China’s Xi speaks with Trump by phone, discusses Taiwan and bilateral ties

- Fed FOMC Meeting, U.S. jobs report, Big Tech earnings, and Trump’s Aug. 1 tariff deadline will be in focus this week.

- Buy Amazon: Strong AWS and advertising gains, cost discipline, and a resilient operating model support positive surprise potential this earnings week.

- Sell Starbucks: Weaker consumer traffic, margin compression, and uncertain turnaround prospects point to earnings risk and further downside for now.

- Looking for actionable trade ideas? Subscribe now to unlock access to InvestingPro’s AI-selected stock winners for up 50% off amid the summer sale!

Stocks on Wall Street closed higher on Friday, with the S&P 500 and Nasdaq Composite reaching fresh records, lifted by solid earnings results and optimism the U.S. could soon reach a trade deal with the European Union.

Source: Investing.com

All three major averages finished the week with gains. The 30-stock Dow Jones Industrial Average rose about 1.3%, the benchmark S&P 500 climbed 1.5%, and the tech-heavy Nasdaq added 1%.

The blockbuster week ahead is expected to be an eventful one filled with several market-moving events, including a key Federal Reserve policy meeting, as well as a closely watched employment report and a flurry of heavyweight tech earnings.

The Fed is widely expected to leave interest rates unchanged on Wednesday, but Fed Chair Jerome Powell could offer hints about when rate cuts might start when he speaks in the post-meeting press conference. Traders see about a 60% chance of a rate cut in September, according to Investing.com’s Fed Rate Monitor Tool.

Source: Investing.com

Besides the Fed, most important on the economic calendar will be Friday’s U.S. employment report for July, which is forecast to show the economy added 108,000 positions, slowing from jobs growth of 147,000 in June. The unemployment rate is seen rising from 4.1% to 4.2%.

In addition to the jobs report, there is also important second-quarter GDP data, as well as the core PCE price index, which is the Fed’s favorite inflation gauge.

Meanwhile, the earnings season hits full swing, with four of the massive ‘Magnificent Seven’ tech stocks set to post their latest results. Microsoft (NASDAQ:MSFT) and Meta Platforms (NASDAQ:META) report on Wednesday evening, while Apple (NASDAQ:AAPL) and Amazon (NASDAQ:AMZN) are due late Thursday.

These mega-caps will be joined by other big names like Qualcomm (NASDAQ:QCOM), ARM Holdings (LON:ARM), Microstrategy (NASDAQ:MSTR), Coinbase (NASDAQ:COIN), Robinhood (NASDAQ:HOOD), PayPal (NASDAQ:PYPL),Boeing (NYSE:BA), United Parcel Service (NYSE:UPS), Ford (NYSE:F), UnitedHealth (NYSE:UNH), ExxonMobil (NYSE:XOM), Chevron (NYSE:CVX), Procter & Gamble (NYSE:PG), Visa (NYSE:V), Mastercard (NYSE:MA), Starbucks (NASDAQ:SBUX), Reddit (NYSE:RDDT), Roblox (NYSE:RBLX), and Spotify (NYSE:SPOT).

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is justfor the week ahead, Monday, July 28 - Friday, August 1.

Stock To Buy: Amazon

Amazon emerges as a compelling buy ahead of its Q2 earnings report, with multiple business segments showing strong momentum and the company well-positioned to exceed expectations.

The e-commerce and cloud leader is scheduled to release its second quarter update after the U.S. market closes on Thursday at 4:00PM ET. A call with CEO Andy Jassy is set for 5:30PM ET.

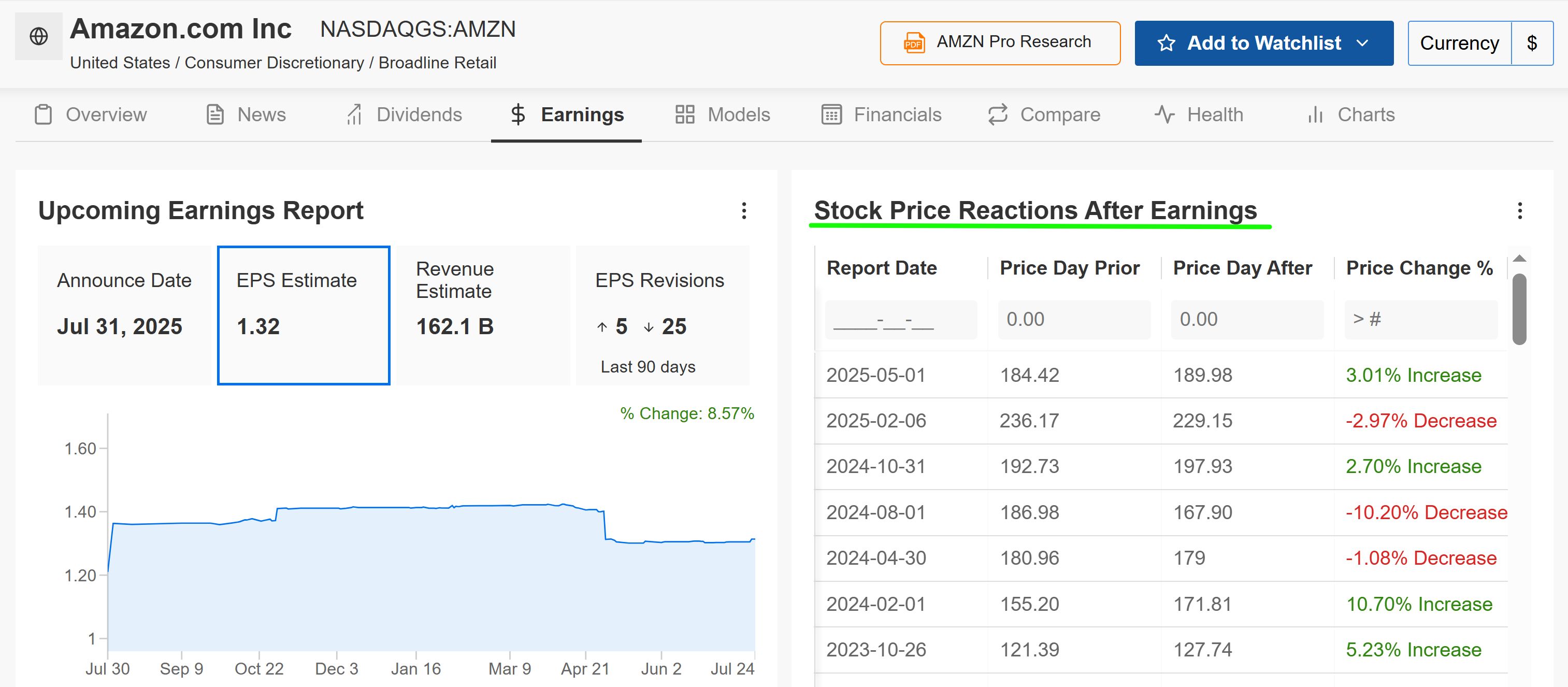

Market participants predict a sizable swing in AMZN stock after the print drops, according to the options market, with a possible implied move of +/-5.4% in either direction. Shares gapped up 3% after the last earnings report in May.

Source: InvestingPro

Analysts project earnings per share (EPS) of $1.32, marking a 4.8% increase from the year-ago period. Revenue is forecast to jump 9.5% year-over-year to $162.1 billion, with Amazon Web Services (AWS) and advertising as key growth drivers.

AWS, a leader in cloud computing, continues to benefit from surging demand for AI infrastructure, as businesses increasingly invest in machine learning and data analytics. Advertising, another high-margin segment, is also gaining traction as Amazon leverages its vast e-commerce platform to attract advertisers.

As is often the case, guidance will be just as crucial as the earnings numbers. Despite concerns about potential tariff impacts on its e-commerce operations, Amazon is likely to provide a positive outlook for the current quarter. The company’s ability to optimize costs, streamline logistics, and expand its cloud and advertising businesses positions it well to navigate macroeconomic challenges.

Source: Investing.com

AMZN stock ended Friday’s session at $231.44, a tad below its Feb. 4 all-time high of $242.52. Shares are up 22.5% in the last three months, signaling powerful momentum heading into earnings.

The Relative Strength Index (RSI) of 63.81 hints at elevated, but not overbought, territory. Short-term technicals show bullish signals on the 1-hour and daily timeframes, with moving averages and momentum indicators flashing "buy."

Additionally, InvestingPro’s AI-powered models rate Amazon with a “GREAT” Financial Health Score of 3.11, reflecting its strong cash flows, profitability, and sector dominance in e-commerce and cloud.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Subscribe now for 50% off and position your portfolio one step ahead of everyone else!

Stock to Sell: Starbucks

By contrast, Starbucks faces a perfect storm of challenges that position it for potential earnings disappointment and continued pressure on its turnaround efforts. The coffeehouse chain is scheduled to deliver its fiscal third-quarter results on Tuesday at 4:05PM ET and the outlook is bleak.

The fast-food sector is showing signs of slowing demand, with inflationary pressures squeezing discretionary spending. Consumers are cutting back on non-essential purchases like premium coffee, putting pressure on Starbucks’ same-store sales.

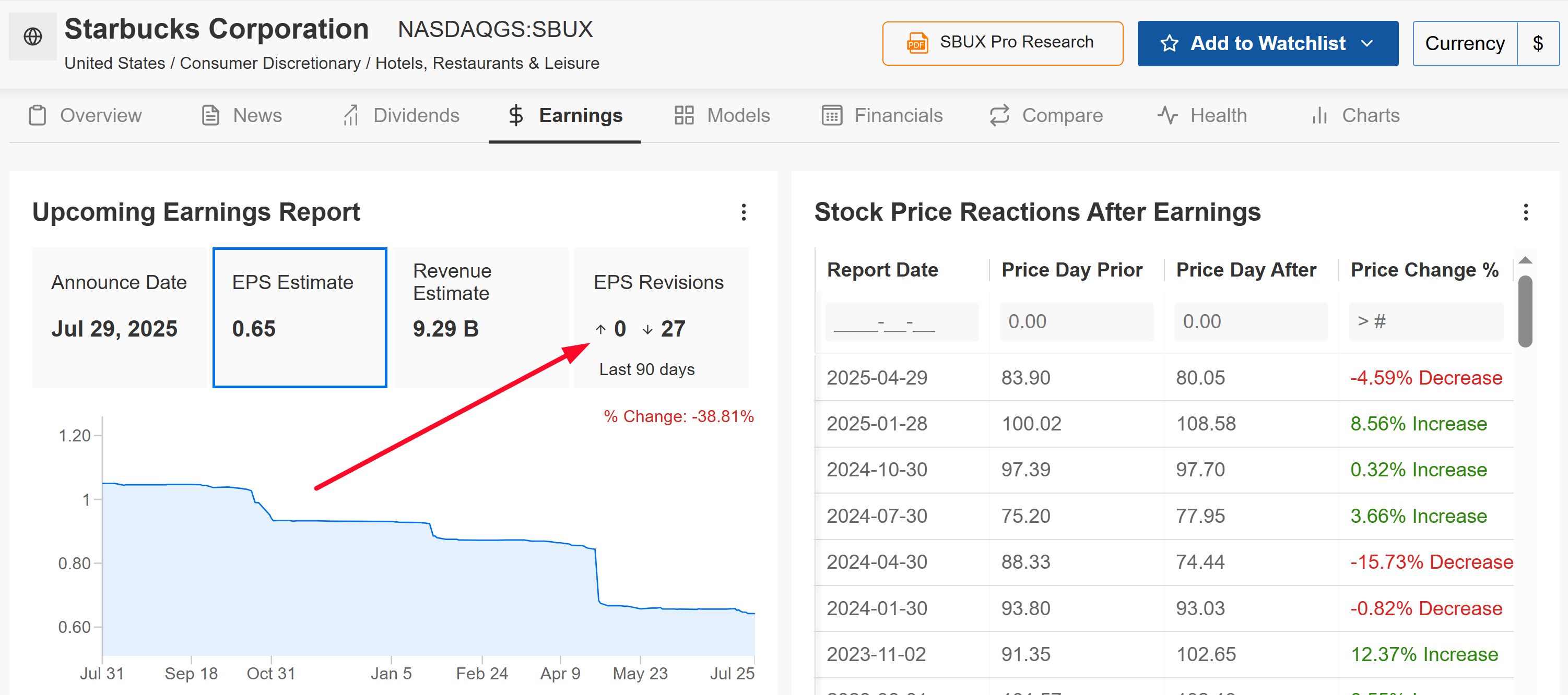

Analysts have grown increasingly bearish on SBUX ahead of the print, with all 27 of the analysts surveyed by InvestingPro revising EPS estimates downward over the past three months. With implied volatility pointing to a +/-6.2% stock move post-earnings, the risk of a miss looms large.

Source: InvestingPro

Wall Street expects Starbucks to report a profit of $0.65 per share, down 30% year-over-year from EPS of $0.93 in the year-ago period. The company’s turnaround plan, which includes operational improvements and menu innovations, is under intense scrutiny, and early results have yet to inspire confidence.

Meanwhile, the coffee giant’s sales are expected to inch up just 2% annually to $9.29 billion amid a sluggish performance in key markets like the U.S. and China. Starbucks faces increasing competition from cheaper alternatives like Dunkin’ and Luckin, as well as independent coffee shops.

Looking ahead, all signs point to CEO Brian Niccol warning of further near-term weakness due to subdued consumer spending, competitive headwinds and challenges in executing its turnaround plan.

Source: Investing.com

SBUX stock closed at $94.42 on Friday. Notably, the stock sits below its 200-day moving average, underscoring the risks as Starbucks approaches its earnings release.

It is worth noting that Starbucks holds a 2.38 Financial Health Score, marked as "FAIR", reflecting concerns around liquidity and moderate debt.

Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

- ProPicks AI: AI-selected stock winners with proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.