Five things to watch in markets in the week ahead

Rarely in the history of US economic analysis have recession forecasts been plentiful and widely embraced. All the more extraordinary is the ongoing resilience of the economy that defies the gloomy expectations. There are real and present dangers lurking that could quickly alter current conditions. However, new numbers published this week reaffirm that business activity in May indicates that recession risk is still low.

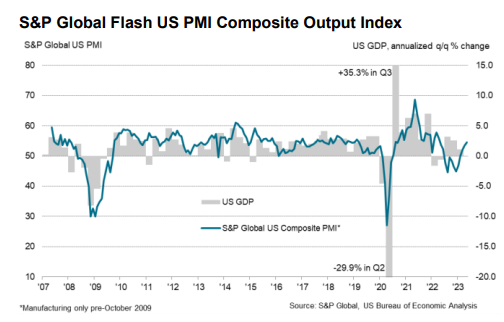

“The US economic expansion gathered further momentum in May,” advises Chris Williamson, the chief business economist at S&P Global (NYSE:SPGI) Market Intelligence, based on this month’s US PMI Composite Output Index, a survey-based proxy for GDP. This benchmark rose to 54.5, a 13-month high that’s comfortably above the neutral 50 mark.

In a sign of the precarious nature of the expansion, virtually all of the strength is due to the services sector. By contrast, “manufacturers are struggling with over-filled warehouses and a dearth of new orders as spending is diverted from goods to services,” advises Williamson.

The uneven state of the economic activity is a risk, and it comes at a vulnerable point when a macro sword of Damocles hangs over the US as debt-ceiling negotiations drag on. The potential for a government default draws closer, perhaps as early as the first half of June. But assuming politicians in Washington find a solution in the days ahead, the economy could be more resilient than the gloomy forecasts of late suggest. Rick Rieder, BlackRock’s bond chief says,

“I think the US economy’s in much better shape than people give [it] credit. There’s this thesis that you will have a dramatic slowdown. When you break down the numbers, it’s just not apparent.”

Recent nowcasts for second-quarter GDP align with Rieder’s view. As CapitalSpectator.com reported last week, a median nowcast compiled on these pages for Q2 output via several estimates reflects a modest pickup in growth over Q1’s weak rise.

Meanwhile, signs of firmer economic activity have been featured in The US Business Cycle Risk Report for over a month. On April 23, the newsletter reported that forward estimates of a proprietary set of business-cycle indicators through May “indicate that economic activity has been firming up after last year’s economic slowdown reached a trough in January.”

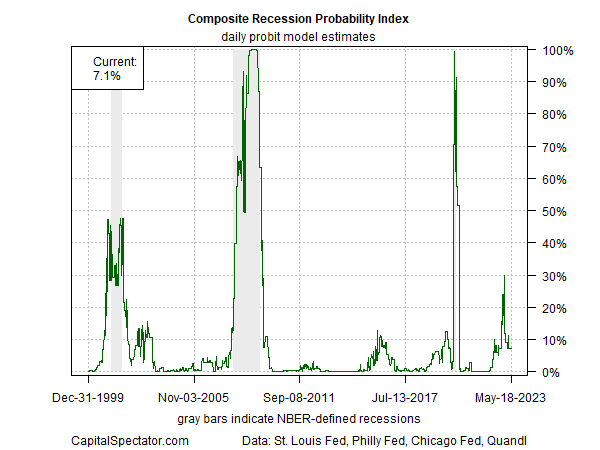

This week’s issue of the newsletter sent to subscribers continues to report a firmer reading of economic activity for the immediate future – through June. In turn, The US Business Cycle Risk Report advises that its primary estimate of real-time recession risk — Composite Recession Probability Index — continues to show that an NBER-defined contraction is unlikely for now.

There are caveats, of course, but a recession almost certainly hasn’t started and (ignoring a self-inflicted blow from the debt-ceiling crisis) isn’t likely to start in the immediate future. The US, in short, continues to post a moderately firm pace of growth momentum. It’s an expansion if we can keep it. Decisions in Washington in the days ahead are the main risk to an otherwise upbeat outlook.