60%+ returns in 2025: Here’s how AI-powered stock investing has changed the game

The bond market has been in a holding pattern this month, looking for new catalysts for clues on assessing the outlook for interest rate cuts. On one side of the ledger: ongoing concerns that tariffs will raise inflation and convince the Fed to keep policy steady. But with signs of slowing economic growth, the case for trimming rates is building.

Enter Federal Reserve Chairman Powell, who’s scheduled to give a speech tomorrow (Friday, Aug. 22) that will receive wide attention in financial markets.

“I don’t think Powell can push the narrative toward cutting because that leaves him no option but to cut,” said Mike Sanders, head of fixed income at investment management firm Madison Investments. “He has to signal, ‘We’re still data-dependent and we’ll see what the data tells us’” in order to leave the central bank’s options open.

Lauren Goodwin, economist and chief market strategist at New York Life Investments, also sees Powell as betwixt and between in terms of clear policy choices.

“Inflation has made little progress toward the Fed’s 2% target since last year’s Jackson Hole conference,” she writes. “The labor market is better balanced, but increasingly shaped by a mix of cyclical softening, structural trends and policy-driven shocks.”

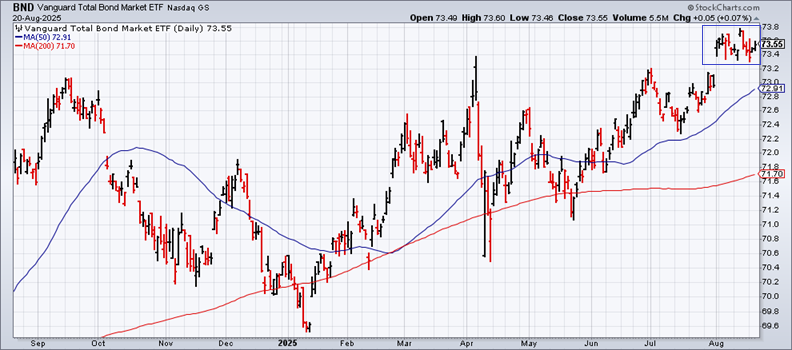

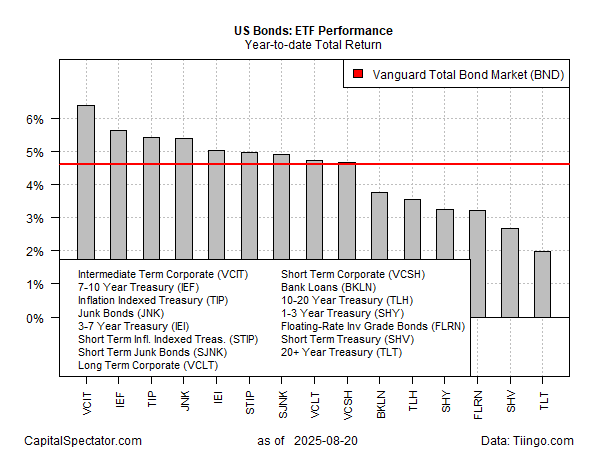

The bond market has been trading in a tight range over the past two weeks, holding on to widely held gains this year, based on a set of ETFs. The investment-grade benchmark – Vanguard Total (EPA:TTEF) Bond Market ETF (NASDAQ:BND) – is up 4.6% year to date through Wednesday’s close (Aug. 20).

Bonds in general are posting gains so far this year, with all the major components firmly in positive terrain. Intermediate-term corporates (VCIT) are the top performer with a 6.4% rally in 2025.

Searching for direction for the rest of the year, the bond market will be keenly focused on Powell’s comments. But it’s not obvious that deeper clarity is imminent, and it’s possible that investors are still left struggling to find a new catalyst in the wake of Powell’s talk.

Meantime, Fed funds futures are pricing in a rate cut at next month’s policy meeting. The current implied estimate is a roughly 79% probability for easing at the Sep. 17 FOMC meeting.

The Fed has “multiple risks that they have to contend with,” said James Clouse, who was the Fed’s division of monetary affairs until May.

“Exactly how they conduct policy in this environment is just very difficult and involves weighing the cost of inflation over the longer run versus the near-term costs of an economy that is weakening.”

The possibility that the outlook is just as cloudy after Powell’s speech as it is now seems like a reasonable bet.