IonQ CRO Alameddine Rima sells $4.6m in shares

We continue with our discussion of investment ideas that could benefit from upgrading and expanding the power grid to accommodate surging demand from AI data centers and EVs.

This third and final part of this series focuses on alternative energy sources, utility companies, and other companies related to the power grid infrastructure.

If you haven’t read Parts ONE or TWO we recommend reading them before continuing.

Alternative/Renewable Energy Sources

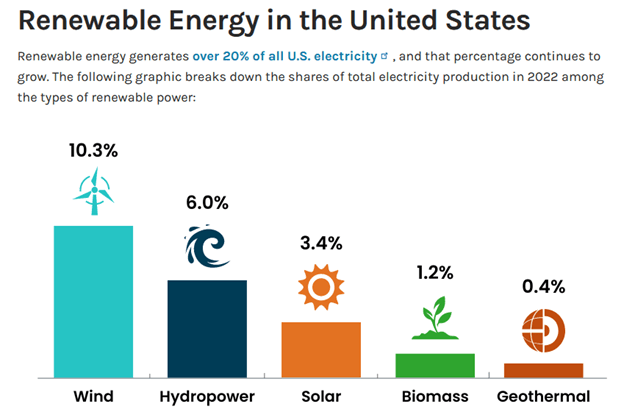

In 2022, the Department of Energy calculated that renewable energy from solar, wind, hydro, geothermal, and biomass accounted for a fifth of all electricity generation. By 2028, the IEA thinks the percentage will double to 42%. Solar and wind power are expected to be the primary alternative energy sources.

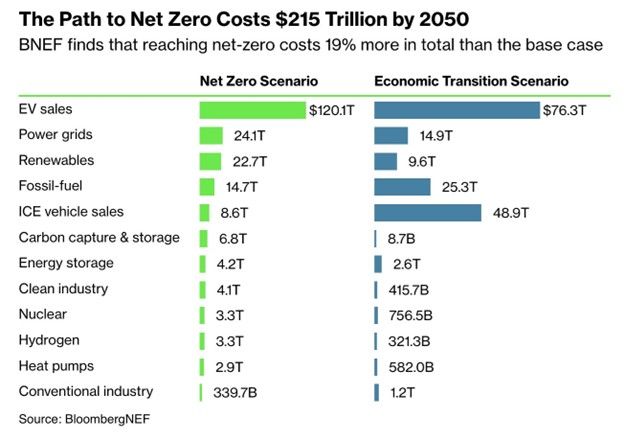

Investments in solar, wind, and other alternative energy sources, along with natural gas, coal, and nuclear, will be increasingly vital to power our utility plants. Furthermore, suppose the US and other nations continue to strive for net zero emissions by 2050 and other environmental goals. The demand for existing and new alternative energy sources will surge in that case.

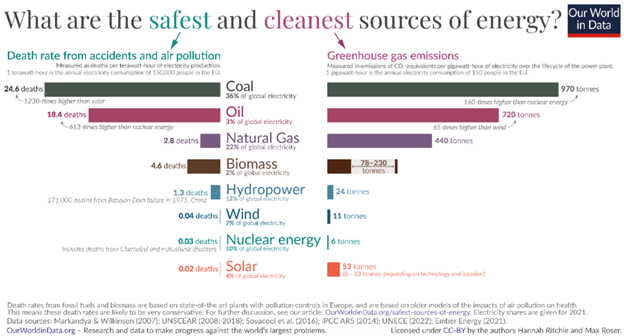

Renewable energy has benefits and flaws compared to natural gas. The significant advantage of renewable energy is it produces minimal greenhouse gas emissions, as shown below. Second, and equally important, according to the IEA World Energy Outlook, solar and wind energy are the cheapest renewable energy sources and cost much less than carbon-based ones.

However, they have considerable flaws that need to be overcome. Consider the following from Green Solutions.

Relies heavily on weather conditions. When adverse weather conditions occur, renewable energy technologies like solar cells may not be as effective. For example, during periods of rain, PV panels cannot generate electricity, necessitating a shift back to traditional power sources.

Lower efficiency. Regrettably, renewable technologies generally exhibit lower efficiency compared to traditional energy conversion devices. For example, commercially available solar panels have an efficiency of about 15% to 20%. In contrast, traditional technologies utilizing coal or natural gas can achieve efficiency levels of up to 40% and 60%, respectively.

High upfront cost. The manufacturing and installation processes for renewable energy devices, such as PV panels, can be relatively expensive. Only for installation, solar panels cost about $17,430 to $23,870 on average.

Limited geographical region. The availability of high-quality land is limited, leading developers to urgently search for new sites. For example, in Germany, regulatory, environmental, and technical limitations significantly reduce the potentially suitable for onshore wind farms to just 2%.

Shortages of key raw materials. This includes essential metals like nickel, copper, and rare earth metals, such as neodymium and praseodymium, which are vital for the creation of magnets used in wind turbine generators.

Renewable Stocks Are Not Following the Narrative

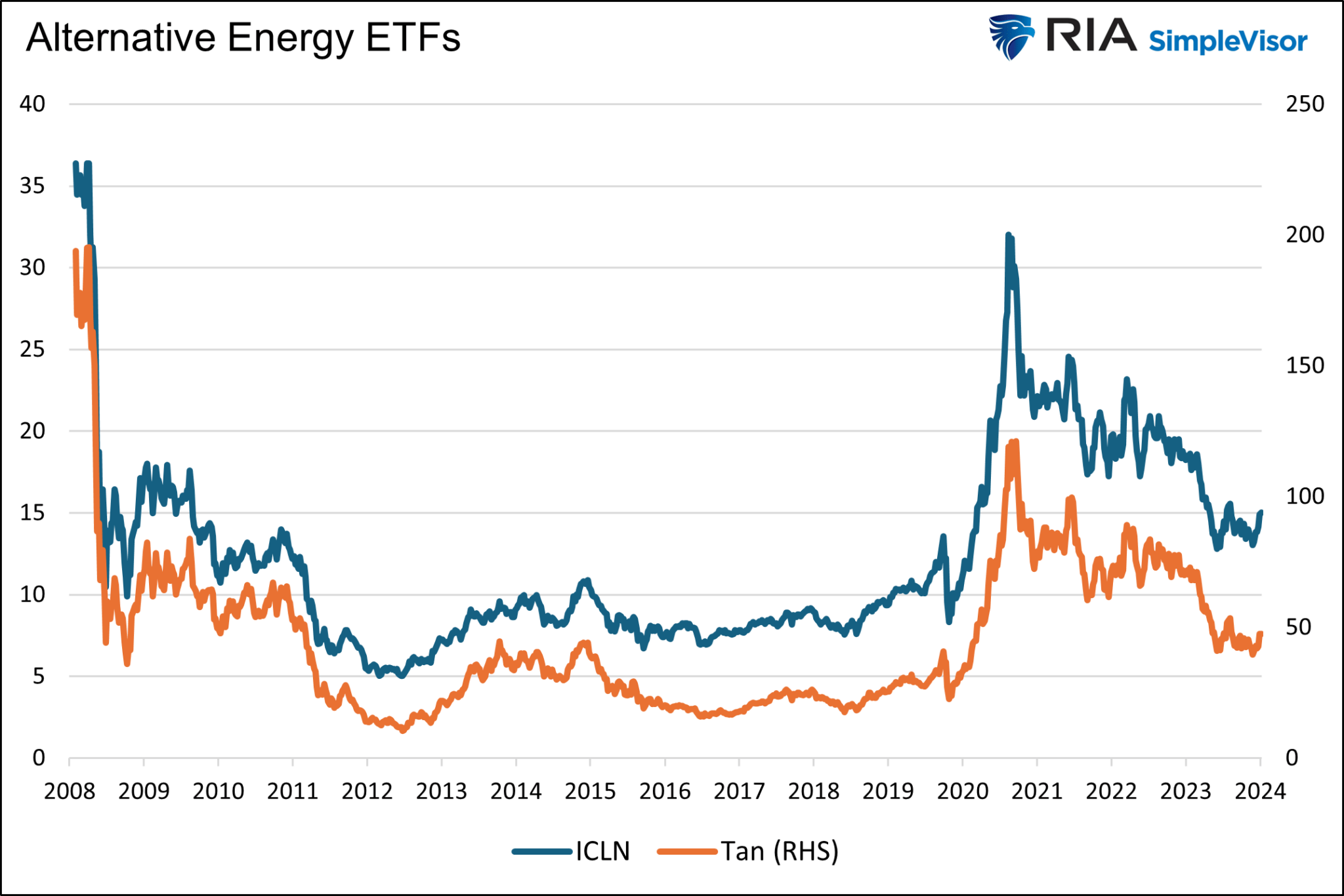

With time, we believe renewable energy will become much more efficient and hopefully be in a better position to help meet the surging needs of the nation’s utility plants. Investors do not seem as hopeful.

The recent narrative pushing investors to power grid-related investments has skipped past renewable stocks. The graph below shows two popular alternative energy ETFs, Invesco's Solar ETF (NYSE:TAN) and iShares Global Clean Energy ETF (NASDAQ:ICLN). Both ETFs are well off their 2008 highs and recent peaks in late 2020.

Alternative energy stocks and diversified ETFs may be excellent investments for longer-term investors as renewable energy will be relied upon heavily. Furthermore, their stocks have not benefited from the power grid expansion narrative.

Batteries Technology Is Vital To Renewable Energy

Solar and wind energy are not dependable due to weather conditions. For example, the following quote from OilPrice.com:

But while solar power has made the U.S. power-generating system greener, it has also made it more volatile, especially in the top solar market, California.

There, peak solar power generation coincides with the lowest residential electricity demand during the midday. When power demand begins to surge after 6 p.m., solar output begins to fade.

In California, for example, “on sunny spring days when there is not as much demand, electricity prices go negative and solar generation must be ‘curtailed’ or essentially, thrown away,” says the Institute for Energy Research (IER).

Accordingly, utilities need more efficient batteries to store excess renewable energy for use during peak demand periods and when the weather isn’t conducive for electricity generation. Without more efficient batteries, undependable alternative energy sources cannot be relied upon as much as the environmental goals demand.

Companies involved in energy storage, especially those at the forefront of producing more efficient batteries, may have significant upside. But, with unproven technology come substantial risks for investors. For instance, many new types of battery technology are in development.

- Solid-state batteries

- Lithium-sulfur batteries

- Cobalt-free lithium-ion batteries

- Sodium-ion batteries

- Iron-air batteries

- Zinc-based batteries

- Graphene batteries

Battery Diversification May Be Critical

Even if you know which type of battery will be the winner, so to speak, you also have the arduous task of figuring out which company will be a primary producer of the battery. Unless you believe you have good insight into battery technology and the key players in the industry, we think a diversified battery ETF may provide the best investment results. Further, the large battery ETFs are also diversified, with investments in lithium and other metal producers. Unfortunately, ETFs in this space are limited.

Global X Lithium & Battery Tech ETF (NYSE:LIT) is far and away the largest, with nearly $1.5 billion AUM. While it invests in companies with new battery technology, it also “invests in the full lithium cycle, from mining and refining the metal, through battery production.” Its top three holdings are lithium producers.

Amplify Lithium & Battery Technology ETF (NYSE:BATT) is the second largest ETF with a mere $89 million in AUM. Like LIT, they invest in lithium producers like BHP and Albemarle (NYSE:ALB).

If you want to make investments in individual companies, Tesla (NASDAQ:TSLA) (battery technologies), LG Chem, and Samsung SDI are well-positioned in the industry.

Lithium Miners

Assuming lithium remains a crucial component in electricity storage batteries, its miners should do well, especially given the recent decline in lithium prices and the related stocks.

North Carolina-based Albemarle (ALB) is the world’s top lithium producer and the largest producer by market cap. It is the only lithium producer of size based in the US. Like the rest of the alternative energy sector, its stock has traded poorly recently. However, with a forward P/E of 16, there is value if its revenues continue upward at their recent pace.

We caution you that lithium deposits are being actively explored. Assuming success, the lithium supply may limit the price appreciation of lithium. As an example from The Hill- Researchers make a massive lithium discovery in Pennsylvania.

Utility and Grid Operators

Utilities will generate more power, thus increasing their revenue. However, they must invest significant capital to modernize, expand, and reduce greenhouse emissions.

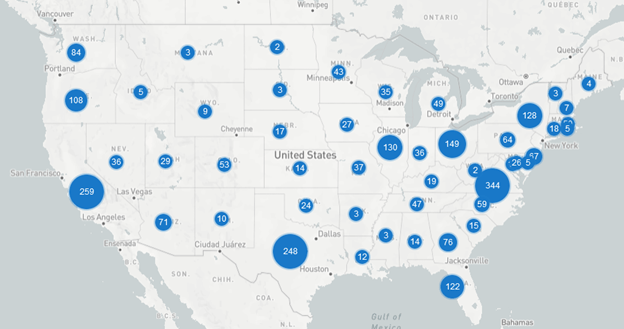

AI data center locations are partially chosen based on their ability to source cheap electricity. Thus, utility companies in the Southeast and Midwest, with access to cheaper natural gas and more reliable alternative energy generation, will be the most cost-effective locations for data centers. The map below shows that Virginia hosts the greatest number of data centers, followed by California and Texas.

Dominion Energy (NYSE:D) in Virginia and Entergy (NYSE:ETR) in Texas are the two utility companies that may be the biggest beneficiaries of the growth of AI data centers. Both stocks have relatively low forward P/E’s of approximately 14 and dividend yields of 4.25% for D and 5.50% for ETR. It will be crucial to follow their margins to see how effectively they offset the expansion costs with rising revenue.

Constellation Energy (CEG) and NextEra Energy (NYSE:NEE) are also worth tracking as they invest heavily in renewable energy infrastructure and will benefit from increased demand. We would add Duke (DUK) and Southern Company (NYSE:SO) to the list of companies to follow.

Additional Investment Ideas

We now present an assortment of industries and firms that can benefit.

Technology and AI Firms

Companies specializing in AI software for energy efficiency and management will find opportunities in this evolving landscape. Some of the more prominent names in this sector include IBM (NYSE:IBM), Google (NASDAQ:GOOGL), Microsoft (NASDAQ:MSFT), Oracle (NYSE:ORCL), and GE Vernova (NYSE:GEV).

Physical Plant Expansion

Companies that supply utility plants with generators, transformers, circuit breakers, and switchboards, among many other parts, will undoubtedly benefit from power grid expansion.

GE Vernova, Eaton (NYSE:ETN), Quanta Services (NYSE:PWR), Emerson (NYSE:EMR) Electric, and Siemens

Water/Cooling

The average data center uses 300,000 gallons of water a day to cool its equipment. That is the equivalent of the water used by 100,000 homes. Therefore, companies that can develop cheap cooling solutions for data centers will be in high demand.

Vertiv Holdings (NYSE:VRT) is a leader in this segment. Its shares have risen tenfold since it went public in 2019 and now trades at a P/E of 100. It’s a high-risk, high-reward stock, not for the faint of heart.

Infrastructure ETFs

There are many other businesses set to profit from the coming infrastructure boom.

Those looking for a diversified investment approach in the power grid may want to explore thematic ETFs.

For example, the First Trust Clean Edge Smart Grid Infrastructure Fund (GRID) holds 103 positions. Beyond diversification and portfolio manager expertise, the fund can buy stocks in foreign markets, which many US investors do not have access to or are uncomfortable with.

iShares (IFRA) is a similar fund with a different basket of stocks and approach toward investing in the industry.

The bottom line is we are confident the expansion and modernization of the power grid will be highly profitable for some companies. However, many companies involved, especially smaller companies with limited product offerings, offer massive rewards but substantial risks. Diversification will prove to be essential for investors.

Summary

The more we researched the power grid expansion, the more industries, and companies we exposed that could benefit from it. While this article stops here, we will continue investigating the topic and share any exciting findings in the future. The number of rabbit holes is seemingly endless. We encourage you to explore the topic and share any findings you may uncover with us.

Like the birth of the internet, some companies like AOL, Yahoo, and Sun Microsystem, which were the supposed internet leaders, fell by the waist side. Other companies, some already large, others virtually unknown, become leaders. The key to investing in this expansion is to remain vigilant for new companies and technologies that can blossom. Do not assume that the companies in charge today will be so tomorrow. Keep your head on a swivel.

For those unable to invest the time and effort to understand industry trends and identify companies likely to profit, a fund(s) with professionals highly focused on the industry may prove an excellent way to take advantage of the potential infrastructure boom.