Street Calls of the Week

- US Cyber Monday 2022 saw a record-breaking $11.3 billion in retail e-commerce sales, 23.9% more than Black Friday of the same year.

- Expectations for 2023 are of further sales growth, albeit at a slower pace from the previous year

- Against this backdrop, let's take a look at 3 tech stocks trading on a massive discount

- Missed out on Black Friday? Secure your up to 55% discount on InvestingPro subscriptions only this Cyber Monday.

The Monday following Thanksgiving is traditionally celebrated as Cyber Monday, marking the day when numerous companies showcase their premier online tech shopping deals.

Cyber Monday etched its place in history as the most lucrative day for retail e-commerce sales in the U.S. during 2022. Demonstrating a substantial 5.8% surge from the prior year, last year's Cyber Monday sales tallied an impressive $11.3 billion. Anticipation is high for this year to set a new record, with projections indicating a further escalation in sales.

The discounts offered on Cyber Monday exert a positive influence on the turnover of companies within the retail sector, particularly impacting the technology-heavy Nasdaq index. Investors can leverage this event as a prime opportunity to explore discounted technology stocks among those listed on Nasdaq.

While technology firms experience a notable uptick in revenue on Cyber Monday, this occasion also serves as an opportunity for investors to enhance their year-end stock portfolios accordingly.

In this realm, InvestingPro is as an exceptionally practical tool for identifying stocks with the most promising upside potential within the technology sector based on specific criteria. It, too, is running a Cyber Monday deal, with up to 55% off in subscription plans.

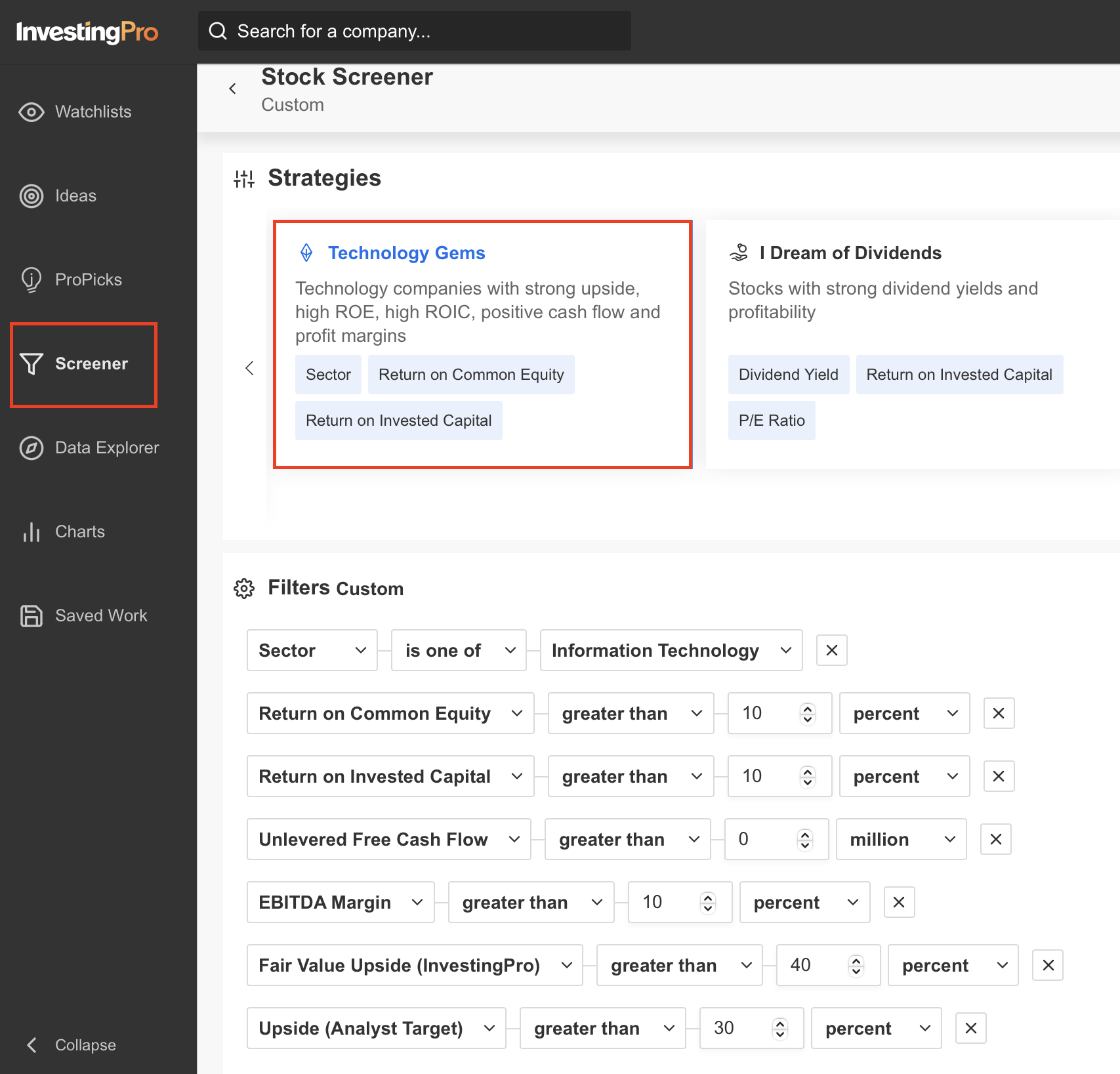

The robust filtering feature of InvestingPro enables swift and efficient identification of these stocks, making it an invaluable resource for investors seeking to capitalize on the opportunities presented by Cyber Monday. Source: InvestingPro

Source: InvestingPro

To do this, you can click on the "screener" tab from the left menu of the InvestingPro platform and list the technology stocks with strong financial structure and upside potential, either by searching yourself or by using the platform's ready-made strategy templates.

Let's take an example by customizing the tech opportunities template on InvestingPro.

This strategy ranks companies in the information technology sector with a return on common equity (ROCE) and return on invested capital greater than 10%, which indicates how well a company is returning on its capital.

Other criteria include a positive capital cash flow before debt and an EBITDA margin above 10%. In addition to this strategy, we narrow the list by selecting stocks that have the potential to rise at least 40% in the next year according to fair value analysis, as well as stocks that analysts estimate to rise at least 30%.

Source: InvestingPro

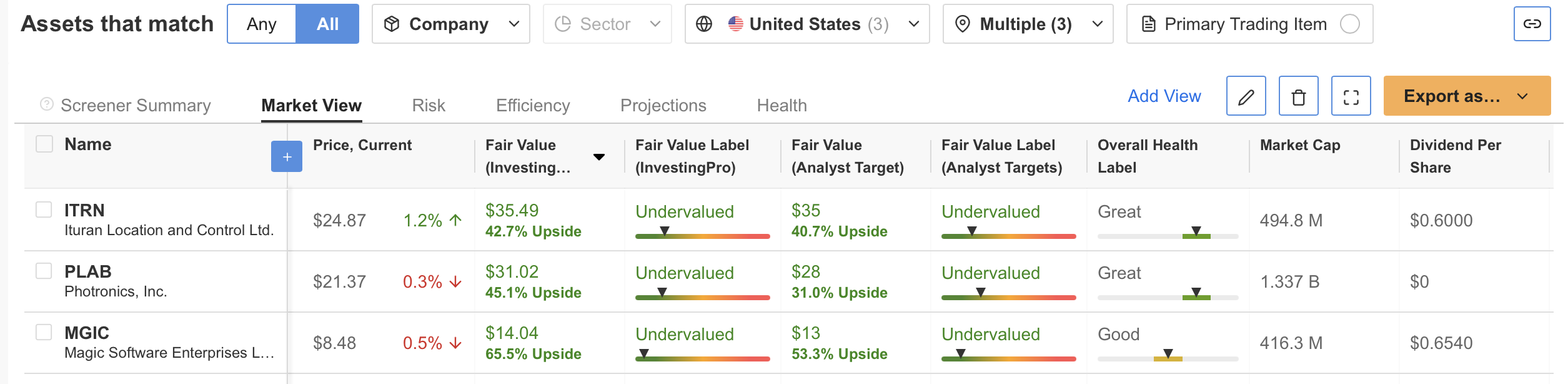

According to these selection criteria, we come up with 3 technology companies traded on the NASDAQ:

- Magic Software Enterprises Ltd (MGIC)

- Photronics (Photronics Inc (PLAB)

- Ituran Location and Control (ITRN)

When we check these stocks, we see that all three are undervalued by InvestingPro, while MGIC, PLAB and ITRN have respectively a 65.5%, 31%, and 35% upside potential, according to the fair value analysis.

At the same time, these shares have a 53%, 31% and 40% price increase forecast, respectively, according to analysts' consensus estimate.

Source: InvestingPro

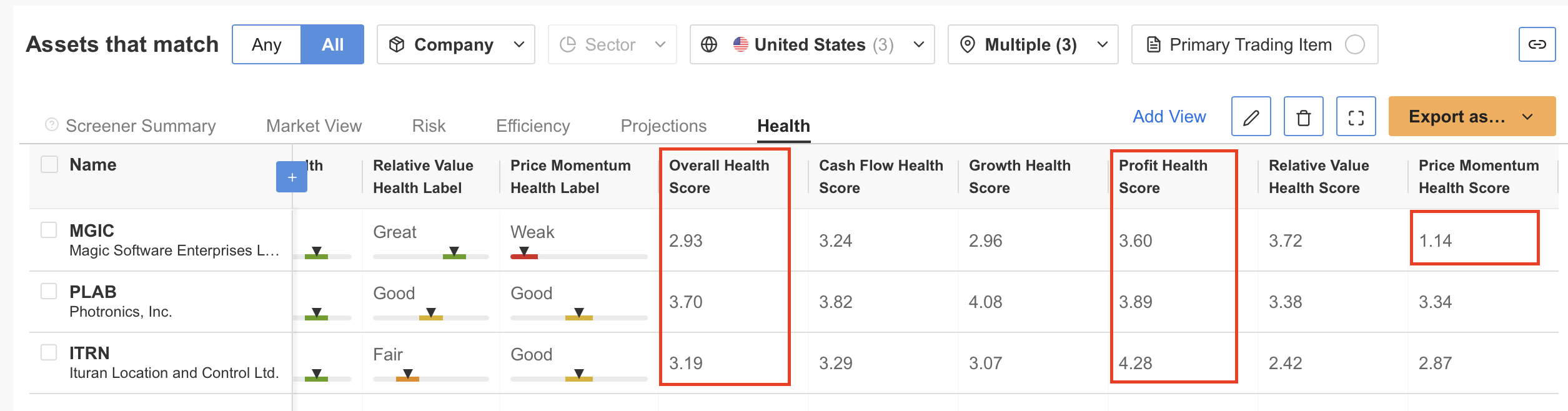

When we take a look at the financial health of these 3 companies from the same list, we can see that all three have a very good overall health score above 2.75 out of 5. MGIC and ITRN stand out with their profitability data, while MGIC's only low criterion is price momentum. PLAB has the best financial health among these 3 stocks with a score of 3.7.

However, you can easily determine whether these companies are suitable for your risk profile by conducting a detailed fundamental analysis on InvestingPro according to your own criteria. This way, you will get highly professional help in shaping your portfolio.

In addition, you can sign up for InvestingPro, one of the most comprehensive platforms in the market for portfolio management and fundamental analysis, much cheaper with the biggest discount of the year (up to 55%), by taking advantage of our Cyber Monday deal.

Disclosure: The author does not own any of the securities mentioned in this report.