’Big Short’ Michael Burry de-registers Scion Asset Management

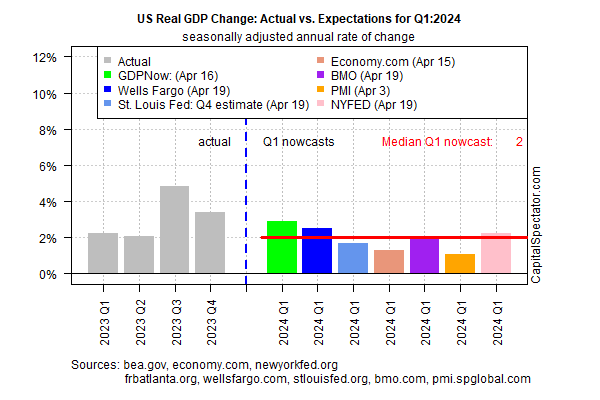

The US economy appears on track to post softer growth in the first-quarter GDP report scheduled for release on Thursday (Apr. 25), based on the median for a set of nowcasts compiled by CapitalSpectator.com.

Output for the January-through-March period is currently estimated at a 2.0% increase (seasonally adjusted real annual rate), unchanged from the previous estimate Published on Apr. 5. If correct, the moderate increase will mark another quarter of decelerating growth.

The economy rose 3.4% in last year’s fourth-quarter, a downshift from the previous quarter. Despite another round of softer growth, most estimates for the upcoming Q1 report — the initial estimate from the Bureau of Economic Analysis — indicate that the economy will continue to expand at a healthy pace that minimizes recession risk.

In fact, by some accounts, the US economy is running too hot.

“The strong recent performance of the United States reflects robust productivity and employment growth, but also strong demand in an economy that remains overheated,” advises IMF chief economist Pierre-Olivier Gourinchas. “This calls for a cautious and gradual approach to (monetary) easing by the Federal Reserve.”

By contrast, some analysts worry that the delay in interest rate cuts by the Federal Reserve raises the potential for trouble later in the year. The concern centers on the lagged effects of rate hikes over the past two years – effects that some economists say could extend the recent slowdown trend into the second quarter and beyond.

In other words, the key debate is whether the economy will stabilize at a softer pace of growth vs. decelerate further in the months ahead. For the moment, current numbers lean toward the former.

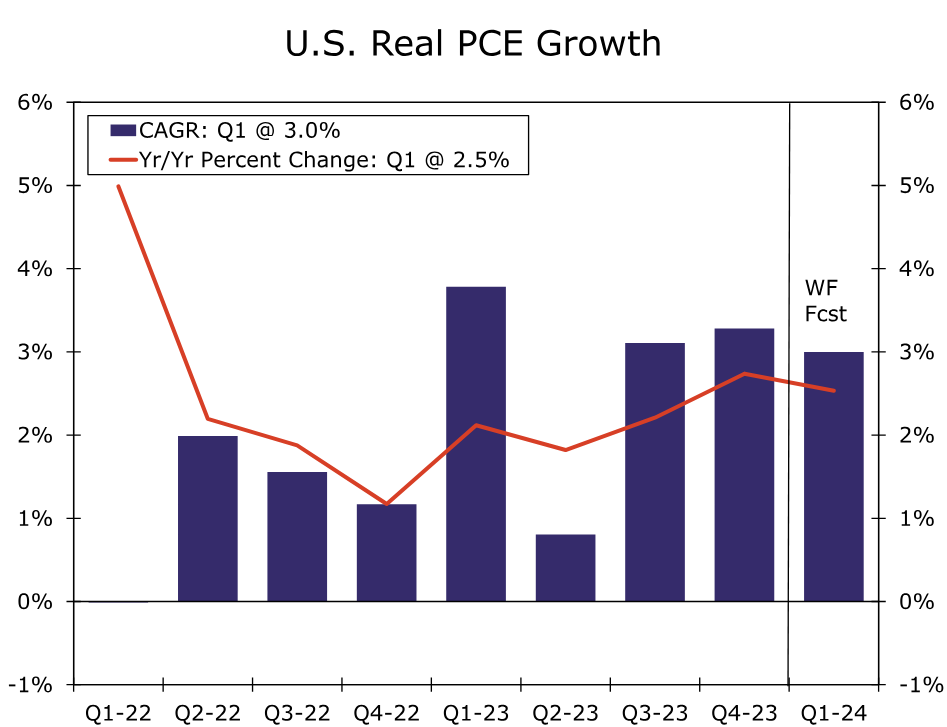

A critical factor supporting the upbeat economic view: consumer spending is still solid, based on real (inflation-adjusted) levels.

Economists at Wells Fargo said,

“Real personal consumption growth has remained remarkably resilient in the face of the Fed’s monetary policy tightening campaign that began in March 2022,”

The firm’s forecast for Q1 spending is expected to dip slightly vs. Q4, but not enough to trigger fears that consumer spending is waning.

“Consumers once again seem to have been unfazed by elevated interest rates and inflation over the first quarter,” analysts at the bank explain.

“Hot retail sales spending in March and the largest jump in services spending in more than a year in February point to real personal consumption expenditures advancing at a 3.0% annualized pace during the quarter.”