Raymond James raises Fulgent Genetics stock price target to $36 on strong performance

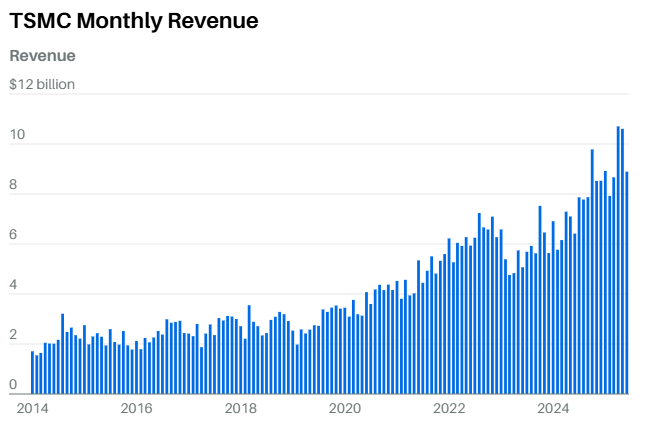

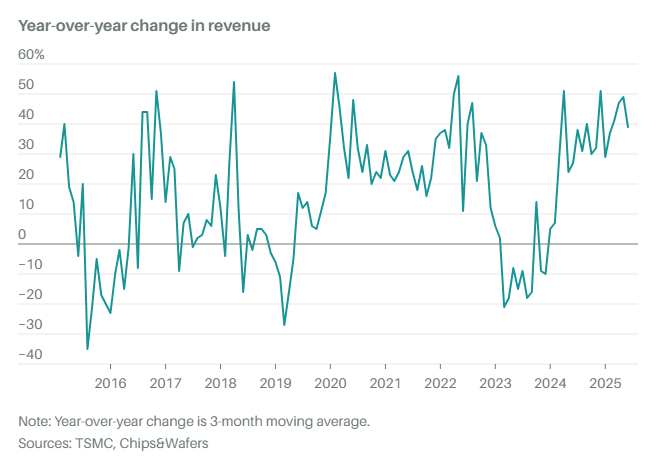

Taiwan Semiconductor Manufacturing (NYSE:TSM) reported June revenue of $8.9 billion, surpassing analyst estimates of $8.51 billion. This reflects a 26.9% year-over-year increase in local currency terms. Despite exceeding expectations, TSMC’s stock price showed some uncertainty following the announcement, which could be attributed to factors such as market sentiment, broader industry conditions, or future outlook concerns. Overall, the strong sales growth underscores TSMC’s leading position in the global semiconductor manufacturing industry.

Key Highlights

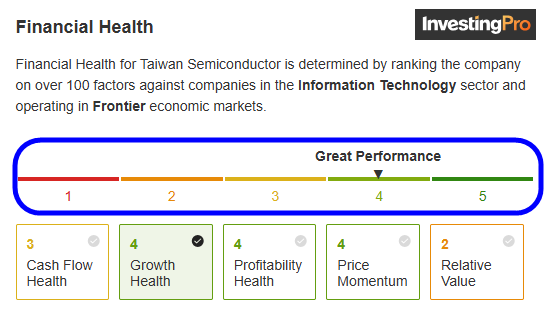

- Taiwan Semiconductor Manufacturing Company has been experiencing robust demand for its AI-focused products, particularly its advanced packaging solutions like Chip-on-Wafer-on-Substrate.

- The company dominates high-end chip manufacturing and there is little to suggest it will face a much competitive threat in the coming years.

- TSM has projected that its revenue from AI-related chips will double in 2025, reflecting the rapidly expanding demand for AI technologies. Additionally, the company anticipates a compound annual growth rate (CAGR) of around mid-40% over the next five years for its AI-related chip segment.

- TSM also makes the core processors inside Apple (NASDAQ:AAPL) iPhones, Qualcomm (NASDAQ:QCOM) mobile chipsets, and processors made by Advanced Micro Devices (NASDAQ:AMD). While that leaves it exposed to cyclical changes in demand for smartphones and other devices, relative to Nvidia (NASDAQ:NVDA), it also gives it a more diversified revenue base.

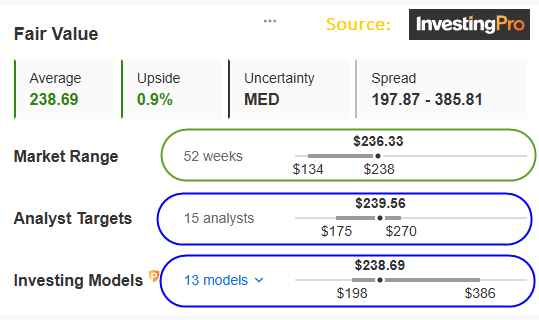

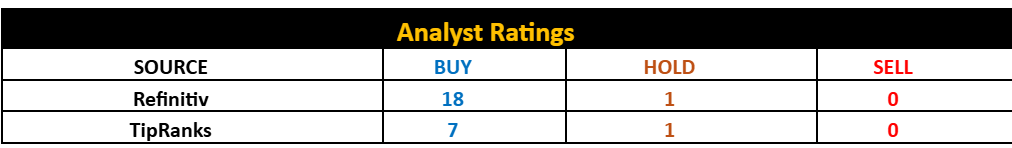

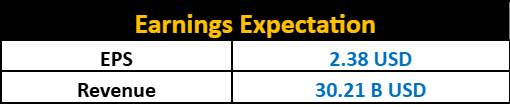

Source: InvestingPro

Source: InvestingPro

TSM Q2 2025 earnings before market Thursday July 17, 2025

Technical Analysis Perspective

- TSM is facing a key rising resistance line around January 2025 which is the previous high recorded at 226.40.

- The above-mentioned obstacle contains rallies around 239 -240 mark.

- TSM has had a tendency of forming rectangle consolidation before recording higher highs since March 2020.

- Prices formed three rectangles in a row during March 2020 to February 2021 rally (Pattern 1)

- Prices recorded three rectangles during September 223 to March 2024 rise (Pattern 2).

- A similar pattern is in the making since April 2025 suggesting a break above 239 – 240 post earning will extend the gains into uncharted territory.

Weekly Candlestick Chart

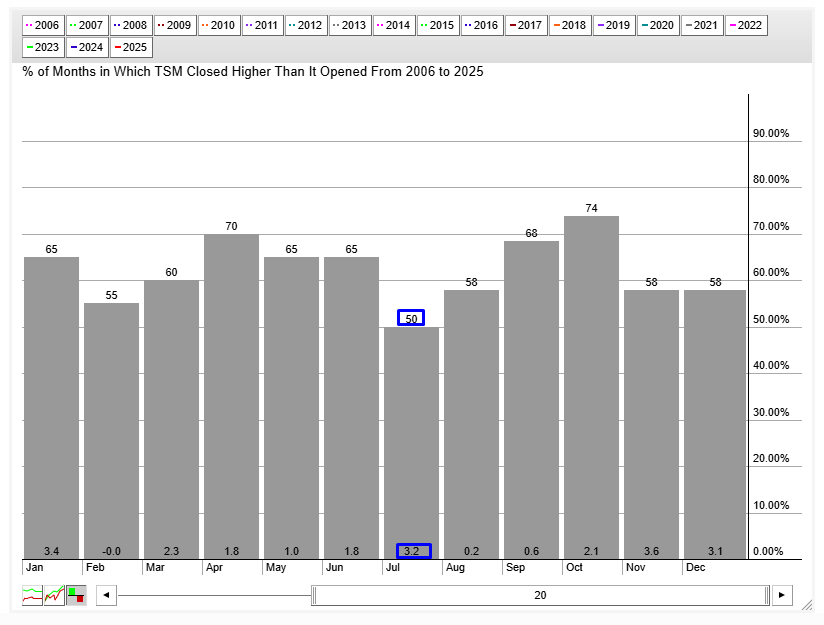

TSM Seasonality Chart

TSM closes 3.2% higher in July 50% of the time since 2006, which gives 50% probability of a move either side.

****

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor’s own risk. We also do not provide any investment advisory services.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor’s own risk. We also do not provide any investment advisory services.