China chip stocks fall as US considers allowing Nvidia H200 sales

- Big Tech faces heavy losses as Trump’s trade policies shake the market.

- Stocks continue to slide, fueling concerns over economic stability.

- Investors weigh risks and opportunities amid ongoing volatility.

- Get the AI-powered list of stock picks that smashed the S&P 500 in 2024 for half price as part of our FLASH SALE.

Trump’s trade war has rattled the markets, and the stocks suffering the most are precisely those of the Magnificent 7, which have been driving Wall Street’s recent gains.

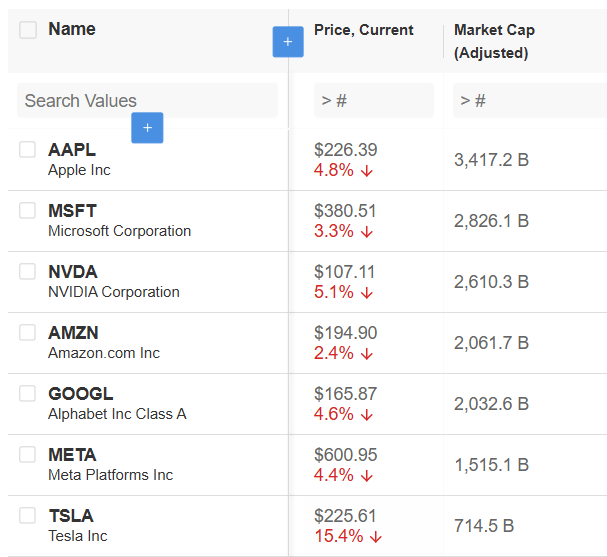

Here are the results of Big Tech’s Black Monday:

- Apple (NASDAQ:AAPL): -4.9%

- Microsoft (NASDAQ:MSFT): -3.3%

- Nvidia (NASDAQ:NVDA): -5.1%

- Amazon.com (NASDAQ:AMZN): -2.4%

- Alphabet (NASDAQ:GOOGL): -4.6%

- Meta (NASDAQ:META): -4.4%

- Tesla (NASDAQ:TSLA): -15.4%

And the sell-off didn’t stop there.

After suffering its worst week since September (-3.1%), the S&P 500 plunged another 2.7% on Monday, while the NASDAQ Composite fared even worse, closing the session down 4%.

Even Trump, while avoiding the word “recession,” admitted that his trade policies would cause market turbulence. Some are already calling for Fed intervention to stabilize the economy and stock market.

Where Are the Best Investment Opportunities?

After the sharp decline, the big question for investors is whether this is a buying opportunity or a sign of a more fundamental shift in market sentiment.

A market correction was expected, given the high valuations of certain stocks and the increasing concentration of market gains in just a handful of companies. However, the current situation is particularly fragile due to economic uncertainty and geopolitical tensions that could dampen global growth. How long this volatility will last remains unknown.

Instead of speculating, we can analyze the data and assess the situation with the right tools.

Looking at Big Tech, recent events have adjusted valuations slightly, making some stocks more appealing for long-term investors. Based on fundamentals and target prices, three names stand out—though with very different risk profiles:

- Tesla: High risk, but high potential upside

- Alphabet: Strong fundamentals at an attractive price

- Microsoft: A defensive choice with steady growth

Tesla: Can Musk and Trump Revive the Stock?

Tesla suffered the worst drop of the day, plummeting 15.4%. But this sharp decline could present an opportunity for investors eyeing an entry point.

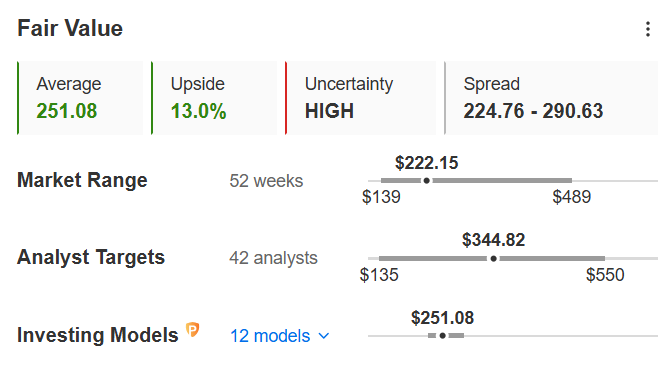

Estimates suggest Tesla’s fair value is $251.08, implying a potential 13% upside. Meanwhile, analysts set a target price as high as $344.82, indicating a possible 55.2% rebound from its closing level on March 10.

Source: InvestingPro

Of course, Tesla remains highly volatile, influenced not only by the EV market’s growth but also by Elon Musk’s strategic decisions. Consumer sentiment toward electric vehicles has been mixed due to macroeconomic challenges, and rising competition from China has put additional pressure on Tesla’s sales.

However, one thing seems certain: President Trump will likely support Musk, his political ally, in efforts to boost Tesla’s stock.

Alphabet: Stability at an Attractive Price

If Tesla is the high-risk bet, Alphabet is probably the best balance of value and stability.

With a P/E ratio of 18.5x, it is among the cheapest Big Tech stocks—a factor that could attract investors looking for a solid long-term play.

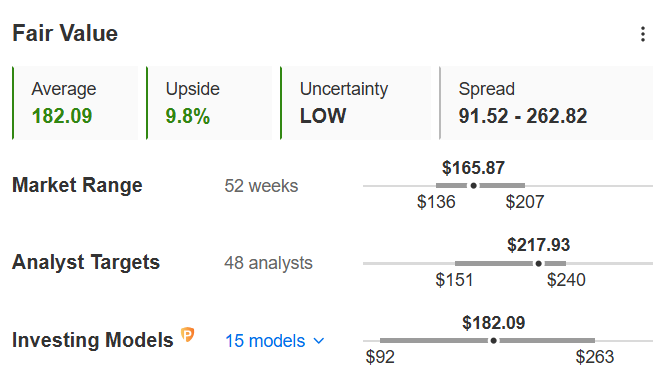

- Fair value estimate: $182.09

- Analyst target price: $217.90 (31.4% upside)

Source: InvestingPro

Alphabet continues to show strong revenue growth (+13.9%) and boasts a high return on invested capital (ROIC) of 28.8%, reflecting excellent capital management. Its dominance in digital advertising and increasing focus on artificial intelligence make it an appealing alternative to other tech giants.

Microsoft: The "Defensive" Pick

For those looking for a less volatile option, Microsoft may be the best choice—if such a term can even apply to a Big Tech stock.

Despite a 3.3% drop, Microsoft managed to limit its losses better than most of its peers. The company continues to post steady revenue growth (+15%) and has a high ROIC of 26.2%, similar to Alphabet’s.

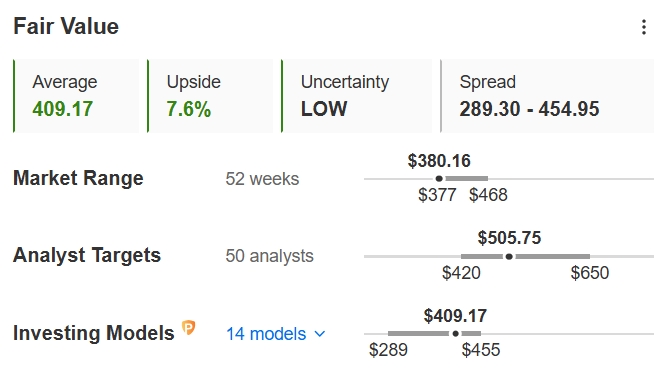

- Fair value estimate (InvestingPro): $409.17

- Analyst target price: $505

- Upside potential: 33%

- Current P/E ratio: Above 30x

Source: InvestingPro

Microsoft is well-positioned in the AI sector, thanks to its strategic partnerships and dominance in cloud computing.

Be Careful Not to Get Burned

Looking at the data, Tesla has the highest estimated upside over the next 12 months—a potential 55% gain according to analysts. However, its extreme volatility and external factors, including competition in the EV industry and global demand trends, pose significant risks.

Meanwhile, Alphabet appears attractive due to its lower valuation compared to its peers and solid fundamentals. Microsoft, on the other hand, offers a more stable and less volatile alternative with strong growth prospects.

The Trump factor has just hit the markets, and no one knows how long this volatility will last. While Monday’s sell-off has certainly reduced sky-high stock valuations, investors should recognize that entering the market now comes with heightened risk.

The best strategy? Don’t be swayed by short-term fluctuations. Instead, stick to your long-term investment plan, rely on data-driven decisions, and use all available tools to manage risk effectively.

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk belongs to the investor. We also do not provide any investment advisory services.