ION expands ETF trading capabilities with Tradeweb integration

- High-growth tech stocks are out of favor as the Fed tightens monetary policy to fight soaring inflation.

- Dramatic selloff created compelling buying opportunities in several former market darlings whose valuations were cut by more than half.

- 3 stocks for investor consideration—Datadog, Cloudflare, and Roku—given their solid demand outlook.

- For tools, data, and content to help you make better investing decisions, try InvestingPro+.

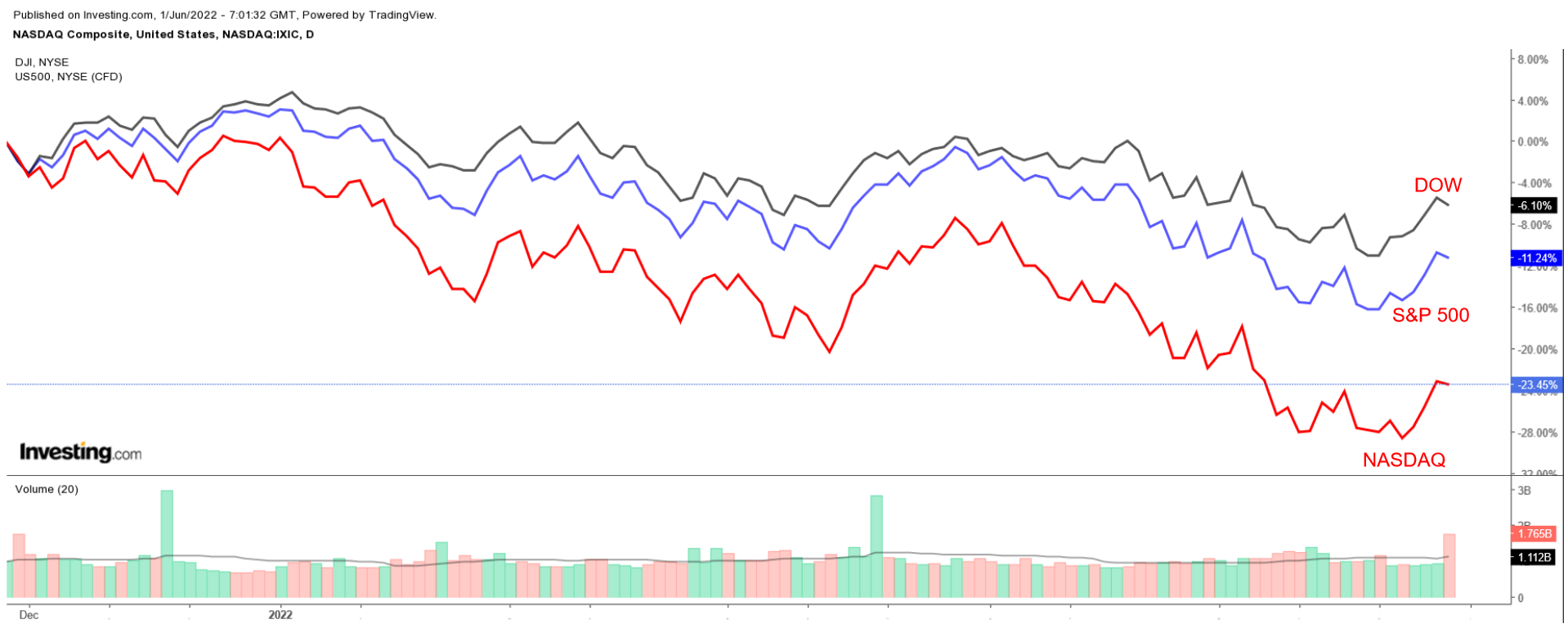

High-flying technology stocks have sold off sharply for much of 2022 amid the Federal Reserve’s plans to aggressively tighten monetary policy.

Indeed, the tech-heavy NASDAQ Composite has fallen 22.8% year-to-date, underperforming the comparable returns of both the Dow Jones Industrial Average and the S&P 500 over the same timeframe.

Despite recent volatility, below we highlight three former market favorites well worth considering as the group attempts to bounce back from the broader selloff.

All three still have plenty of room to grow their respective businesses, making them solid long-term investments.

1. Datadog

- Year-To-Date Performance: -46.4%

- Percentage From ATH: -52.2%

- Market Cap: $30.1 Billion

Given the fragile sentiment on many top-tier technology stocks, specifically those in the Software-as-a-Service sector, Datadog (NASDAQ:DDOG) has taken a beating amid the sharp reset in valuations across the frothy tech space over the past several months.

After scoring sizable gains of 160% and 80%, respectively, in 2020 and 2021, Datadog—which provides a security monitoring and analytics platform for software developers and information technology departments—has seen its stock crater 46.4% year-to-date.

DDOG closed Tuesday’s session at $95.39, roughly 52% below its record peak of $199.68 reached in November 2021. At current valuations, the New York City-based enterprise software maker has a market cap of $30.1 billion.

In our opinion, Datadog shares are well-positioned to resume their march higher in the near term as the current work-from-home and hybrid work environment drive businesses to accelerate digital transformation trends.

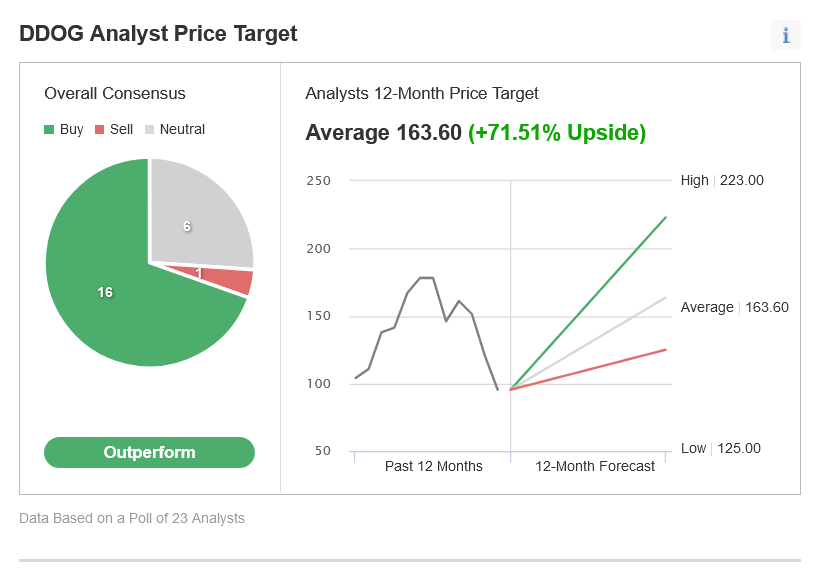

Not surprisingly, 16 out of 23 analysts surveyed by Investing.com rated DDOG stock as “Buy,” implying more than 71% upside from current levels to an average of $163.60/share. Just one analyst surveyed has a ‘Sell’ rating on the name.

Source: Investing.com

Datadog reported first quarter financial results that crushed Wall Street’s earnings and revenue estimates on May 5. It also provided an upbeat outlook, lifting its full-year guidance for both profit and sales. As Chief Executive Oliver Pomel explained in the company's earnings statement:

“We continue to see customers of all sizes and in all industries progressing along their digital transformation and cloud migration journeys.”

The security-monitoring platform provider said that it had 2,250 customers with annual recurring revenue (ARR) of $100,000 or more as of the end of March, up 60% from the year-ago period.

Datadog’s guidance made clear that the security software maker does not expect any slowdown in the months ahead, reflecting strong demand for its cloud-based cybersecurity software tools from large enterprises.

The company now sees 2022 earnings per share ranging from $0.70 to $0.77, up sharply from prior guidance for EPS of $0.45 to $0.51. It expects revenue to range from $1.60 billion to $1.62 billion, improving from management’s previous call for a range of $1.51 billion to $1.53 billion.

2. Cloudflare

- Year-To-Date Performance: -57.4%

- Percentage From ATH: -74.7%

- Market Cap: $18.3 Billion

Cloudflare (NYSE:NET), which provides web security and infrastructure services, also fell victim to the general selloff of non-profitable high-growth tech companies, especially those that had lofty price-to-earnings (P/E) ratios.

Shares of the San Francisco, California-based cybersecurity specialist—which recently plunged to their lowest level since October 2020—have lost roughly 57% year-to-date as investors flee tech companies with sky-high valuations.

NET is nearly 75% below its all-time high of $221.64 reached in November 2021. Shares ended at $56.00 yesterday. At current valuations, the web security provider has a market cap of $18.3 billion.

Despite the recent turmoil, we believe that the dramatic pullback in Cloudflare stock has created a compelling buying opportunity in the beaten-down name, considering the robust demand for its networking and cybersecurity tools amid the current geopolitical backdrop.

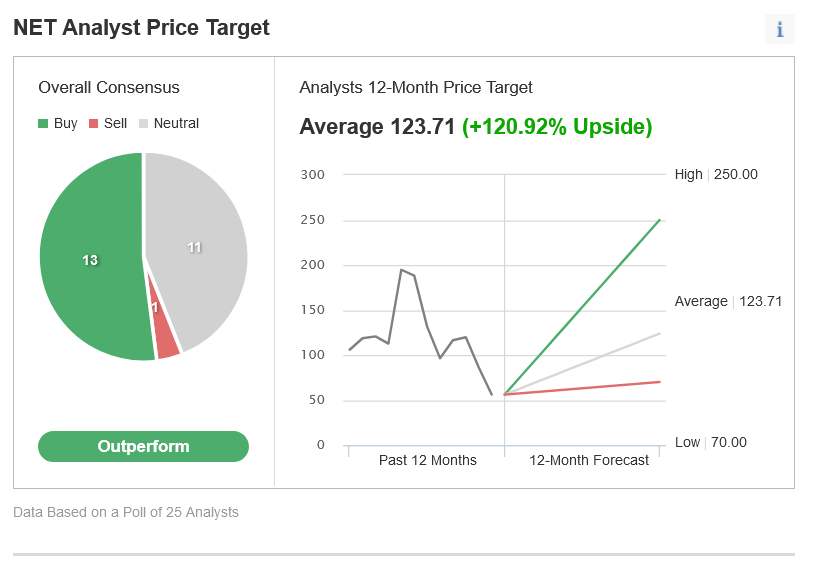

According to Investing.com, the average NET stock analyst price target is around $123.70, implying a whopping 120.92% upside from current levels over the next 12 months.

Source: Investing.com

Cloudflare shattered its sales record and provided upbeat guidance when it delivered first quarter results on May 5, thanks to ongoing demand for its web security, content delivery, and enterprise networking services and solutions.

“Cloudflare had a terrific first quarter, beating expectations with revenue growth up 54% year-over-year and adding more than 14,000 new paying customers - a quarterly record,” co-founder and CEO Matthew Prince said in the earnings release.

“Our largest customers continue to get larger, with those spending over $1 million a year growing 72% year-over-year.”

Looking ahead, Cloudflare boosted its full-year revenue outlook to a range of $955 million to $959 million, up from a previous range of $927 million to $931 million.

3. Roku

- Year-To-Date Performance: -58.4%

- Percentage From ATH: -80.6%

- Market Cap: $12.9 Billion

One of the big winners of the COVID pandemic, Roku (NASDAQ:ROKU) has seen its valuation crumble as a potent combination of rising interest rates and accelerating inflation triggered a broad-based dump of high-growth tech names.

Shares of the San Jose, California-based company, which sells devices and provides a platform that allows users to access streaming services, have lost approximately 58% year-to-date, a result of investors' recent growth stock exit.

Shares of ROKU—which are about 81% below their all-time high of $490.76 reached in July 2021—closed Tuesday’s session at $94.90. At current levels, the digital media player manufacturer has a market cap of $12.9 billion.

We believe that the once high-flying growth stock—which has climbed roughly 27% since falling to a more than two-year trough of $75.03 on May 24—is poised to extend its rebound in the weeks ahead as the streaming video pioneer benefits from broad strength in its core ad-revenue business.

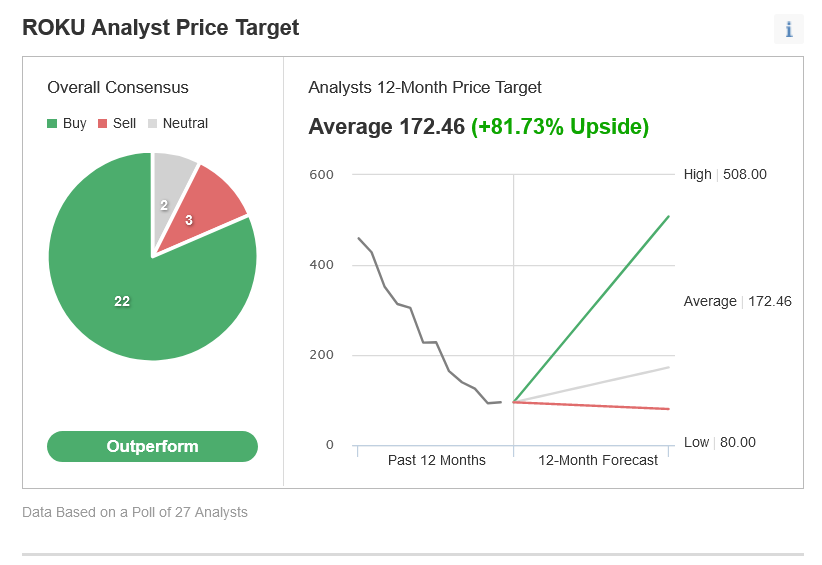

Of the 27 analysts surveyed by Investing.com, 22 are bullish on ROKU, forecasting an upside of approximately 82% from current prices to an average of $172.46/share.

Source: Investing.com

The streaming media platform reported a smaller loss than expected and sales which easily topped forecasts when it released first quarter financial results in late April.

Roku's platform revenue, made up mostly of advertising, increased 39% year-over-year to $646.9 million. It added 1.1 million active accounts in the first three months of 2022, bringing the total to 61.3 million.

Chief executive Anthony Wood and Chief Financial Officer Steve Louden said in the earnings report:

“We have delivered solid performance in a challenging operating environment and expect that we will continue to navigate through macro headwinds, including inflationary pressures, geopolitical conflict, and supply chain disruptions.”

Looking ahead, Roku’s management forecasts revenue to grow 25% year-over-year to $805 million in the current quarter. For the full year, it anticipates annualized revenue growth of 35%.

***

Interested in finding your next great idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More »