Oracle stock falls after report reveals thin margins in AI cloud business

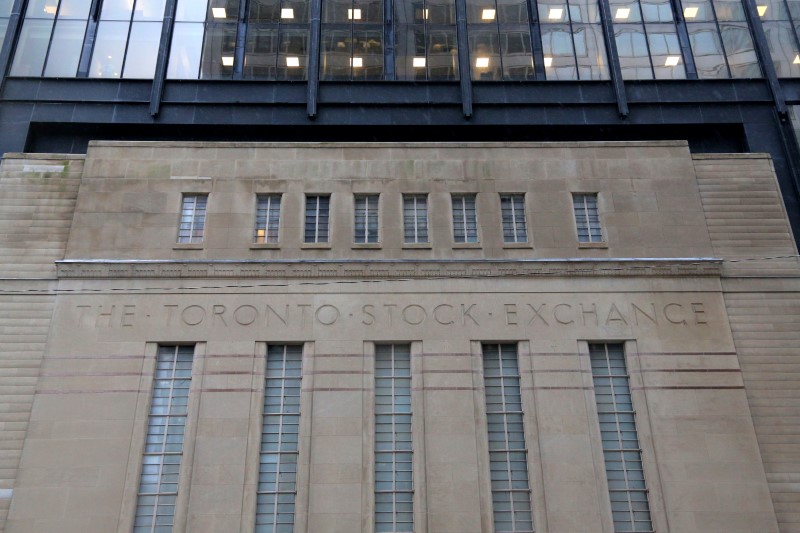

Investing.com - Canada’s main stock index extended gains to clinch record high on Thursday.

The S&P/TSX composite index settled at up 0.61% at 27,034.26.

During the session, in U.S, Trump’s Big Beautiful Bill passed thorough narrow margin.

Sentiment was also bolstered the announcement of a trade deal between the U.S. and Vietnam, which comes as markets are eyeing the possibility of a similar accord between Washington and Ottawa in the coming days.

U.S. stocks higher

U.S. stocks were trading high on Thursday after a better jobs data. The tax and spending bill also passed the House during the session. Nvidia (NASDAQ:NVDA) also touched record high driving the gains at indices. Nvidia was up more than 2% becoming the most valuable company.

The Dow Jones Industrial Average gained 344 points, or 0.77%, to 44,828.53, the S&P 500 was up 0.83%, to 6,279.35, and theNASDAQ Composite gained 207 points, or 1.02%, to 20,601.10.

Markets will see a shortened trading session on Thursday, ahead of the July 4 Independence Day holiday.

Better nonfarm payrolls data

Data showed nonfarm payrolls increased by 147000 jobs last month, following a revised figure of 144000 advance in May. This was better than the consensus.

Economists predicted that the Bureau of Labor Statistics’ June nonfarm payrolls report will show that the U.S. economy added 110,000 roles, down from 139,000 in May.

The ADP (NASDAQ:ADP) National Employment Report on Wednesday suggested that, against tariff-fueled economic uncertainty, firms are hiring less and workers are more reticent to leave their current jobs. However, there is little correlation between the ADP and BLS numbers.

Fed policymakers — who are partly tasked with aiming for maximum employment — keeps close tabs on incoming labor market data.

Fed Chair Jerome Powell, who has faced intensifying pressure from Trump to quickly slash rates, has backed a cautious approach to future interest rate changes, but did say this week that the central bank could bring down borrowing costs at its four remaining policy meetings this year.

Gold down

Gold prices were trading down after three days of gains, with better U.S. payrolls data.

Bullion found support from U.S. fiscal deficit concerns as House Republicans pushed to pass Trump’s sweeping tax-cut bill, while uncertainty around U.S. trade deals ahead of the July 9 tariff deadline also supported sentiment.

Spot gold was down slightly by 0.93% to $3,325.80 an ounce, while gold futures for August were down 0.7% to $3,336.12 /oz by 12.05 ET. The yellow metal has risen nearly 2.5% so far this week.

Crude falls ahead of OPEC+ meeting

Crude prices fell Thursday, handing back some of the previous session’s gains after an unexpected build in U.S. inventories and ahead of an upcoming OPEC+ meeting, which is expected to result in an output hike.

At 06:57 ET, Brent futures dropped 0.3% to $68.94 a barrel and U.S. West Texas Intermediate crude futures fell 0.2% to $67.33 a barrel.

Both contracts gained around 3% on Wednesday, rising to their highest in one week as Iran suspended cooperation with the U.N. nuclear watchdog, raising concerns the lingering dispute over the Middle East producer’s nuclear program may result in a disruption to supply from this region.

U.S. oil inventories grew by 3.85 million barrels last week, government data showed on Wednesday, raising questions about just how strong fuel demand will be this summer season.

OPEC+, a group of top producers, will meet over the weekend, and is expected to boost production by 411,000 barrels per day in August.