Bitcoin price today: steady near $92k after sharp losses; Fed caution weighs

With over 75% support, Tesla (NASDAQ:TSLA) shareholders approved Elon Musk’s record-breaking, one trillion dollar executive compensation package. The deal is contingent on Musk delivering significant value to shareholders. The package is an all-stock plan structured into 12 tranches.

If he meets all the milestones, Musk could receive as many as 423.7 million additional shares, equating to 12% of the company. The one trillion-dollar payout is massive, but consider what Musk must do over the next ten years to receive the full payout.

- Boost Tesla’s market cap to $8.5 trillion. $8.5 trillion is almost twice Nvidia’s (NASDAQ:NVDA) market cap and a 6x increase from its current level.

- Deliver 20 million Tesla vehicles cumulatively over the ten years. Its 2025 sales are projected to be 1.6 million.

- Sell or deploy 1 million Optimus robots.

- Operate 1 million robotaxis without safety drivers.

- Secure 10 million active full self-driving subscriptions (FSD). This entails selling its FSD software to other automakers.

- Earn $400 billion in adjusted annual EBITDA over multiple periods. Year to date, Tesla’s EBITDA was just under $13 billion.

While the one-trillion-dollar payout is astonishing, the milestones he must meet to get paid are daunting. Proponents of the deal believe that if Musk delivers on the goals, the rewards for shareholders will be well worth the award. Critics say it is excessive and exacerbates wealth inequality. Others are concerned that the deal grants Musk unchecked power without enough oversight.

The Week Ahead

This week looks to be a quiet one, with little economic data in large part due to the government shutdown and few earnings. That said, a resolution to the shutdown, which is looking more likely, should set a timeline for the release of critical employment and inflation data.

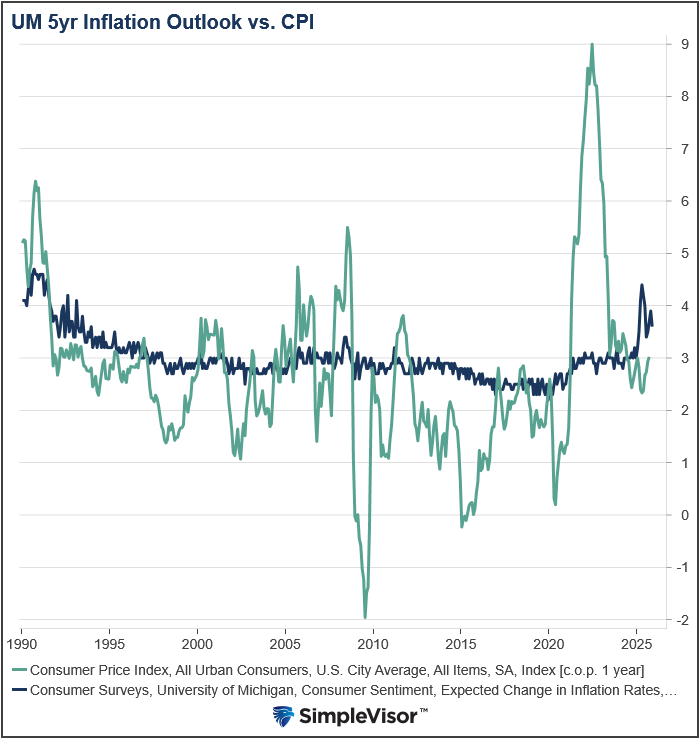

On Friday, the University of Michigan’s five-year consumer inflation outlook fell from 3.9% to 3.6%. The gauge peaked at 4.4% in April. Some in the media tout the recent decline as good news. We argue, based on the graph below, that it’s meaningless.

As shown, the University of Michigan survey anticipated only a minor uptick in inflation in 2020-22, despite a tripling of the CPI. However, it did expect a 1.5% increase due to tariffs. When graphed against CPI, you can see that the Michigan survey number has no predictive value. Thus, while it may be good from an economic perspective that consumers are less worried about inflation, it is not a reliable indicator of future inflation.

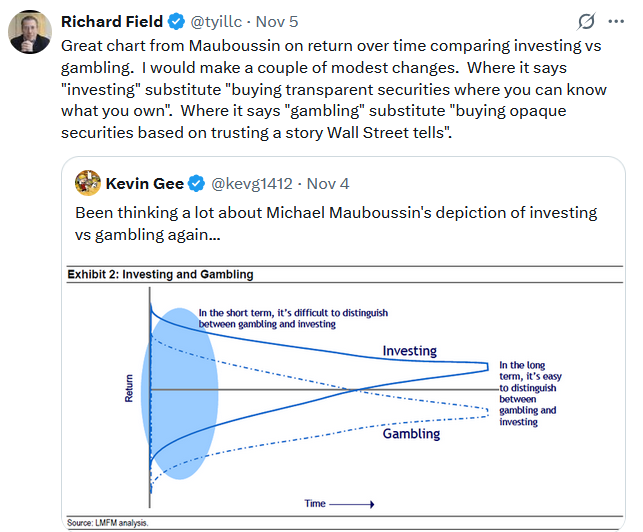

Tweet of the Day