S&P 500 falls as ongoing government shutdown, trade jitters weigh

This article was written exclusively for Investing.com

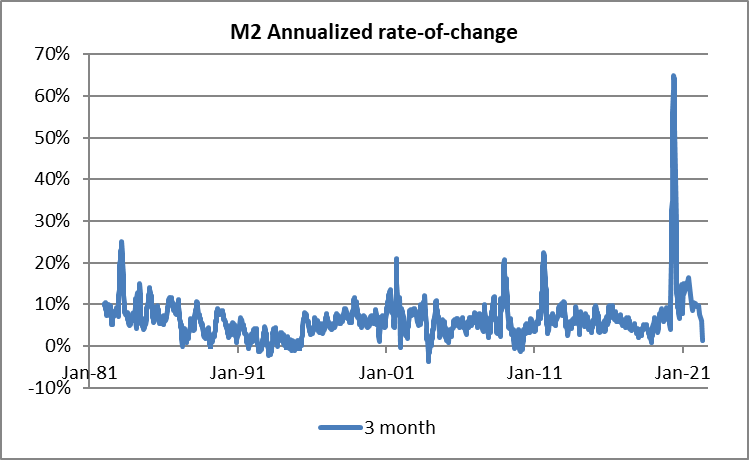

We finally got some good news on inflation this past week. M2 money supply declined in April versus March, to the lowest rolling 3-month rate of change since 2018. While the rolling-3-month average does whip around a bit—as I said, it was lower than this as recently as 2018—it is still much better news than when the figure was hitting 60% back in 2020.

If we can continue to see money growth at 2%, inflation will eventually decelerate once we have achieved the price level we’re already locked into. Not in 2022 or 2023, probably, but maybe beyond that. To be sure, it’s still early to get too excited about a 3-month change, but at least it’s in the right direction.

The Fed reported this data weekly, until early 2021. At that point, they decided to make the data monthly, with a lag. I can’t help but wonder if the 26% year-over-year rate of growth at the time had anything to do with the decision, but the argument was that money growth doesn’t have any prognosticative power so why continue to place such an emphasis on it? After all, it wasn’t as if that sort of money growth was going to produce inflation, and besides the inflation was transitory, and caused by supply constraints, not something as plebeian as too much money chasing too few goods.

I mean really, who could have foreseen that we would have inflation? They probably should stop producing the money supply data altogether. That’ll teach those silly monetarists!

Comedienne Lily Tomlin once wryly remarked, “No matter how cynical I get, I just can’t keep up.”

It just can’t be as easy as watching money supply growth, and in fact, it’s not. The dynamics of money velocity are difficult to model tightly—although despite what people will tell you, velocity is not some random number and Milton Friedman never said it was constant.

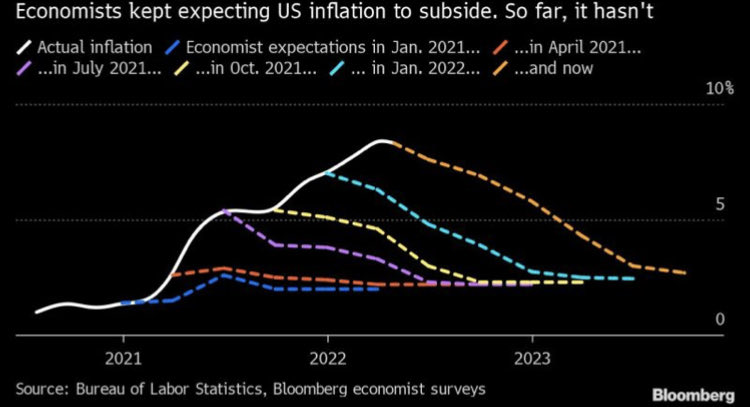

But when money growth is at 27%, you just don’t have to be very good at modeling velocity. The outcome was obvious. Although not as obvious to blue-chip economists. Hat tip to @MacroAlf for this Bloomberg chart:

Source: Bloomberg

The train was coming down the track, fast, blowing its whistle. Economists heard the whistle but evidently didn’t know what it meant. I would say “that’s going to leave a mark,” but the cynic in me says that they won’t learn anything from this series of colossal errors.

Taking a Step Back…

As an aside, notice in the chart above that the forecasts always converge eventually on 2% or thereabouts. The amazing lack of imagination might be a sine qua non for getting a job as a professional economist. The fact that current inflation readings came so completely unglued from those targets might make a humbler forecaster question whether inflation isn’t as automatically mean-reverting as the model says.

But that mean reversion is a very important part of modern macroeconomic models of inflation; as I have previously pointed out, this was destined to be so because of survivor bias. From 1990 to 2020, any economic model that did not forecast inflation mean-reverting to a fixed level or slowly-drifting target was discarded. The entire universe of generally-accepted models was fed on data coming from a period of low and stable inflation, and therefore only models predicting that outcome survived.

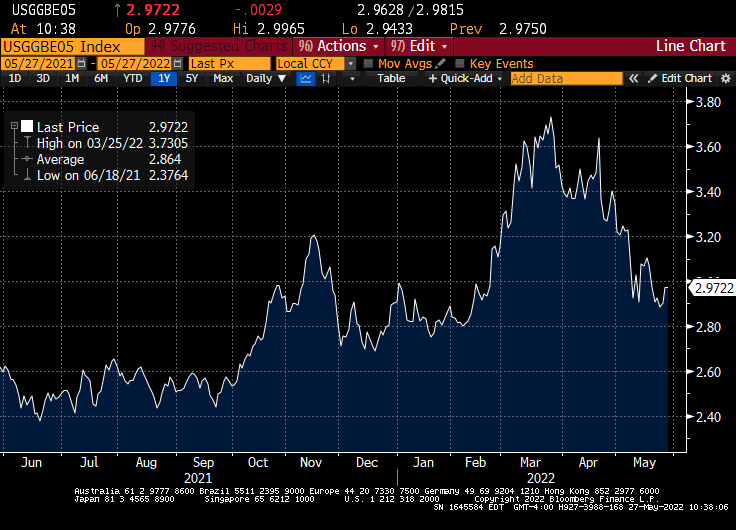

Naturally, to utilize a mean-reverting model it is necessary to have a theory about why inflation should be mean-reverting. The answer given was “anchored inflation expectations.” The flattening out in the forecasts on the preceding chart shows the influence of that supposed anchor. While blue-chip economists are as indifferent about the drop in money supply growth as they were insouciant about its spike, they are positively giddy about the 50-60bp setback in inflation expectations, at least as measured by TIPS breakevens. The chart below shows 5-year inflation breakevens calculated by Bloomberg.

Source: Bloomberg

Now, I personally don’t think inflation expectations matter as much as the blue-chip economist community does. I think it’s likely that such an ‘anchor’ diminishes inflation volatility when the overall level is pretty low and stable since vendors prefer to keep prices unchanged rather than call attention to them by moving them all the time.

But when costs are rapidly increasing and customers have 40% more cash than they did two years ago? I think ‘expectations’ don’t matter in that scenario.

However, even if I thought that expectations mattered I wouldn’t get very excited about this “decline in expectations” for at least two reasons. First, we don’t have a good way of measuring expectations. Surveys are bad for this because so many cognitive biases operate in the inflation realm—for example, people’s inflation expectations are unreasonably influenced by frequently-purchased items like gasoline—and market-based measures like breakevens are polluted by Fed actions in the bond market.

Second, and more important in this case, is that the decline in breakevens to date is almost entirely due to the carry. If you think that prices over the next 5 years are going to rise at a rate of 3.5%, and then for three months they actually rise at 9%, then if your expectations about the forward price level haven’t changed your "4.75-year breakeven" will be much lower. So looking at breakevens is an exceptionally bad way of looking at expectations, when monthly inflation outturns are so large.

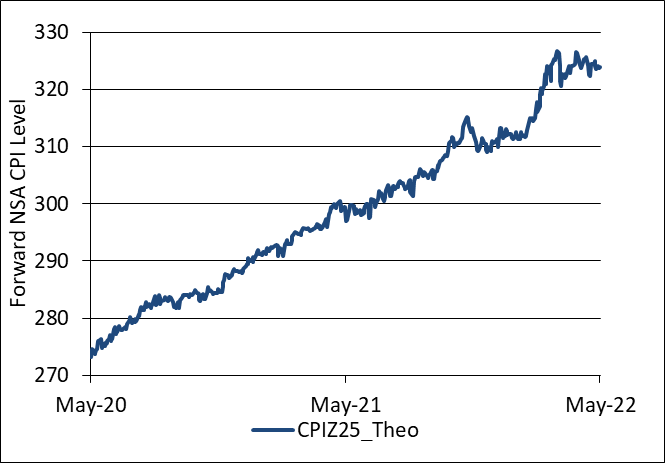

The decline in these “expectations” are in fact not significant at all. For years I’ve been advocating for an inflation futures contract that would allow us to see and trade the forward price level for a particular date.

My company tracks where such futures contracts would trade, if they existed, based on current inflation market levels. This is a way of looking beyond the carry issue. The question that futures answer is: what forward price level do I expect? The chart below shows our calculations for where the December 2025 futures would trade, if there were futures.

Source: Enduring Investments

The chart illustrates that expectations for the forward price level were rising along with the actual experienced inflation for several years. Recently, expectations for the forward price level stopped getting worse but they’re also not getting better.

If expectations are stabilizing, they’re stabilizing at a high level. Viscerally, that’s what I seem to be hearing from people but I’m cognizant of selection bias (if you’re the Inflation Guy, more people grouse about inflation). “Optimistic” on inflation, at this point, isn’t the same as expectations of a return to 2%. Optimistic is a return to 4%.

Michael Ashton, sometimes known as The Inflation Guy, is the Managing Principal of Enduring Investments, LLC. He's a pioneer in inflation markets with a specialty in defending wealth against the assaults of economic inflation, which he discusses on his Cents and Sensibility podcast.