SoFi stock falls after announcing $1.5B public offering of common stock

This article was written exclusively for Investing.com

- The trend is always your best friend in markets

- Impossible to call tops in even the most aggressive parabolic markets

- Digital currencies went parabolic - Charlie Munger chimes in on the future

- Government officials are getting nervous

- The issue is control of the money supply

Bitcoin’s ascent has been nothing short of mind-blowing. After reaching a high of over $20,000 per token in late 2017, the price corrected to a low of $3,120 in 2018. It then consolidated below the record high until 2020.

Warren Buffett and Charlie Munger called Bitcoin and the other cryptos “financial rat poison.” Jamie Dimon, the Chairman and CEO of JPMorgan Chase, said the digital currency market was a “fraud.”

Last week, as the price of nearby Bitcoin futures eclipsed the $58,000 per token level, along with the many other naysayers, they have been noticeably quiet. In October 2020, Square's (NYSE:SQ) Jack Dorsey invested $50 million in Bitcoin at the $11,000 level.

More recently, Elon Musk and Tesla (NASDAQ:TSLA) upped the ante with a $1.5 billion investment below the $40,000 per token level. Last week, Square ponied up another $170 million to increase its Bitcoin holdings. SQ and TSLA are not only invested in Bitcoin but are furthering acceptance for the digital currency asset class. SQ is processing payments in Bitcoin, and TSLA has said it will accept it as payment for EVs.

With any asset, risks of a severe correction rise during parabolic price appreciation. The trend is always your best friend in markets, but digital currencies continue to face some powerful foes as the price climbs.

The trend is always your best friend in markets

Trends in markets are critical because:

- They tell us if sellers or buyers are more aggressive in markets

- A trend reflects momentum. In physics, a body in motion tends to remain in motion

- The path of least resistance for prices represents underlying supply and demand fundamentals

Bullish trends can take prices far higher than most market participants believe possible. During bull markets, prices often rise to illogical, unreasonable, and irrational levels.

Bear markets often do the same on the downside. Trend-following traders and investors know that the trend is your friend until it bends.

Impossible to call tops in even the most aggressive parabolic markets

Calling tops or bottoms in markets is more about ego than making a profit. Since bullish or bearish trends can turn into parabolic moves or falling knives, supply and demand often take a backseat to price momentum.

The pursuit of a market’s top or bottom price is a pure value judgment. John Maynard Keynes, the English economist who fundamentally changed the theory and practice of macroeconomic and government policy, once said:

“Markets can remain irrational longer than you can remain solvent.”

The noted economist was referring to the power of the trend.

The advent of digital currencies, an asset class that is a little over one decade old, has put Keynes’s statement to the test for those that believe cryptocurrency values have reached unsustainable levels. On the other hand, those embracing the digital currency revolution believe the rallies that took the asset class’s market cap to over the $1 trillion level are still in early days.

Digital currencies went parabolic; Charlie Munger chimes in on the future

A parabolic move refers to an upward price trend that looks like the right side of a parabolic curve.

Source: Google

In mathematics, a parabola is a plane curve that is mirror-symmetrical and approximately U-shaped. In markets, a parabolic move occurs along the positive sides of the X and Y-axis.

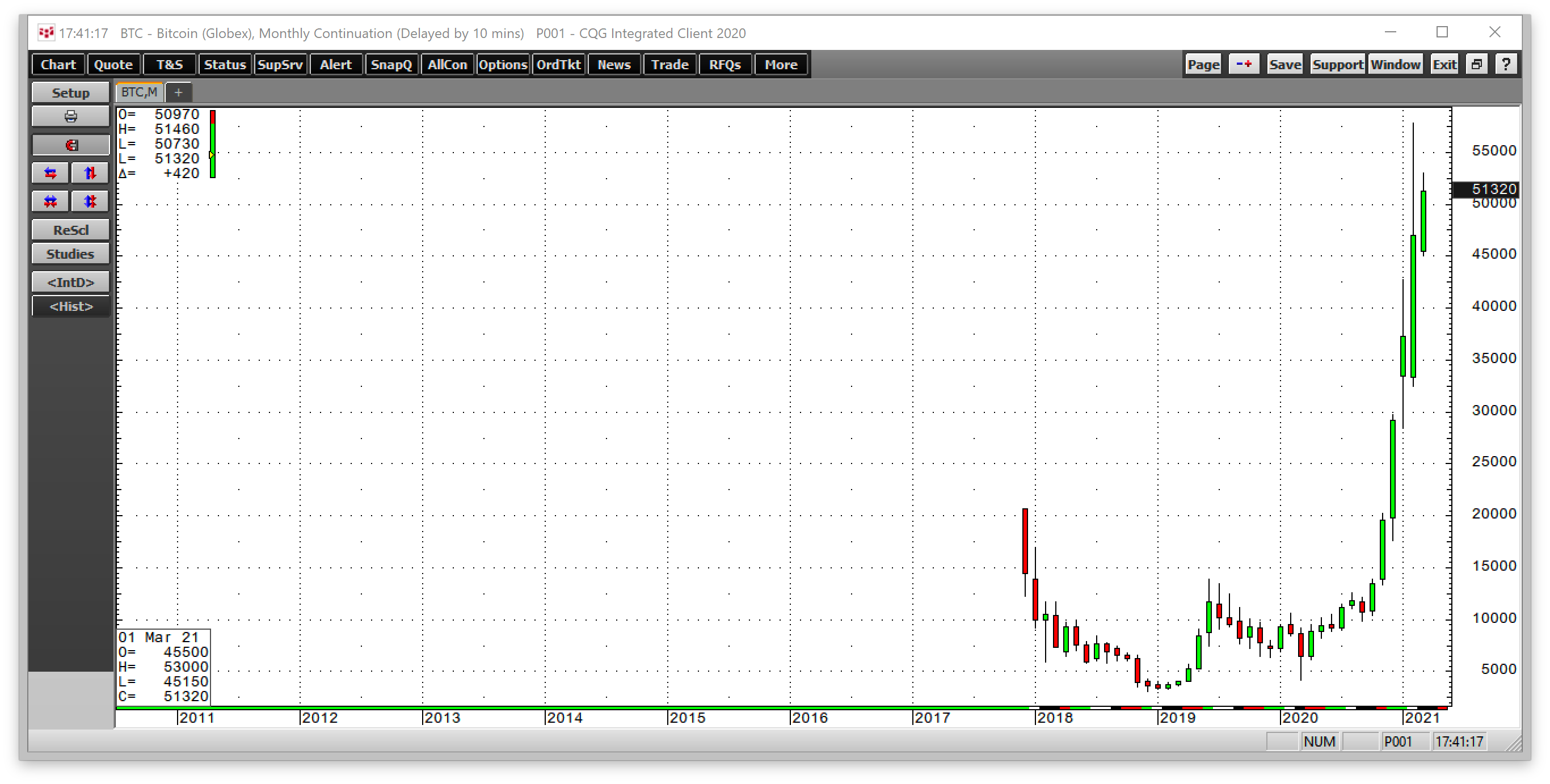

Source: CQG

The monthly chart of the CME Bitcoin futures, which reflect the price action in the digital currency, qualifies as a parabolic move that took the price from $4,210 in Mar. 2020 to a high of $57,790 in February 2021—or nearly fourteen times higher in twelve months.

Other markets experienced parabolic moves over the past weeks and months. Tesla the EV maker, saw its shares rise from $83.67 at the end of 2019 to a high of $900.40 in late January, over ten times higher in a little over one year.

The latest example was GameStop (NYSE:GME), the stock that rose from below $10 in October 2020 to nearly $500 per share in late January, a rise of around fifty times.

Charlie Munger has been Warren Buffett’s partner at Berkshire Hathaway (NYSE:BRKa) for years. While the Oracle of Omaha has a folksy and appealing way of presenting his views, Munger has no filter; he calls it as he sees it in the markets. Someone asked him if he thought it was crazier for Bitcoin to hit $50,000 or Tesla to reach a $1 trillion fully diluted enterprise value. The acerbic Mr. Munger said:

“I have the same difficulty that Samuel Johnson once had when he got a similar question, he said, ‘I can’t decide the order of precedency between a flea and a louse.’ And I feel the same way about those choices. I don’t know which is worse.”

He went on to say, “Bitcoin reminds me of what Oscar Wilde said about fox hunting. He said it was the pursuit of the uneatable by the unspeakable.”

His commentary on one of the parabolic stocks, GameStop, was, “It’s really stupid to have a culture which encourages as much gambling in stocks by people who have the mindset of racetrack bettors."

The outspoken Mr. Munger also took on SPACs, the special purpose acquisition companies raising money from investors that then merge with private companies to take them public in what amounts to “blank check” arrangements. His unfiltered opinion was, “the investment banking profession will sell s%#t as long as s%#t can be sold.”

When it comes to Bitcoin, Warren Buffett continues to believe that the cryptocurrency and the other digital currencies are “probably rat poison squared.” At the current prices, he may have upped the ante to cubed.

Government officials are getting nervous

Warren Buffet and Charley Munger are more than “old school.” Both of the legendary investors are in their 90s. At 97, Munger is coming up on a century while the younger Buffett just reached his 90th milestone. It is easy to dismiss their comments on Bitcoin and the other cryptos as a function of their advanced years. However, central banks and governments are another story.

As the prices of digital currencies and the asset class’s market cap rise, voices of opposition from the government regulatory sector are getting louder. Christine Lagarde, the President of the European Central Bank, when asked if central banks would hold Bitcoin as a reserve currency any time soon said:

“It’s very unlikely—I would say it’s out of the question.”

Indeed, in January 2021, she called for more regulation as Bitcoin has been used for some “funny business,” including money laundering.

Janet Yellen, the US Treasury Secretary, recently warned that Bitcoin is an “extremely inefficient” way to conduct monetary transactions. She went on to say that it is often used for “illicit finance.”

Digital currencies are not going away. However, the US, Europe, and other governments will not be on board until they issue and control digital means of exchange.

The underlying issue is not “illicit finance,” “funny business,” and “efficiency.” It is control of the money supply.

Government power comes from controlling the legal tender that is the basis for the global financial system. The US dollar and euro are the world’s reserve currencies. While a digital dollar and a cyber euro would be acceptable to those with their fingers on the printing presses or the digital function that expands and contracts supplies of cash, the ones out of their control are not.

The issue is control of the money supply

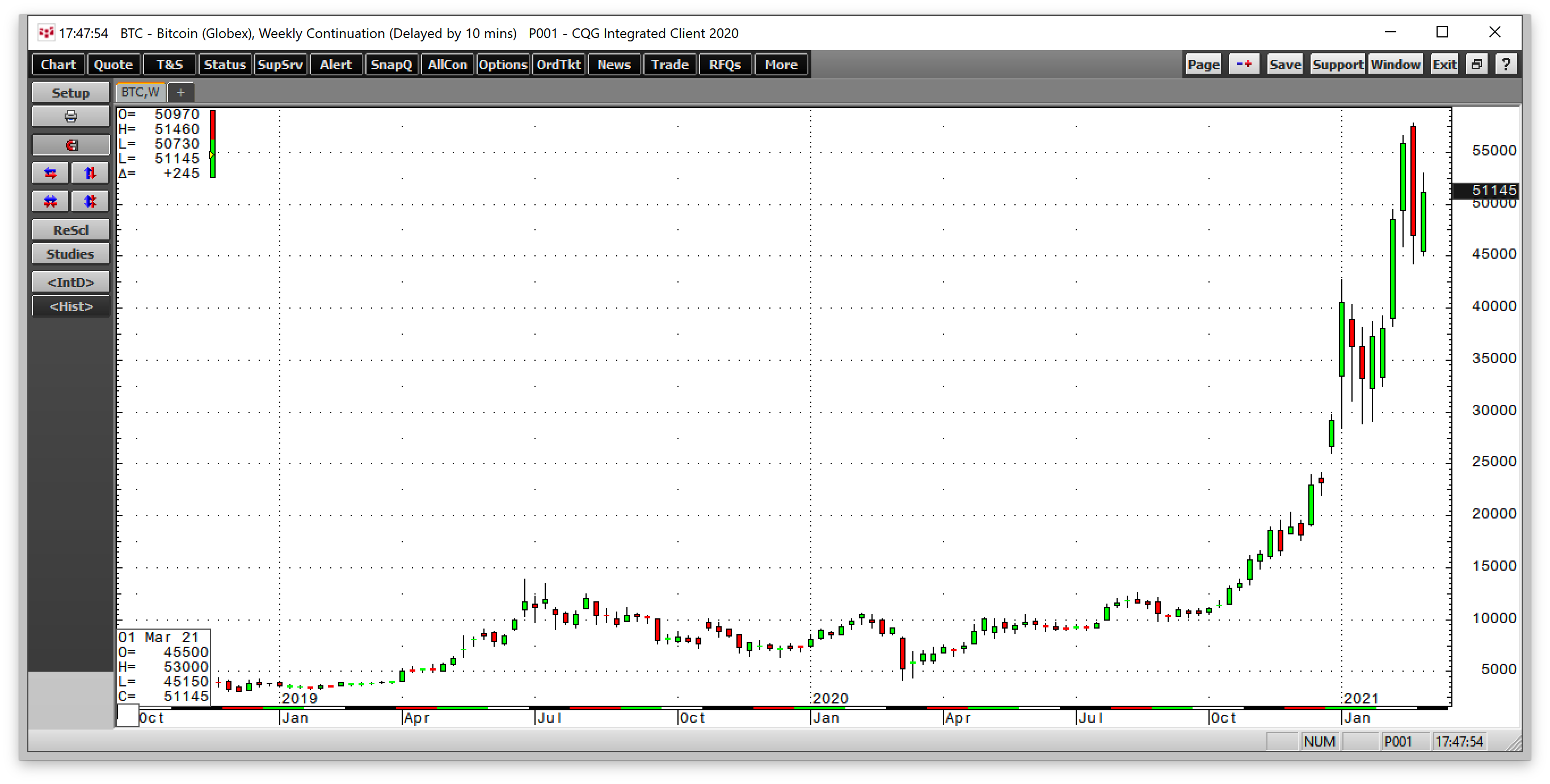

The parabolic move in Bitcoin began in late 2020.

Source: CQG

The weekly chart shows the extent of the move over the past five months. There is no question that the trend remains higher. Buyers are more aggressive than sellers, momentum is to the upside, and demand for Bitcoin and other tokens is greater than supplies.

Whether you agree with Buffett and Munger or Musk and Dorsey, the critical issue is Lagarde and Yellen. Governments will not surrender control of the money supply without an epic battle. They appear ready to capitulate with their versions of digital tokens, but that is as far as they may go.

Digital currencies pose an issue far greater than the Wall Street versus Main Street battle in the US. As more companies embrace cryptocurrencies, they fuel those looking to strip control of the money supply from government bureaucrats. As the money supply swells and deficits grow, the argument against digital currencies becomes far more of a challenge to defend.

Bitcoin’s trend remains higher, but the risk rises exponentially as the parabolic price appreciation continues.