Stock market today: S&P 500 climbs as health care, tech gain; Nvidia earnings loom

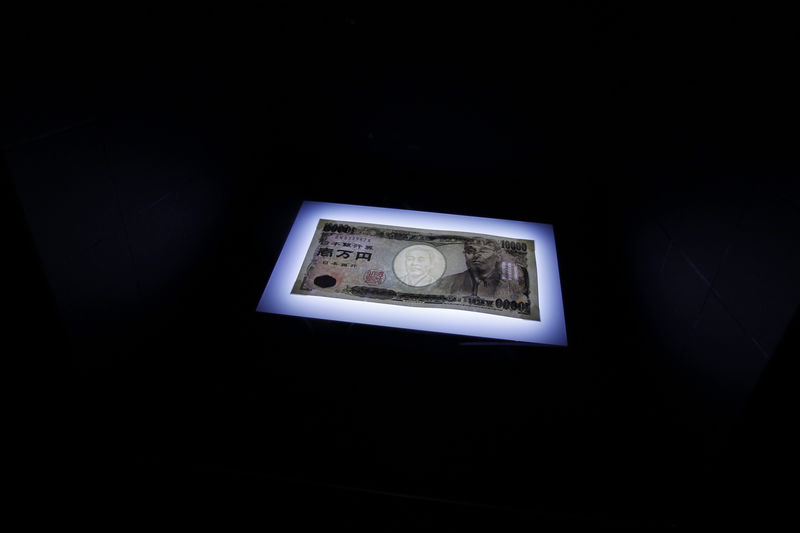

* Yen has recouped more than half its vaccine-driven losses

* Dollar steady as risk currencies struggle for headway

* China's economic performance powers yuan to 29-month top

* Graphic: World FX rates in 2020 https://tmsnrt.rs/2RBWI5E

By Tom Westbrook

SYDNEY, Nov 18 (Reuters) - The safe-haven Japanese yen sat

near a one-week high and a steady U.S. dollar held commodity

currencies in check on Wednesday, as worries about rising

coronavirus cases tempered optimism around promising vaccine

trials.

At 104.14 per dollar, the yen JPY= has recouped more than

half of the steep losses it suffered last week after Pfizer

announced it had developed a working COVID-19 vaccine.

Bitcoin BTC=BTSP , sometimes regarded as a haven asset or

at least a hedge against inflation, has surged to a three-year

high against the dollar and the risk-sensitive Australian and

New Zealand dollars were a fraction softer, along with stocks.

"The slight cooling of equity sentiment has put a cap on

currencies," said Westpac currency analyst Imre Speizer.

"We know we've got a vaccine. Now it's about distribution

and how quickly it can start to make a difference, which is

going to be quite a few months away."

Before then, a tough winter looms.

Surging cases have driven record hospitalisations and fresh

restrictions on gathering in the United States, while new

outbreaks vex authorities in Japan, South Korea and Australia.

Federal Reserve Chair Jerome Powell said on Tuesday that

there was "a long way to go" to economic recovery. The Australian dollar AUD=D3 slipped 0.3% on Tuesday and

was a shade weaker still on Wednesday at $0.7288. The New

Zealand dollar NZD=D3 was 0.1% softer at $0.6889. AUD/

The euro EUR= was steady at $1.1862 and against a basket

of currencies the dollar =USD held at 92.439 - a little softer

than earlier in the week as a slight bond rally has knocked the

shine off U.S. Treasury yields. US/

"It's back to pondering short-term negatives vs longer-term

vaccine positives, and that's creating volatility," ANZ analysts

said in a note. "Vaccine deployment isn't an immediate fix ...

expect things to remain mixed and messy."

Elsewhere sterling edged higher as traders hoped for a

Brexit trade deal breakthrough. GBP/

Britain's chief negotiator David Frost has told Prime

Minister Boris Johnson to expect a Brussels trade deal "early

next week", The Sun newspaper reported, with "a possible landing

zone" as soon as next Tuesday. As soft economic data in the United States weighed on dollar

sentiment, strong industrial output in China kept the yuan's

barnstorming run alive, sending it to an almost 29-month high of

6.5457 per dollar in offshore trade CNH= . CNY/

The Chinese yuan has gained nearly 9% against the dollar

since late May, despite the central bank taking various actions

to temper its strength.

Later on Wednesday British inflation figures are due and

several U.S. Fed members make speeches. In emerging markets,

focus is on a Bank of Thailand meeting, though most economists

expect rates to be kept on hold. Currency bid prices at 11:19AM in Sydney (0019 GMT)

Description RIC Last U.S. Close Pct Change YTD Pct High Bid Low Bid

Previous Change

Session

Euro/Dollar EUR=EBS $1.1861 $1.1861 +0.03% +5.82% +1.1868 +1.1861

Dollar/Yen JPY=D3 104.1350 104.1900 +0.00% -4.07% +104.1900 +0.0000

Euro/Yen EURJPY= 123.50 123.57 -0.06% +1.27% +123.6300 +123.5100

Dollar/Swiss CHF=EBS 0.9114 0.9116 -0.03% -5.82% +0.9115 +0.9112

Sterling/Dollar GBP=D3 1.3253 1.3250 +0.04% -0.06% +1.3263 +1.3250

Dollar/Canadian CAD=D3 1.3108 1.3107 +0.02% +0.91% +1.3110 +1.3102

Aussie/Dollar AUD=D3 0.7289 0.7300 -0.14% +3.89% +0.7299 +0.7288

NZ NZD=D3 0.6886 0.6894 -0.10% +2.35% +0.6893 +0.6887

Dollar/Dollar

All spots FX=

Tokyo spots AFX=

Europe spots EFX=

Volatilities FXVOL=

Tokyo Forex market info from BOJ TKYFX