Wall St futures flat amid US-China trade jitters; bank earnings in focus

- Uber and Airbnb face similar macroeconomic headwinds

- But the pandemic shock has shown that their business models are resilient and can withstand a sudden drop in demand

- Uber stock has rebounded sharply during the past three months, surging about 50% from its June low

Unless the economy takes a sharp turn for the better, the two modern-era technology disruptors, Uber Technologies (NYSE:UBER) and Airbnb (NASDAQ:ABNB), are poised to experience their first recession since becoming public companies.

The San Francisco cohabitants belong to a market segment that came into existence after the Global Financial Crisis of 2008. As such, they have not yet experienced challenges like the ones we currently face.

However, although investors are usually reluctant to hold tech companies in their portfolios when the sailing is rough, both global operators have emerged much stronger after the pandemic-driven shock to the economy.

Here is a deeper look into their recent business performance to analyze whether their stocks could prove bargains for long-term investors.

Uber Benefits From Diversification

CEO Dara Khosrowshahi’s key post-pandemic strategy has been to capitalize on the boom in delivery by expanding into other categories like convenience-store items, alcohol, and groceries, turning the Uber rides app into much more than just ride-sharing.

The San Francisco-based Uber’s latest earnings show that this strategy is paying off. Both revenue and gross bookings surged to a record high in the quarter ended on June 30.

Uber Eats revenue grew 25% from a year ago and is expected to keep doing so, as Khosrowshahi told analysts that a key focus for the remainder of this year would be increasing profitability in the delivery segment.

Uber stock has rebounded sharply during the past three months, surging about 55% from its June low. According to most analysts, this momentum will likely continue as the company moves closer to profitability.

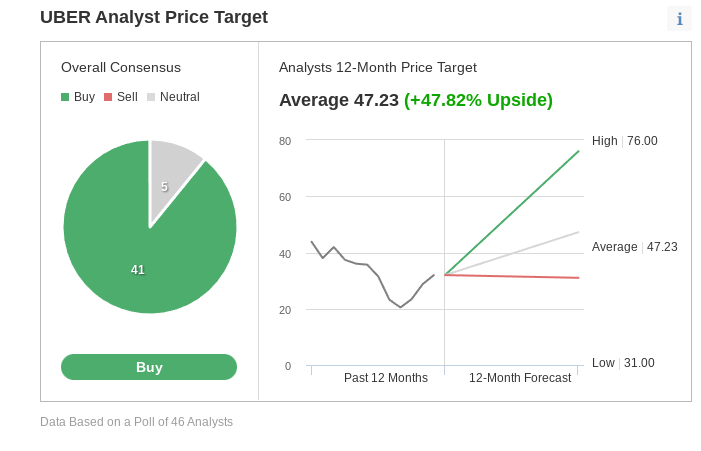

In an Investing.com poll of 46 analysts, 41 rate UBER stock a buy, with a consensus price target implying a 48% upside.

Source: Investing.com

In a recent note, Wolfe reiterated Uber as a top pick, saying it sees a “significant runway for profitability” for the company. Bernstein also reiterated Uber as outperform, arguing that during a harsh economic environment, investors should stick with market leaders, such as Uber, that can emerge from this period as better businesses.

Airbnb Benefiting From Global Travel Rebound

The also San Francisco-based rental platform has developed a business model which is flexible enough to deal with the various economic challenges. The recent evidence of this adaptability came during the pandemic when travel demand suddenly plunged, casting doubts over a company’s future that went public during one of the biggest health crises of modern history.

But during those two years of upheaval, Airbnb not only managed to weather the pandemic but also thrived, achieving the best year in the company’s history in 2021.

The company quickly restructured its app to take advantage of a new world of travel due to the flexibility offered by new remote work policies that allowed people to spread out to thousands of towns and cities, staying for weeks, months, or even entire seasons at a time.

Long-term stays were the fastest growing category in the second quarter, gaining almost 90% from three years ago, suggesting some portion of the pandemic-related surge is here to stay, especially when a large pool of workers have choices to work from anywhere.

According to its latest earnings report, ANBN posted a 58% year-over-year jump in its sales in Q2 to $2.1 billion, helping to drive the company’s most profitable second quarter to date. Still, that growth was slower than it was last quarter, when revenue surged 70% over the first quarter of 2021.

As soaring prices and higher interest rates begin to curtail consumers’ spending power, travel demand could take a hit in the coming days when the post-pandemic desire to take the plane will decline.

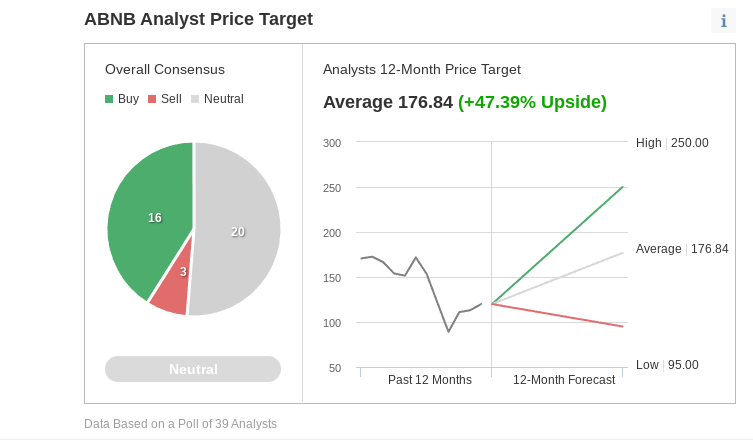

That’s the main reason that most Wall Street analysts are not convinced that this is the right time to bet on Airbnb stock despite the company predicting a record third quarter in terms of gross bookings and sales. In an Investing.com poll of 39 analysts, only 16 rate the stock a buy.

Source: Investing.com

Bottom Line

Though I like both stocks for any long-term buy-and-hold portfolio, Uber’s diversified business model makes it much more resilient to weather an economic shock. While still strong, Airbnb is more prone to economic headwinds if travelers hold back on their discretionary spending. If you have to choose between the two, I recommend sticking with Uber.

Disclosure: The writer is long on both Uber and Airbnb.