Oracle stock falls after report reveals thin margins in AI cloud business

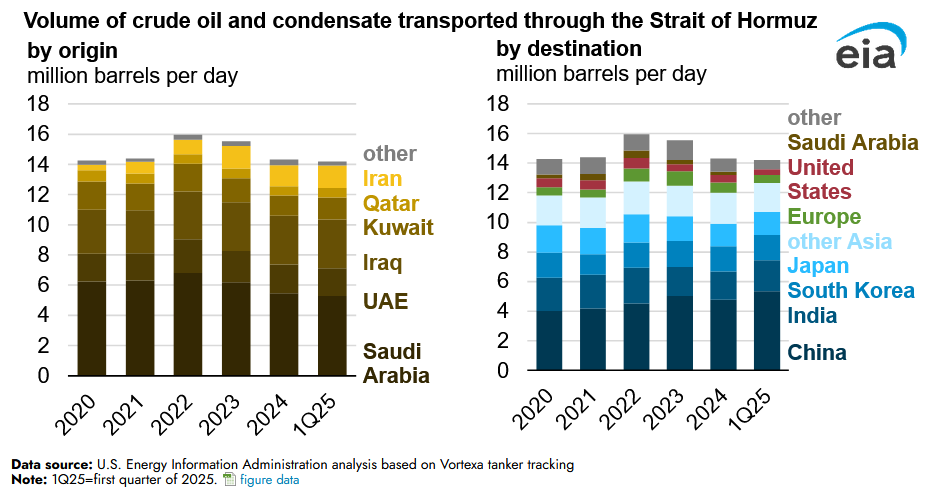

Closing the Strait of Hormuz would have severe implications for global trade, most importantly oil. As the graphic below, courtesy of the EIA, shows, about 14 million barrels of oil and condensate flow through the Strait daily. That equates to about 15% of daily global shipping.

Accordingly, closing the Strait of Hormuz may seem like a viable way for Iran to retaliate economically against the West. However, the implications of such a move could backfire on Iran. Consider the points below:

- Economic Impact: 20% of Iran’s GDP is from oil revenue. Blocking it would halt Iran’s oil shipments, crippling its economy due to lost revenue and increased global oil prices. Such an impact could further damage its economy.

- International Backlash: Closing the Strait would likely provoke strong reactions from global powers, particularly the European Union, China, and Saudi Arabia. This could lead to military escalation and/or sanctions with strong support of countries that have not been involved thus far. As shown below, Saudi Arabia is the most heavily reliant on the Strait for exporting oil. Conversely, China is the most dependent on the Strait for its oil imports.

- Domestic Instability: Iran’s economy is already under severe economic pressure from sanctions, inflation, and unemployment. Closing the Strait of Hormuz could spike domestic fuel and goods prices, worsening living conditions, and potentially fueling unrest among its population.

What To Watch Today

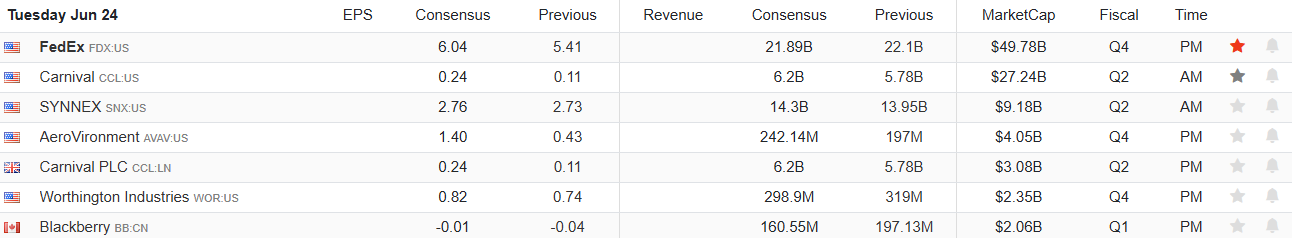

Earnings

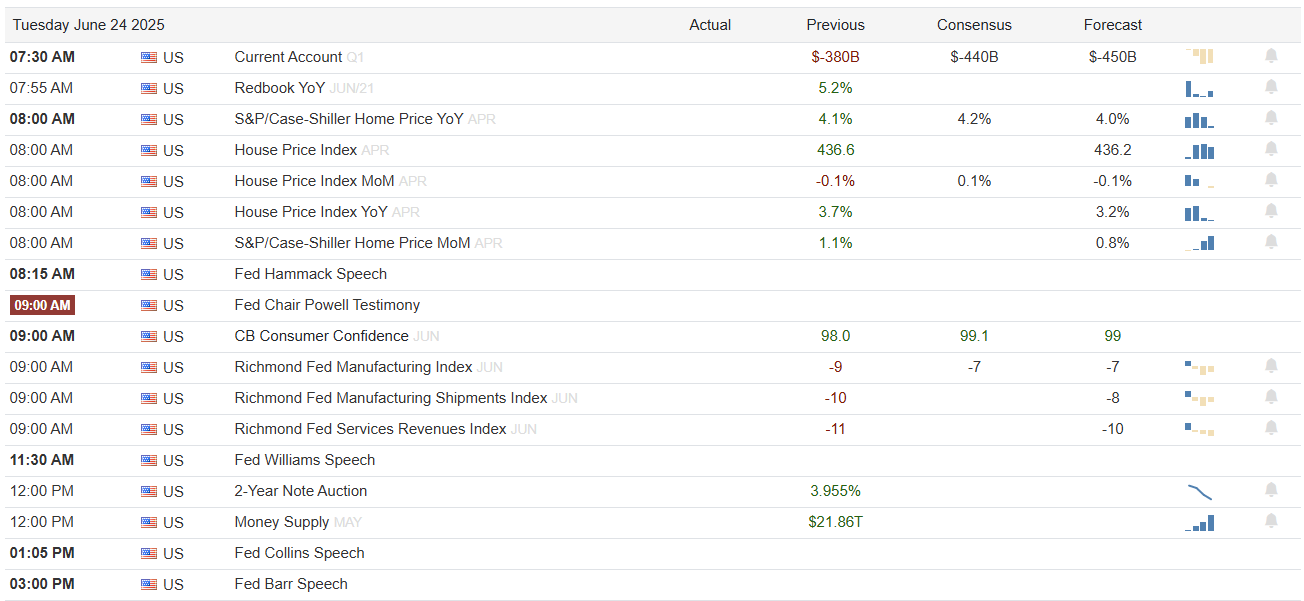

Economy

Market Trading Update

Yesterday, we noted that bullish optimism is building in the markets, which is evident given that markets rallied despite the headline events over the weekend of the U.S. bombing Iranian nuclear facilities.

As noted in that article, the dollar, Treasury bonds, energy, and defense stocks tend to be the better performers during conflicts. However, the market rallied out of the gate yesterday, holding support at the 20-DMA and keeping the bulls in the driver’s seat for now. The reason for the rally is that while Iran did retaliate, it was a very restrained response.

“Iran responded Monday by attacking an American base in Qatar, Tehran’s armed forced said. Qatar said the missiles launched by Iran were intercepted, however. Investors saw this response as more muted than anticipated.” – CNBC

On that news, oil prices quickly tumbled 5%, falling below $70/bbl, while the dollar and bonds rallied. Given the nature of the conflict, such is certainly not the market reaction one would expect; however, Iran’s allies, China and Russia, are not threatening any retaliatory response either.

With that stated, even with today’s rally, the market does continue its ongoing consolidation process that started on May 12th, which is slowly reversing its previous overbought condition.

Notably, this week is the end-of-quarter rebalancing for mutual and hedge funds. Given the sharp rally from the April lows (the beginning of the quarter), funds may be overweight equities and underweight bonds. This could lead to more volatility by Friday as that rebalancing is completed.

With money flows waning, remain cautious over the next few days as we wrap up the month. The good news is that historically, July is one of the stronger months of the year. Continue to manage risk and exposures momentarily, but look for opportunities to buy assets that have retraced and are oversold as needed.

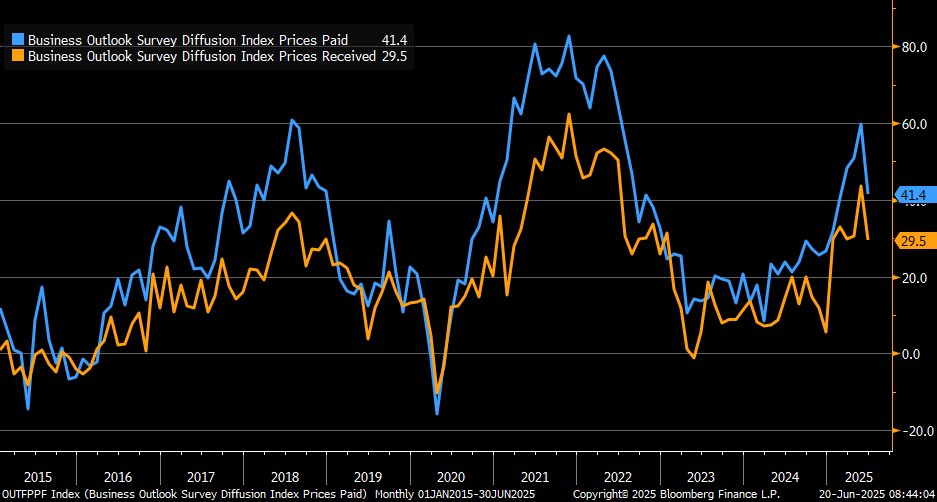

Price Indices From Regional Fed Surveys

Like many other price expectation gauges a few months ago, the regional Fed manufacturing surveys spiked due to concerns about tariffs. With a couple of months of tariffs in action, we are finding the impact on prices has been minimal. Importantly, we also see the expectations for inflation from tariffs are normalizing.

To wit, the Philadelphia manufacturing survey for June showed a notable decline in price pressures. As shown below, the prices paid index dropped 18 points to 41.4, the lowest since February. The prices received index also fell. Thus, it suggests that manufacturers were less able to pass on costs.

Both indices remain elevated compared to the past couple of years, but those concerns are certainly easing. The New York survey also reported a decline, from 59 to 46.8. The Richmond, Dallas, and Kansas City surveys all indicate a topping of price expectations, but not the steep declines seen on the East Coast.

Tweet of the Day