Gold prices hover near 6-week high amid softer dollar, Fed rate cut bets

- SNAP shares are down almost 79% since the beginning of 2022

- In addition to disappointing Q2 results, Q3 metrics are likely to show flat revenues and mounting losses

- Yet, the current price reflects most of the bad news

Shareholders in the California-based social media stock Snap (NYSE:SNAP) have seen the value of their investment decline by around 78.8% since January. By comparison, other ad-focused social media shares, namely Meta Platforms (NASDAQ:META), Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) and Twitter (NYSE:TWTR), have lost 49.7%, 25.5% and 7.8%, respectively, so far in 2022.

Source: Investing.com

On Sept. 24, 2021, SNAP shares surpassed $83, hitting a record high. The stock’s 52-week range has been $9.66-$83.34, with the market capitalization currently at $16.8 billion.

Like other social media names, Snap relies on online advertising revenue. Recent metrics suggest social media ad spending worldwide should exceed $225 billion this year. Over a third of that amount will be spent in the U.S. Alphabet and Meta Platforms currently have the top spots in terms of global advertising revenue.

Recent Metrics

Owner of the Snapchat app released disappointing Q2 metrics on July 21. While daily active users (DAUs) were 347 million, which represents an18% year-over-year increase, the average revenue per user (ARPU) declined 4% YoY to $3.20.

The top line recorded $1.11 billion, up 13% YoY, but fell short of estimates. Diluted net loss per share was 2 cents compared with an EPS of 10 cents a year ago.

On the results, CEO Evan Spiegel commented:

“While the continued growth of our community increases the long-term opportunity for our business, our financial results for Q2 do not reflect our ambition. We are evolving our business and strategy to reaccelerate revenue growth, including innovating on our products, investing heavily in our direct response advertising business and cultivating new sources of revenue to help diversify our topline growth."

The company declined to issue an outlook for Q3 results, but expects revenue in the current quarter to stay flat compared to the previous year. In fact, recent user statistics provided by Similarweb show total visits to Snap in June was 5.4 million, down 10.27% from May.

Wall Street was not pleased with the results that showed a significant decline in ad spending and revenue growth. Prior to the release of the Q2 results, SNAP stock was around $16.30. But on July 2, shares closed at $9.96, a decline of about 38%.

What To Expect From Snap Stock

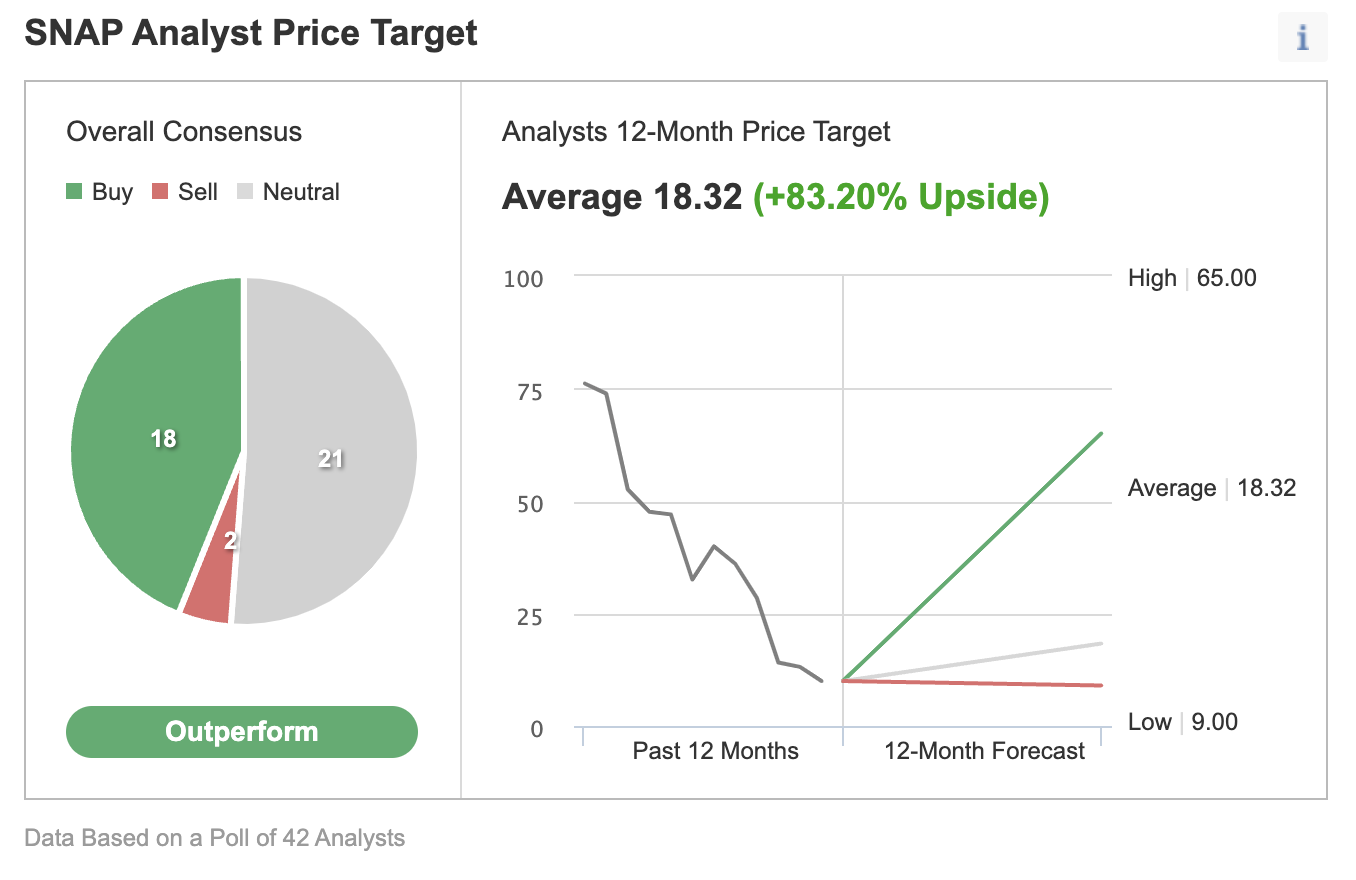

Among 42 analysts polled via Investing.com, SNAP stock has an "outperform" rating.

Source: Investing.com

Wall Street also has a 12-month median price target of $18.32 for the stock, implying an increase of more than 83.2% from current levels. The 12-month price range currently stands between $9 and $65.

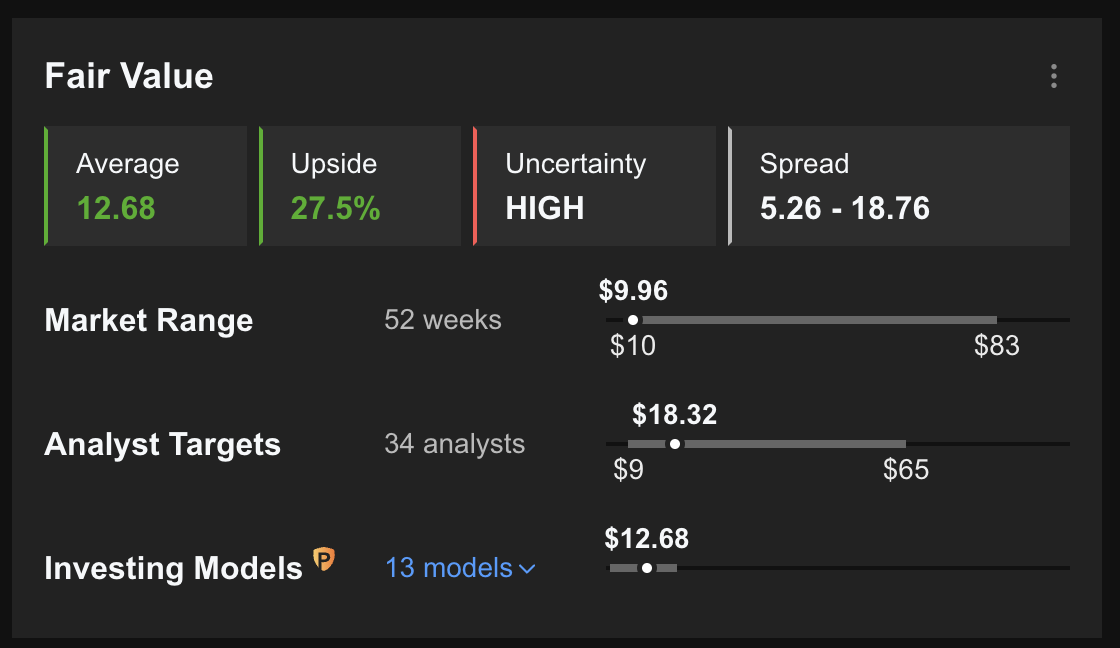

But according to a number of valuation models, like those that might consider revenue or P/S multiples or terminal values, the average fair value for Snap stock on InvestingPro stands at $12.68.

Source: InvestingPro

In other words, fundamental valuation suggests shares could increase about 27%.

We can also look at SNAP’s financial health as determined by ranking more than 100 factors against peers in the communication services sector. For instance, in terms of growth health, it scored 3 out of 5. But cash flow and relative health scored 2. Its overall score of 2 points is a fair performance ranking.

Our expectation is for SNAP stock to trade in a wide range between $9 and $11, and build a base. Afterwards, shares could potentially start a new leg up.

Adding SNAP To Portfolios

Snap bulls who are not concerned about short-term volatility could consider investing now. Their target price would be $12.68, as suggested by quantitative models.

Alternatively, investors could consider buying an exchange-traded fund (ETF) that has SNAP stock as a holding. Examples include:

- Global X Social Media ETF (NASDAQ:SOCL)

- Roundhill Ball Metaverse ETF (NYSE:METV)

- ProShares On-Demand ETF (NYSE:OND)

- First Trust Indxx Metaverse ETF (NASDAQ:ARVR)

- SPDR Morgan Stanley Technology (NYSE:XNTK)

Finally, those experienced with options could also consider selling a cash-secured put option in SNAP stock—a strategy we regularly cover. Such a bullish trade could especially appeal to those who want to receive premiums (from put selling) or to possibly own SNAP shares for less than their current market price of $9.96.

Most option strategies are not suitable for all retail investors. Therefore, the following discussion on SNAP stock is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Cash-Secured Puts On SNAP

Price Now: $9.96

Let's assume an investor wants to buy SNAP stock, but does not want to pay the full price of $9.96 per share. Instead, the investor would prefer to buy the shares at a discount within the next several months.

One possibility would be to wait for SNAP stock to fall further, which it might or might not do. The other possibility is to sell one contract of a cash-secured SNAP put option.

So the trader would typically write an at-the-money (ATM) or an out-of-the-money (OTM) put option and simultaneously set aside enough cash to buy 100 shares of the stock.

Let's assume the trader is putting in this trade until the option expiry date of Sept. 16. As the stock is $9.96 at time of writing, an OTM put option would have a strike of $9.

The SNAP Sept. 16 9-strike put option is currently offered at a price (or premium) of 80 cents.

An option buyer would have to pay $0.80 X 100, or $80, in premium to the option seller. This premium amount belongs to the option seller no matter what happens in the future. This amount is the seller’s maximum gain. The put option will stop trading on Friday, Sept. 16.

If the put option is in the money (meaning the market price of Snap stock is lower than the strike price of $9) any time before or at expiration on Sept. 16, this put option can be assigned. The seller would then be obligated to buy 100 shares of SNAP stock at the put option's strike price of $9 (i.e. at a total of $900).

The break-even point for our example is the strike price ($9) less the option premium received ($0.80), i.e., $8.20. This is the price at which the seller would start to incur a loss.

Bottom Line

Cash-secured put selling is a moderately more conservative strategy than buying shares of SNAP outright at the current market price. This can be a way to capitalize on further choppiness in Snap stock in the coming weeks.

Investors who end up owning SNAP shares as a result of selling puts could further consider setting up covered calls to increase the potential returns on their shares. Thus, selling cash-secured puts could be regarded as the first step in stock ownership

Disclaimer: On the date of publication, Tezcan Gecgil, Ph.D., did not have any positions in the securities mentioned in this article.