China chip stocks fall as US considers allowing Nvidia H200 sales

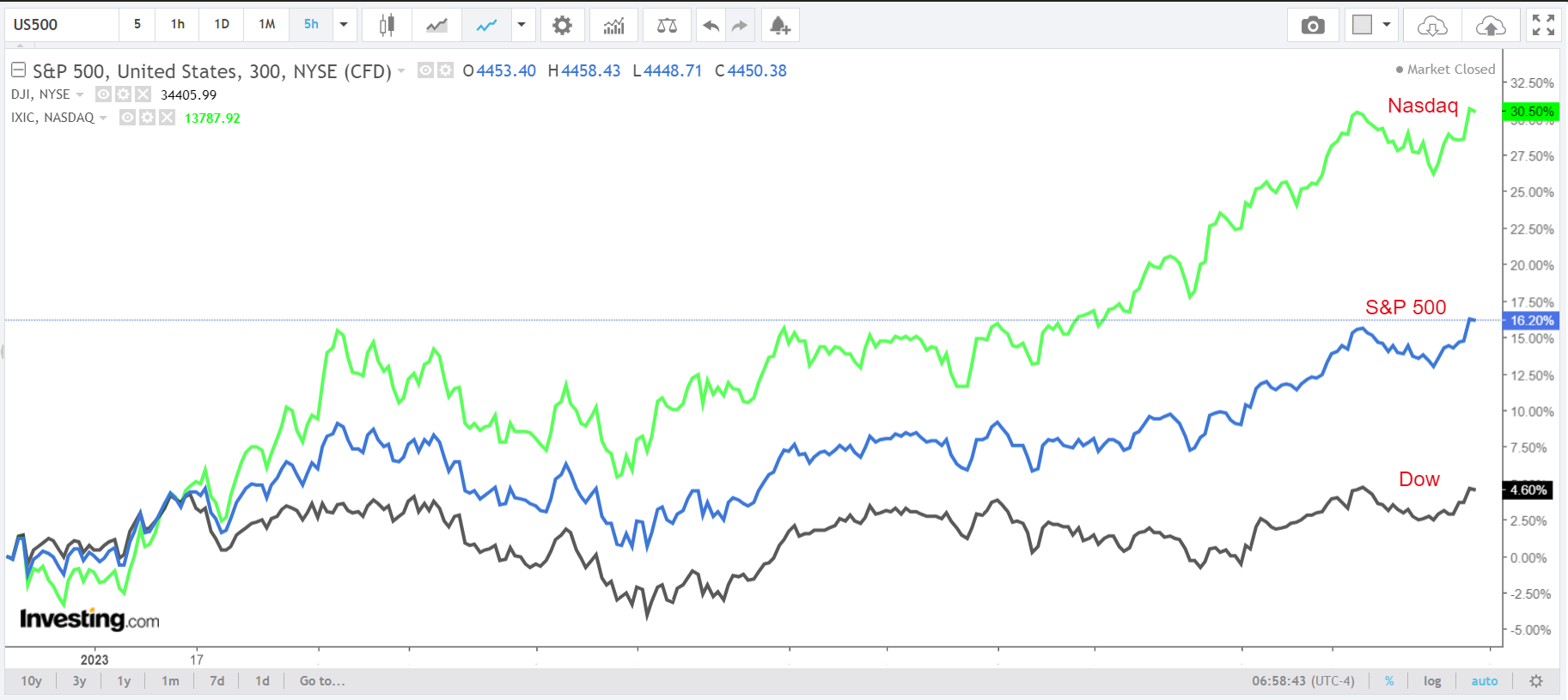

- Wall Street kicks off the second half of 2023 with the stock market near 16-month highs after a roaring start to the year.

- Amid the current backdrop, I used the InvestingPro stock screener to search for undervalued companies that may shape the investment landscape in the months ahead.

- Looking for more actionable trade ideas to navigate the current market volatility? InvestingPro Summer Sale is on: Check out our massive discounts on subscription plans!

Stocks on Wall Street have been on a tear since the start of the year as signs of cooling inflation fueled bets the Federal Reserve is nearing the end of its tightening cycle while a recent batch of upbeat economic data helped ease recession fears.

U.S. stocks posted strong gains for the first half of 2023, with the tech-heavy Nasdaq Composite surging 31.7% to record its best six-month start to a year since 1983. The benchmark S&P 500 is up 15.9% for its best first half since 2019.

Meanwhile, the blue-chip Dow Jones Industrial Average is the relative underperformer, up just 3.8%. Amid the current backdrop, I used the InvestingPro stock screener to uncover the top 15 stocks poised for success as we step into the second half of 2023.

Amid the current backdrop, I used the InvestingPro stock screener to uncover the top 15 stocks poised for success as we step into the second half of 2023.

By leveraging the InvestingPro stock screener's robust features - including advanced filters, and comprehensive financial metrics - investors can identify stocks with the potential for significant growth, strong fundamentals, and favorable market trends.

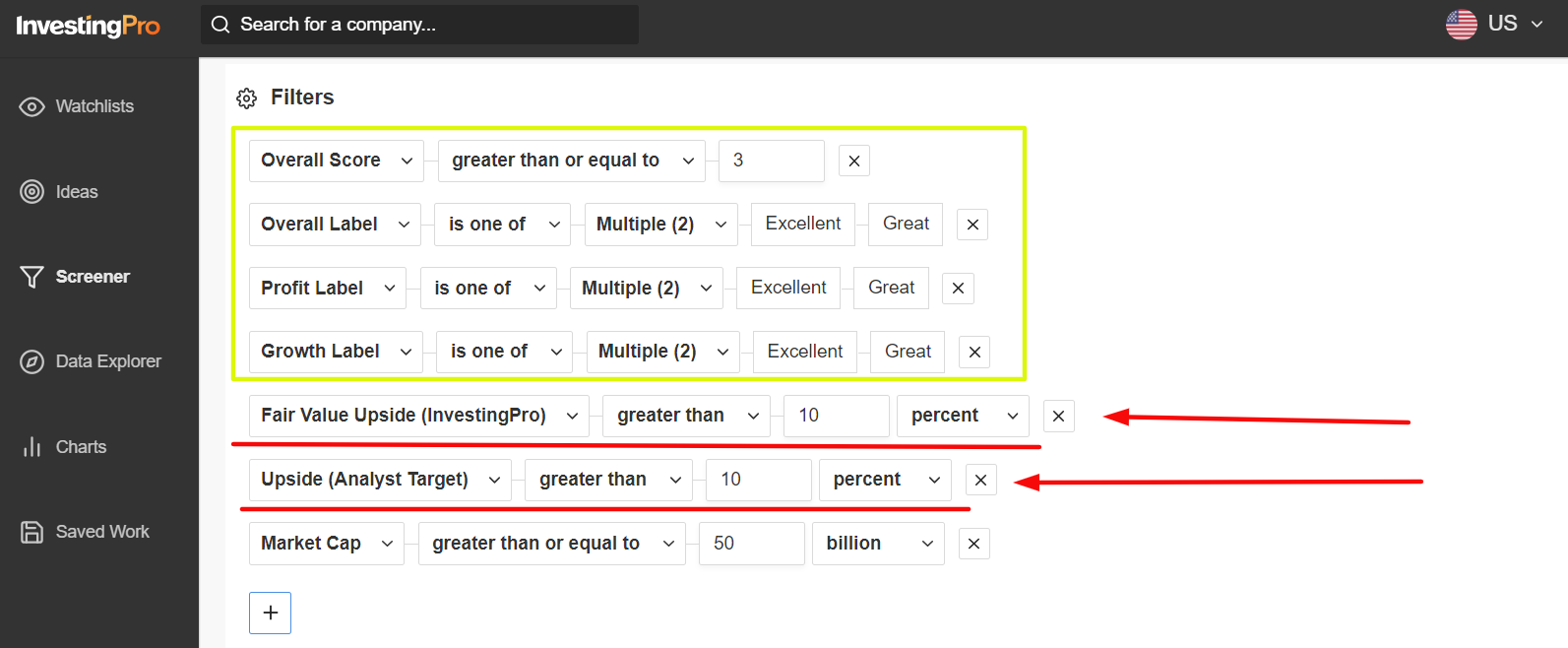

I first scanned for companies with an InvestingPro Overall Score greater than or equal to 3.0. Financial health score values range between 0.0 to 5.0 and very roughly translate to a company’s percentile ranking in its sector according to the InvestingPro models.

It should be noted that companies with InvestingPro health scores higher than 2.75 have consistently outperformed the broader market by a wide margin over the past seven years, dating back to 2016.

I then filtered for stocks that displayed the InvestingPro Overall Health Label, InvestingPro Profit Label, and an InvestingPro Growth Label of either ‘Excellent’, or ‘Great’.

The InvestingPro financial health label benchmark is an advanced stock ranking system that considers over 100 metrics pertaining to the company's profitability, growth, cash flow, and valuation. Value is one of ‘excellent’, ‘great’, ‘good’, ‘fair’, or ‘weak’. Source: InvestingPro

Source: InvestingPro

Finally, I searched for names with an InvestingPro ‘Fair Value’ Upside greater than or equal to 10% that also possessed an analyst price target upside greater than or equal to 10%.

And those companies with a market cap of $50 billion and above made my watchlist.

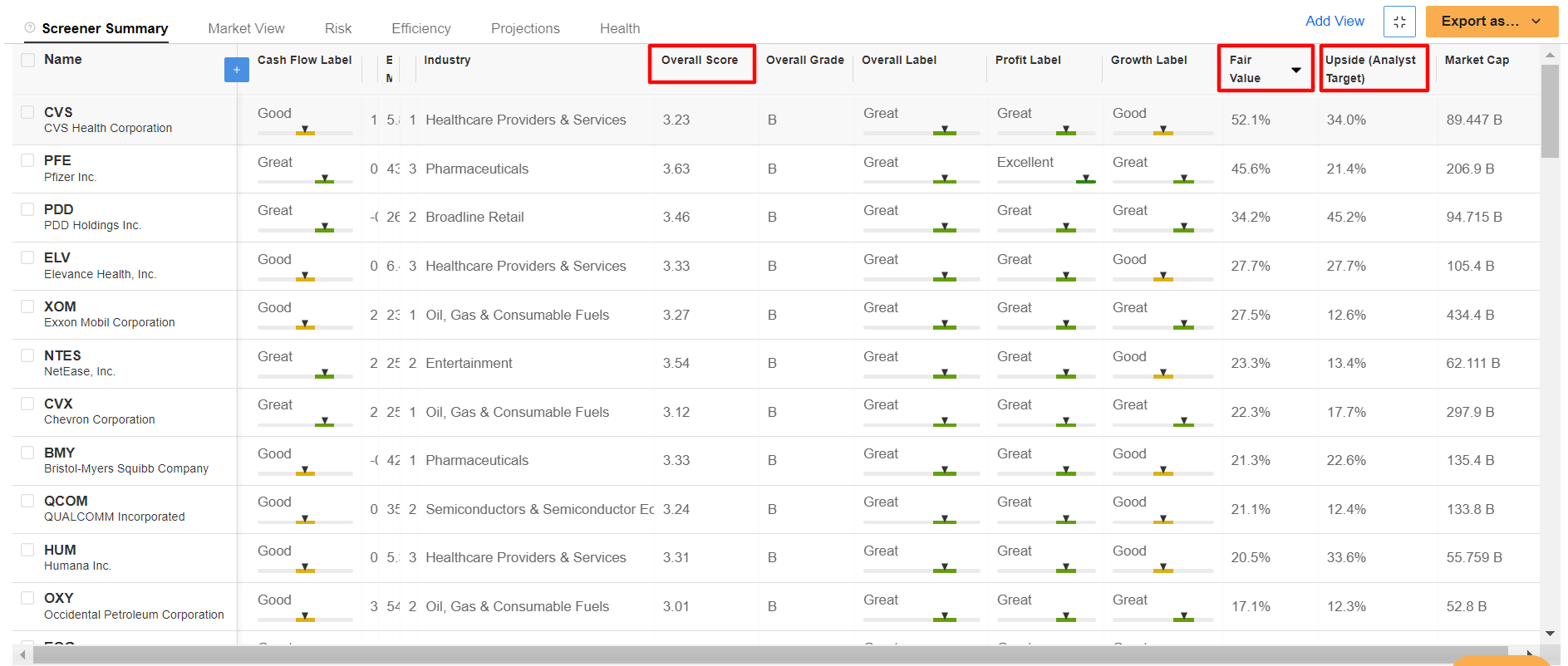

Once the criteria were applied, I was left with a total of 18 companies that may shape the investment landscape in the second half of 2023.

Top 15 Stocks For H2 2023 According to InvestingPro:

Among the S&P 500, here are the top 15 stocks that are expected to rise the most over the next 12 months, based on InvestingPro ‘Fair Value’ price targets. The InvestingPro fair value estimate is determined according to several valuation models, including price-to-earnings (P/E) ratios, price-to-sales (P/S) ratios, and price-to-book (P/B) multiples.

- CVS Health (NYSE:CVS): InvestingPro Fair Value Upside: +52.1%

- Pfizer (NYSE:PFE): InvestingPro Fair Value Upside: +45.6%

- PDD Holdings (NASDAQ:PDD): InvestingPro Fair Value Upside: +34.2%

- Elevance Health (NYSE:ELV): InvestingPro Fair Value Upside: +27.7%

- Exxon Mobil (NYSE:XOM): InvestingPro Fair Value Upside: +27.5%

- NetEase (NASDAQ:NTES): InvestingPro Fair Value Upside: +23.3%

- Chevron (NYSE:CVX): InvestingPro Fair Value Upside: +22.3%

- Bristol-Myers Squibb (NYSE:BMY): InvestingPro Fair Value Upside: +21.3%

- Qualcomm (NASDAQ:QCOM): InvestingPro Fair Value Upside: +21.1%

- Humana (NYSE:HUM): InvestingPro Fair Value Upside: +20.5%

- Occidental Petroleum (NYSE:OXY): InvestingPro Fair Value Upside: +17.1%

- EOG Resources (NYSE:EOG): InvestingPro Fair Value Upside: +16.7%

- AbbVie (NYSE:ABBV): InvestingPro Fair Value Upside: +16.7%

- ConocoPhillips (NYSE:COP): InvestingPro Fair Value Upside: +14.5%

- Adobe (NASDAQ:ADBE): InvestingPro Fair Value Upside: +13.8%

Source: InvestingPro

For the full list of the 18 stocks that met my criteria, join InvestingPro now and unlock must-have insights and data!

If you're already an InvestingPro subscriber, you can view my selections here.

With InvestingPro, you can conveniently access a single-page view of complete and comprehensive information about different companies all in one place, eliminating the need to gather data from multiple sources and saving you time and effort.

As part of the InvestingPro Summer Sale, you can now enjoy incredible discounts on our subscription plans for a limited time:

- Monthly: Save 20% and gain the flexibility to invest on a month-to-month basis.

- Yearly: Save a jaw-dropping 50% and secure your financial future with a full year of InvestingPro at an unbeatable price.

- Bi-Yearly: Save an astonishing 52% and maximize your returns with our exclusive web offer.

Don't miss out on this limited-time opportunity to access cutting-edge tools, real-time market analysis, and expert insights. Join InvestingPro today and unlock your investing potential. Hurry, Summer Sale won't last forever!

***

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.