US stock futures inch lower after Wall St marks fresh records on tech gains

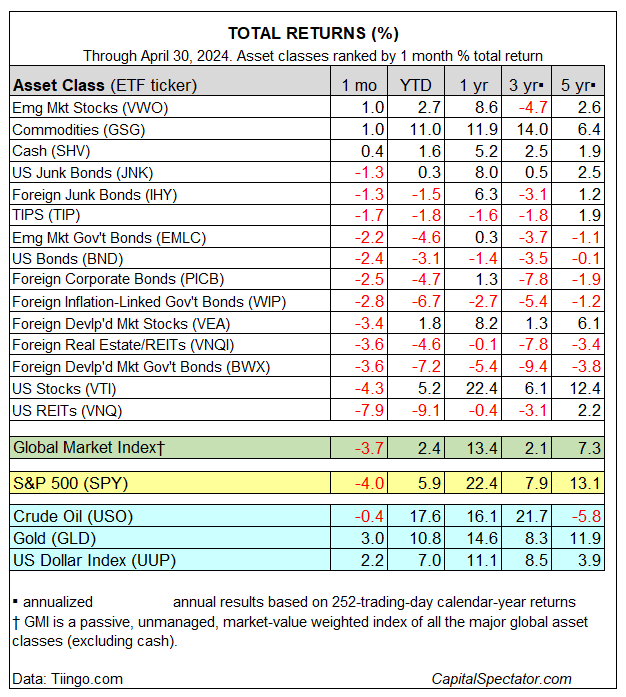

Most of the major asset classes retreated in April. The overall losses mark the worst month for global markets so far in 2024, based on a set of ETFs.

The upside outliers last month were limited to emerging markets stocks (VWO), a broad measure of commodities (GSG) and a cash proxy (SHV). Otherwise, red ink dominated April’s performance ledger.

US real estate investment trusts (VNQ) suffered the deepest loss in April, tumbling 7.9% — the deepest setback in nearly two years.

US stocks (VTI) also fell last month – the 4.3% drop is the first monthly decline so far this year. US bonds (BND) also took a hit, declining 2.4%. The weakness in US fixed income has persisted in three of the four months year to date.

On a year-to-date basis, most of the major asset classes are posting losses. Bucking the trend by a wide margin: commodities (GSG), which are up 11.0% in 2024. US stocks (VTI) are a distant second with a 5.2% year-to-date gain.

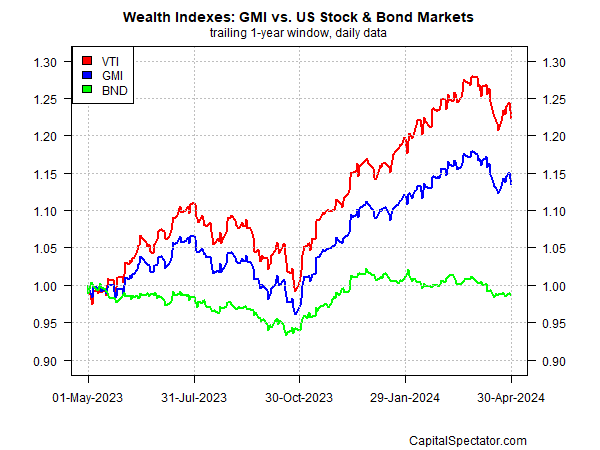

The winning streak in 2024 ended in April for the Global Market Index (GMI), an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive benchmark for multi-asset-class portfolios. GMI dropped 3.7% last month. Year to date, however, GMI is holding on to a modest 2.4% advance.

GMI’s one-year performance remains relatively strong at 13.4% through the end of April. US stocks (VTI) continue to post an above-average return over the trailing one-year window at more than 22%. The US bond market (BND), by contrast, is under water, falling 1.4% vs. the year-ago level.