Gold has topped $4,200. Here’s why Yardeni thinks the rally could go even higher.

Well, the move lower in the equity market seemed pretty well telegraphed over the past few days, as I’ve noted the Tax Day TGA rise and the unimpressive price action on Monday and Tuesday.

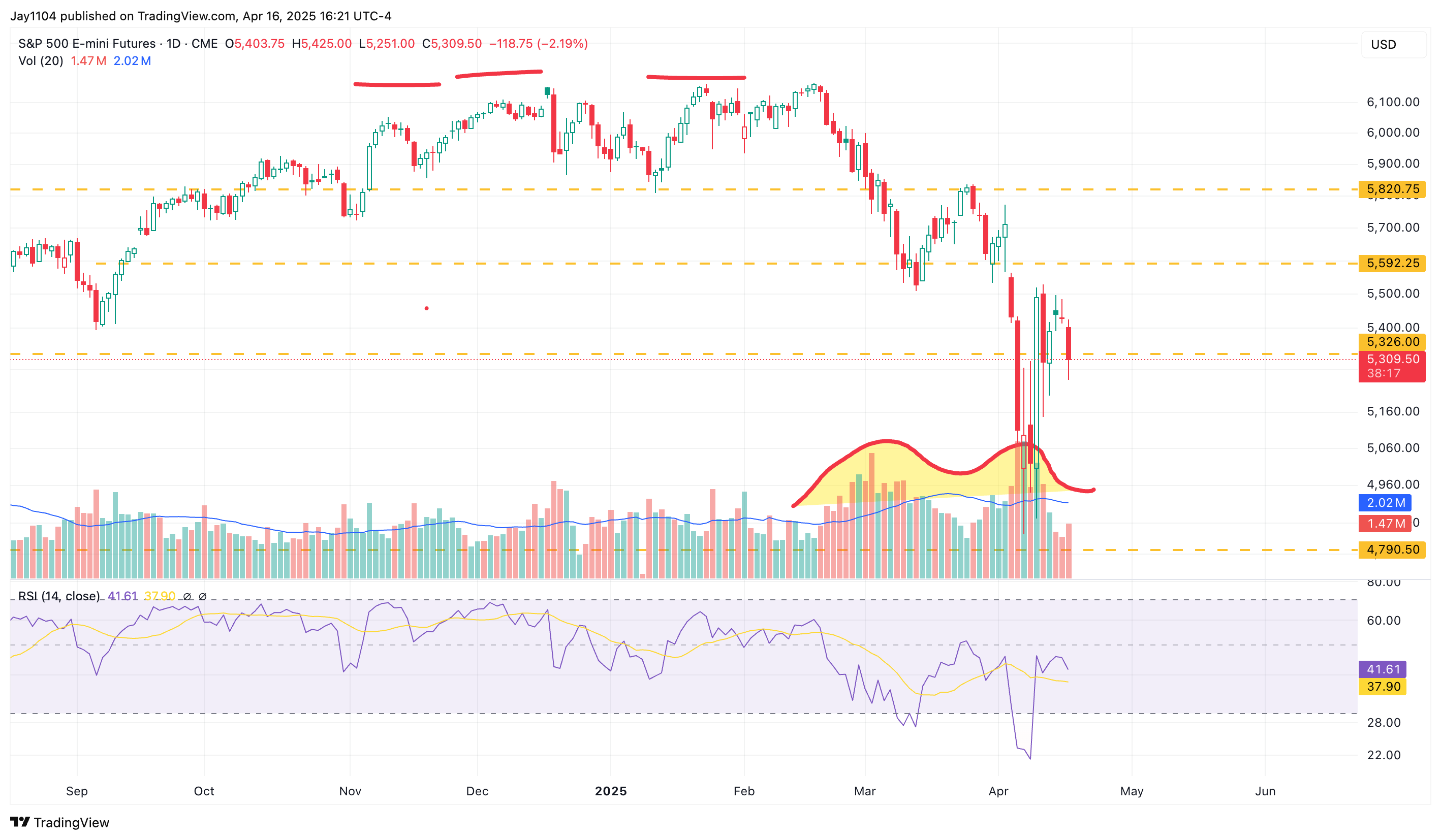

Yesterday’s sell-off saw a rise in volume, but not by much, so either the selling is going to intensify, or this was a one-day wonder. Volume on the S&P 500 futures was nothing noteworthy.

The volume has been coming in waves, and yesterday may have just been the start of the next one. If volume is heavy today, it’s likely because sellers are pushing prices lower.

Yesterday’s price action looked pretty much like what we have seen the last few weeks, just the constant selling pressure that takes place nearly all day, with the exception of the final 30 minutes. If this is the start of wave 5, then we likely still have much more to fall, and it likely involves undercutting the April 7 lows.

That 4,500 level I have spoken so much about for the last 18 months is just a region; for all I know, the bottom could be around 4,200 or 4,700. But I think it is a good range; we must assess things as they develop. Of course, my view could be completely wrong, and today’s move down was a fake-out.

That is a region where you can start to argue that stocks are at least nearing fair value, based on where I think earnings for 2025 are likely to be.

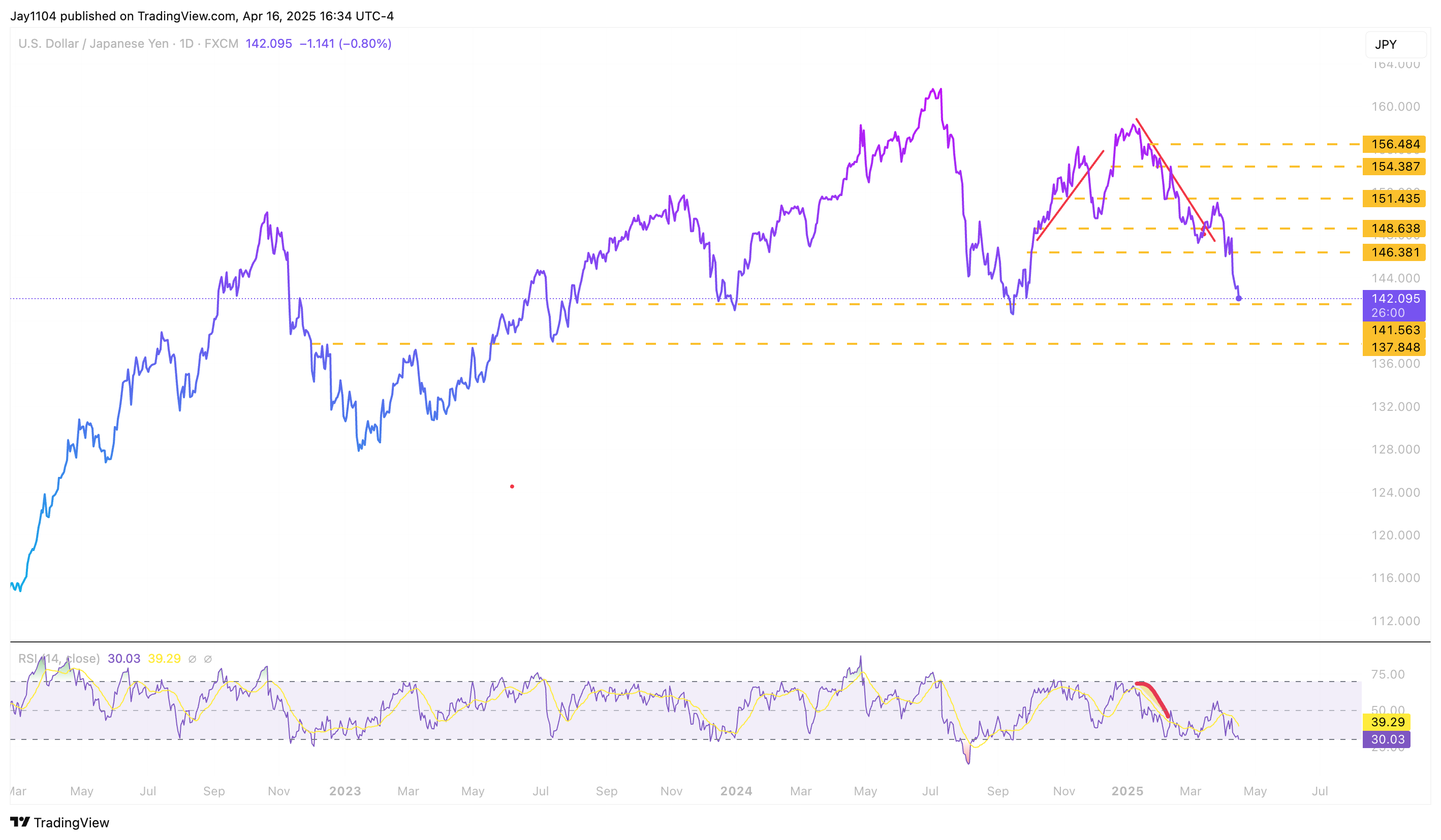

I think it really comes down to the FX market telling us what happens because it is clear at this point that as stocks drop, the US dollar weakens, and that is due to global outflows. Well, the USD/JPY is on the cusp of a major break lower. A break of support at 142 could easily set up a return to 137-138, and if the USD/JPY is going lower, the S&P 500 and the NASDAQ are likely to follow.