China’s Xi speaks with Trump by phone, discusses Taiwan and bilateral ties

The Fed will remain on hold today, and the main justification is the risk of persistently higher inflation due to tariffs. However, the inflation data through May have been weaker than expected, with limited signs of a tariff pass-through to consumer prices.

The most likely explanation is that it’s too early to see the price effects of tariffs, but it could also be a sign of weaker demand limiting the pass-through to consumer prices. The smaller the boost to consumer inflation from tariffs, the more likely the Fed is to cut rates this year.

Today’s post digs into one of the surprises in the recent inflation data: apparel prices have fallen in the past two months despite being one of the most import-intensive consumer goods. The post attempts to trace tariffs through economic data and offers some industry-specific context. Spending on apparel accounts for only 2.5% of the CPI, so it won’t settle the debate about tariff-related inflation risks. However, it provides some counter to the worst-case scenarios.

Consumers Have Yet to See Prices Increase in Apparel

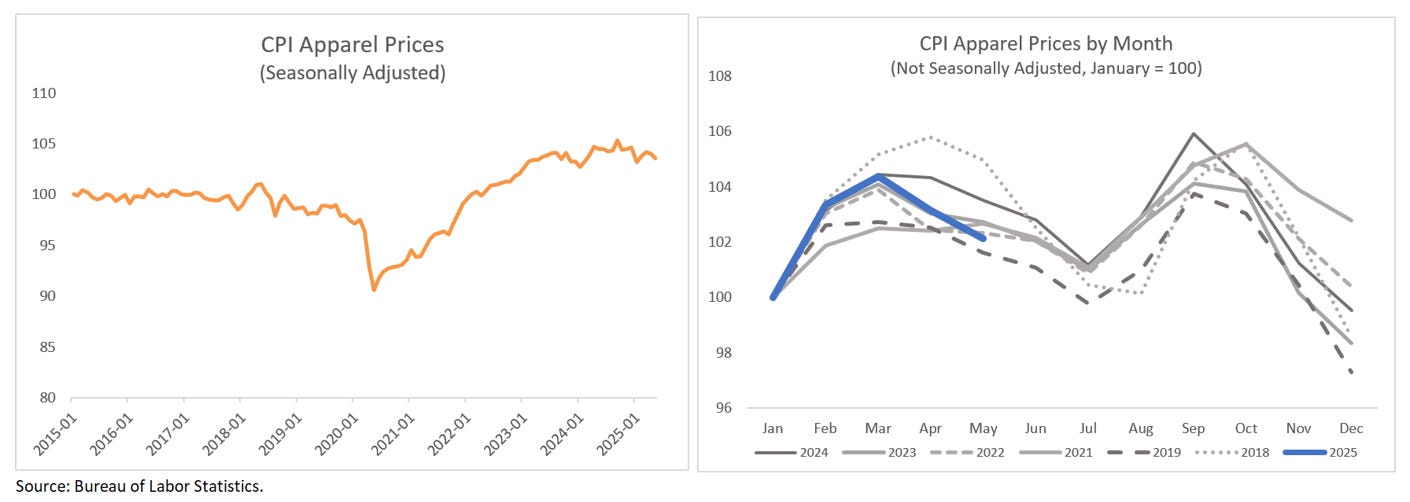

Apparel prices in the CPI declined 0.4% in April, marking the second consecutive monthly decline, and are down 1% since the end of last year (orange line in left chart). The recent moves do not stand out when compared to the usual monthly volatility. Still, they are somewhat surprising given the tariff increases this year and the sector’s high import intensity.

The most recent declines are also apparent in the non-seasonally adjusted data (blue line in the right chart). The non-seasonally adjusted data show two clear peaks in prices during the year. Additionally, due to the industry’s import-intensive nature, production and delivery of goods often occur several months later. The tariffs are likely to be more relevant for the pricing of apparel later in the year. The Beige Book included a reference in the Boston District on repricing:

A clothing retailer, which typically tags items with prices months in advance, took the rare step to retag items with higher prices to cover the cost of tariffs, and those items will hit store shelves this summer.

Some delay in passing costs to customers is possible, but there are alternative ways to absorb the tariffs and other factors that influence pricing decisions.

Import Prices for Apparel Have Declined.

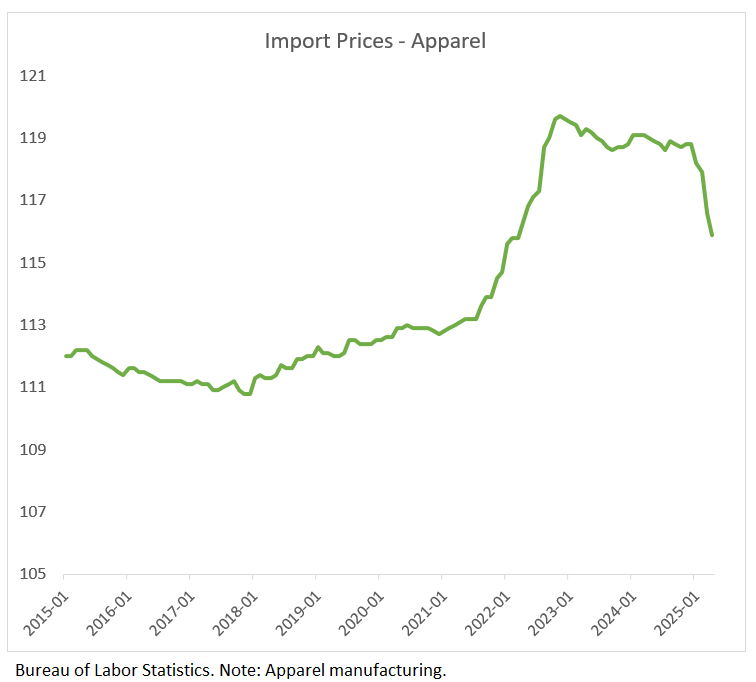

While the domestic importer pays the tariff to the US government, the foreign producer can bear some of the tariff burden if it reduces the prices it charges to US importers. The import price refers to the transaction price between businesses upon entry and does not include tariff duties, insurance, or shipping costs.

Overall import prices for end-use goods have remained little changed this year, but import prices for apparel have declined by nearly 3% through May. That is consistent with foreign producers bearing some of the burden of tariffs, though it is insufficient to fully offset the increased tariff duties that the domestic importers must pay.

The longer production cycles may have given US apparel importers more leverage than importers in other industries. In a Bloomberg interview, Sarah LaFleur, the owner of a women’s clothing brand, M.M.LaFleur, explained that the clothes had already been produced when the tariffs were announced.

Reducing the import price could be a better alternative than losing the entire order payment for the foreign apparel manufacturers. That particular form of leverage may diminish over time. Still, it does suggest less cost pressure on US apparel importers due to tariffs so far, and could partly explain why consumer prices have not risen.

Tariff Collections Have Risen, but Are Likely Still in the Process of Adjustment.

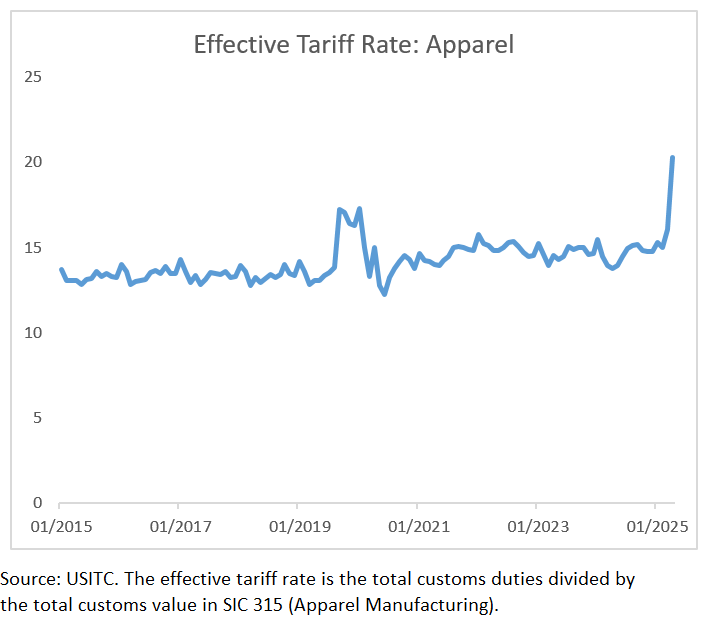

Another reason why the effects of tariffs on apparel consumer prices may be muted is that the ramp-up in tariff collections has been more gradual than the announced changes in tariff rates. Businesses have less cost to pass on than the policy announcements might have suggested.

The effective tariff rate on apparel manufacturing—total value of duties divided by total customs value of imports—from all countries has risen 5.5 percentage points through April. For Chinese apparel imports, it was 34 percentage points higher.

Those are notable increases, but by April, the tariff rate on apparel had increased by at least 10 percentage points for most countries and by more than 145 percentage points for China. Exemptions from the reciprocal tariffs for goods shipped before April 5 (for the 10% baseline tariffs) and April 9 (for the country-specific tariffs) are likely the primary reason for the gap. That was a one-time way to avoid the tariff increases.

Given the breadth of the 10% baseline tariffs, the effective tariff rate is likely to rise further, even though the tariff policy rates have declined since April. The tariffs for most countries on apparel were reset to 10% in mid-April, and for China, to 30% in mid-May. June will be the first full month at the current level. The timing of shipping is a good example of how businesses will make an effort to minimize the extra costs of tariffs. Lower costs incurred are lower costs to pass on.

Gross Margins Are Little Changed, but Could Offer a Buffer.

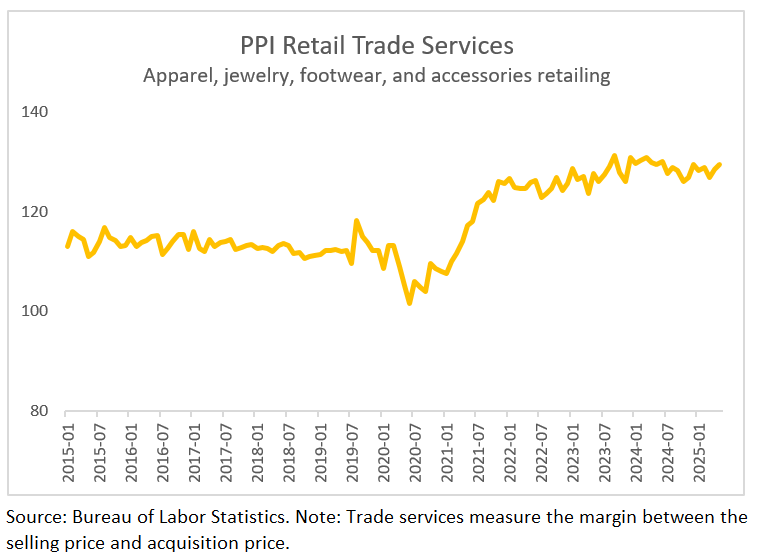

Businesses that import tariffed goods can also absorb some of the cost by operating with narrower profit margins or by reducing other expenses. One measure of margins is trade services indexes in the Producer Price Index report, which capture the difference between the selling price and the acquisition price of a good.

Note that the acquisition price (like the import price) does not include tariffs; therefore, a constant trade services margin would suggest that the business is bearing any additional costs associated with the tariff. Trade services for apparel retailers were unchanged in May compared to the end of last year. Steady margins also correspond roughly to declines in apparel import prices and consumer prices in recent months.

For now, any extra costs of tariffs (not offset by the lower import prices) appear to be absorbed by businesses. Those costs could be passed on later via higher consumer prices, but the apparel gross margins are elevated relative to pre-pandemic levels, which could provide some cushion.

In his analysis of tariffs and pricing of apparel from 2015 to 2024, Professor Sheng Lu argued:

… about 50% to 80% of the variation in U.S. retail prices is explained by its past values, underscoring the persistence of retailers’ pricing practices. Meanwhile, U.S. apparel retail sales account for about 27% of the changes in U.S. apparel retail prices. In comparison, apparel tariff changes explained only about 5% of the retail price fluctuations. In other words, market factors, particularly consumer demand, play a more significant role in shaping fashion companies’ pricing decisions than tariffs.

The declines in consumer prices for apparel could also be a sign of weakening consumer demand. Apparel need not be representative of other consumer goods. Its trade services margins rose less than half as much as retailers overall. However, the lack of price increases in apparel consumer prices may indicate the restraints on passing tariffs on to consumers.

In Closing

In 2021, the Fed told us not to worry when inflation rose, saying it would be transitory. Now the Fed is telling us to worry even as inflation has slowed, saying more inflation is coming and it might be persistent.

The most logical explanation for the modest signs of tariffs on consumer inflation is that it’s too soon to see the effects. But that’s not the only possible explanation. The declines in apparel consumer prices in recent months also suggest greater demand sensitivity and some tariff cost sharing by foreign producers. That would imply a smaller boost to inflation from tariffs, as opposed to simply a delay in the boost.

It’s too soon to know the effects of the tariffs, but it will be important to hear how the Fed is sifting through the data and assessing the risks.