Nvidia pushes back on AI bubble narrative as Blackwell drives Q3 beat

The latest correction in the S&P 500 was led by a short and shallow bear market in the Magnificent-7 stocks. Trump’s Tariff Turmoil clearly drove lots of the selling pressure. However, the stock market selloff this year was also attributable to the downward rerating of the elevated valuation multiples of S&P 500 Information Technology sector stocks, and particularly the Mag-7, which began after the release of open-source Deep Seek on January 24 triggered investor fear that capital spending on AI infrastructure would nosedive.

Consider the following:

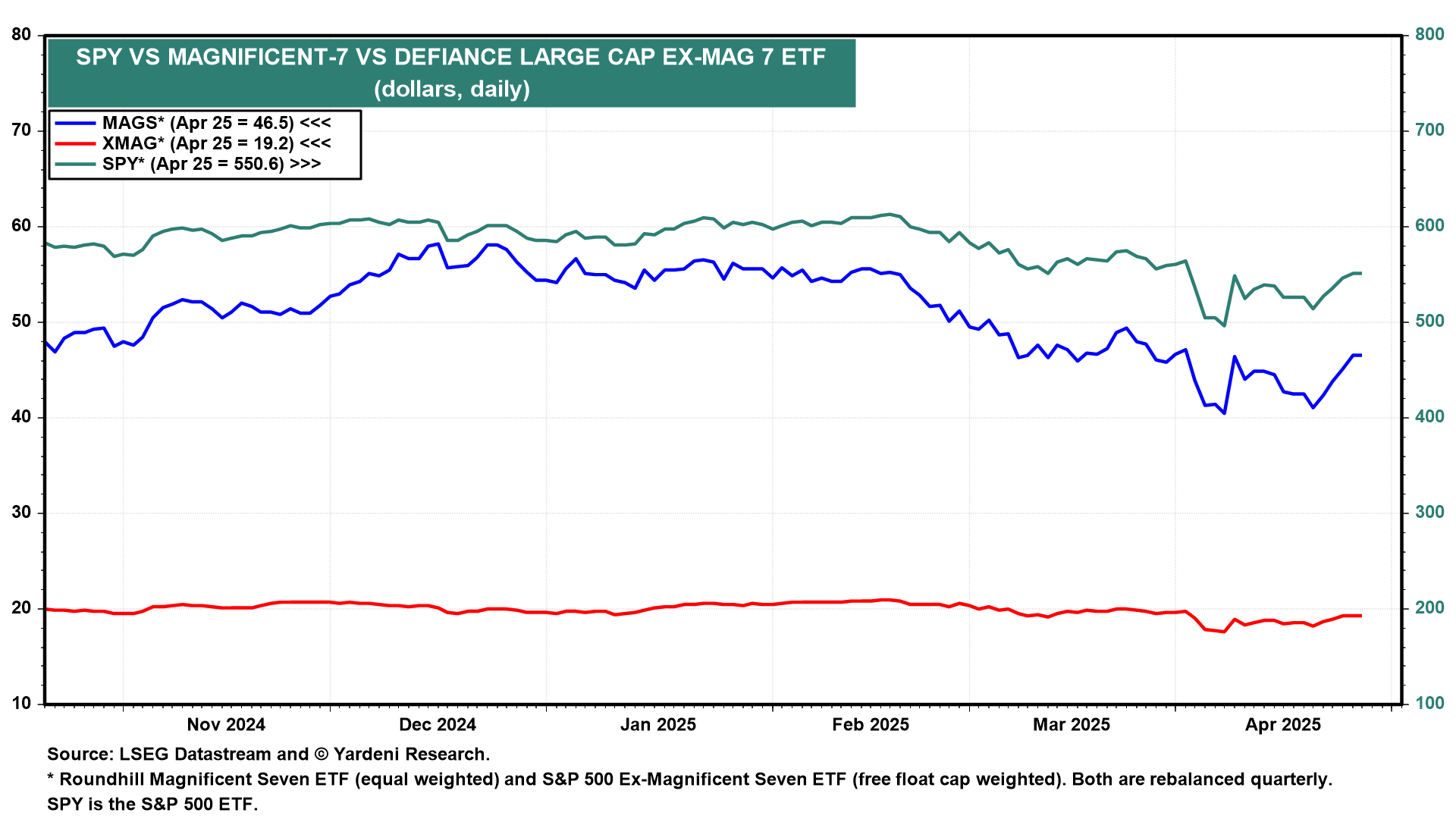

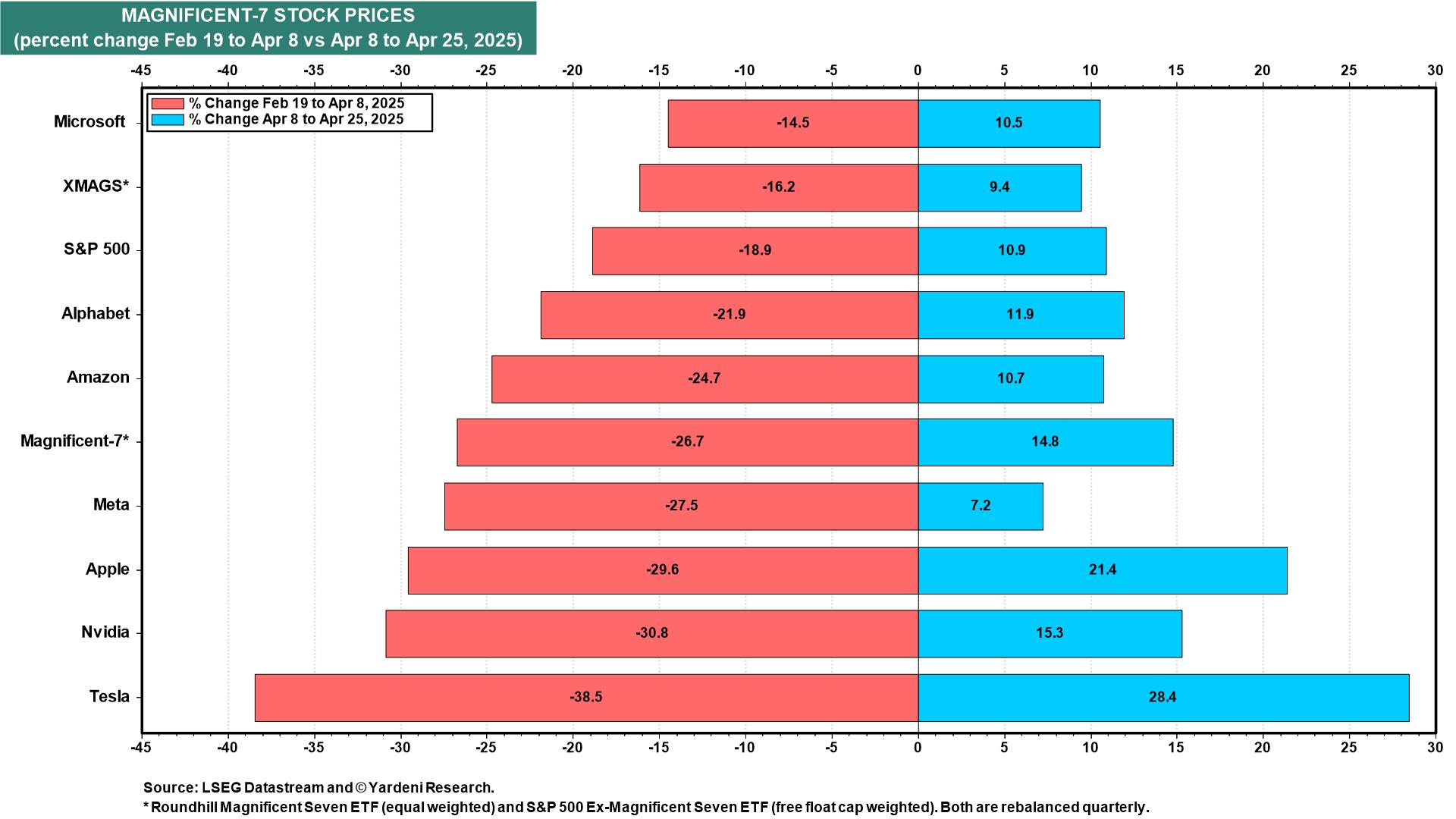

(1) SPY (the S&P 500 ETF) fell 19.0% from February 19 through April 8. The Roundhill Magnificent Seven ETF (NYSE:MAGS), which is equal-weighted and rebalanced quarterly, dropped 26.7%, while the XMAG ETF (which is free-float cap-weighted) declined only 16.2% over this period. Since April 8, SPY is up 10.9%, with MAGS up 14.8% and XMAG up 9.4%.

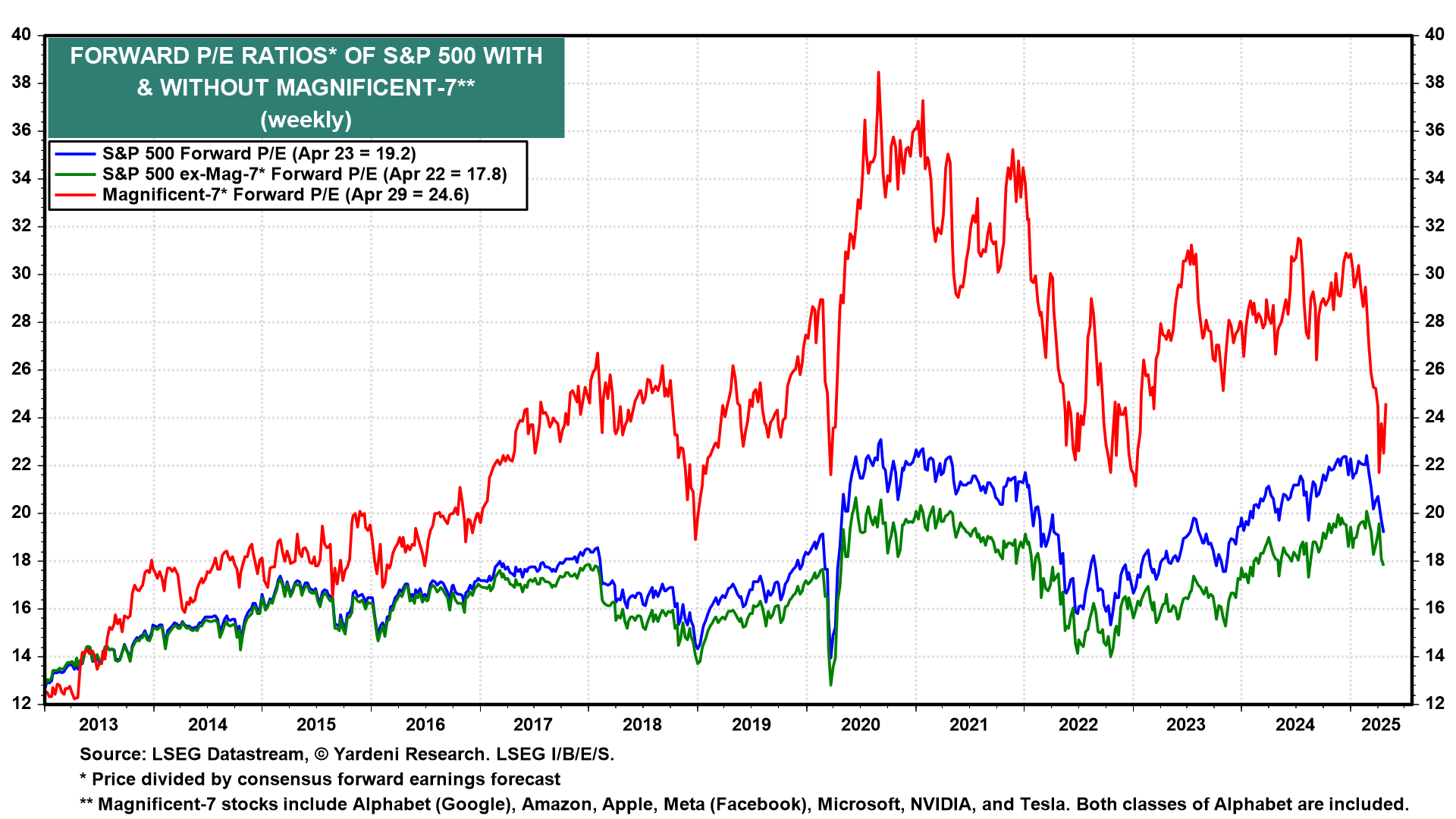

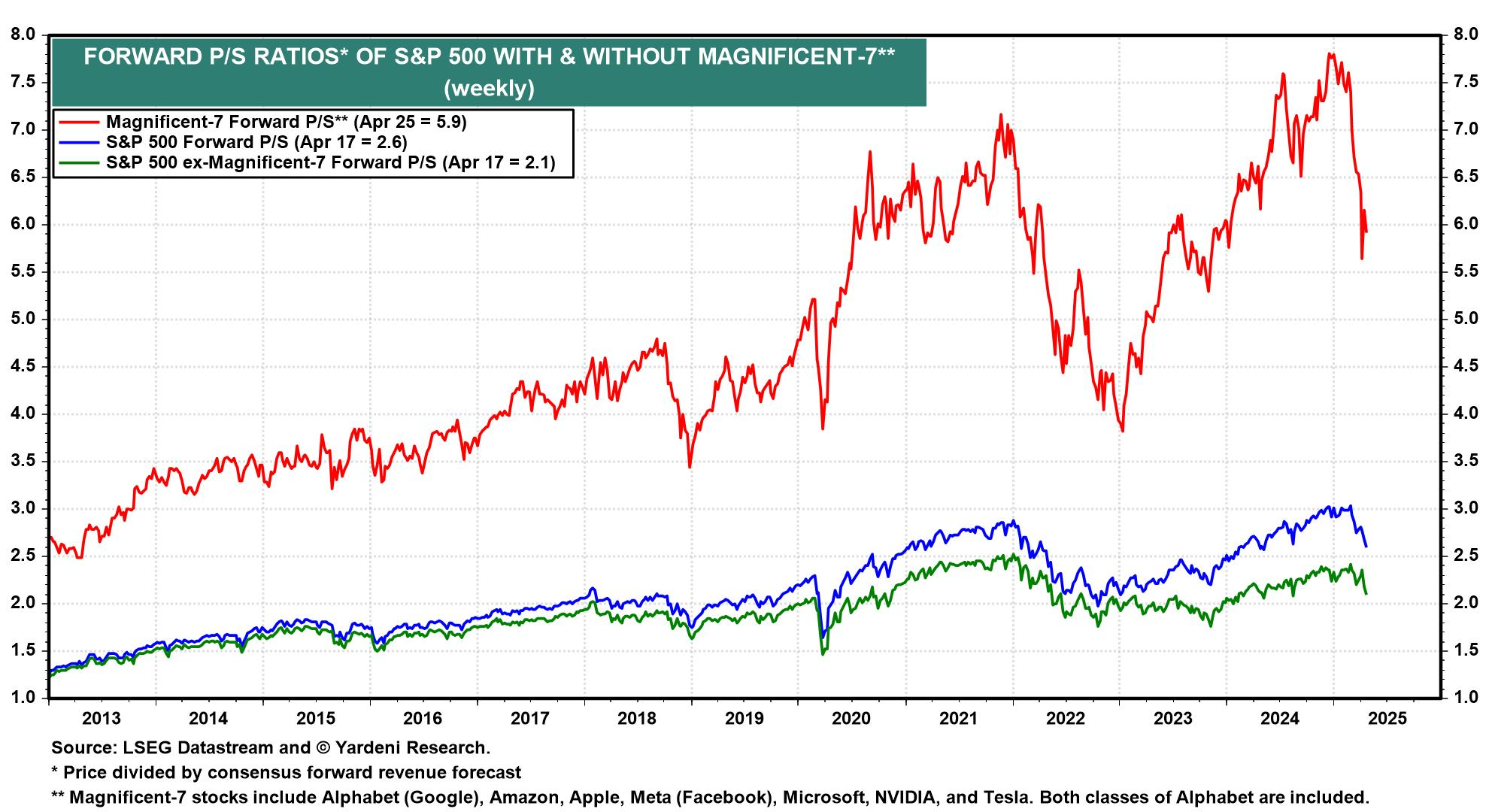

(2) The forward P/E of the Mag-7 plunged from 30.0 at the start of the year to 21.7 on April 8. Over that same period, the forward P/E of the S&P 500 fell from 22.4 to 19.2, while the forward P/E of XMAG declined from 18.6 to 17.8. The forward price-to-sales (P/S) ratio of the Mag-7 plunged from 7.7 at the start of the year to 5.6 on April 8.

It is back up to 5.9. The forward P/S of the S&P 500 excluding the Mag-7 edged down from 2.2 to 2.1 over this same period through the week of April 17.

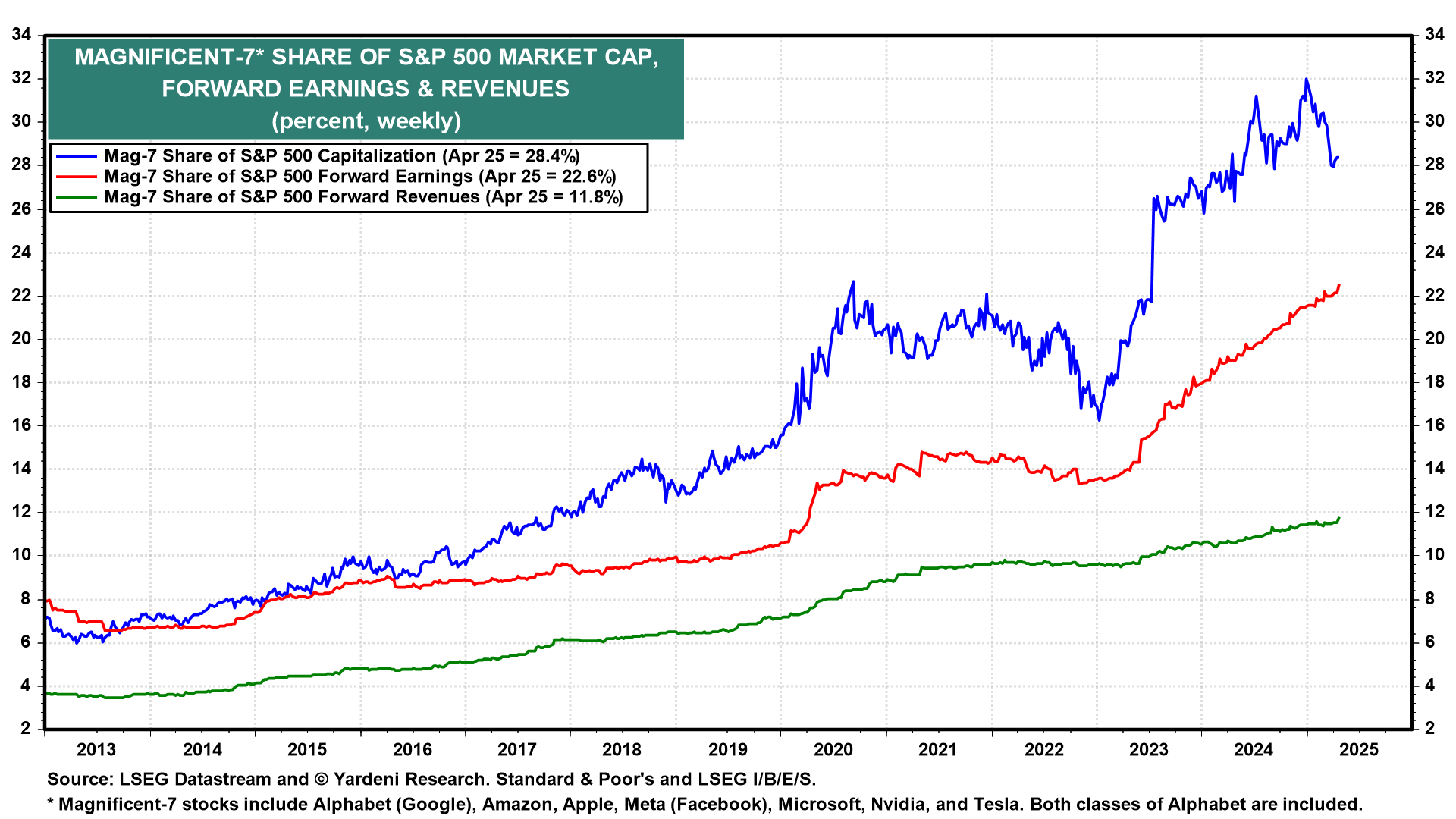

(3) While the Mag-7’s share of the S&P 500’s market capitalization has dropped from 32.0% at the start of the year to 28.4% currently, the Mag-7’s forward revenues and forward earnings shares both are at new record highs of 11.8% and 22.6%.

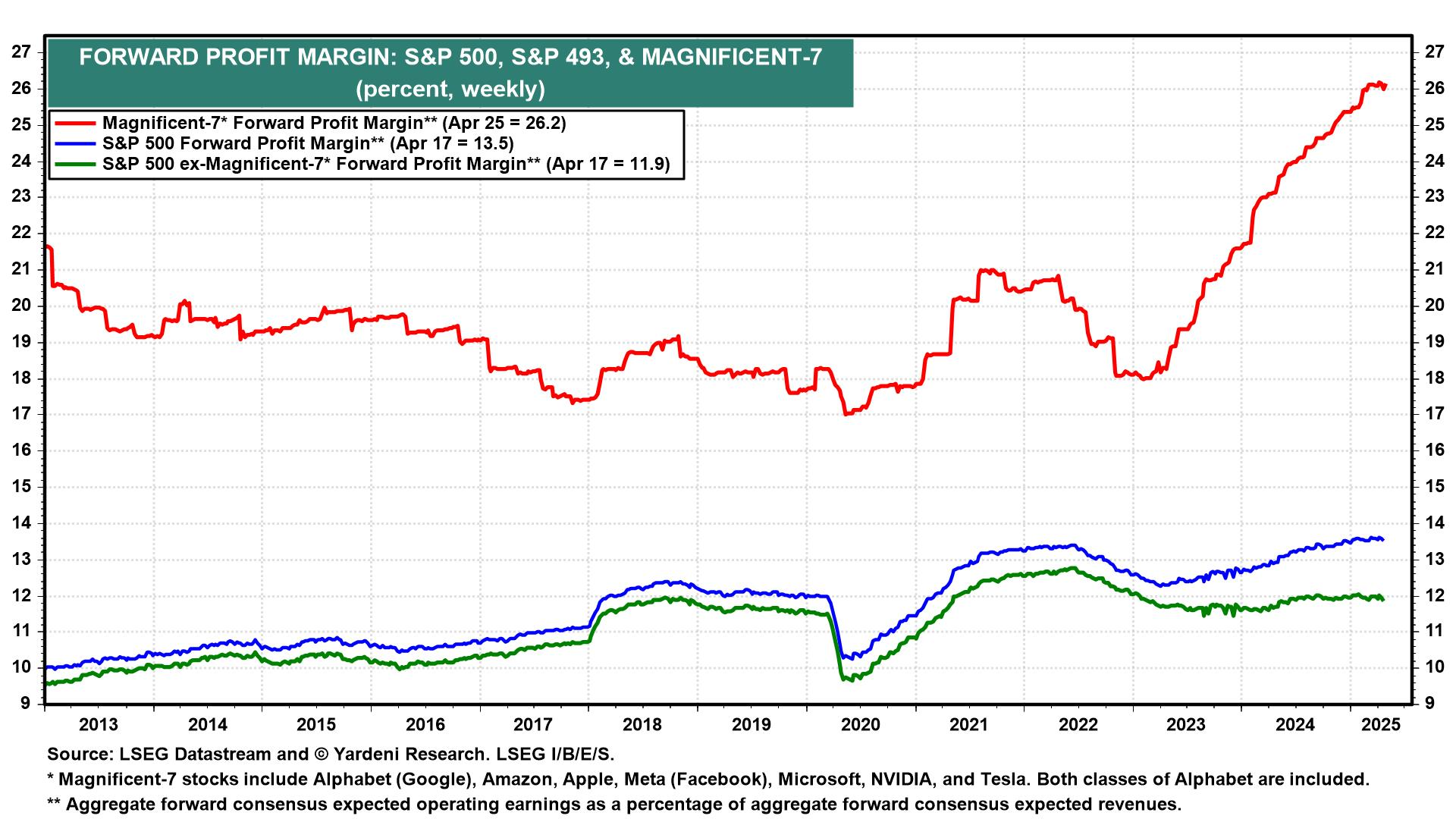

(4) Also at a record high is the collective 26.2% forward profit margin of the Mag-7 at the end of April. That’s more than twice the 11.9% forward profit margin of the S&P 493!

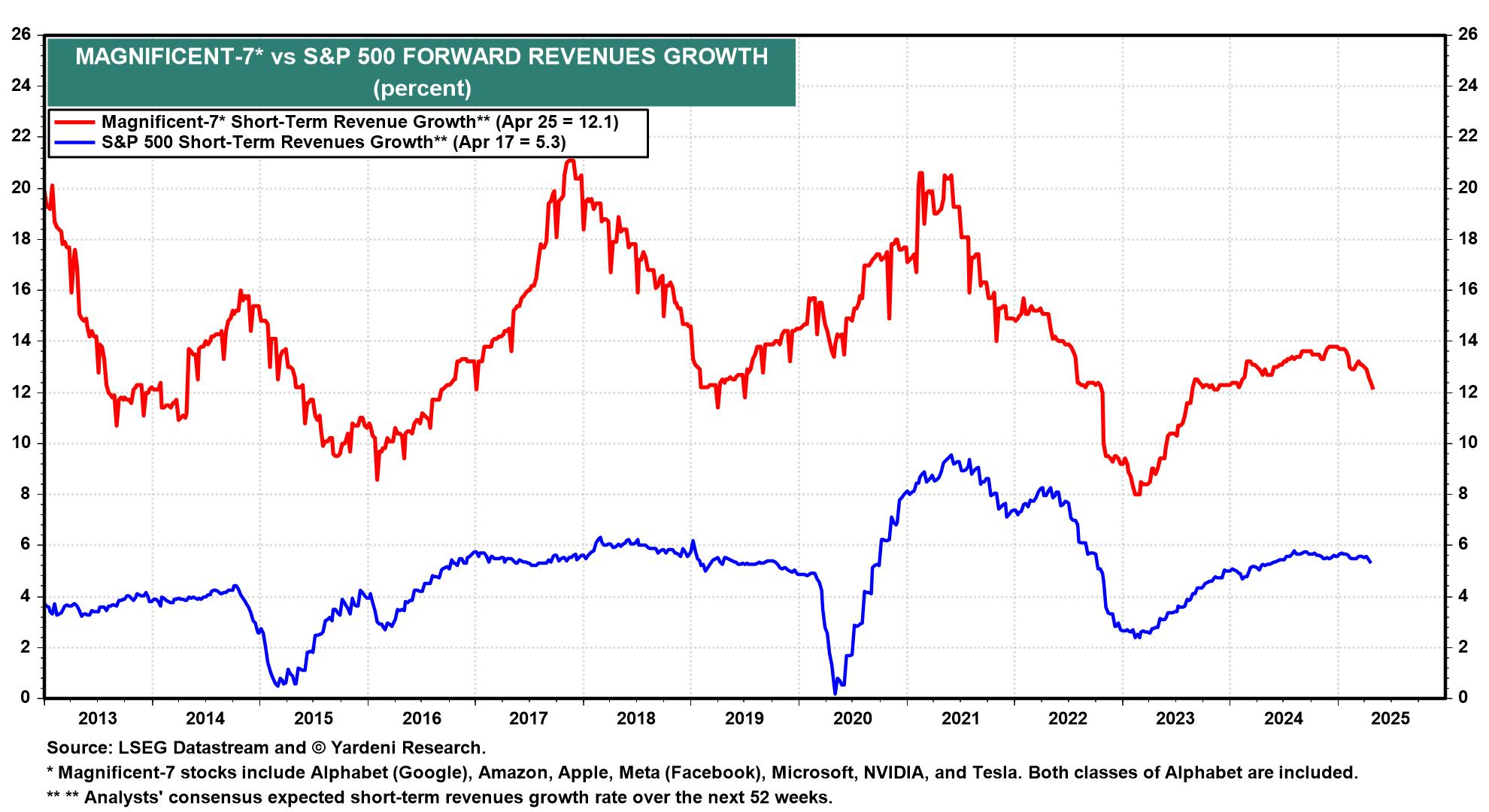

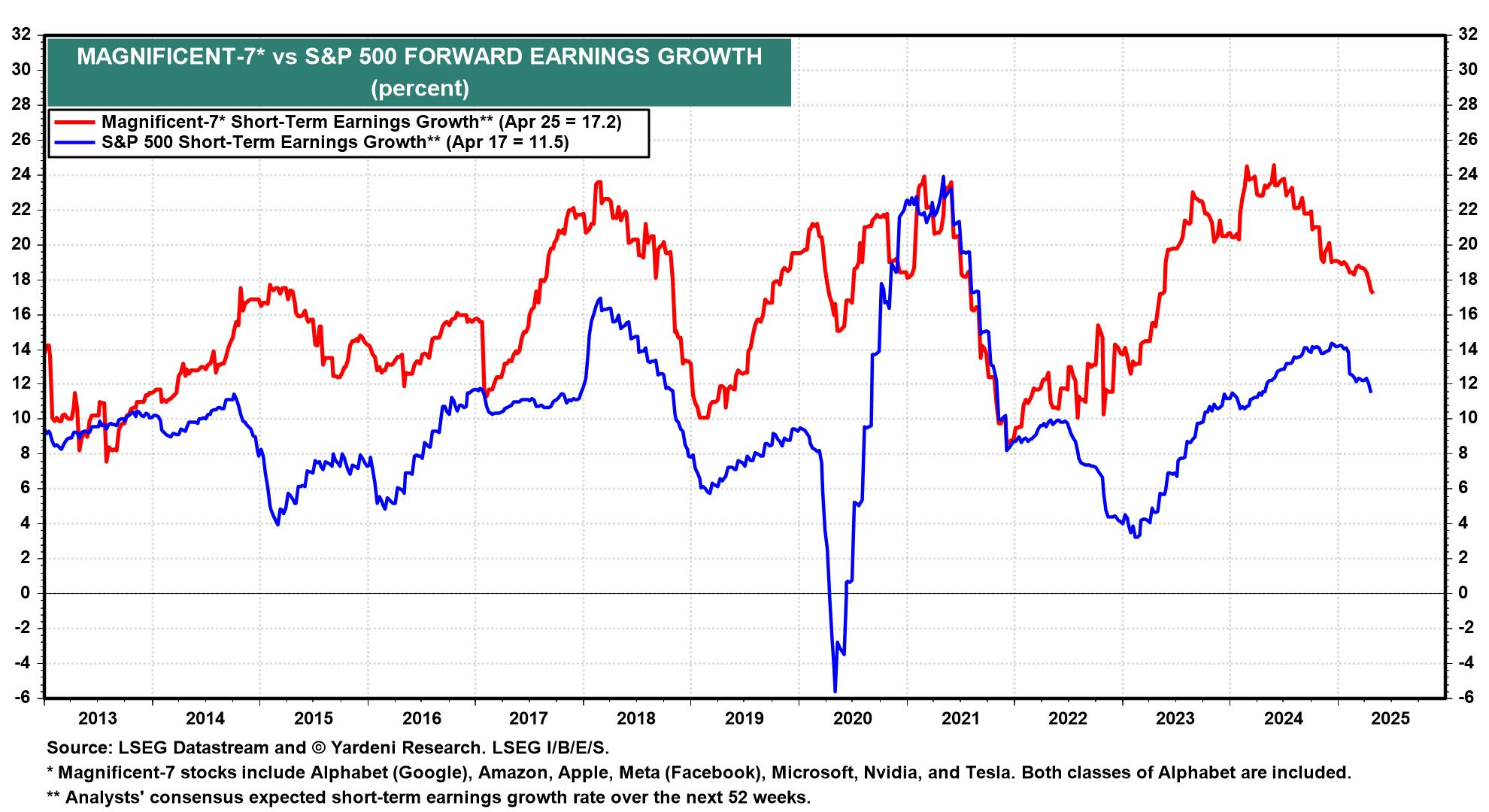

(5) Analysts’ consensus expected (i.e., forward) short-term growth rates for the revenues and earnings of the S&P 500 have been declining since the start of this year, led by the Mag-7.

The forward revenue growth of the S&P 500 currently is at a still-solid 5.3%. The comparable series for the Mag-7 is down from 13.8% at the start of this year to 12.1% currently. The forward earnings growth rates of the S&P 500 and the Mag-7 currently are down a couple of percentage points since the start of this year to 11.5% and 17.2%, respectively. Those are still robust readings.

(6) The rebound in the stock market since April 8 was attributable to Trump’s postponing his reciprocal tariffs (except on China) and to his more moderate tone regarding the prospect of negotiating a trade deal with China. In addition, he backed off from his recent attacks on Fed Chair Powell.

Also positive: Investors may be returning to the Magnificent-7, which collectively is up 14.8% since April 8, outpacing the 9.4% increase in the XMAG since then. We’ve observed that AI is just the latest evolution of the Digital Revolution that started in the mid-1960s. It’s another technology that increases our ability to process more data faster and more cheaply. So it’s increasing the business of cloud computing companies and boosting their capital spending on cloud infrastructure.

(7) Alphabet’s Google Cloud Platform (GCP) results, reported last week, support our narrative. In Q1-2025, GCP reported revenue of $12.26 billion, slightly below Wall Street expectations of $12.27 billion but reflecting robust 28% y/y growth. Margins improved significantly to 17.8% from 9.4% a year ago, indicating better operational efficiency.

Heavy AI investments are paying off, with Google Cloud’s AI portfolio, powered by the Gemini large language model, attracting new customers and securing larger deals. Developer usage of Gemini doubled to 4.4 million users in six months by Q4-2024.

Capital expenditures are set to rise significantly, with Alphabet (NASDAQ:GOOGL) planning to spend $75 billion in 2025 (up from $52.5 billion in 2024) to expand its AI and data center infrastructure.