Infosys, Wipro decline despite upbeat Q2 earnings; margin concerns weigh

Yesterday it was the S&P 500’s turn to fall, dropping 55 bps, while the RSP Equal Weight ETF managed to rise 12 bps. Round and round the market goes—where it stops, nobody knows.

It’s almost comical to watch how this market trades day to day, always finding a Mag 7 stock to lift or a Mag 7 stock to knock down, to keep dispersion alive.

Yesterday, Apple (NASDAQ:AAPL) was the hero, up more than 4% alongside Nvidia (NASDAQ:NVDA). yesterday, Amazon (NASDAQ:AMZN) played the sacrificial lamb, falling 3%, with Meta Platforms (NASDAQ:META) and Microsoft (NASDAQ:MSFT) chipping in, each down about 1%. At this point, it feels like an absolute joke.

Who knows what today brings—it all depends on whether the options crowd can keep volatility contained enough to keep the circus going.

Meanwhile, volatility moved higher across the board: the 1-month correlation index, the S&P 500 dispersion index, the Left Tail Index, the VIX, the VVIX, and the S&P 500 Consistent Volatility Index all rose. A clean sweep higher, even though it makes no sense—since, in theory, dispersion should fall when correlations rise. But hey, I don’t make the rules.

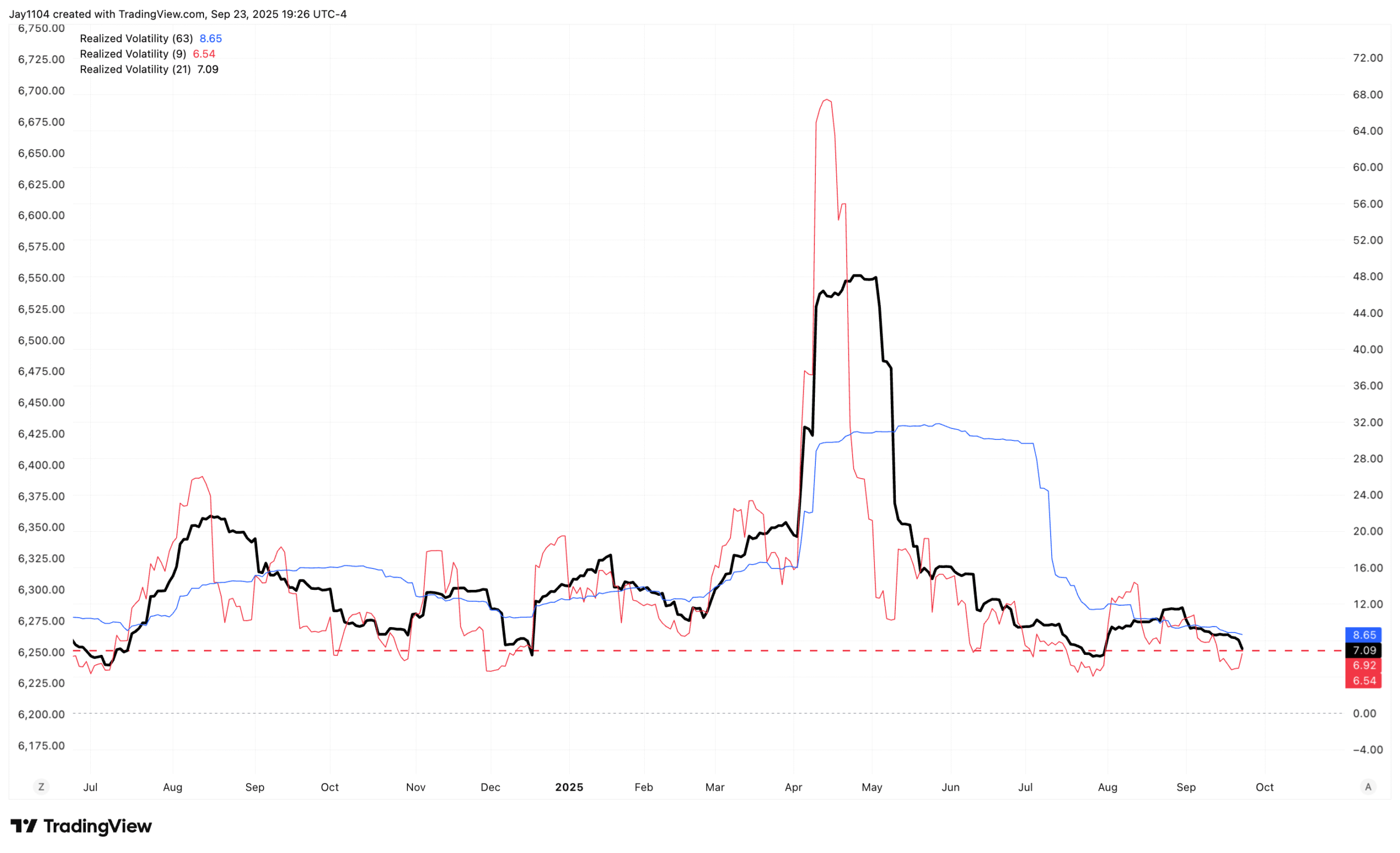

We also saw the 9-day realized volatility tick higher, now closing in on a move above the 21-day realized volatility. At the same time, 63-day realized vol is compressing, and it won’t take much of a move in the S&P 500 to push 21-day vol above 63-day. That could be enough to trigger the unwinding of vol-control funds’ short index implied volatility and long single-stock volatility trades.

At this point, it all screams of desperation—and as I write tonight, it would seem the music has stopped, and all I hear is silence.