Six Flags stock rises after appointing John Reilly as new CEO

We’re entering yet another week of limited visibility on the economy thanks to the government shutdown. This leaves markets attempting to fill the statistical void with private surveys, comments from Federal Reserve officials, and the odd corporate report to gauge the balance of economic risks.

This gives added weight to October’s flash purchasing managers’ index data (Fri) for both manufacturing and services. Just as important will be the delayed release of September’s CPI (Fri).

Fed speakers this week include Governors Christopher Waller (Tue) and Michael Barr (Wed and Thu). This week will also be one of close credit market surveillance following bankruptcies at auto parts manufacturer First Brands Group and subprime auto lender Tricolor.

Fed speakers this week include Governors Christopher Waller (Tue) and Michael Barr (Wed and Thu). This week will also be one of close credit market surveillance following bankruptcies at auto parts manufacturer First Brands Group and subprime auto lender Tricolor.

JPMorgan CEO Jamie Dimon’s warning that "when you see one cockroach, there are probably more" in response to private credit concerns hardly instills confidence. Nor did regional Zions Bancorp’s telegraphing a $50 million Q3 loss. Such concerns sent the 10-year Treasury yield briefly below the key 4.00% level for the first time since April.

Earnings reports from Netflix and Tesla could offer insights into the state of consumer demand. It’s also a big week for aerospace and defense companies with Lockheed Martin, GE Aerospace, RTX, and Northrop Grumman reporting.

On the international front, investors will pay close attention to the latest volleys in the US-China brawl over tariffs and restrictions on rare-earth materials. In Tokyo, we’ll get greater clarity on whether Sanae Takaichi has the support of enough opposition parties to become Japan’s first female prime minister.

Here’s a look at the data releases most likely to influence views on the economy and whether the Federal Open Market Committee will vote to ease again at its October 28-29 meeting:

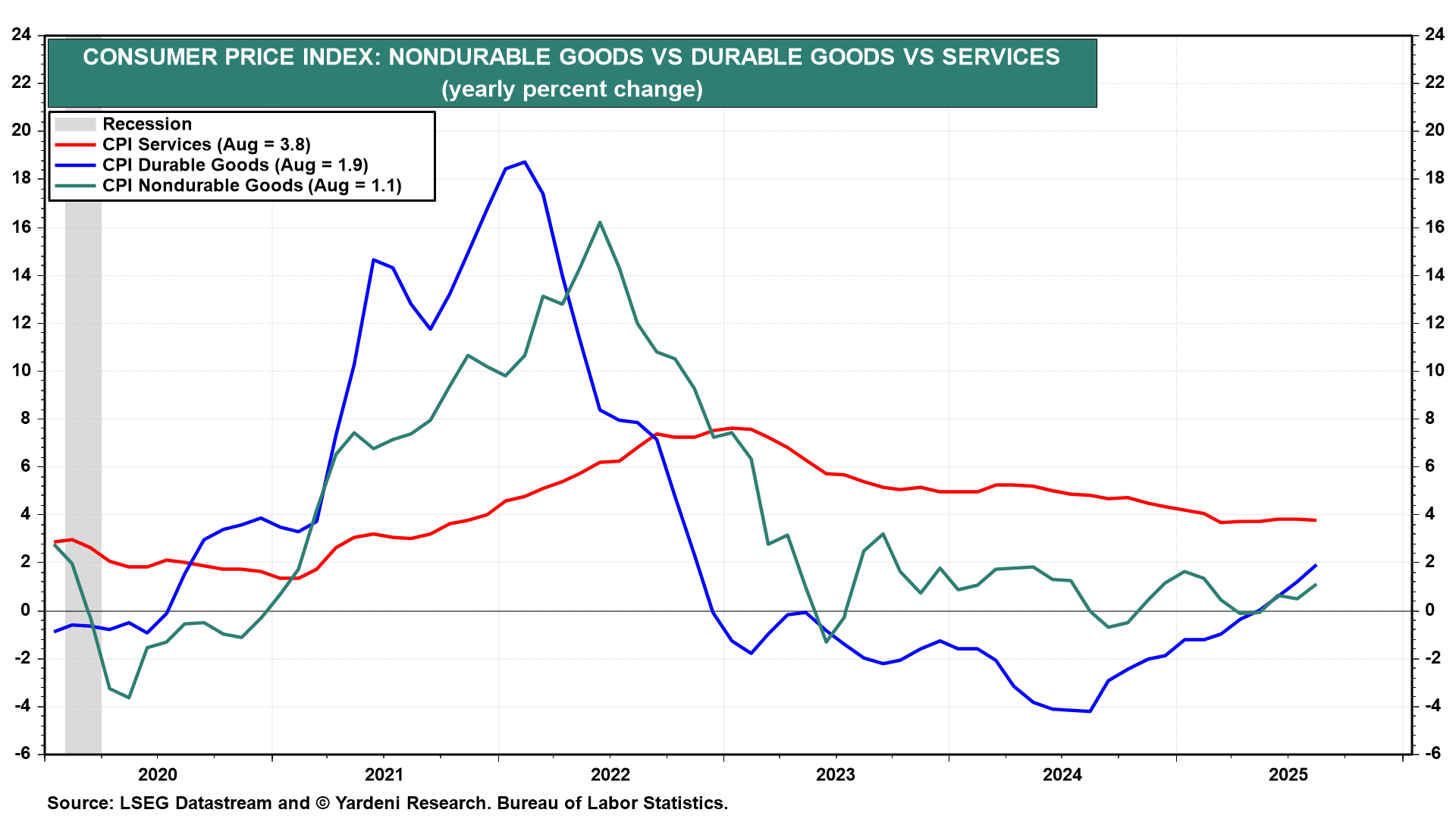

(1) CPI. Notwithstanding the government shutdown, September’s inflation data will be released this week on Friday. The headline and core CPI inflation rates (Wed) likely rose 2.99% y/y and 2.95% y/y during September, according to the Cleveland Fed’s Inflation Nowcast. This would confirm our view that Trump’s tariffs didn’t boost inflation but did keep it from falling to the Fed’s target of 2.0% by now. The tariffs boosted the CPI durable goods inflation rate (chart).

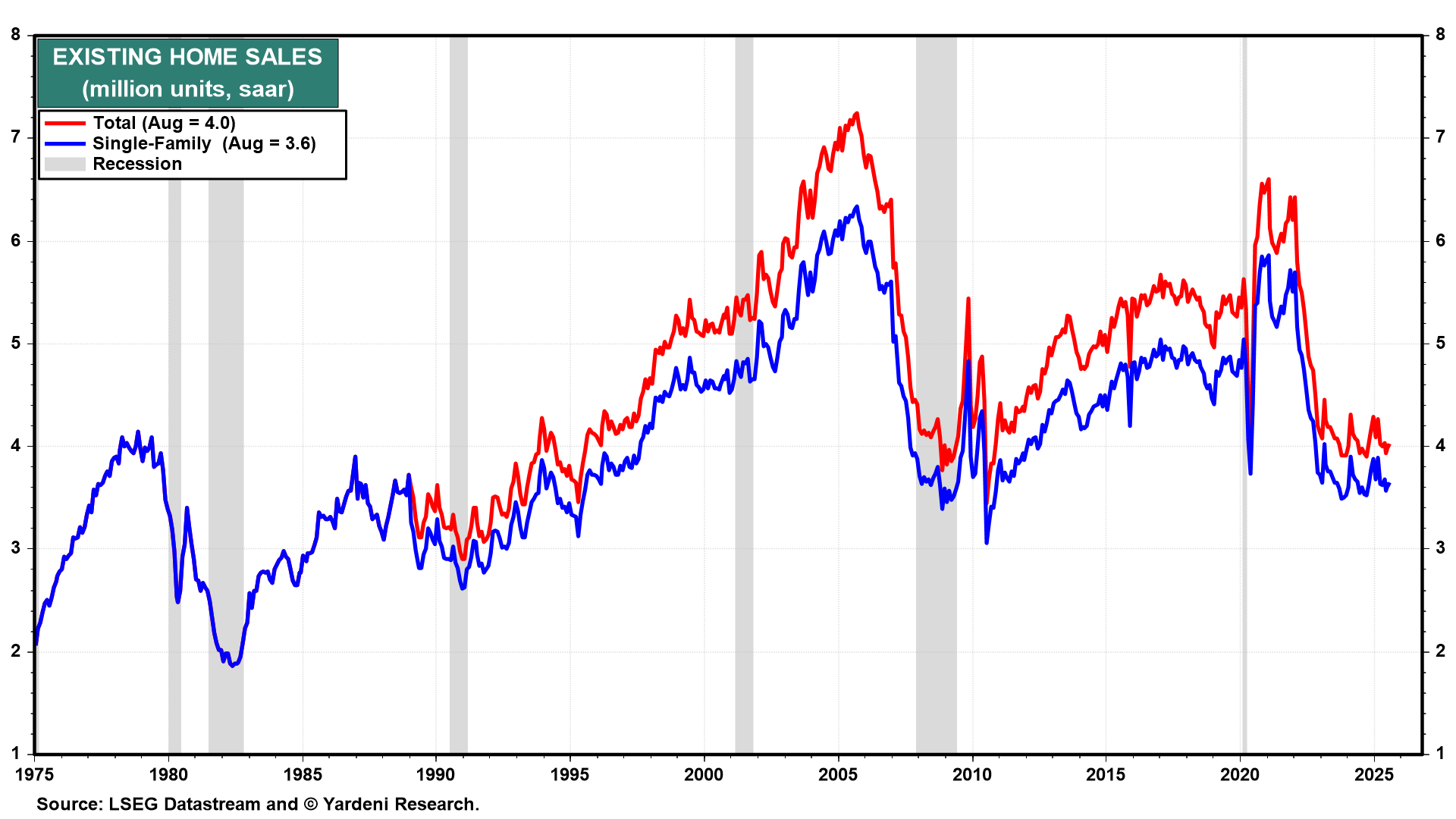

(2) Home sales. In August, sales of previously owned homes essentially stalled at around 4 million units (saar) (chart). Since then, Fed Chair Jerome Powell has begun giving the housing industry what it wants, i.e., lower mortgage rates. Markets are keen to see whether September’s report (Thu) hints at a recovery in housing activity.

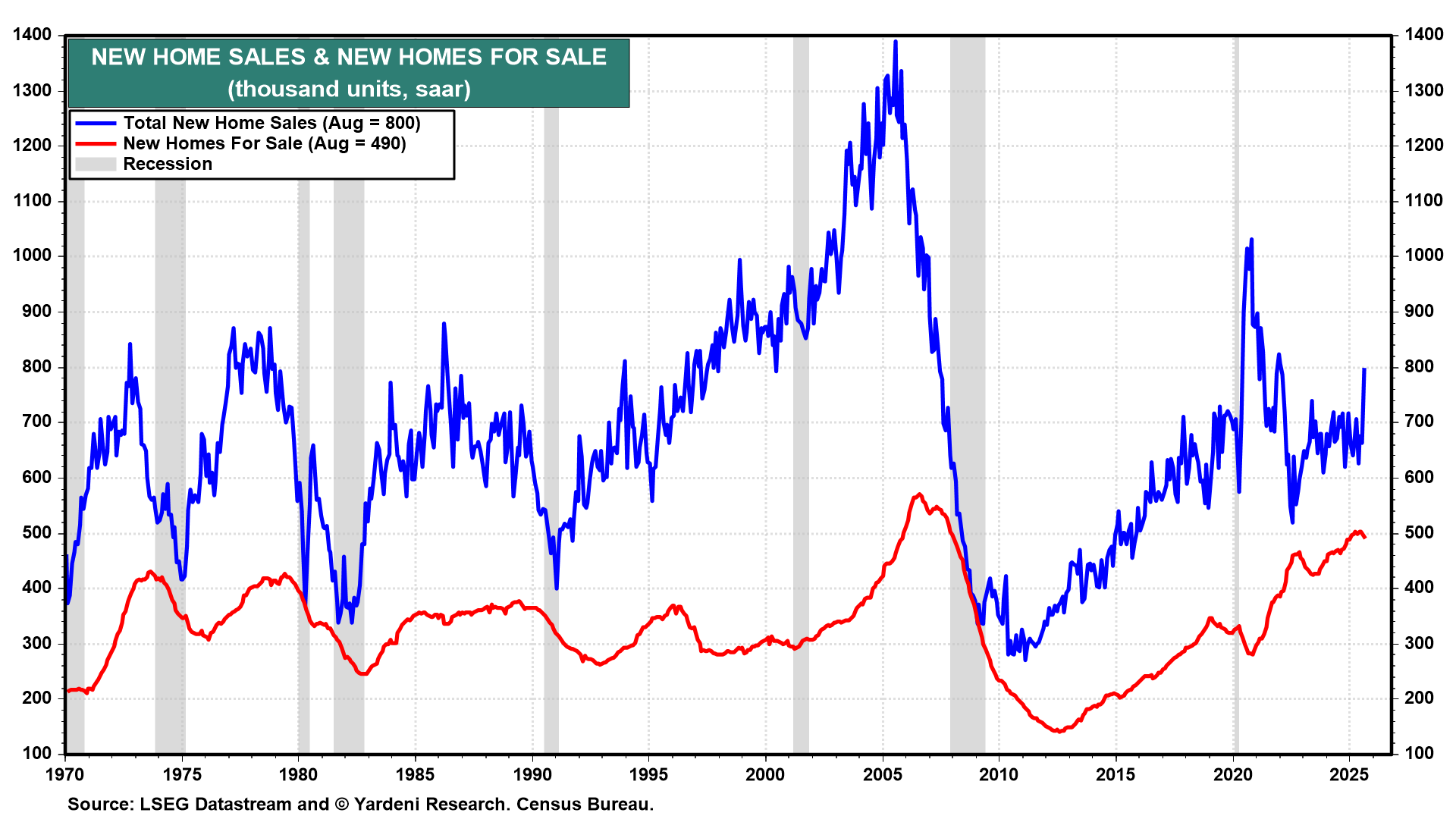

The same goes for new home sales data for September (Fri), which jumped during August (chart).

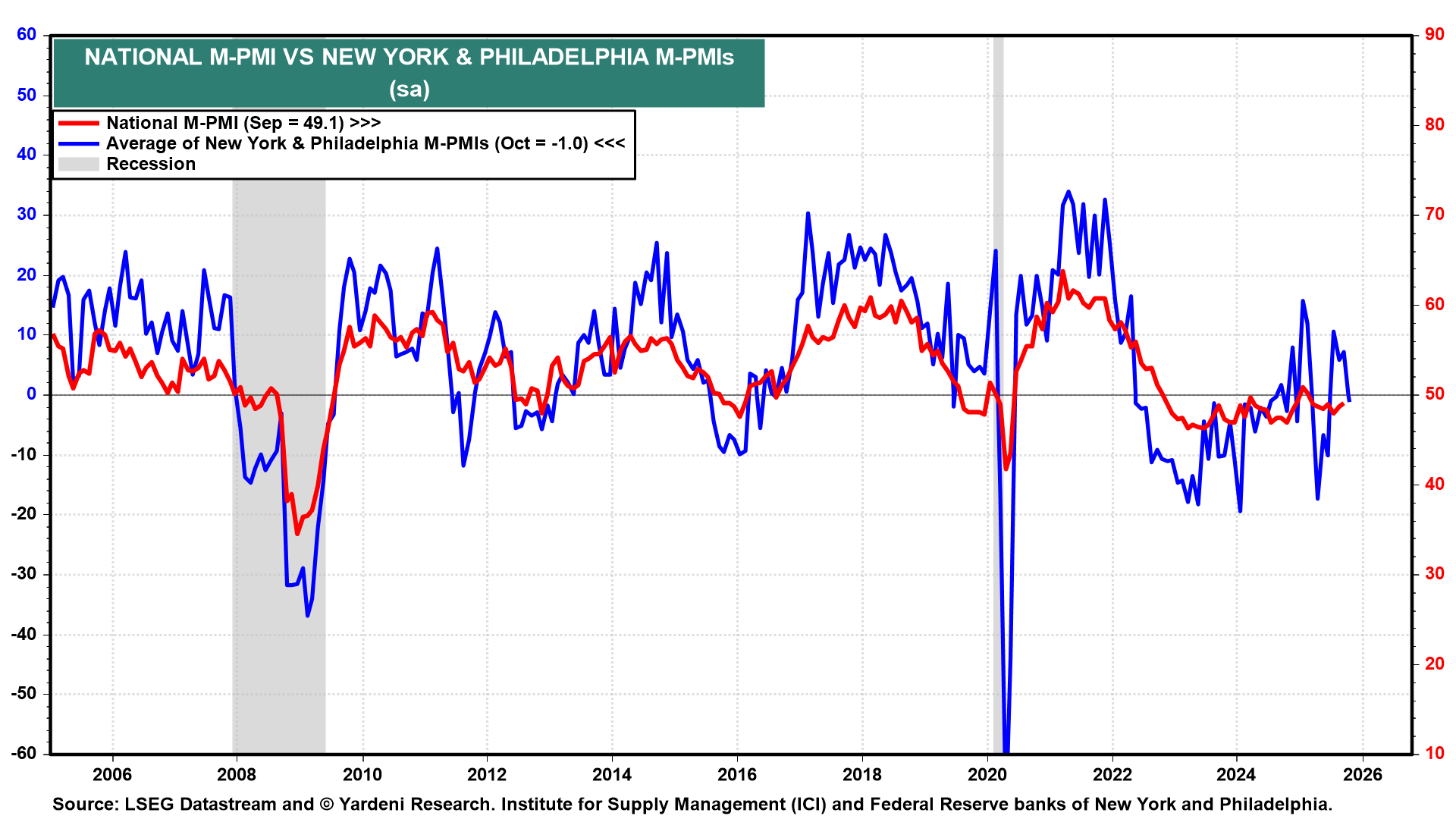

(3) Fed business surveys. In August, the Chicago Fed’s national activity index posted its best performance in five months, coming in at -0.12. Its September survey (Thu) will be released the same day as the Kansas City Fed’s read on its regional business activity, which showed a modest decline in September. The average of September’s New York and Philadelphia Fed district surveys remained weak (chart).

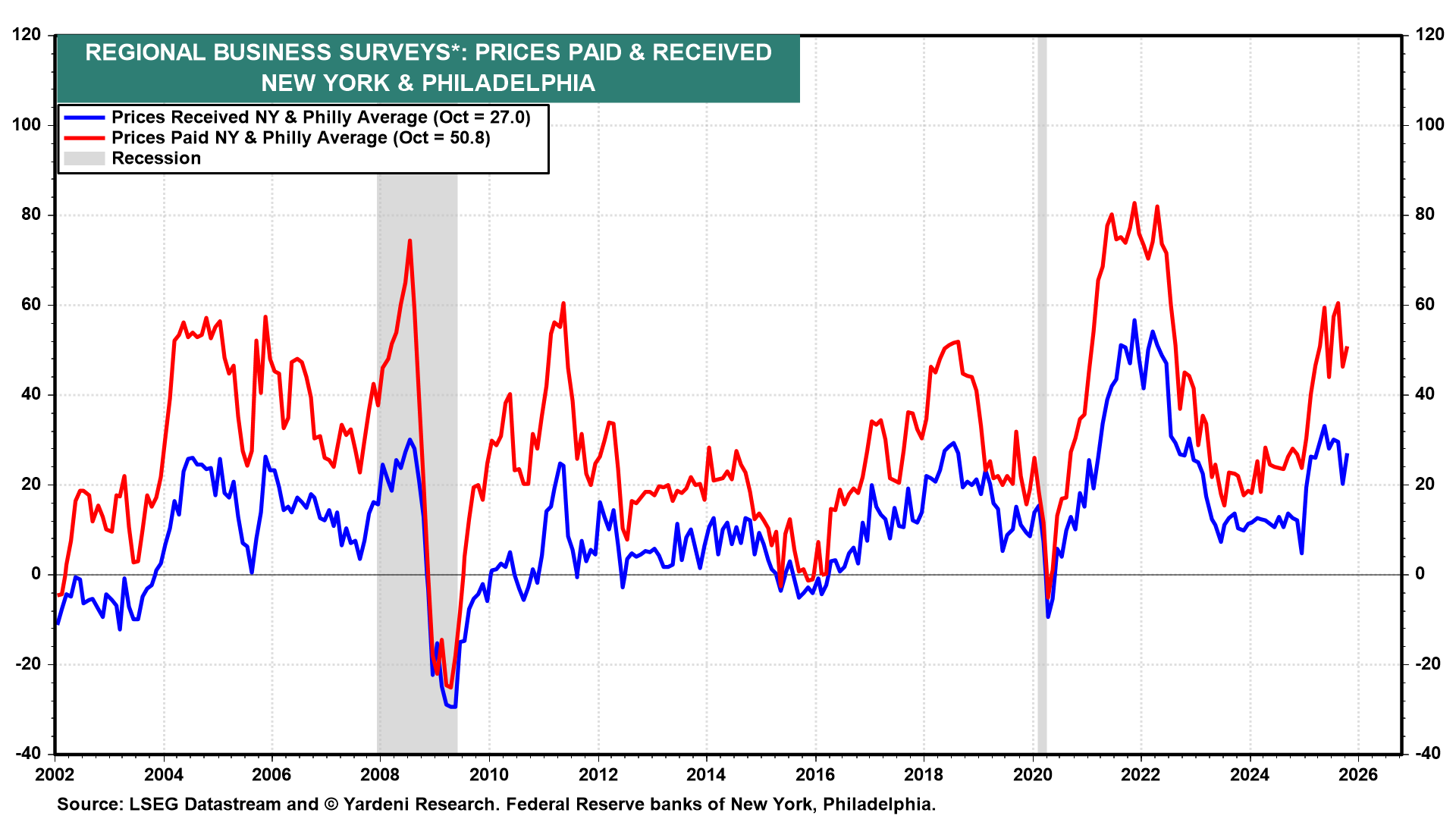

September’s averages of the prices-received and prices-paid indexes remained elevated in the New York and Philadelphia business surveys (chart).