Asia stocks upbeat on US tech rise; Japan reverses gains on BOJ ETF sale plans

- The Bank of Japan may conclude its ultra-loose monetary policy in the next 2-3 quarters.

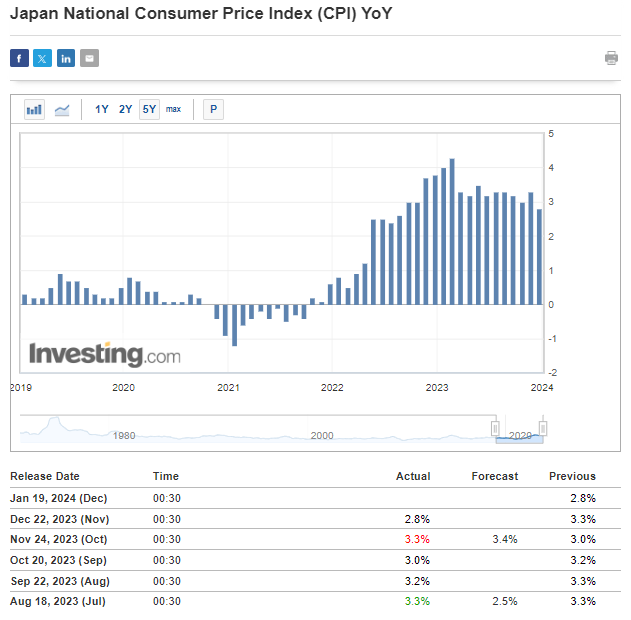

- Deflation is progressing in the Japanese economy.

- A return above 150 yen per dollar is possible later this month.

- Looking to beat the market in 2024? Let our AI-powered ProPicks do the leg work for you, and never miss another bull market again. Learn More »

The last BOJ meeting of 2023 took place before the holidays in December, and as expected, it brought no changes to the dovish BOJ monetary policy that has been in place for many years.

The accompanying statement was interpreted as a continuation of the current policy, especially with the governor's assertion that the Central Bank would not rush to change the current approach.

April is currently mentioned in the public space as a potential start date for the rate-hike cycle, but this has not been confirmed through official channels.

Meanwhile, in the absence of hawkish declarations, the Japanese yen remains under selling pressure, evident in pairs like USD/JPY, which has the potential to return above 150 yen per dollar.

The Bank of Japan Approaches Monetary Policy Normalization Cautiously

Investors hoping for more detailed information on the exit strategy from the dovish monetary policy after the last BOJ meeting of the previous year may be disappointed.

The BOJ maintains the current status quo, and even if a rate-hike cycle is initiated, it will be extremely cautious, with a pace of one or two hikes per year to reach a level of 0.5% over the next four years.

This is the scenario outlined by Makoto Sakurai, a former BOJ board member from 2016 to 2021.

Meanwhile, the OECD is calling for monetary policy normalization in Japan when inflation hovers around the 2% target.

Normalization is expected to include a gradual increase in interest rates and the flexibility of yield curve control, especially for Japan 10-Year government bonds.

However, the Bank of Japan does not need to hurry, especially in the face of the upcoming pivots by the Fed and ECB in the coming months, which may reduce pressure on bond yields globally.

Inflation in Japan is Clearly Slowing

The next inflation projection in Japan by the Bank of Japan will be on January 23, but the forecasts will likely be revised downward.

Current assumptions show average inflation this year at 2.8%, but with recent declines in prices, especially oil, inflationary pressure may decrease. However, it is unlikely that the revision will be drastic enough to fall below the 2% level.

Looking at the inflation dynamics year-on-year, it has remained above 2% since May 2022, peaking at 4.2% in February 2023. The potential revision in monetary policy conditions will depend on readings in the next 2-3 months.

The key in this context will be the readings in the next 2-3 months, which, if the current trend continues, could result in a postponement of the normalization of monetary policy.

USD/JPY to Attack Recent Highs: How to Trade It

Considering the Bank of Japan's stance and recent upward reactions, the bullish scenario can currently be considered the most likely. Such developments should first lead to an attack on the psychological barrier of 150 yen per dollar.

The main goal for buyers, however, remains the recent long-term highs in the price range of 152 yen. The negation of this scenario would be a move below the 140 yen barrier, where the main line of defense can be considered.

Much will also depend on what the Fed does. If the scale of interest rate cuts is greater than what the market currently assumes (4-5 cuts of 25 bps), a weakening dollar may prevent a continuation of the upward move.

***

In 2024, let hard decisions become easy with our AI-powered stock-picking tool.

Have you ever found yourself faced with the question: which stock should I buy next?

Luckily, this feeling is long gone for ProPicks users. Using state-of-the-art AI technology, ProPicks provides six market-beating stock-picking strategies, including the flagship "Tech Titans," which outperformed the market by 670% over the last decade.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.