German construction sector still in recession, civil engineering only bright spot

By Barani Krishnan

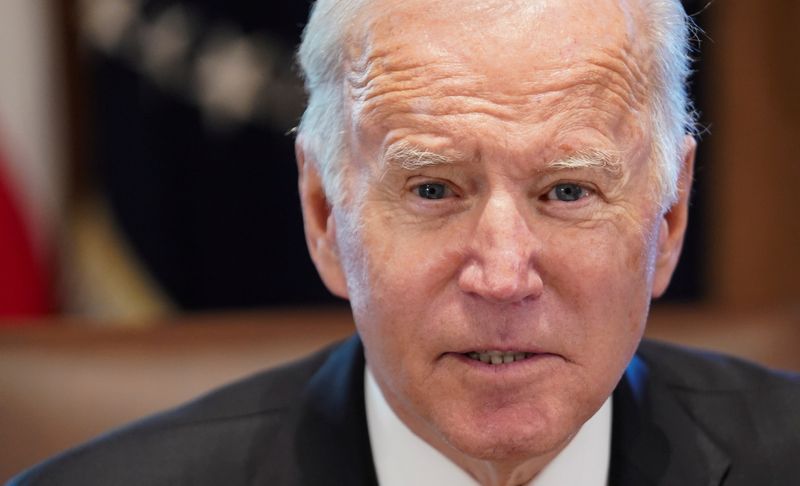

Investing.com - Question: How do you replace 200 million barrels of oil that you’ve used? Biden administration: A little at a time.

And that’s how it began, with an announcement that seemed timed with the one-year low in crude prices. The U.S. Department of Energy said on Friday it will start refilling the nation’s heavily drawn-down Strategic Petroleum Reserve, or SPR, from February with an initial purchase of 3 million barrels.

News of the SPR’s refilling came amid a renewed hawkish tone for interest rates from the Federal Reserve, European Central Bank and the Bank of England. The stance of the global central banks dampened risk appetite across markets and heightened recession fears, cutting short a rally in crude prices that came just after the worst week for oil in nine months.

The Biden administration drew some 200 million barrels from the SPR over the past year, sending inventories in the reserve to 38-year lows, as it attempted to bridge a global supply deficit in crude caused by Russian President Vladimir Putin’s decision to invade Ukraine and the West’s subsequent sanctions on Moscow.

Reliance on the SPR accelerated after the White House approved a 180-million barrel draw over a six-month period beginning May. U.S. crude surged to just above $130 a barrel in the first week of March while global benchmark Brent hit almost $140, shortly after the Ukraine invasion began. The 14-year highs in crude prices then and the sanctions on Russia combined to eventually send U.S. pump prices of gasoline to hit record highs of $5 per gallon by June.

As of Friday though, U.S. crude settled at under $75 per barrel and Brent at below $80. Gasoline at U.S. pumps averaged $3.18 per gallon, according to the American Automobile Association — although some areas in the United States with refineries in their proximity were pricing a gallon at under $3 due to cheaper costs of moving the fuel.

Oil bulls had been anticipating a major swing up in crude prices from any attempts to refill the SPR and the Biden administration has said for a while that it aimed to pay around $70 a barrel for the deed — well below the three-digit pricing expected by those long the market.

Seventy dollars a barrel is “a good price for companies and it's a good price for taxpayers", the president himself was quoted saying on Oct. 19 when asked how much the government intended to pay to bring SPR stockpiles back to their previous threshold of around 700 million barrels. As of a week ago, the reserve held just over 382 million barrels, its lowest level since March 1984.

When Biden spoke about $70 oil, U.S. crude was trading at around $85 a barrel. Many thought it would go to $100 from there, not drop by another $10 to $15.

Any positive impact from the SPR’s refilling was further watered down on Friday by an administration official saying the reserve would also loan out 2 million barrels to domestic energy companies to relieve any supply shortage caused by the Keystone pipeline’s closure.

The 622,000 barrel-per-day Keystone pipeline is a critical artery shipping heavy Canadian crude from Alberta to U.S. refiners in the Midwest and the Gulf Coast. It has been closed for a week now, after causing what officials say is the largest U.S. oil spill in a decade.

Under the loan arrangement reported Friday, companies will immediately receive 2 million barrels from the SPR to resolve the supply crunch emanating from the Keystone crisis and return them much later, at a mutually-agreed time.

“It’s a smart hedge, if you ask me,” John Kilduff, a partner at New York energy hedge fund Again Capital, said, referring to the two countervailing decisions involving the SPR.

“Instead of announcing a massive purchase that would take care of the entire 180 million barrels that were drawn down the last six months, the administration chose to just begin with a 3 million barrel purchase. The positive impact on the market will be minimal, just as U.S. consumers at the pump would have liked.”

It was a sign of the administration’s resolve to continue using the SPR as a mechanism to keep oil prices low, as well as fix supply problems in the marketplace. Biden’s critics say the reserve was never meant to be a price-fighting tool. The president says his priority is providing relief to Americans suffering from the worst inflation in 40 years.

So, here’s the other question: Did the administration effectively check-mate oil longs with its SPR announcement?

Yes, for now. Though it’s never a good idea to bet on oil prices staying this way for too long, simply because of supply-demand dynamics.

Crude prices could surge if the oncoming cold snap during the Christmas week and beyond sends heating demand through the roof. They could also bolt upright from any Putin idea of slashing Russian production (though he seems to need the money from oil now, the way he’s happy supplying as many barrels as needed by India, which is complying with the G7’s $60 price cap on each barrel of Russian sea-borne crude).

Conversely, crude prices could fall further, to mid-$60 levels for WTI and just under $70 for Brent, if the COVID crisis gets out of hand again in China, the world’s largest oil importer. Beijing reopened cities that were under lockdown and rolled back safeguards against the coronavirus last week amid public protests against its tough Zero-COVID policy.

With the relaxing of China’s health rules, experts say up to 60% of the population could eventually be infected with the virus, and a January peak could hit vulnerable people such as the elderly and those with pre-existing conditions. They worry about China’s large pool of susceptible individuals, the use of less effective vaccines, and low vaccine coverage among those 80 and older, who are at the greatest risk of severe disease.

“If COVID spreads freely and many people cannot get care, we estimate that in the coming months 1.5 million Chinese people will die from the virus,” The Economist said.

China’s oil demand could suffer as well. “People’s will to go out may still be conservative in the next one or two months as most cities have yet to see big outbreaks,” Zhang Xiao, an analyst at OilChem, said in comments carried by Bloomberg. He added that gasoline usage may actually drop near term as people opt to stay home to avoid infection or to recover “The market will wait at least till March to see a recovery in gasoline demand.”

It’s going to be an interesting Christmas and New Year for oil.

Oil: Market Settlements and Activity

U.S. West Texas Intermediate crude for delivery in January did a final trade of $74.50, after officially settling Friday’s trade at $74.29, down $1.82, or 2.4%.

Earlier on Friday, WTI, as the U.S. crude benchmark is known, hit an intraday low of $73.33. For the week, it rose 4% after an 11% drop last week, like Brent. WTI fell to as low as $70.11 a week ago — hitting a bottom not seen since Dec 21, 2021.

U.K. origin Brent crude for delivery in February did a final trade of $79.26, after officially settling Friday’s trade at $79.04, down $2.17, or 2.7%.

Earlier on Friday, Brent hit a session low of $78.29. For the week though, the global crude benchmark was up 3.9% after the 11% slump in the week prior that took a barrel of Brent to as low as $75.14 — a bottom not seen since Dec 23, 2021.

Oil Price Technical Outlook: WTI

Going into the week ahead, a sustained move above $73 will keep WTI’s chances valid for a further retest of the $77 level, said Sunil Kumar Dixit, chief technical strategist at SKCharting.com.

“A strong consolidation above $78 will help extend gains to the psychological handle of $80 and the 100-Week SMA of $82,” Dixit said, referring to the Simple Moving Average.

But he cautioned that a break and consolidation below $73 will prompt a retest of WTI’s $70 support base.

“If this support base is decisively broken, it exposes WTI to major correctional target-cum-support at the 200-Week SMA of $65.10,” Dixit said.

Gold: Market Settlements and Activity

Gold futures’ benchmark February contract on New York’s Comex did a final trade of $1,803 after officially settling Friday’s trade at $1,800.20, up $12.40, or 0.7%.

Earlier on Friday, February gold hit a session peak of $1,804.20. Earlier in the week, the benchmark gold futures contract hit a six-month high of $1,836.80. Despite the daily rise, for the week, February gold fell 0.6%.

The spot price of gold, which is more closely followed than futures by some traders, settled below the $1,800 mark, finishing up $16.41, or 0.9%. Spot gold’s peak for the week was $1,824.53, the highest in six months. For the week itself, spot gold slipped 0.2%.

Traders attributed the softer weekly sentiment in gold to the renewed hawkish tone of the Fed and other central banks that sent the dollar higher in the last two days of the week, after the currency’s drop in the first three days.

“It seems bullion traders won’t have the green light to buy gold until they are confident that the peak in yields is in place,” said Ed Moya, analyst at online trading platform OANDA. “Eventually, Wall Street will feel confident that the Fed is ready to hold and that might be when gold will be able to resume its role as a safe haven.”

“As trading volumes ease into year-end, gold might find itself stuck in a range that could see $1,750 as support and $1,830 as major resistance.”

Gold Technical Outlook: Spot Price

Spot gold’s second weekly settlement below the 100-week SMA of $1,800 calls for some caution for bullion bulls, said Dixit.

“If gold fails to establish its acceptance above the $1,800 level, the risk of a break below $1,788 and $1,773 will increase. If this happens, it can trigger a correction sell-off towards $1,765-$1,745 and which can even extend towards $1,722.”

On the positive side, a strong consolidation above $1,800 will help spot gold retest $1,824, Dixit said. “This can extend the rally towards $1,842, possibly setting a new six-month high thereon,” he added.

Disclaimer: Barani Krishnan does not hold positions in the commodities and securities he writes about.