segment in Europe where it is second (just a few thousand units behind Volkswagen), and in the U.S. where it is third.

Growth Story:

Source: CIQ

Stellantis has much to celebrate following its last report. This can’t be said for its two main competitors, Ford and Volkswagen, which have been navigating the same market headwinds and tailwinds. They are struggling to reach double-digit EBIT margins, while Stellantis sails above 11%. It is clear that the positive results have more to do with execution than with simply riding the tight market cycle.

*

Source: InvestingPro

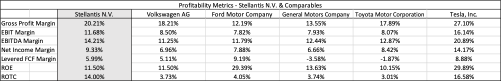

Profitability is key in the auto industry, even more so than in other sectors. Since Carlos Tavares’ appointment to CEO, Stellantis has continued to improve its profitability metrics and is now well ahead of the remaining legacy automakers. In fact, it is starting to catch up to Tesla, which, given its sole focus on electric vehicles, benefits from much higher margins.

For industrial firms, the return on total capital (ROTC) makes a great indicator of efficiency. Unlike return on equity (ROE), it considers both equity and debt, which is key for industrial companies. As is clear from the table above, Stellantis makes much better use of its capital, which indicates a strong management team. Another reason why Stellantis has managed to push up profitability and turn that margin into free cash flow is that the synergies between PSA and FCA are still coming into action. Management believes it could lead to more than $5 billion in savings. As of now, large-scale industrial synergies have spared $3.1 billion.

Future Opportunities

Stellantis’ management team has done a great job so far, but in presenting the ‘Dare Forward 2030’ plan it reckons it can do even better. The company is doubling down on its electrification strategy and is committed to become a point of reference in the fight against climate change. Just recently, Stellantis decided to extend its agreement with Punch Powertrain in pursuit of their ‘Dare Forward 2030’ electrification objectives. The car-maker's progress up until 2Q22 is already impressive. The company ranked second in Europe for sales of only electric (BEV) and low-emission vehicles (LEV) and third in the U.S. for LEV sales. Though unknown to most, Stellantis is quietly becoming a global EV leader.

Stellantis also holds many iconic brands under its umbrella, most of which are far from reaching their true value. Lancia and DS are strong names that have yet to experience a turnaround like Alfa Romeo, which is now highly profitable. Maserati is also one of the world’s most well-known auto brands, yet its operating margin is still at 6.6%. With time, Stellantis will shift its focus to leverage these classics, possibly unlocking a lot of value.

Stellantis’ future seems bright. An anecdote from the company’s CEO Tavares, summarizes the feeling at the firm nicely:

“Employees and our union partners. They started from a position a few years ago where they only wanted base salary increases because they didn't trust that the recurrent profits would happen […]. Now, through the level of demand and the way we are managing the company, they are trusting that performance bonus are as good money and as a pure base salary increase.”

Valuation

Investors are failing to notice how much more value Stellantis is creating compared to its peers. It is reporting numbers stronger than its U.S. counterparts but is still priced like the French-Italian dinosaur it was 10 years ago.

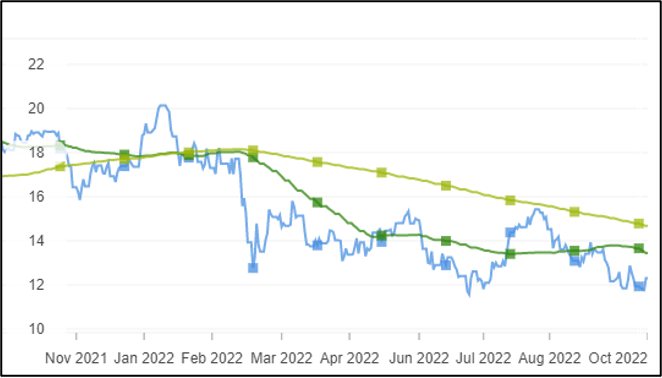

With a forward P/EPS of 2.56x, Stellantis is much cheaper than Ford and Volkswagen. It seems unreasonable that investors aren’t willing to pay more than two and a half times earnings for a company with a very strong balance sheet and a positive long-term outlook. Stellantis also generates a significant amount more of free cash flow compared with its peers. The company’s 21% forward FCF yield is almost four times Ford’s.

Source: InvestingPro

The stock has a good possibility of upside by InvestingPro metrics, yet my DCF gives an even higher target price. I model a two-year downturn, an FCF growth rate of 1%, and an 11% discount rate.

I think this is one of those stocks that you buy and hold, waiting for the market to discover its true value while collecting a nice 8.53% dividend.