Raymond James raises Fulgent Genetics stock price target to $36 on strong performance

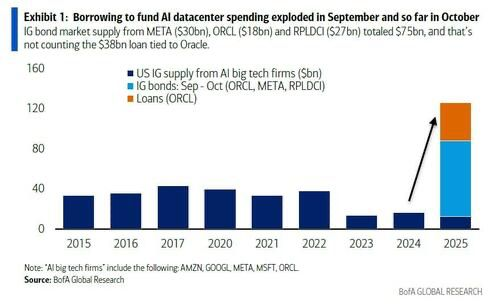

Meta (NASDAQ:META) and Google (NASDAQ:GOOGL) recently borrowed a combined $55 billion in the corporate bond market. As we share below, this debt represents a new source of funding for data center expansion.

Further, as shown in orange, Oracle tapped the private market for loans to secure the capital needed to sustain AI innovation and the related data center buildout. The graph below shows that borrowing for data centers surged this year, more than three times the amounts in the prior couple of years.

It appears that cash flow and earnings from the hyperscalers are no longer enough to fuel data center growth. Some estimate that the global data center infrastructure buildout could be over $5 trillion, possibly even $7 trillion. This year, the hyperscalers are expected to generate approximately $700 billion in annual operating cash flow, of which about $500 billion has been invested in AI data centers.

While a massive investment, the graph below shows it’s not sufficient. The high credit ratings and strong fundamentals of some hyperscalers should allow them to continue issuing debt and using cash flows to meet their investment needs. These companies include Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT), Google, and Meta. Others may not be so fortunate.

For instance, Oracle (NYSE:ORCL), which has negative cash flows and a debt-to-EBITDA ratio of over 4x, borrowed $38 billion in October for data center construction. This loan allows the BBB-rated company to avoid the more turbulent corporate bond market. Regardless of whether they borrow in the public or private markets, the market is noticing.

Their credit default swap spreads have doubled this year to 88bps. While the market assigns only a slight chance of default, the trend warrants note. It signals that Oracle’s financial wherewithal to fund data center expansion may hinder its opportunities relative to its larger competitors.

What To Watch Today

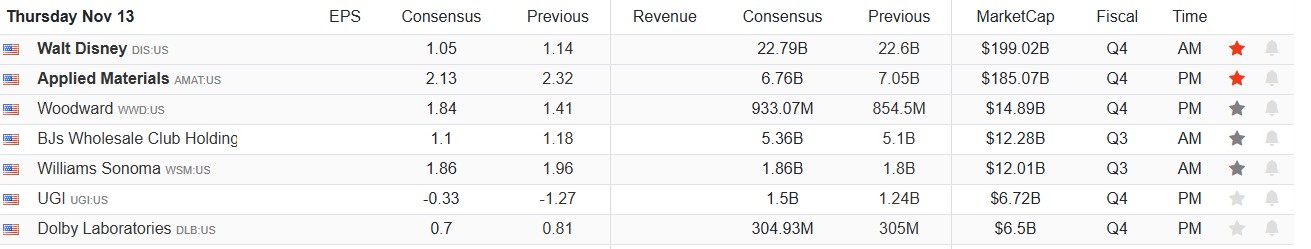

Earnings

Economy

- No notable releases today

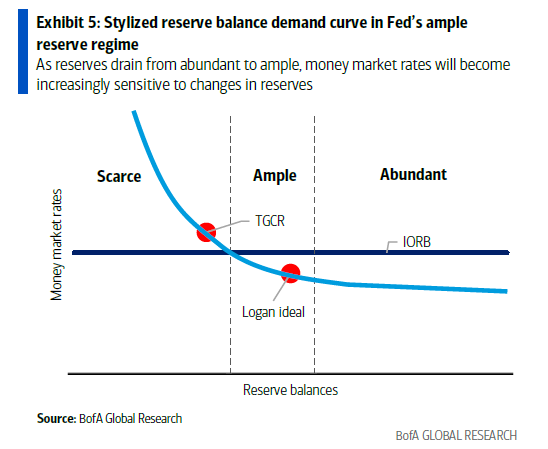

More On QE

If you have read our article linked above, we urge you to consider the following quote from New York Fed President John Williams (h/t ZeroHedge):

Looking forward, the next step in our balance sheet strategy will be to assess when the level of reserves has reached ample. It will then be time to begin the process of gradual purchases of assets that will maintain an ample level of reserves as the Fed’s other liabilities grow and underlying demand for reserves increases over time. Such reserve management purchases will represent the natural next stage of the implementation of the FOMC’s ample reserves strategy and in no way represent a change in the underlying stance of monetary policy.

Determining when we are at ample reserves is an inexact science. I am closely monitoring a variety of market indicators related to the fed funds market, repo market, and payments to help assess the state of reserve demand conditions. Based on recent sustained repo market pressures and other growing signs of reserves moving from abundant to ample, I expect that it will not be long before we reach ample reserves.

Tweet of the Day