Morningstar estimates that as of 2022, there is nearly $3 trillion invested in target-date mutual funds. Per Morningstar:

Target date strategies remain the investment vehicle of choice for retirement savers.

Whether retirement savers in target date funds know it or not, and we presume most don’t, they are mindlessly investing their wealth. The allocations between stocks and bonds in these funds are not based on risk or reward but solely on the calendar.

Managing target date funds requires zero investment expertise, yet mutual fund and ETF managers rake in hundreds of millions of dollars a year in management fees.

The volatile market environment helps us appreciate why target date funds are foolish.

What Are Target Date Funds?

- Barrons estimates that approximately 42% of all retirement plan dollars are in target date funds.

- Per Investopedia, more than 75% of investors have some money in target date funds.

- The Department of Labor claims that 70% of employers use target date funds as their default investment.

Target Funds are passive mutual funds run by simple algorithms. To be frank, the word algorithm makes their investment process seem more complicated than it is.

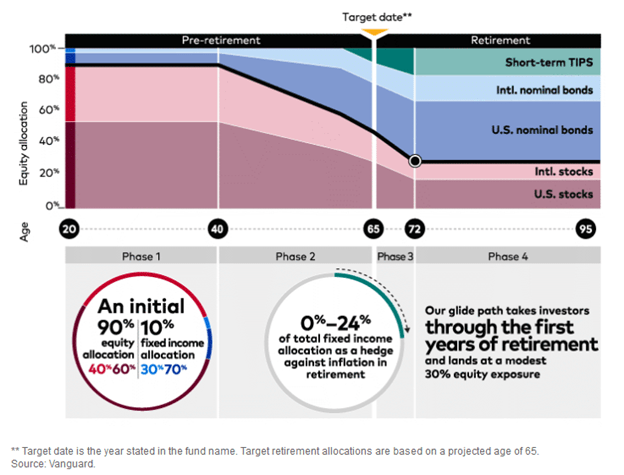

The funds with the target dates furthest in the future are almost fully allocated to stocks with a minimal allocation to bonds.

As each year passes, the funds slowly allocate away from stocks and toward bonds. The stock-bond targets for the funds are based solely on the target date.

The graphic below, courtesy of Vanguard, the world’s largest manager of target date funds, shows the “glide path” of investment allocations based on age.

Time dictates the funds’ allocation between stocks and bonds, not the traditional metrics investors use, like potential risks, rewards, and valuations.

Do You Care About Expected Returns?

Target date fund investors, by default, must believe that stocks will outperform bonds over the long haul. While such is often true, it is far from accurate over shorter or medium-term periods.

Further, such a longer-term approach misses incredible short- to medium-term opportunities in stocks and bonds. Accordingly, target fund investors are sometimes making poor investments, which may not align with their investment goals.

To help appreciate these inherently flawed investment strategies, we ask two questions. In both questions, we ask you to allocate your retirement nest egg into A and B securities.

- Question 1:

Security A has an expected ten-year annualized total return of 6.00% with a likely range of returns of 0% to 12%. Security B has a guaranteed annualized return of 0.75%.

- Question 2:

Security A has an expected ten-year annualized return of 2.50% with a likely range of returns from 7.00% to -4.50%. Security B has a guaranteed annualized return of 5.00%.

If you favored A in the first question and B in the second, expected returns and risk probabilities matter to you.

Question 1 is based on data from March 2020, when stock valuations cheapened considerably, and bond yields were among the lowest in U.S. history.

Question 2 corresponds to the current investment environment for stocks and bonds.

Questions 1 and 2 represent recent extremes of stock and bond return expectations. More importantly, they correspond to periods when target date stock and bond allocation percentages were likely inappropriate for a decent proportion of target date fund investors.

What About Today?

Let’s go into more detail on question 2 to better appreciate the current risk-reward framework for stocks and bonds. To repeat question 2:

Security A (stocks) has an expected ten-year annualized return of 2.50% with a likely range of returns from 7.00% to -4.50%. Security B (bonds) has a guaranteed annualized return of 5.00%.

Should a 2025 target date fund be heavily invested in bonds while a 2055 fund be almost solely invested in stocks in the current environment?

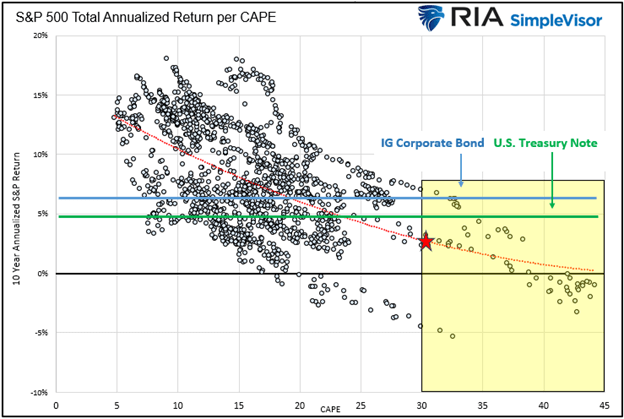

The easy way to answer is by studying the graph below. It shows every monthly instance of CAPE 10 stock valuations and the following ten-year return, including dividends.

The green line shows the current ten-year UST yield (4.90%), and the blue line indicates the investment-grade corporate bond yield (6.45%).

The current CAPE, as starred, is slightly over 30. The yellow box highlights each instance when CAPE was 30 or greater.

The expected annualized total return on stocks for the next ten years is 2.35%, much lower than the returns on bonds. Of all the instances in which CAPE was greater than 30, only a few of them were followed by a ten-year period in which stock returns beat Treasury bond returns. The number dwindles to one when stocks are compared to investment-grade corporate bonds.

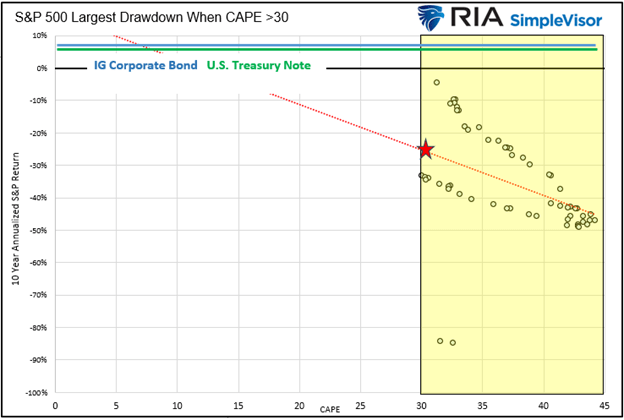

Let’s take the analysis further and focus on maximum drawdowns when CAPE was greater than 30. The following graph shows the peak percentage drawdown from the month each CAPE valuation eclipsed 30. As it shows, skewing allocations toward bonds in environments like today allows you to preserve cash and take advantage of lower stock prices.

Ten Year Forecasts Don’t Mean Ten Year Investments

Bonds are much more likely to offer a better return over the next decade than stocks. However, and this is a big issue, markets change rapidly. In a year, we could be amid a recession with bond yields at 2% and equity valuations near normal. If so, profits on bonds should be taken, and a reallocation back toward stocks would likely be appropriate.

Target date funds will not adjust for the lopsided return probabilities. Target-date funds are blind to risk and reward. Therefore, they are indifferent to what is in the best interest of their investors.

Summary

In the current environment, 25-year-olds and 75-year-olds should have increased allocations to bonds versus stocks. In target date fund terminology, the 2025 and 2050 funds should look much more alike than they do. The Vanguard Target Retirement 2050 Fund holds under 10% of bonds and 90% of stocks. The Vanguard Target Retirement 2025 (NASDAQ:VTTVX) fund has approximately 45% of bonds and 55% of stocks.

A blind formula dictates these percentages, not basic financial investment management rules.

Investing for the long run is thoughtful. Investing without considering risks and rewards is idiotic.