cathie wood’s ARK sells Tesla stock, buys Baidu and Trade Desk

- The Federal Reserve’s June FOMC meeting comes at a critical moment for the stock market.

- While rates are forecast to remain unchanged, investors will scrutinize the updated dot plot as well as comments from Fed Chair Powell for hints on rate cuts and inflation trends.

- With the Fed facing a barrage of tariffs and geopolitical-related uncertainty, its communication will be key in shaping market expectations and guiding investor sentiment.

- Looking for actionable trade ideas to navigate market volatility? For a limited time, get access to InvestingPro’s AI-selected stock winners for under $7/month.

The Federal Reserve’s June policy meeting arrives at a critical moment for the stock market, with the benchmark S&P 500 sitting around 3% below its February record high despite a barrage of lingering uncertainty, including persistent trade war fears and fresh geopolitical headwinds between Israel and Iran.

Source: Investing.com

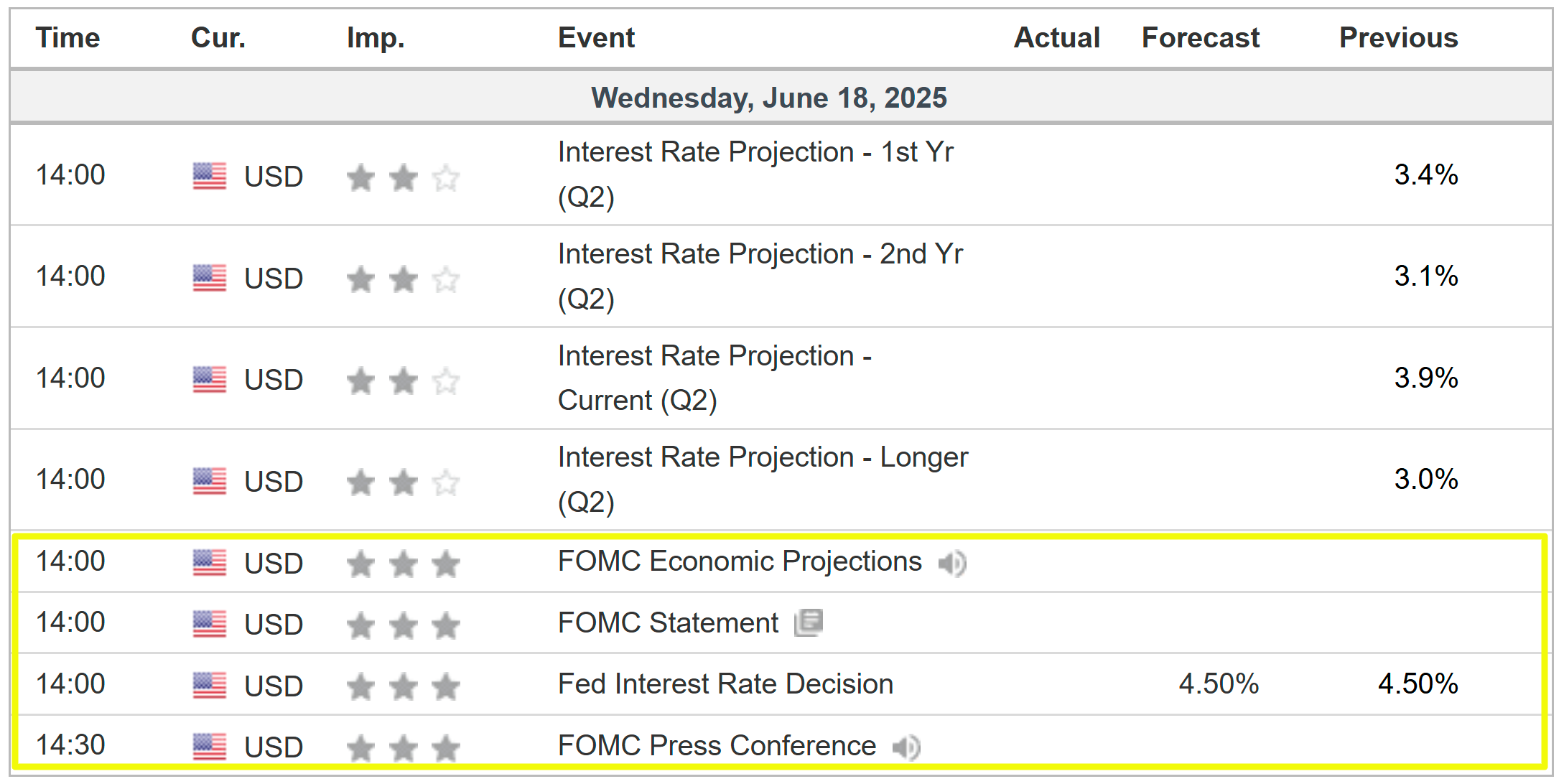

As such, a lot will be on the line when the Fed delivers its latest interest rate decision at 2:00 PM ET on Wednesday. While the US central bank is widely expected to hold rates steady at 4.25%-4.50%, investors are eager for any hints about whether it might be poised to lower borrowing costs in the coming months.

Markets currently expect two rate cuts by the end of this year, with the next one likely in September, as per the Investing.com Fed Rate Monitor Tool.

Alongside the rate decision, Federal Open Market Committee (FOMC) officials will also release their new quarterly economic projections for interest rates, inflation, and unemployment, known as the ‘dot plot’.

The last dot plot, released in March, revealed a consensus among Fed officials for two cuts in 2025.

If FOMC policymakers stick with that forecast, it could reinforce bullish sentiment—especially since recent economic data shows some softening. But if the outlook shifts to just one cut (or pushes the timeline further out), expect a market recalibration and possible pressure on stocks and risk assets.

Source: Investing.com

Post-meeting comments from Fed Chair Jerome Powell at 2:30 PM ET will be closely watched and could move the market as his words often carry as much weight as the policy decision itself. Powell is likely to emphasize a data-dependent approach, citing the need for further clarity on the economic and inflationary impact of President Donald Trump’s trade tariffs before adjusting rates.

Speaking of Trump, the president’s repeated public calls for rate cuts and criticism of Powell could complicate the Fed’s messaging, though Powell is expected to reaffirm the central bank’s independence.

Market Implications

Financial markets may see muted initial reactions to a widely anticipated hold, but equities, bonds, gold, and the US Dollar could move based on the updated dot plot and Powell’s comments.

If the Fed signals a dovish pivot—hinting at potential rate cuts in the near future due to confidence in declining inflation—equity markets could rally, as lower borrowing costs typically support corporate earnings and valuations. Growth stocks, particularly in technology, which are sensitive to interest rates, would likely see the most benefit.

Bond yields, such as those on the 10-year Treasury, could decline in anticipation of looser monetary policy, boosting fixed-income assets.

Source: Investing.com

Conversely, a hawkish stance—suggesting that rates will remain higher for longer to combat stubborn inflation—could pressure risk assets like stocks, as higher interest rates increase borrowing costs and dampen economic growth prospects.

In this scenario, the US dollar might strengthen, as elevated rates attract capital inflows, while commodities like gold could face headwinds due to a stronger currency and higher opportunity costs.

Source: Investing.com

Bottom Line

Investors and traders should remain informed and agile, ready to adjust their portfolios in response to the Fed’s guidance and resulting market conditions. As ever, maintaining a diversified investment strategy will be essential to navigating the potential impacts of the Fed’s decisions.

Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging market backdrop.

That means immediate access to insightful tools like:

- ProPicks AI: AI-selected stock winners with a proven track record.

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ). I am also long on the Invesco Top QQQ ETF (QBIG), and Invesco S&P 500 Equal Weight ETF (RSP).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.