One & One Green Technologies stock soars 100% after IPO debut

Markets stepped back once more, but not in any capacity to suggest fear is rising, but more a general complacency as to where the markets will go next. I would view this as bullish in the long term.

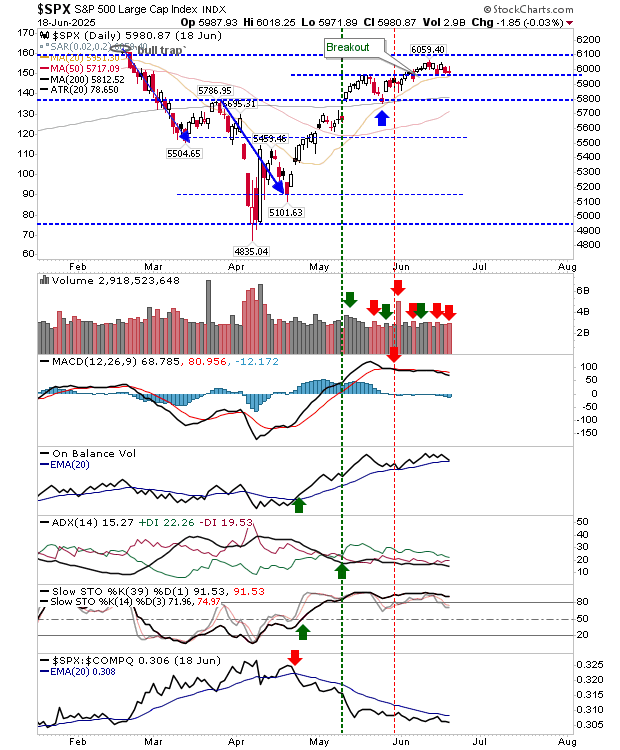

The S&P 500 posted a distribution day as selling brought the index back to its 20-day MA. The ’inverse hammer’ suggests the index will undercut this average, but given recent price action, it’s unlikely to do so by much.

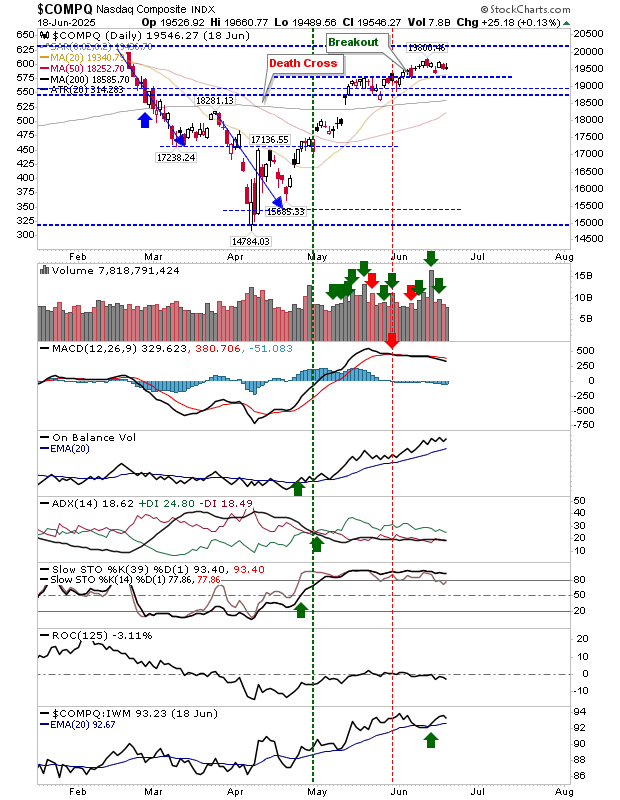

The Nasdaq is looking a little more bullish with room to maneuver to 20-day MA support. Technicals are more bullish than the S&P 500 with only a weak MACD trigger ’sell’ to manage.

The rally has been strong, but I would like to see a test of the 200-day MA to shake out the weak hands before pushing past 20,000. Of course, the Nasdaq will ultimately do its own thing.

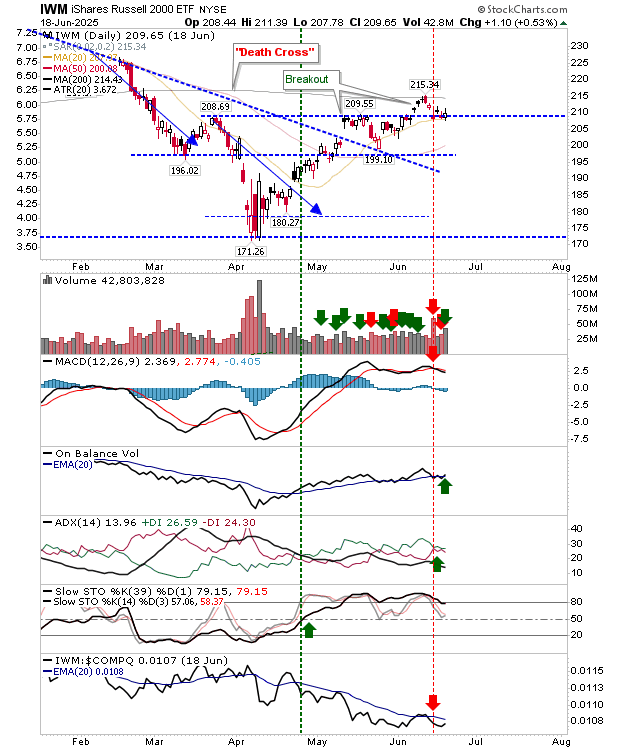

The Russell 2000 (IWM) is resting on its 20-day MA with a new ’buy’ trigger in On-Balance-Volume as action registers as accumulation.

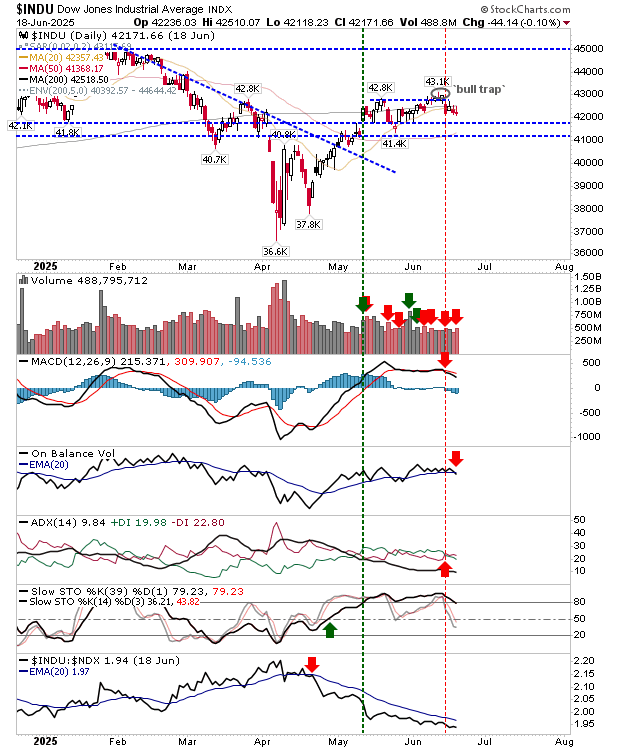

The one index that is breaking the mould a little is the Dow Industrial Average. There are ’sell’ triggers for the MACD, On-Balance-Volume and ADX to go with the undercut of the 20-day MA and ’bull trap’. It’s the most bearish of the indices, without being too bearish.

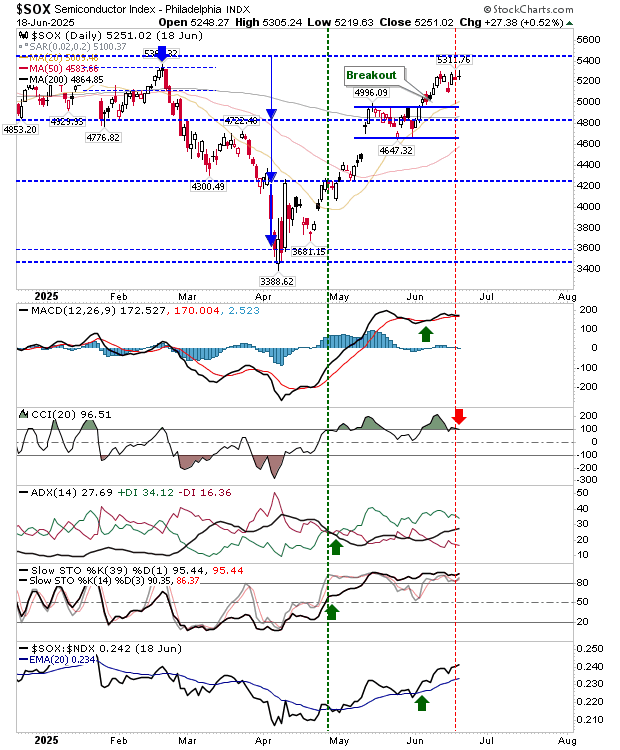

The Semiconductor Index sits at the other end of the scale. It’s very close to breaking to new highs, and recent action is bullish. The only bearish signal is the CCI. Look for further advances in the coming days.

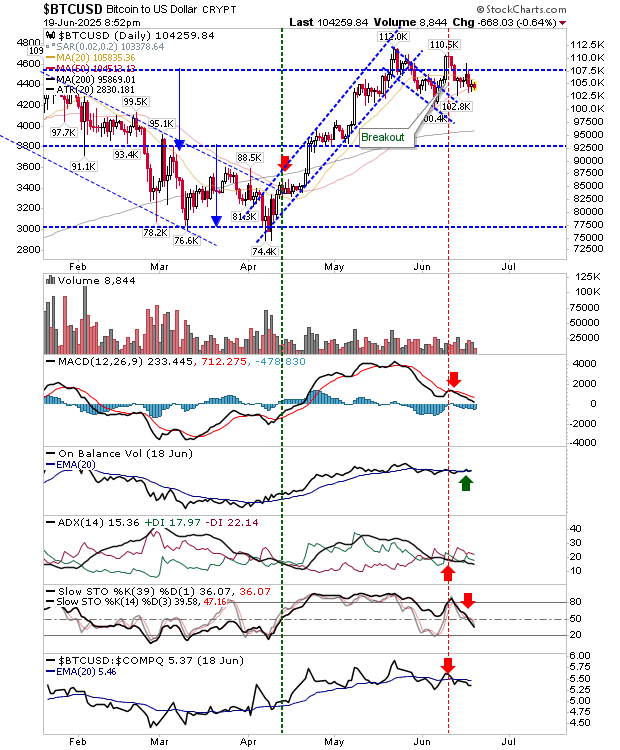

Bitcoin continues to hold its 50-day MA as part of a multi-week basing process. Trading volume has dropped off sharply since the tariff-fueled panic of March, and early-year fears. Technicals are mostly bearish, but price action sides more with bulls.

So we come to the end of the week much as we started it. I will be looking for markets to advance in the long term, but as to when the kick-off occurs is anyone’s guess, but it will likely be sooner rather than later.