Two National Guard members shot near White House

The Moody’s downgrade caught nearly everyone off guard on Friday afternoon. Most are dismissing the news as not a big deal, and perhaps it’s not. After all, the US has already had two prior downgrades. However, the timing is particularly sensitive, especially given the current negotiations around the tax bill. The key issue is that this downgrade comes at a moment when term premiums were already rising, potentially adding even more upward pressure.

At this point, the bond market is essentially in control—and more importantly, it has put the administration in a tight spot.

Scott Bessent had been trying unsuccessfully to lower the 10-year rate, and now the market clearly knows how to provoke a response from him and his team. With rates already back to levels seen before the pre-Liberation Day pause, one must assume the market will continue pushing rates higher until it gets a meaningful reaction from the administration.

Additionally, rates have already been rising, and given the recent breakout, it’s plausible that the 10-year could continue to climb, perhaps back toward 4.6%.

It’s a similar scenario for the 30-year, which is likely to push above 5%. It has already tested that level twice after breaking out of a bull flag, and we could see another attempt at surpassing that mark.

The US dollar has also been the focus of attention; the ironic thing about the dollar is that there was a “source” noting during the week, trade deals are not working to include currency policy pledges in the agreements. Interestly, just a couple of days later, Japan’s finance minister Kato said, “If circumstances allow, I’d like to use this opportunity to have a meeting with Treasury Secretary Scott Bessent and continue to discuss foreign exchange”.

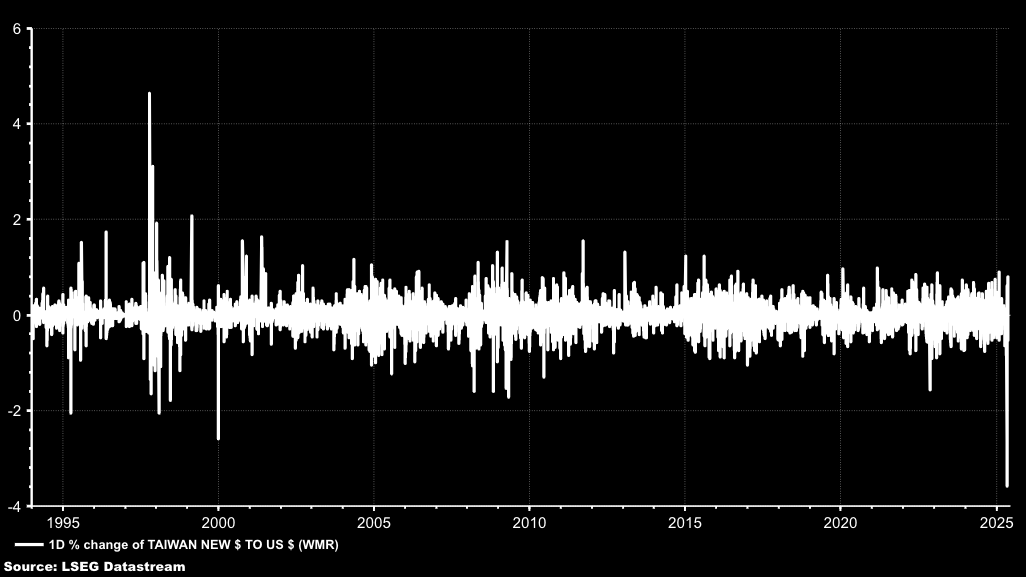

This would be at this week’s upcoming G7 conference. There were also reports that Taiwan and South Korea could use these as part of trade deals.

Indeed, the movements in the USD/TWD—a typically stable currency—have been historic over the past few days.

The way I see it, we have a bond market and a US dollar that are vulnerable to further weakness, with the USD/JPY now positioned to strengthen again against the US dollar—especially given its recent failure to break above 148.

As for the stock market, not much has stopped its recovery so far, but there’s also not much good news left to propel it higher. In fact, one could argue the news flow will likely worsen from here, given that the major positive trade news has already been announced. We probably won’t see any trade deals better than the one reached with the UK, and the China trade pause was arguably the largest possible deal.

Additionally, President Trump has signaled plans to start assigning specific tariff rates to various countries. On top of that, announcements regarding pharmaceutical and semiconductor tariffs are still pending.

If anything, the market’s significant rally has likely given the President the green light to move forward with his tariff agenda. Previously, rising rates, a weakening dollar, and falling stocks were the key factors that prompted the administration’s pause. Now that stocks have recovered most of their losses, it seems like the ideal moment for the administration to advance its tariff plans.

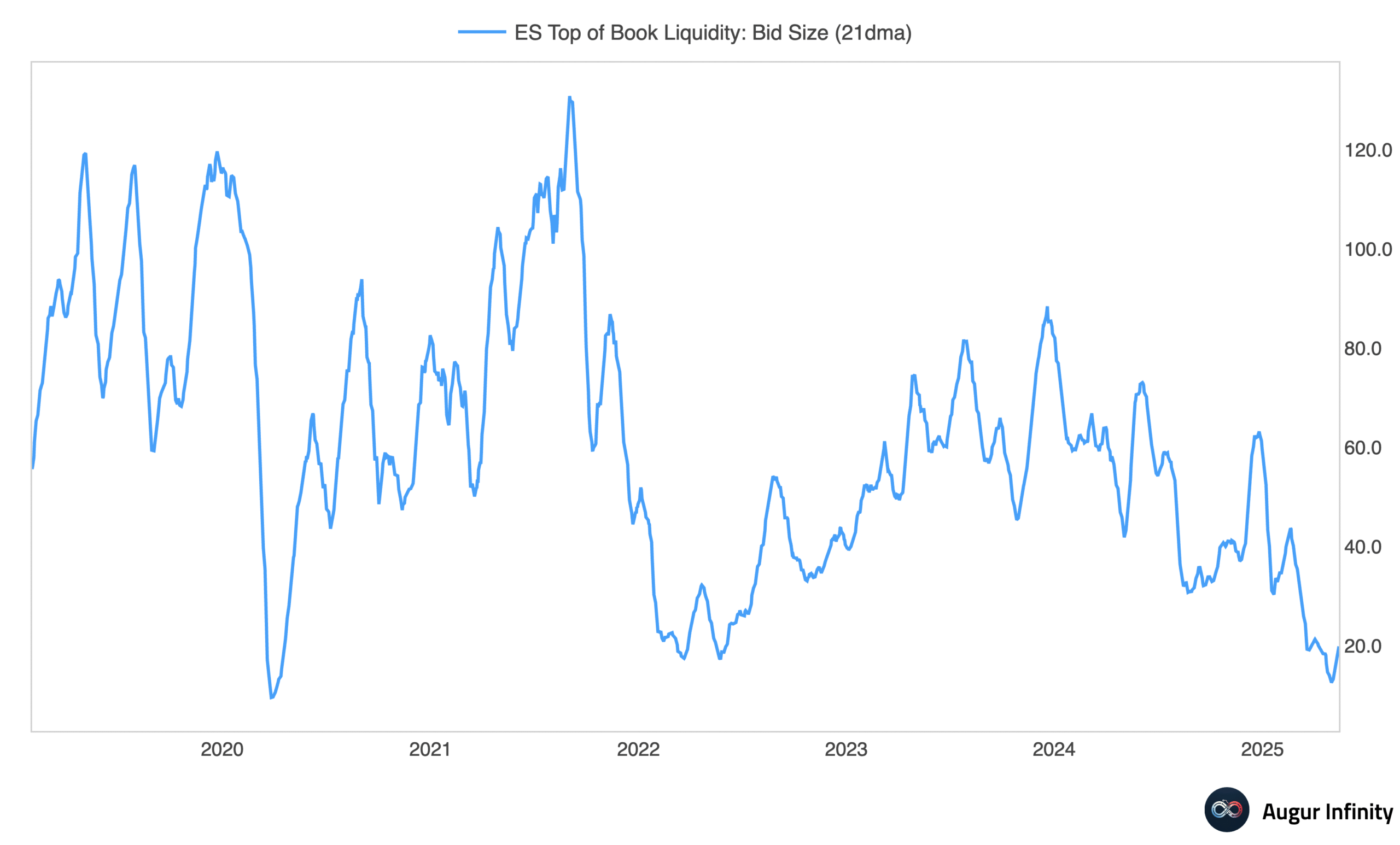

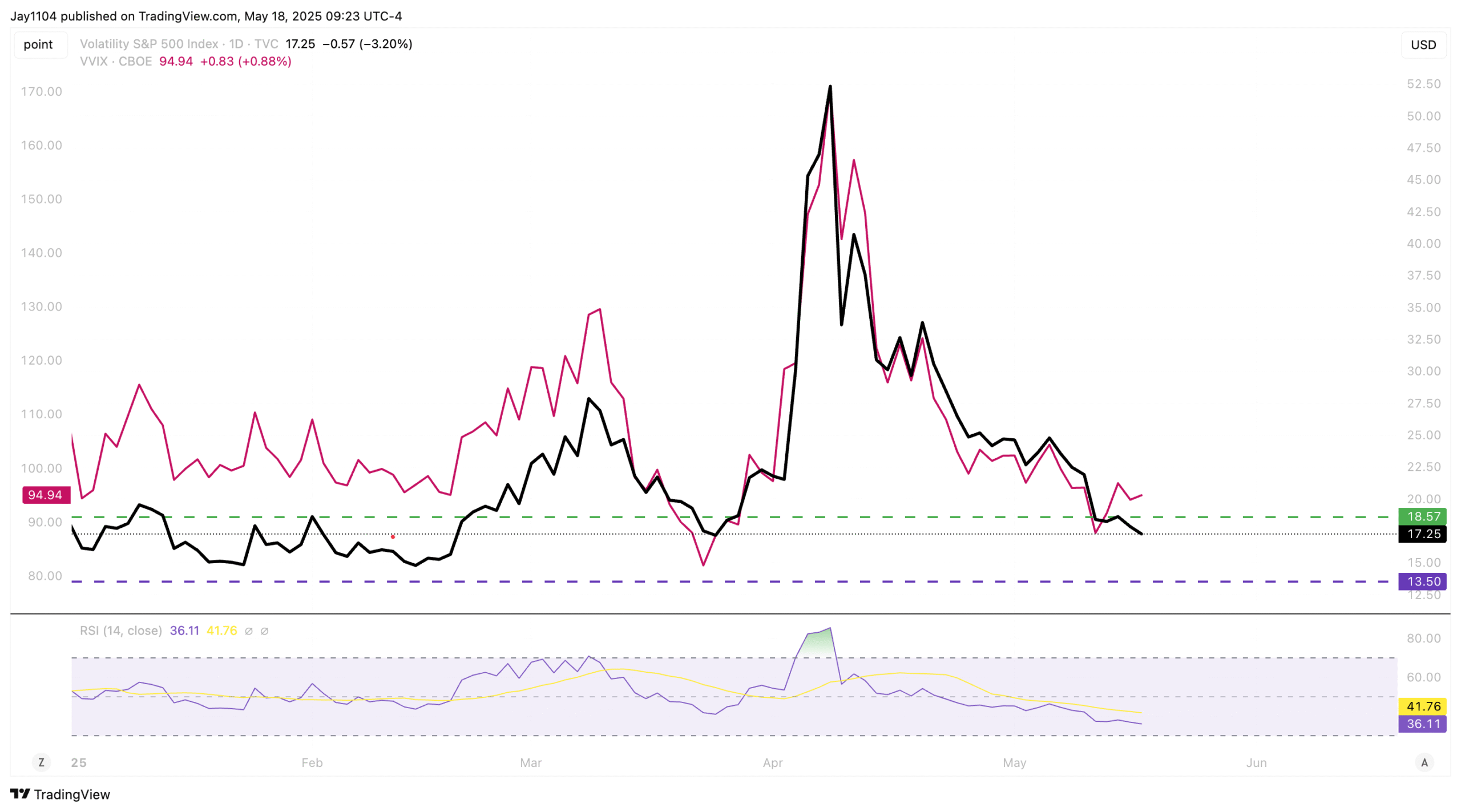

To me, considering where realized volatility currently stands and the thin liquidity at the top of the order book, implied volatility levels should be higher than they are now. In fact, we’ve already started to see the CBOE Vix Volatility move upward.

With the recent market surge likely driven by repositioning after the trade pause and the announcement of the agreement with China, markets have probably overshot to the upside and are now due for a correction. Considering the post-OPEX landscape coupled with the Moody’s downgrade, conditions seem ideal for a substantial decline.

I don’t see any reason why we couldn’t fill the gap at 5,680 and then reassess from there.