Gold prices dip as December rate cut bets wane; economic data in focus

The outlook for the US economy is on track to close 2023 with a relatively upbeat outlook for the fourth quarter, based on a set of nowcasts compiled by CapitalSpectator.com.

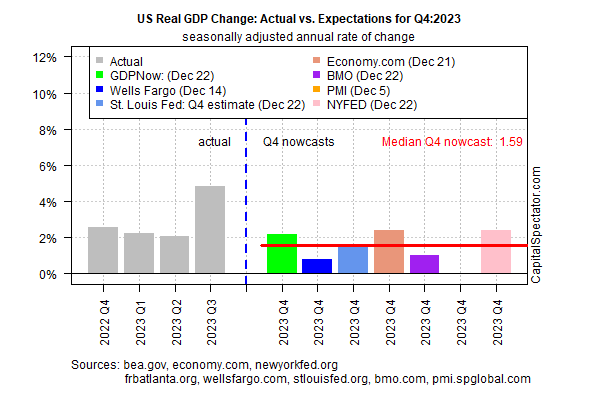

The official Q4 GDP release from the Bureau of Economic Analysis, due in late-January, is expected to report the economy expanded by 1.6% (seasonally adjusted annual rate), based on the median shown in the chart below.

Today’s revised nowcast marks a sharp deceleration from Q3’s strong 4.9% increase, but it’s strong enough to keep the economy on a low-recession risk path through 2023’s close.

Today’s Q4 nowcast is unchanged from the 1.6% median estimate published on Dec. 15.

At this late date in the current quarter, the steady nowcast suggests a relatively high degree of confidence in favor of the so-called soft-landing outlook for the economy — softer growth that helps tame inflation but avoids an NBER-defined recession.

To be fair, a 1.6% pace marks a clear slowdown from recent history. The average GDP increase for the four quarters through Q3 is 2.9%, although that reflects the upside outlier in the Q3 data.

In any case, it’s obvious that the expansion has downshifted, but it’s still debatable if the slower growth indicates trouble ahead or a moderation from the extremes of the pandemic’s effect to a softer but sustainable trend.

Economists offer mixed views on what’s in store for 2024. A new survey finds that 76% of business economists expect the odds of a recession at some point in 2024 in 50% or less, reports the National Association for Business Economics.

“Our base case is that we have a mild recession,” says Larry Adam, chief investment officer at Raymond James.

Expectations that the Federal Reserve will start cutting interest rates early in 2024 provide support for thinking that monetary policy will assist in offsetting some of the headwinds brewing.

“An improbable ‘soft-landing’ for the US economy seems more likely next year,” writes John Min, chief economist at Monex USA, in a recent research note.

Although it’s challenging to forecast what may, or may not, happen beyond the next several months, what is becoming increasingly clear is that the US economy will exit 2023 with a modest tailwind.

“There is plenty to cheer about the economy, and next year should be even better as the Federal Reserve takes the brakes off the economy now that inflation is going their way,” predicts Christopher Rupkey, chief economist at FWDBONDS in New York.

A key reason is a resilient labor market. Although hiring is moderating, the low level of jobless claims – a leading indicator for payrolls – continues to signal growth in the near term.

In the latest report, new filings for unemployment benefits through Dec. 15 totaled 205,000, close to the lowest number on record.

That’s a sign that a solid pace of hiring looks set to continue, and in turn, provide support for keeping economic activity positive through early 2024.