TSX gains after CPI shows US inflation rose 3%

Well, it seems like it’s been a while since the last CPI update! Thanks to the government shutdown, it has been since this data is a week and a half later than it was scheduled to be. The importance of the CPI release is obvious, but it was reinforced by the fact it’s the only one the government is calling people back to release. It isn’t that we don’t have reasonably-accurate alternative ways to measure price pressures, though – it’s because unlike Payrolls and most other government releases that are important touchpoints for economists, the CPI is an important legal touchpoint for contracts, bonds, and legal obligations of the federal government. In this case, September’s data is a crucial number needed to calculate COLA adjustments for Social Security for next year. If this had been October’s data? I’m not sure they call back workers to release it. But that’s next month’s problem.

Speaking of next month’s problem: the government shutdown did not affect data gathering for this month’s number; they had to recall the people to collate the data and publish it but not the collectors. So the quality of the data should be fine. The data-quality question is much murkier when we look forward to next month, but since much less of the data collection is done by guys with clipboards these days, it might not be as bad as you think. Still, that will be the concern for the October CPI released next month. Like I said: next month’s problem!

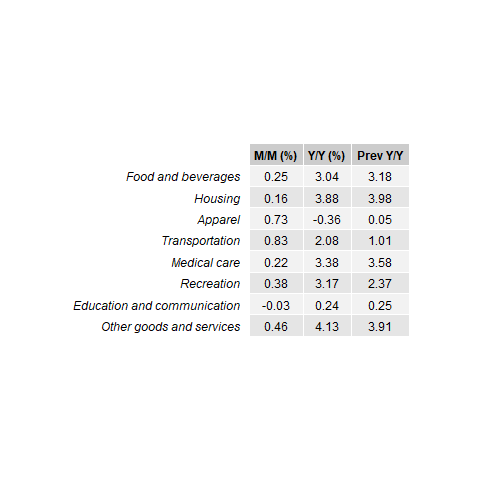

Heading into the release, consensus was for +0.37% on headline CPI (SA) and +0.29% on core. I have to admit that I was confiding to people that this seemed sporty because the prior month had seen a surprising acceleration in rents that could be reversed, indications are that Used Cars would be a drag, and Food at Home also looked soft (I was right on 2 out of 3 – Food at Home was an add). That told us going in that if we were going to get to +0.29% core, either I had to be wrong on most of that or core goods ex-used cars was going to have to be pretty strong. Tariffs definitely are helping to push that narrow group of the consumption basket higher. But is that enough? Let’s see.

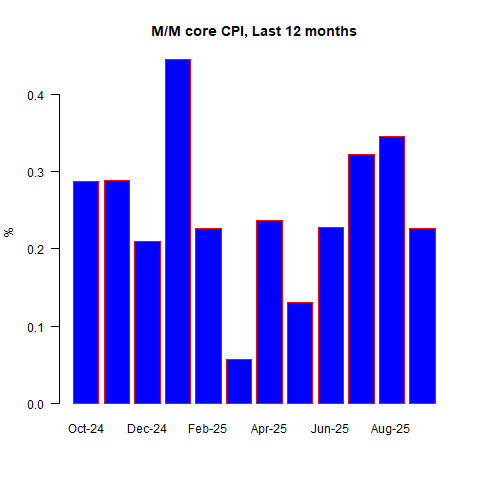

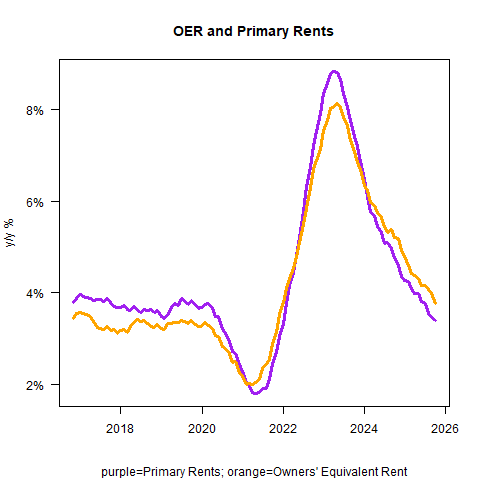

Actual print: SA CPI +0.31%; SA Core +0.227%. Softer than expected, and it took only a moment to see that a big part of that was due to a sharp deceleration in Owners’ Equivalent Rent (see chart). Some of that was the give-back I expected, but it was more than that and so we should put this in the back of our minds for next month – we’re probably due a reversal in the other direction over the next month or two.

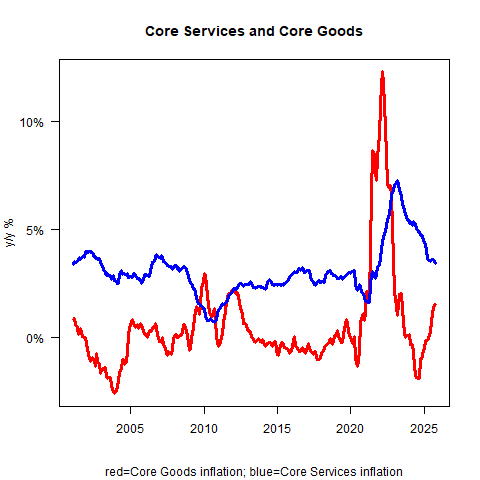

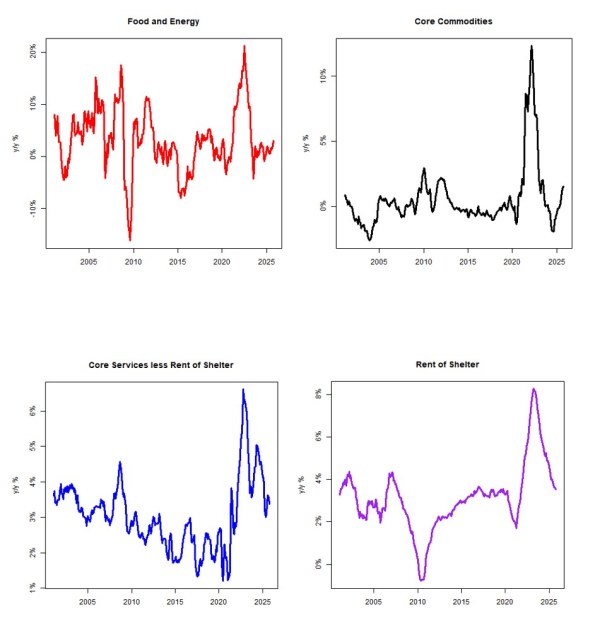

Core goods inflation rose slightly to +1.54% y/y, and core services declined to 3.47% y/y. The latter is mostly and maybe entirely due to housing, which is a core service. The former is interesting because Used Cars/Trucks was -0.41% m/m. That was expected, but it means that other core goods were more buoyant.

So here are OER and Primary Rents. 3.76% y/y (only +0.13% m/m) and 3.4% y/y (only +0.2% m/m). You can’t really tell a lot about the miss today from this chart – I showed the m/m series earlier, and the bottom line is that this continues to level out. I think the flattening is going to be more dramatic over the next 3-6 months but we’ll see. Lodging Away from Home rose again, +1.3% m/m, and is now flat y/y.

At this point, I’m thinking: with rents a downside surprise and Used Cars a downside surprise, this isn’t that bad a miss. In other words, if you’d told me we were going to get those numbers from rents and cars I would have thought core would be a lot weaker than +0.23% m/m.

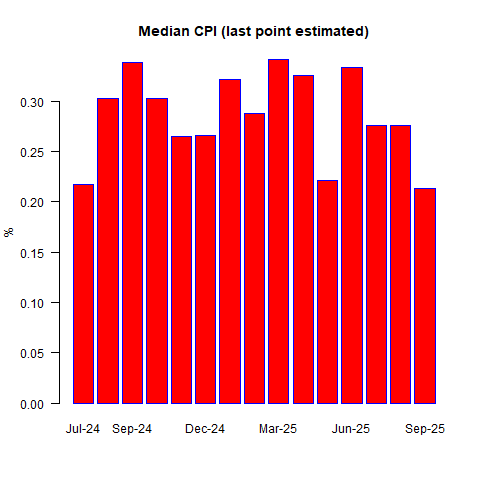

Earlier I showed the last 12 Core CPIs. My guess at Median looks better, but that’s mostly because the median category is West Urban OER and even split up, an aberration in OER – and that’s what I think this is – is enough to sway Median CPI. It also means my estimate of median, +0.213% m/m, might be off because the Cleveland Fed separately estimates the seasonals for the regional OERs and so I have to guess at that part. My guess will take y/y Median CPI to 3.5% from 3.6%. And the Fed is easing. Hmm.

Here are the four-pieces charts. Food and Energy +2.99% y/y. Core Commodities +1.54%. Core Services less Rent of Shelter (Supercore) +3.37%. Rent of Shelter +3.53%. These are the four pieces that add up to CPI. None of them looks terrible except for Core Goods, and there’s limited upside to that – and it has a short period, so in a year it’s likely to be lower. I do think that going forward, core goods remains positive instead of the steady deflation it was in for decades, but not big positive. However, you need it to be negative if you want inflation at 2%, unless you get core-services-ex-rents a lot lower (but that’s highly wage-driven, and reversing illegal immigration helps support that piece somewhat) or rent of shelter a lot lower. The latter is certainly receding but it’s not going to go a lot lower.

I don’t usually spend a lot of time talking about energy, because that’s a hedgeable piece (largely – gasoline is a big part of energy and that’s easy to hedge with a little lag; electricity is harder). This month, Energy was +0.12% NSA. But next month, we’ll see a decent drag because of the sharp drop in gasoline over the last few weeks. That’s a little early compared to the usual seasonal, and it may mean we get the usual December drop in gasoline in October CPI.

Except…that I think the White House has teased that we might not get October CPI at all, just skip it, because of the difficulty gathering data. If that is true, the fallback mechanisms will kick in. See my piece on what that means, but the bigger point is that you wouldn’t get my scintillating commentary. I guess again that’s not this month’s problem.

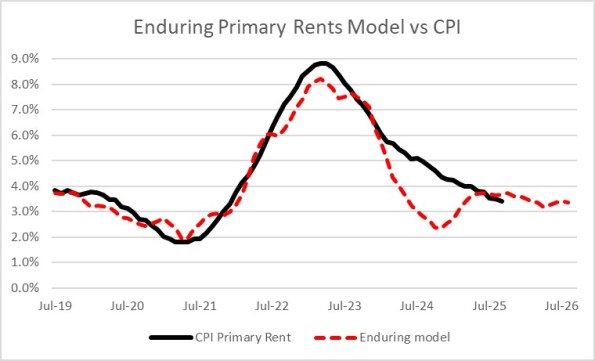

Now, I have to show this almost by habit, and because the economists expecting housing deflation will be dancing in the streets. Take pictures, and show them again next year. They never learn. Housing inflation is slowing but there is no sign rents are going to come anywhere near deflation. Except maybe on a weighted basis if Mamdani gets elected Mayor of New York City and freezes rents. But then we’ll have to start looking rents ex-NYC.

How disinflationary a period are we in? Wellllll…of the item categories in the median CPI calculation, there were zero core categories that decelerated faster than 10% annualized over the last month (-0.833% or faster). On the plus side, there were Personal Care Services (+11.9% m/m annualized), Footwear (+12.0%), Motor Vehicle Fees (+14.2%), Tenants’ and Household Insurance (+15.2%), Lodging Away from Home (+17.5%), Miscellaneous Personal Goods (+17.9%), Men’s and Boys’ Apparel (+19.3%), and Public Transportation (+21.5%). These are small categories for the most part – but not all import goods and interesting in that the tails are all to the upside. That’s not the way a disinflationary economy usually looks, although I don’t want to overstate the importance of a single month!

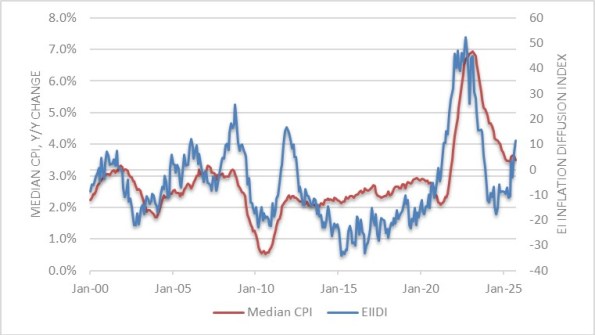

Here’s the observation about long tails compressed into a single number, the Enduring Investments’ Inflation Diffusion Index. It’s signaling upward pressure.

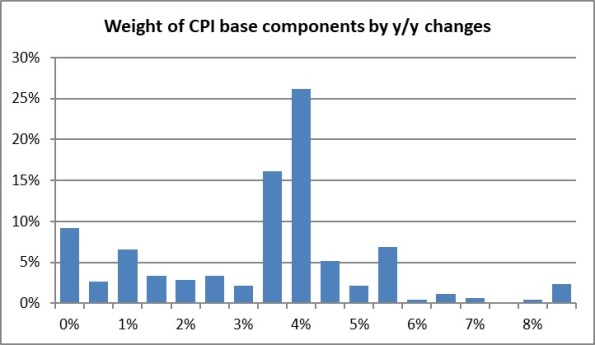

Below is a chart of the overall distribution. The two big spikes in the middle are mainly rents and OER. But take those away and you can see there’s not a lot of categories in the 1-3% range, and a decent weight in the 5-6% range. This doesn’t really look like a price system settling back down placidly to 2%.

Now, the stock market clearly loves this, which makes sense. The Fed is going to ease, probably twice more this year. But that was already baked into the cake in my mind, because the Fed no longer targets 2% inflation. Remember that in the most-recent change to the 5-year operating framework the Fed, in Chairman Powell’s words, “…returned to a framework of flexible inflation targeting and eliminated the ‘makeup’ strategy.” Ergo, the Fed doesn’t really care if we get to 2%. They’d prefer to not see inflation head higher, but they can spin a story to themselves that even though median inflation is in the mid-to-high 3s, “the process of inflation anchoring is underway” or some such nonsense. As long as it’s not hitting them in the face that inflation is going up, they’ll keep relying on their models that say it should be going down. N.b., those are the same models that said inflation shouldn’t have gone up that much to begin with, and should have been transitory, but we all know “Ph.D.” stands for “Pile it higher and Deeper.”

Eventually, inflation going up probably will hit them in the face. But that’s such a 2026 problem.