Uxin shares drop 45% as predicted by InvestingPro’s Fair Value model

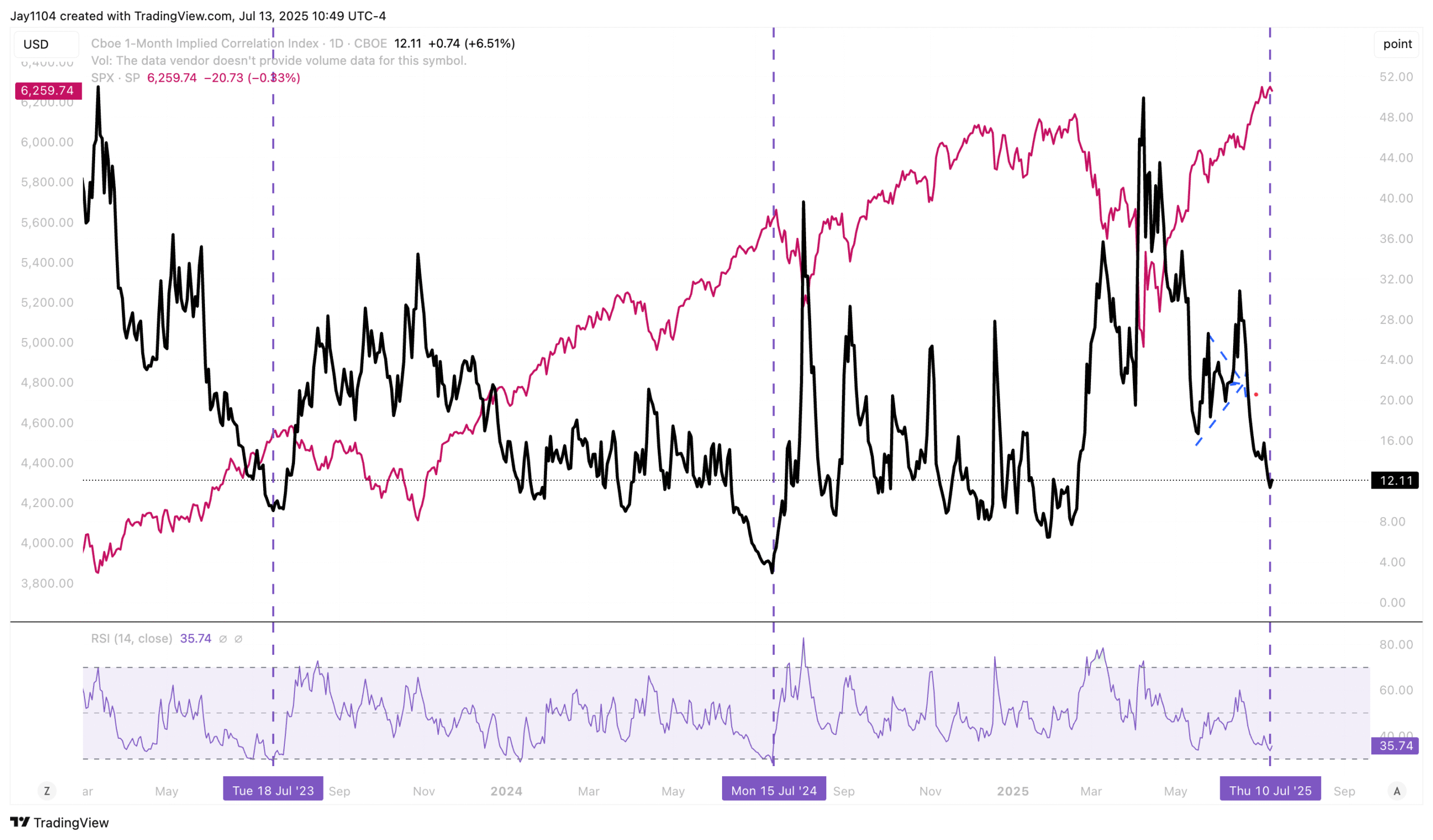

Historically, we are entering the period of the year when 1-month implied correlations typically bottom, and when implied correlations bottom, markets often top. This pattern is largely driven by the implied volatility dispersion trade and the subsequent unwind following earnings releases. With earnings season about to begin, the unwind should be roughly a week away.

When the 1-month Implied correlation index starts to rise, you will know.

The S&P 500 moved lower in the past week. Apart from the Canada tariff headlines on Thursday, the week was relatively uneventful, making it a good week to be away. One notable observation is the shift occurring in the dollar. The RSI readings are improving, and the DXY is on the verge of breaking above two significant downtrends.

With Saturday morning’s announcement of 30% tariffs on the EU, the EUR/USD weekend trading is down 40 basis points. This move will likely be sufficient to push the DXY above the trendline when trading resumes on Sunday night. Although this shift may not occur immediately, there’s a strong chance the DXY is headed back towards the 101 level.

That likely means that the EUR/USD is heading back to the 1.12 region.

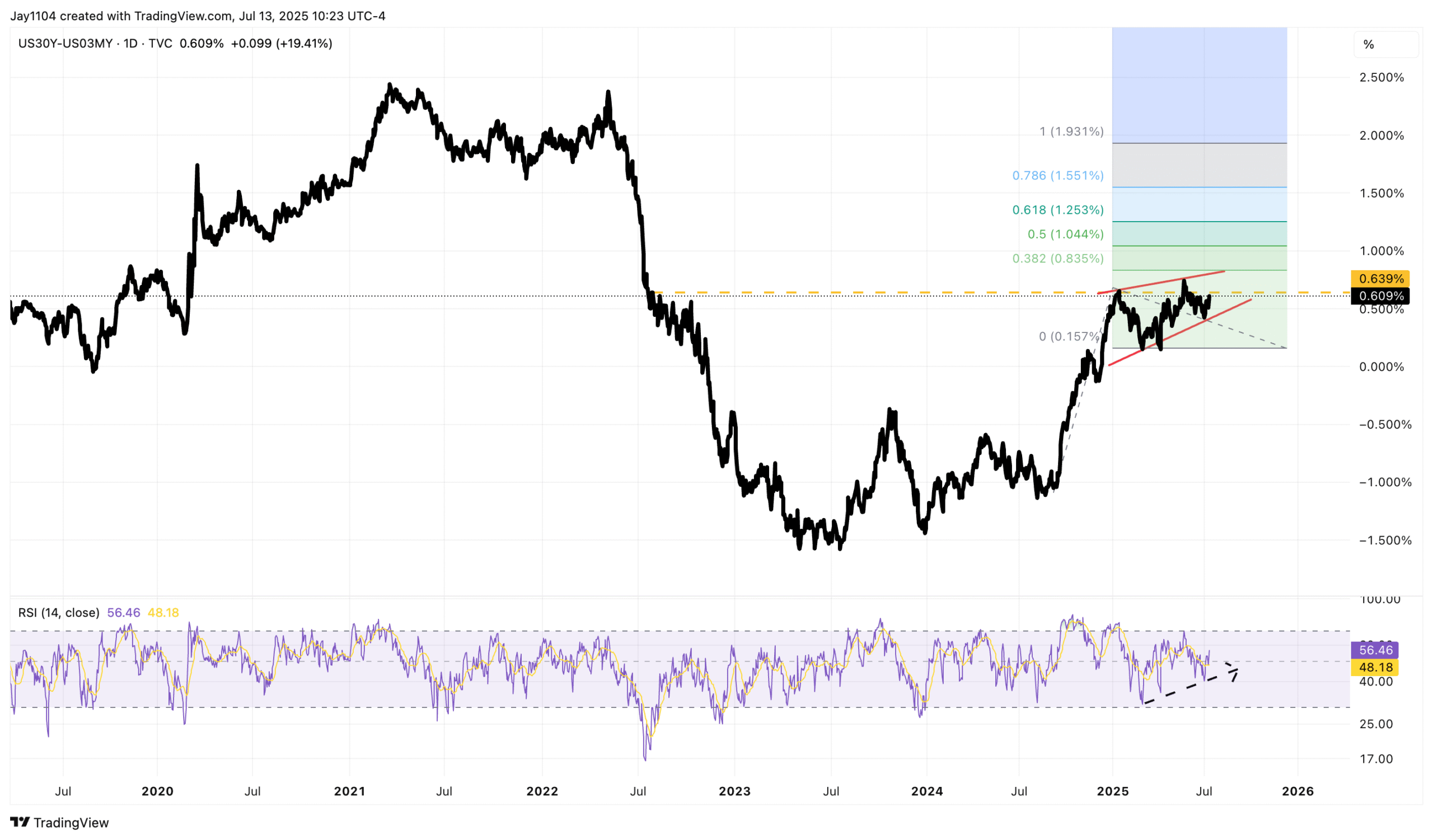

In the meantime, we are seeing 30-year rates moving higher and positioned to potentially surpass the 5.1% level observed in mid-May. It appears the 30-year rate broke out of a bull flag on July 7 and has since advanced to 4.96%. Even a 61.8% extension of this flag suggests the 30-year rate could reach 5.17%, while a 100% extension points toward 5.35%.

Ultimately, I think we could see the 30-year minus 3-month Treasury curve steepen out to about 190 bps, with the majority of this move coming from the 30-year rate rising. This isn’t to say the 3-month Treasury bill won’t fall—clearly, if the Fed starts to cut rates, it will—but I believe the 30-year rate has further to rise.

It is the same story for the TLT, which also shows the ETF breaking out of a bear flag, signaling potentially lower prices.

Ultimately, what is driving this is inflation expectations. The RINF ETF, which measures inflation expectations, is again attempting to break out of a broadening wedge pattern. It still needs to surpass 33.50 to signal a larger breakout, but there are indicators within the chart suggesting it could reach that position.

I had mentioned this a few days ago—I can’t exactly remember when—that Meta (NASDAQ:META) could be forming a 2b top, and so far that still appears to be the case. The chart clearly shows a failed breakout attempt, an RSI that’s rolling over, and volume picking up as the stock declines. A break below support at $710 would likely confirm this pattern and signal the start of a much bigger pullback.

Netflix (NASDAQ:NFLX) reports results this week, and the chart doesn’t look great heading into the announcement. The RSI is rolling over, and volume has been increasing on recent down days. Additionally, shares have broken below an uptrend at $1,260, within what appears to be a larger rising broadening wedge pattern. If this pattern plays out, it wouldn’t seem unreasonable for the stock to decline back to around $1,100.