Street Calls of the Week

- The 'Technology Gems' strategy on InvestingPro allows users to pick out top tech stocks

- You can even refine your search further to build a quality watchlist

- InvestingPro makes this process a breeze

- Secure your Black Friday gains with InvestingPro's up to 55% discount!

The Nasdaq 100 serves as the primary benchmark for technology sector companies, renowned for their strong performance in bull markets, often surpassing traditional value companies.

For uncovering stocks with promising returns, the 'Technology Gems' strategy within the InvestingPro tool is a valuable resource.

Let's examine the criteria steering the selection of companies and factor in additional considerations for thorough screening, ensuring the curation of a watchlist featuring stocks with significant upside potential.

What Criteria Does the 'Technology Gems' Strategy Take Into Account?

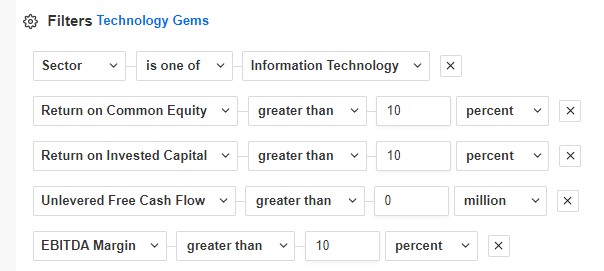

Every strategy has its foundation in a few key factors that help sift through a wide array of companies. Here's a breakdown of how these factors come into play for the "Technology Gems" strategy:

- Cash Flow: We look at how much cash a company has after covering its debts. We specifically focus on companies with positive cash flow.

- Return on Invested Capital (ROIC): This tells us how efficiently a company generates returns on the money it has invested. We set a minimum threshold of 10% for a company to meet our strategy's criteria.

- Return on Equity (ROE): Unlike ROIC, this shows how a company generates returns on its ownership equity. The higher, the better, with a minimum requirement of 10%.

- EBITDA: This is a basic indicator showing a company's operating profit before considering interest, taxes, depreciation, and amortization.

- Industry Focus: Since we're on the lookout for technology gems, we narrow down our search to companies in the information technology sector.

By focusing on these aspects, we aim to pinpoint standout companies in the technology sector that meet our specific criteria.

Source: InvestingPro

How to Refine Your Search Further

To enhance the selectivity of the chosen companies, users can leverage the flexibility in creating investment strategies in the InvestingPro tool.

One effective addition, as suggested earlier, is incorporating leveraged free cash flow above $100 million. This helps filter out companies with a potentially significant portion of debts in their total cash flow.

Once this adjustment is implemented, users can then narrow down their choices from the initial list of 21 companies listed on the US stock market. Despite these parameters, there's still room for further refinement using additional indicators.

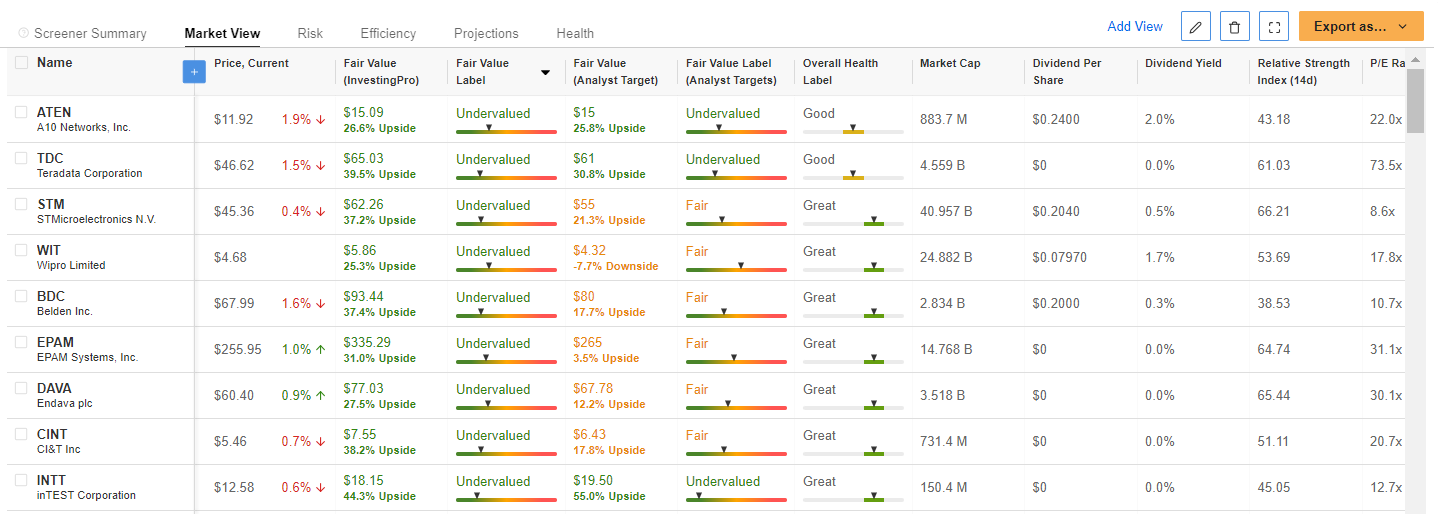

Notably, paying attention to the fair value indicator is recommended. This indicator offers insights into whether a company is undervalued or overvalued based on available investment models, providing a valuable layer of analysis in the selection process.

Source: InvestingPro

So, now we've got a list of 9 companies that really fit the bill as tech gems, at least when we look at some basics like how they're doing financially. Keep in mind that the level of detail depends on what each investor likes.

The InvestingPro scanner gives plenty of room to play around with these preferences. This trimmed-down list is a starting point for deeper analysis and matches up with what each person looks for in their investments.

***

Buy or Sell? Get the answer with InvestingPro for Half of the Price This Black Friday!

Timely insights and informed decisions are the keys to maximizing profit potential. This Black Friday, make the smartest investment decision in the market and save up to 55% on InvestingPro subscription plans.

Whether you're a seasoned trader or just starting your investment journey, this offer is designed to equip you with the wisdom needed for more intelligent and profitable trading.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.