BofA’s Hartnett says concentrated U.S. stock returns are likely to persist

- Maxine Waters criticized PayPal’s new stablecoin and believed that PayPal (NASDAQ:PYPL) launched the stablecoin in the absence of US regulations.

- Without legislation, consumers are at greater risk of harm at the hands of bad actors,” she stated.

- Photos of her with Sam Bankman-Fried, the founder of FTX, were circulated on Twitter in response to her criticism.

PayPal’s new stablecoin received strong criticism from Maxine Waters, the top Democrat on the House Financial Services Committee. She stated that PayPal launched the stablecoin while there aren’t clear US regulations for stablecoins in cryptocurrency.

Waters said in a statement, “I am deeply concerned that PayPal has chosen to launch its own stablecoin while there is still no federal framework for regulation, oversight, and enforcement of these assets.”

Stablecoins are used to reduce unpredictability compared to other volatile cryptocurrencies; however, Waters feared that consumers were at greater risk. She said, “Without legislation on the books that establishes clear and strong consumer protections at the federal level, consumers are at greater risk of harm at the hands of bad actors.”

She added, “Given PayPal’s size and reach, Federal oversight and enforcement of its stablecoin operations is essential to guarantee consumer protections and alleviate financial stability concerns.”

Waters mentioned how the Democrats on the Committee have been working diligently on legislation to create a protected environment for consumers during such events. While she believed the Republicans were proposing “toxic and problematic” legislation.

“The Republican bill gives stablecoins like PayPal USD that are issued under state regimes a seal of approval, but blocks the Federal Reserve from overseeing or enforcing any Federal standards,” she stated. Furthermore, she believed the Republicans were making it harder to protect the economy against inflation or support maximum employment if stablecoins were adopted.

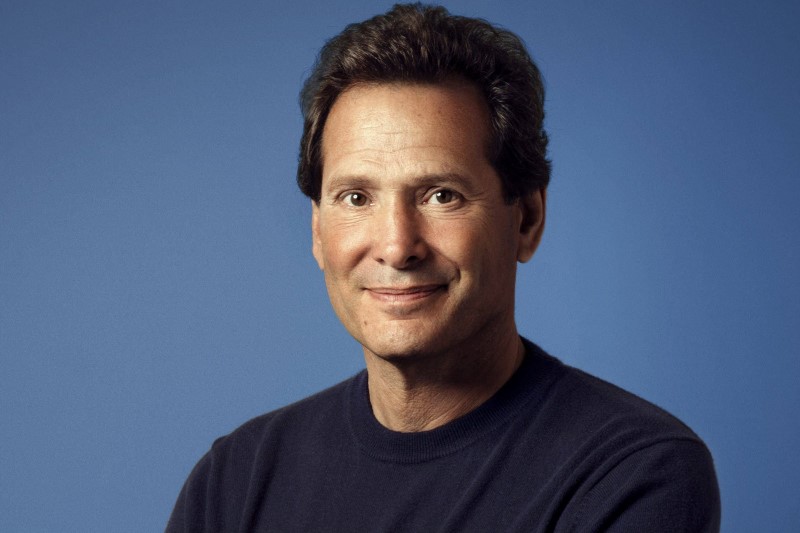

The crypto Twitter community didn’t receive her comments well and shared pictures of Waters with Sam Bankman Fried of bankrupt FTX. Matt Walsh, CEO of Castle Island Ventures, a venture capital firm focused on public blockchains, said, “[FTX] is the federal stablecoin issuer Maxine Waters was hoping for. Slow down PayPal!”

PayPal launched its stablecoin PayPalUSD (PYUSD) earlier this week and announced a giveaway on Twitter. PayPal shared the terms and conditions of the stablecoin, which the crypto community has taken issue with.

Users highlighted certain aspects of the stablecoin’s smart contract that stated PayPal has the right to freeze the stablecoin or wipe it off, which is considered a questionable degree of centralization.

The post PayPal’s Stablecoin Is Harshly Criticized by Top Democrats appeared first on Coin Edition.