Trump to impose 100% tariff on China starting November 1

- USD/JPY closes below 142.00 despite strong U.S. retail sales.

- AUD/USD near key resistance ahead of Aussie jobs report.

- ECB guidance on euro strength may rattle FX markets.

- Thin liquidity heightens the risk of sharp moves across majors.

USD/JPY and AUD/USD sit at key levels on the charts heading into what is traditionally a period of poor market liquidity ahead of Easter. With unemployment data to navigate in Australia and several major risk events later in the session—headlined by the European Central Bank’s April rate decision where guidance will drive direction—the prospect of heightened market volatility is in place even before headline risk related to U.S. trade policy is considered.

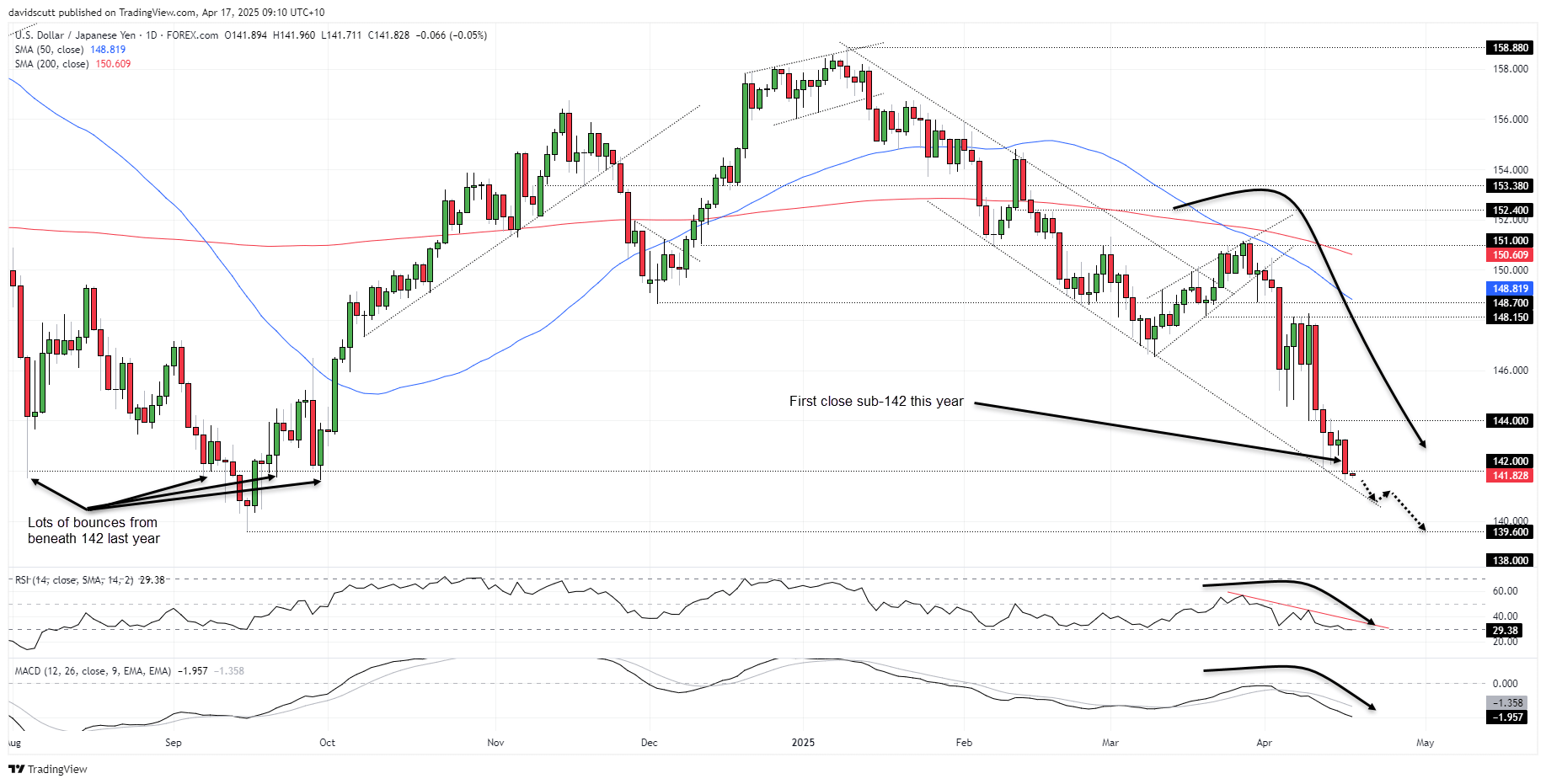

USD/JPY Slips Below 142.00

After a brief pause on Tuesday, the slide in USD/JPY resumed on Wednesday as news broke of further export restrictions on NVIDIA’s (NASDAQ:NVDA) H20 chips to China, kicking off another wave of US dollar selling in Asia. Not even a stronger-than-expected U.S. retail sales report or neutral remarks from Federal Reserve Chair Jerome Powell were enough to support the buck, seeing USD/JPY close at the lowest level since September 2024.

Source: TradingView

Looking at USD/JPY on the daily chart, the close beneath the important 142.00 level looms as significant, considering how many times the pair bounced from it during August and September last year. The only time we saw a successful breach was on September 12, 2024, resulting on that occasion in USD/JPY sliding to 139.60.

If the break and close beneath 142.00 can be sustained in Asian trade today, it may embolden bears to look for a similar outcome on this occasion.

Aside from 142.00, downtrend support dating back to February is another level for traders to keep an eye on, especially as we’ve seen more than a handful of bounces from it since it was established. Today, the trendline is found around 141.30. If the downside break fails to be sustained, 144.00 is a level of note above.

Momentum indicators remain firmly in the sell-on-rallies camp, with bearish momentum in RSI (14) and MACD continuing to grow. While that skews directional risks towards the downside, the risk of a countertrend squeeze remains elevated with RSI (14) now sitting beneath 30. Any good news on the trade negotiation front could be the catalyst for such a move.

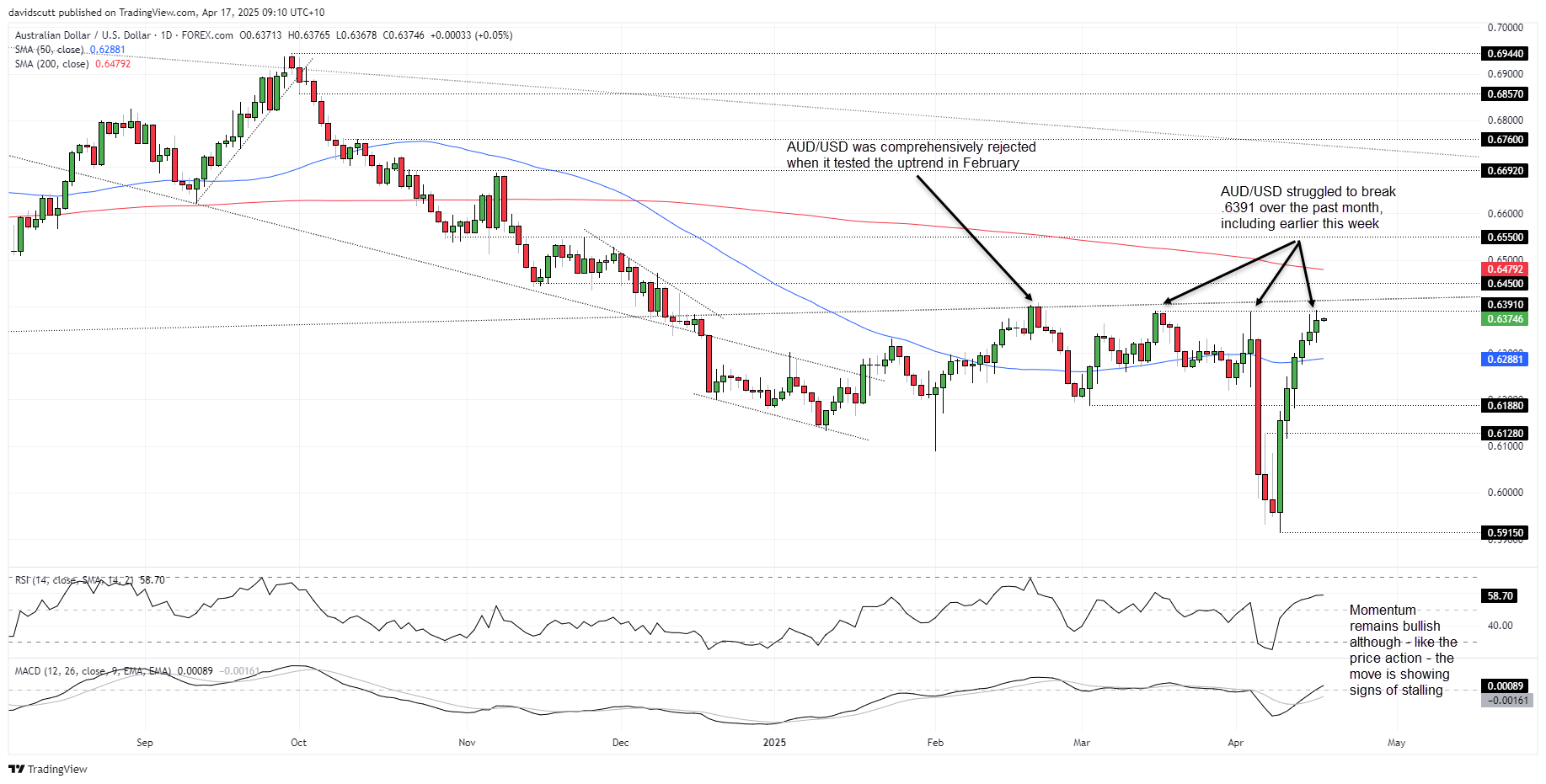

AUD/USD Bullish Momentum Slows

The Australian dollar is also eyeing fresh cyclical highs against the US dollar today, sitting just beneath a key zone comprising horizontal resistance at .6391 and uptrend resistance currently located around .6415. The latter was established in October 2022 and formerly acted as support. Since being broken, AUD/USD has only been tested once and was categorically rejected. It’s therefore important technically.

Source: TradingView

While the momentum picture points to upside risks, with RSI (14) and MACD both moving higher above neutral levels, the bullish advance is showing signs of slowing, underlining the need to see bullish price signals to add to the move already seen. Indeed, another failure at .6391 may shift directional risks lower, not higher.

If AUD/USD were to break above the October 2022 uptrend, .6450, the 200-day moving average and .6550 are levels that bulls may target. Beneath .6391, a bearish reversal would put the 50-day moving average and .6188 on the radar for shorts.

Providing a potential catalyst to dictate medium-term directional risks, Australia’s March employment report will be released at 11.30 am AEST. Employment is expected to lift by 40,000 after an even larger fall in February. Unemployment is expected lifting rise to 4.2%, driven by disruptions caused by Cyclone Alfred early in the month.

While the unemployment rate is the most important figure for the RBA, markets typically react to the jobs figure first as it has a knack for delivering extreme volatility.