EchoStar stock soars after SpaceX valuation set to double

Let me start with the punch line, which I think will not be a very common take: this report does not stop the Fed from easing 50bps next week, and honestly doesn’t really even hurt the chances very much.

The inflation swaps market was pricing in 0.05% on an NSA basis, roughly 0.13% on a SA basis. Actually, that market was better offered, with traders either expecting a weaker number or wanting to hedge that possibility more than the chance of a stronger number.

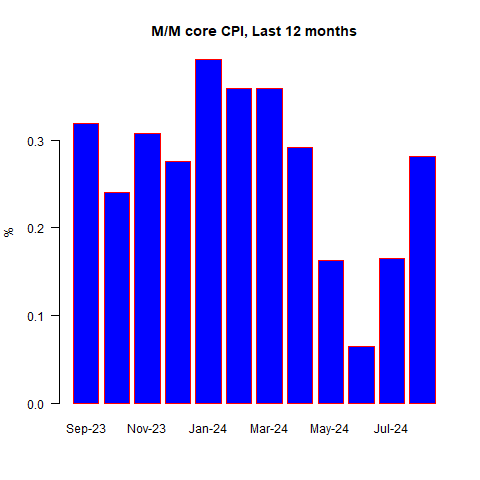

Economists gathered around a consensus of 0.16% for headline, and 0.20% on core CPI. The actual print was +0.19% m/m on CPI, and +0.28% on core CPI, bringing the y/y numbers to 2.59% and 3.27% respectively. It was the worst monthly core print since April, and the initial market response was predictably poor.

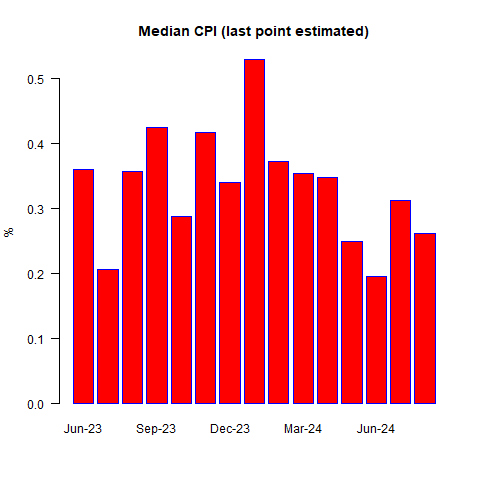

My early estimate of Median CPI for the month is +0.26% m/m, bringing the y/y median to 4.16%. (Sharp-eyed readers will note that neither headline, nor core, nor median CPI are at the Fed’s target).

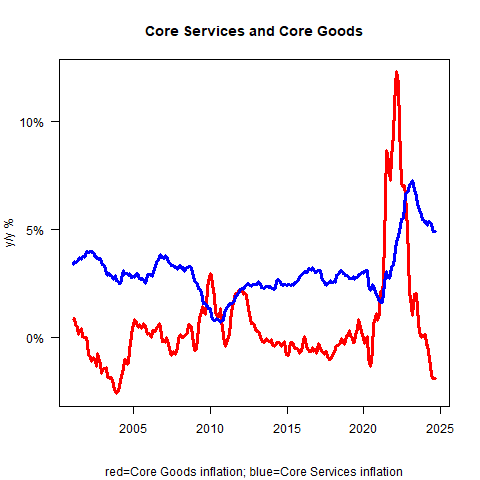

Interestingly…at least, if you’re the kind of square who finds the CPI interesting…the y/y changes in Core Goods (-1.9%) and Core Services (+4.9%) were steady. That’s the first time in a while we’ve seen that.

Wow, right?

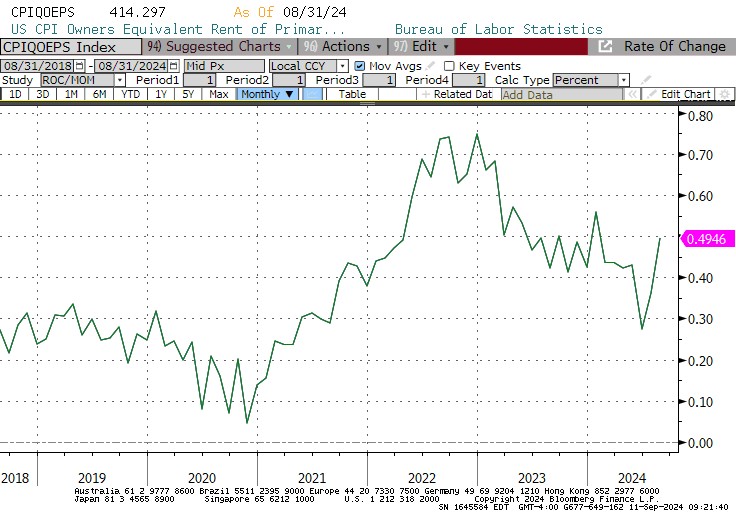

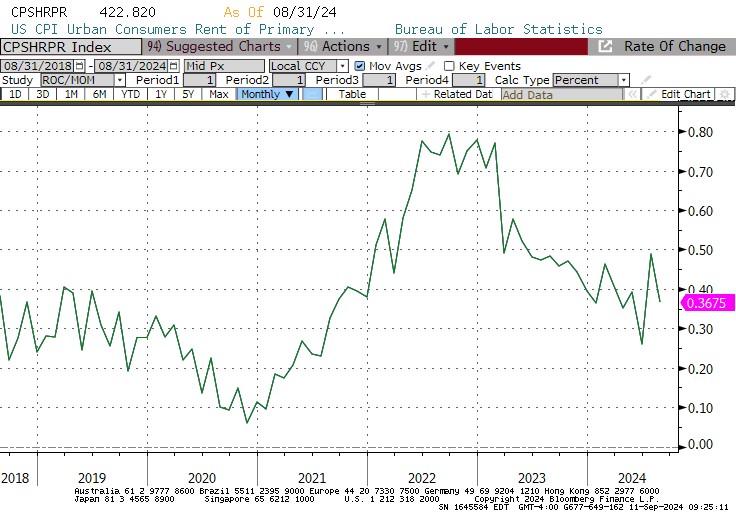

A rounded +0.3% on core CPI takes the Fed out or at least puts them on a 25bps cut, right? Well, not so fast. The monthly change in Owners Equivalent Rent immediately jumps out at you (at least, if you’re the kind of square who looks at these things deeply) as +0.495% m/m.

That’s the largest m/m change since February, and it hasn’t been appreciably higher on a regular basis since early last year.

That looks a little quirky, especially following the recent dip. And it looks suspiciously like a one-month-lagged chart of the m/m changes in Primary rents, which dipped a few months ago before paying it back last month.

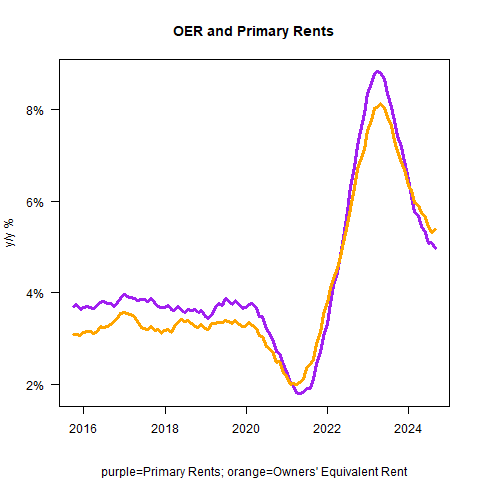

That looks to me like some weird seasonal wrinkle. The y/y shelter figures are still declining. But, if you look carefully, you can see that the rate of improvement is slowing. And maybe my math isn’t so good but it doesn’t look like these are converging on deflation.

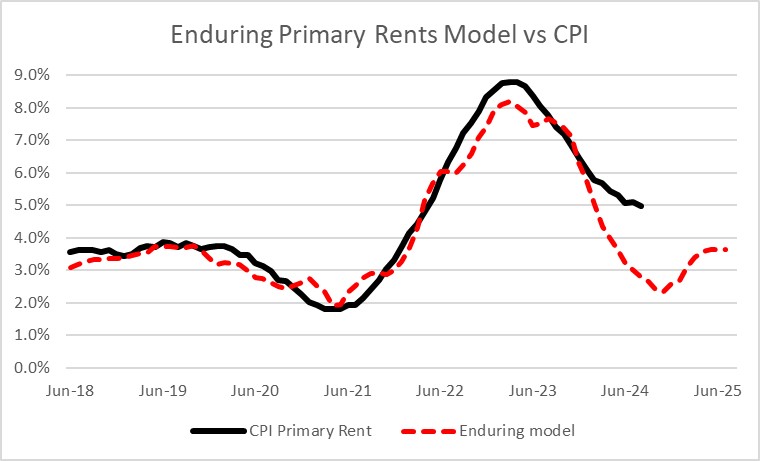

The rents data are therefore both the good news and the bad news. The good news is that in this month’s CPI, it was a miss higher only because OER had the quirky jump. I’ll get into more of the number in just a second, after sharing the bad news: there is nothing in the trajectory of rents to suggest that the operating theory of many forecasters for a long time – that rents would soon be in deflation – is going to happen. Heck, as I keep pointing out the trajectory of rents is higher than my bottom-up rents model, which suggested we should be bottoming out around 2.4% y/y right about now. And my forecast was on the very high side of what people were saying.

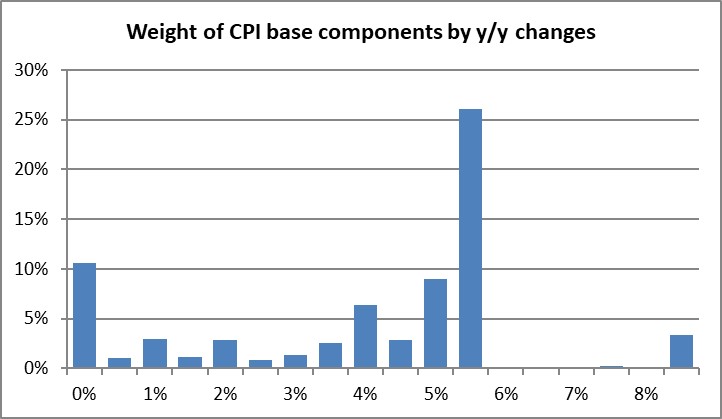

But let’s get beyond rents. The ‘big sticky’ is always important to watch, but outside of rents things looked pretty good this month. There were some outliers on both sides (Lodging Away from Home +1.75% m/m, Airfares +3.9% m/m after 5 straight declines; Car/Truck Rental -1.5% and Used Cars -1% m/m), but core CPI ex-shelter declined to only +1.72% y/y. The list of monthly categories shows a long list of categories whose price fell m/m: jewelry, car/truck rental, used cars, energy services, miscellaneous personal goods, personal care products, household furnishings and operations, medical care commodities, medical care services, recreation, communication, and a few others. Not that we are headed for deflation, but look at this distribution of y/y price changes. I haven’t shown this for a few months.

Again, this doesn’t look like something that screams deflation, but the far right tails are all moving left. There’s still a cluster around 4-5%, which shouldn’t be surprising since Median CPI is at about 4.2%. Do also notice that there aren’t a lot of categories showing deflation on a y/y basis, but if you take out shelter from this you get something that looks more disinflationary: a mode around 4-5%, but tails to the downside. In inflationary periods, the tails stretch to the upside, and we had that for a while; but the signature of the overall distribution is encouraging.

The conclusion, as I said up top, is that if the Fed was leaning towards cutting rates 50bps next week this is not a number that should change their collective mind very much. Unless the Fed cares only about the top line numbers, this isn’t an alarming report.

It isn’t the lovely deflationary print that bond bulls wanted, but that wasn’t really in the cards. We’re arguing over a couple of hundredths in the monthly core print, and that is entirely attributable – still – to shelter. In fact, there are signs of broadening disinflation.

To be clear, I personally do not think the FOMC should stop quantitative tightening and there’s no hurry to cut rates. The fight against inflation is not only unfinished, it won’t be finished for quite a while…and an ease now will just make it harder later. But that’s what I would do. What I am saying is that the Fed is not likely to change course on the basis of this number.

The y/y figures for headline CPI are going to keep dropping for a few months here, partly on base effects and partly because energy prices are very weak. A perfectly reasonable trajectory for monetary policy (if you think that rates ought to at least be eased back to neutral in the 3-4% range) would be 25bps next week, and then larger cuts in a few months when the headline inflation number is lower and the unemployment rate is higher.

The only problem with that approach is that an acceleration in the pace of easing later may look like concern, which is why some FOMC members favor getting out of the gate quickly. As I said, there’s nothing here that should stop that.

But median inflation is still headed for ‘high 3s, low 4s,’ with a potential dip into the low 3s before a re-acceleration. The hard work on inflation is still ahead, and it is going to get harder now that we are in a recession.