Street Calls of the Week

On Friday, Goldman Sachs analyst Eric Sheridan upgraded Lyft (NASDAQ:LYFT) stock from Neutral to Buy, setting a new price target at $20, up from the previous $19. This change follows Lyft’s first-quarter earnings report, which highlighted several positive developments within the company. With a current market capitalization of $5.5 billion, InvestingPro analysis suggests Lyft is currently undervalued, supported by strong financial health indicators and a "GOOD" overall rating.

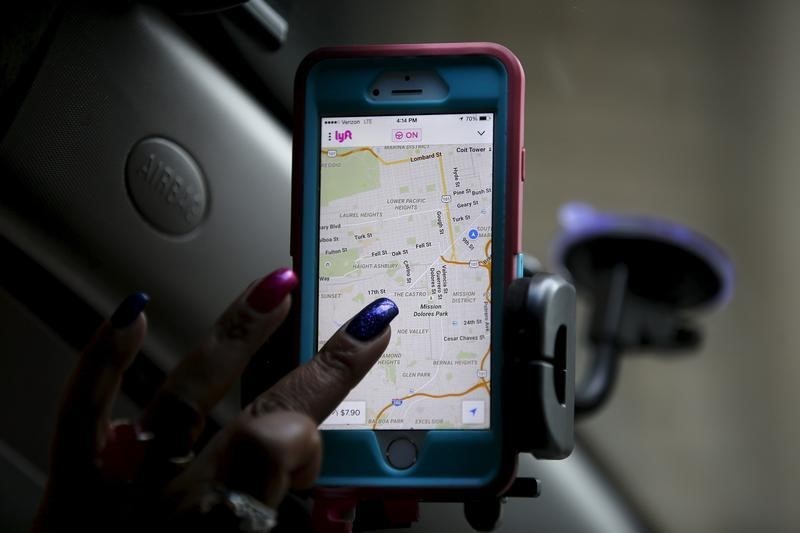

Lyft reported a substantial increase in Gross Bookings, with rides growing by 16% year-over-year in the first quarter. This growth is expected to continue into the next quarter with mid-teens growth projections. The company’s focus on product innovation and improved driver supply has been instrumental in driving this momentum. Revenue growth remains robust at 27% over the last twelve months, with analysts forecasting 13% growth for the current fiscal year.

The rideshare company also reported that its adjusted EBITDA exceeded expectations, delivering a solid 10% incremental margin on Gross Bookings. This was achieved with lower sales and marketing expenditures than anticipated, indicating efficient capital utilization while maintaining revenue growth. The company has demonstrated profitability over the last twelve months, with a gross profit margin of 35%. For deeper insights into Lyft’s financial metrics and valuation, InvestingPro subscribers have access to over 30 additional financial metrics and expert analysis.

In addition to operational successes, Lyft announced an increase in its share repurchase authorization to $750 million. The company plans to deploy $500 million towards share buybacks over the next 12 months, which is expected to reduce the share count and potentially enhance shareholder value.

Sheridan’s outlook for Lyft is optimistic despite potential concerns around rideshare pricing, market share dynamics, autonomous vehicle integration, and consumer spending behavior. The analyst believes that the current market price does not reflect Lyft’s earnings potential over the next two to three years, which has prompted the upgrade and increased price target.

In other recent news, Lyft’s Q1 2025 earnings report showed a mixed financial performance, as the company missed both earnings per share (EPS) and revenue forecasts. Lyft reported an EPS of $0.01, falling short of the $0.19 forecast, and revenue of $1.45 billion, missing the expected $1.47 billion by $20 million. Despite these misses, the company achieved its strongest Q1 ever in terms of gross bookings and free cash flow, highlighting strong operational achievements. JPMorgan analyst Doug Anmuth recently raised Lyft’s stock price target to $16 from $14, maintaining a Neutral rating, citing record driver hours and increased ride frequency. Anmuth also noted significant growth in markets such as Canada, Indianapolis, and Charlotte, despite a 3% decline in gross bookings per ride. Lyft’s strategic expansion into new markets, including Europe and Canada, and its increased share repurchase program to $750 million, were well-received by investors. The company’s acquisition of Free Now is expected to support international growth, while investments in autonomous vehicle technology and partnerships, such as with May Mobility, are anticipated to drive future opportunities.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.